Bullish view

- Buy the GBP/USD pair and set a take-profit at 1.2600.

- Add a stop-loss at 1.2375.

- Timeline: 1-2 days.

Bearish view

- Sell the GBP/USD pair and set a take-profit at 1.2400.

- Add a stop-loss at 1.2600.

The GBP/USD exchange rate rose slightly as trade tensions eased and as traders waited for the upcoming Bank of England (BoE) interest rate decision. It moved to a high of 1.2500, up by over 3% from its lowest point this year.

The GBP/USD pair rose after the recent trade war fears eased. Donald Trump inked deals with countries like Canada and Mexico in which they will negotiate a wide-ranging trade deal in good faith. He also wants these countries to help the US with the illegal migration and fentanyl crisis. Therefore, the GBP/USD pair is rising as traders anticipate a deal in the coming weeks.

The GBP/USD pair also rose after the US published weak economic numbers. According to the Bureau of Labor Statistics (BLS), the number of job openings in the US dropped from over 8.15 million in November to 7.6 million in December. These numbers were weaker than the median estimate of 8.01 million.

ADP will release the private payroll numbers later on Wednesday, while the BLS will release the official nonfarm payroll (NFP) numbers on Friday. Economists expect the ADP report to show that payrolls increased by 148k in January from 122k a month earlier.

These job numbers are important as they will help the Fed when delivering the next interest rate decision. The bank left interest rates unchanged at 4.5% in the last monetary policy meeting and hinted that it will maintain a hawkish tone for a while.

The GBP/USD pair will react to the upcoming Bank of England (BoE) interest rate decision. Economists see the bank cutting interest rates by 0.25% and starting a dovish shift since the economy is slowing.

Top Forex Brokers

GBP/USD technical analysis

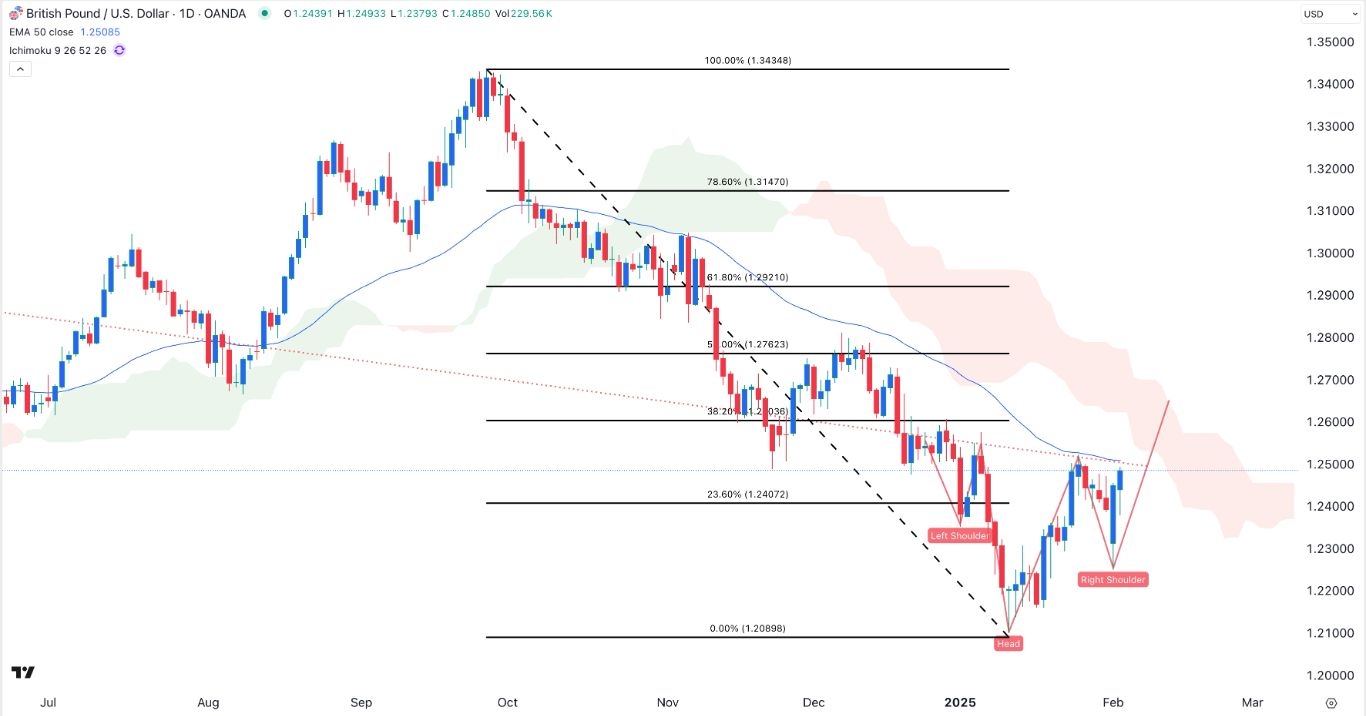

The GBP/USD pair has bounced back in the past few days, moving from a low of 1.2090 to a high of 1.2500. It has formed an inverse head and shoulders chart pattern, a popular bullish reversal sign.

The pair has moved above the 23.6% Fibonacci Retracement level at 1.2408. However, it remains below the 50-day Exponential Moving Average (EMA) and the Ichimoku cloud indicator, a sign that it is facing some bearish pressure.

Therefore, the pair will likely keep rising as traders target the 38.2% Fibonacci Retracement point at 1.2600.

Ready to trade our free trading signals? We’ve made a list of the best UK forex brokers worth using.