Cryptocurrency prices are seeing immense sell pressure as the month of February winds down, hampered by macro factors weighing on the market while traders also grapple with the fallout from the ByBit hack, which saw $1.5 billion flow into the coffers of hackers.

Bitcoin (BTC) has fallen below $87,000 for the first time since early November and now trades more than 20% below its all-time high just a month prior, officially putting BTC in a technical bear market.

Bitcoin $BTC enters technical bear market after falling more than 20% from its January 20 all-time high ? pic.twitter.com/eWDjR5GpyZ

— Barchart (@Barchart) February 25, 2025

And it's not just Bitcoin that is feeling the heat, as data provided by CoinMarketCap shows that all but 10 tokens in the top 200 are seeing red on the 24-hour chart, with many nursing double-digit losses.

XRP headed for $1.50

XRP has been one of the hottest tokens of this cycle, hitting a high of $3.40 on Jan. 16, less than 5% below its all-time high of $3.55 set in January 2018.

But with cryptos facing pressure from multiple angles, commentators in the XRP community are warning that further declines are expected, and the token could hit a low of $1.50.

The faster we go down, the faster we'll rise.

— BearX (@bearx589) February 25, 2025

Expect at least $1.50..

This will be the last free fall.

No one said it would be easy, but together it’s not as bad.

Lock in!#XRP

On Tuesday, President Trump highlighted that tariffs on imports from Canada and Mexico are still on as the month-long delay in their implementation nears expiration, causing the market to take another leg down.

XRP, like the broader crypto market, was negatively affected by the announcement, falling more than 20% from Monday to Tuesday, hitting a low of $2.07.

While the appearance of an asymmetrical triangle on the daily chart suggested that a strong momentum trend was underway, the breakdown below the triangle, combined with a drop in XRP futures demand, has analysts warning that a retreat toward $1.50 could be on the table.

Mounting Bearish Indicators

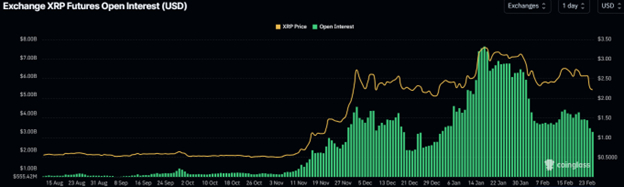

Data provided by CoinGlass shows XRP open interest has dropped by 20% from $3.63 billion on Feb. 24 to the current level of around $2.93 billion, levels last seen on Jan. 3.

Past trends show that significant declines in OI have historically been followed by major drops in the price of XRP, and analysts are sounding the alarm.

Further evidence of bearish pressure can be found in XRP funding rates, which declined from 0.0077% on Monday to a low of -0.0003% on Tuesday.

Since Sunday, more than $69.5 million long XRP positions have been liquidated, compared to $10.15 million short liquidations.

Taken together, this data suggests that the pain XRP holders are experiencing could get worse.

XRP headed for $1.50

Based on XRP’s historical price performance, analysts have warned that XRP could decline another 30% before finding support, which equates to a price of around $1.50.

According to Egrag Crypto, the breakdown of the ascending triangle in the 12-hour timeframe could see XRP price retest the $1.61 zone

Technical Analyst Ali Martinez has warned of a similar outcome, giving a possible target of $1.65.

$XRP is breaking out of an ascending parallel channel, targeting $1.65! pic.twitter.com/7WhTmy7mLf

— Ali (@ali_charts) February 25, 2025

But a more macro view shows that while the negative crypto news stories over the past week have impacted sentiment in the short term and led to losses across the board, in the case of XRP, the current pullback and consolidation to follow could just a test of resistance before the token charts a path to a new all-time high.

Here's the old Ripple $XRP getting rejected exactly where it collapsed seven years ago. pic.twitter.com/WsgChr3jjn

— Alfonso De Pablos, CMT (@AlfCharts) February 25, 2025

It remains to be seen whether the XRP price will recover after consolidating or continue to trend lower. While analysts widely agree that further near-term downside is expected, that hasn’t stopped the most bullish in the XRP Army from doubling down on their allocations.

$XRP The highest potential asset in history is on sale and you are panicked? Scared?

— Armando Pantoja (@_TallGuyTycoon) February 25, 2025

You didn't catch it from .35 to $3.80 but now it's at $2.21... and you're complaining?

I don't know about you, but i just bought a massive amount.

Ready to trade our Ripple forecast? We’ve shortlisted the best MT4 crypto brokers in the industry for you.