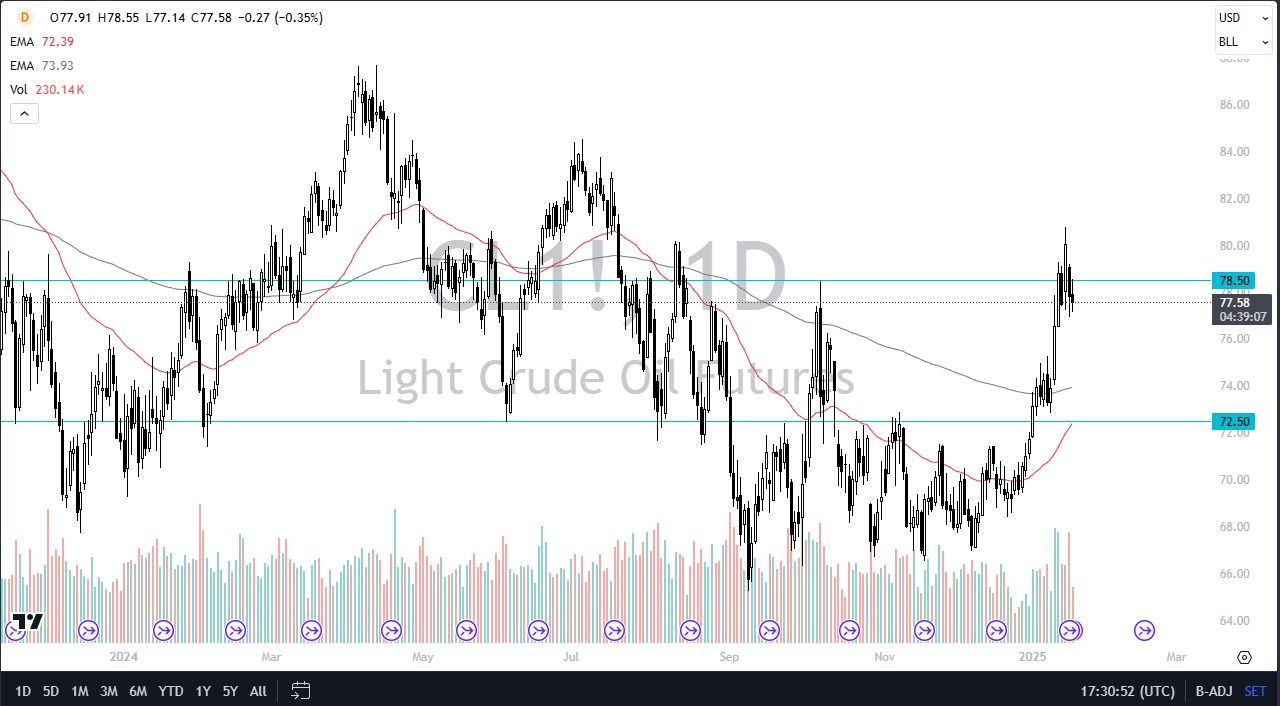

- The West Texas Intermediate or Light Sweet Crude market has been somewhat noisy during the trading session on Friday as we continue to bounce around an area that quite frankly is going to end up being more or less consolidation and resistance.

- After all, the $78.50 level has been resistance in the past, so it does make a certain amount of sense that there's market memory here, causing a bit of a headache.

I do think at this point, you probably see a lot of volatility and perhaps even a bit of a pullback. That pullback might be a nice buying opportunity, especially if we drop towards the $75 level, as the 200-day EMA is racing towards that region.

Top Forex Brokers

Alternatively…

On the other hand, if we break above the $80.56 level, then it's likely that the crude oil markets will continue to go higher. Nonetheless, this is a market that I do think you're looking for value to take advantage of and it makes quite a bit of sense that we would see oil slightly positive due to concerns about supply coming out of places like Russia and the possibility of sanctions against Iran now that the Trump administration is taking over.

But at the end of the day, I think there's also the idea that central banks around the world cutting rates will probably continue to spur demand as well. I do think ultimately pullbacks though get bought into and those are probably the entry points that you're looking for as chasing the move all the way up here has been a bit risky as oil shot straight up in the air over the last couple of weeks to get to this region. In other words, we have to work off some of that inertia that has been expended. Ultimately, I like finding value on dips in this bullish market.

Ready to trade Crude Oil daily analysis and predictions? Here are the best Oil trading brokers to choose from.