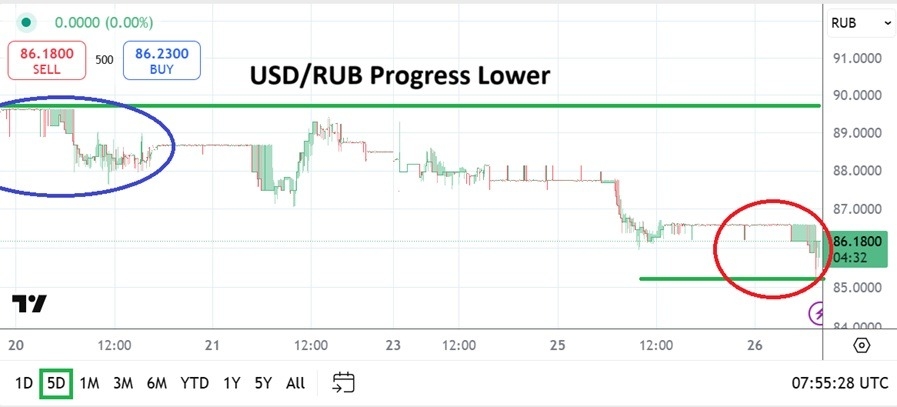

The lower move in the USD/RUB has become clear. The USD/RUB as of this writing is flirting with 86.1800 via trading platforms. An advance in negotiations regarding the Russia/ Ukrainian war has certainly started to shift the behavioral sentiment of financial institutions dealing with the Russian Ruble. Traders need to practice patience if they want to pursue the USD/RUB.

While President Trump’s tactic have drawn the ire of many, apparently the Ukraine has announced today that it has agreed to a draft of a mineral rights deal with the U.S which has been sought by the White House administration. This agreement apparently has opened the door for a discussion between Ukraine’s Zelensky and Trump for this coming Friday in Washington D.C, which will likely create the potential for the Ukraine to become more involved in talks the U.S has been conducting with Russia. These developments have helped bolster the bearish trend in the USD/RUB.

Top Forex Brokers

USD/RUB Resistance Levels Appear Durable

Traders need to remember the USD/RUB does not have a great deal of volume. While wagering on the currency pair speculators should use entry price orders to make sure their fills meet expectations. Looking for more downside in the USD/RUB is a logical wager, but traders must remember Forex is seldom a one way avenue. Reversals higher will be seen as part of the natural trading landscape in the USD/RUR. Do not get overly ambitious regarding targets.

The ability of the USD/RUB to sustain values below the 90.0000 level is significant and if the 89.0000 to 88.0000 start to see less challenges, this might indicate financial institutions are still leaning into their bearish sentiment. Long-term technical charts now have to be used by traders looking for insights into potential price levels which could be challenged near-term. The last time the USD/RUB touched its current values in a sustained manner was in August of 2024.

Speculative Wagering in the USD/RUB

Traders who want to pursue the USD/RUB need to understand they are entering a domain that is not completely transparent. Large commercial orders for the Russian Ruble are taking place, but there is not a lot of transparency. However, traders can use behavioral sentiment effectively. It is clear that current talks underway between the U.S, Russia and the Ukraine are gathering momentum.

- Certainly there will be moments when loud disagreements will be heard in the coming days and weeks, but it is also clear that President Trump’s negotiating tactics are causing movement.

- Financial institutions may believe there is more downside momentum possible for the USD/RUB.

- In June and July of 2024 the USD/RUB was sometimes trading near the 84.0000 level.

- Traders wanting to wager on the currency pair are encouraged to use risk management and take profits orders to cash out winnings if they materialize.

USD/RUB Short Term Outlook:

Current Resistance: 87.6000

Current Support: 86.1100

High Target: 89.9000

Low Target: 85.1000

Ready to trade our daily Forex analysis? Here's a list of the best forex trading platforms Russia to choose from