Bearish view

- Sell the BTC/USD pair and set a take-profit at 82,000.

- Add a stop-loss at 88,000.

- Timeline: 1-2 days.

Bullish view

- Set a buy-stop at 86,000 and a take-profit at 90,000.

- Add a stop-loss at 82,000.

Bitcoin price rose and crossed an important resistance level at $85,000 as investors embraced a risk-on sentiment after the Federal Reserve decision. The BTC/USD pair rose to a high of 85,950, the highest point since March 8. It has jumped by over 11% from its lowest level this year.

Bitcoin price rises after the Fed decision

The BTC/USD pair rose as investors moved to risky assets after the Federal Reserve March meeting. Jerome Powell and other officials left interest rates unchanged between 4.25% and 4.50% as most analysts were expecting.

He warned that the US was barreling towards a stagflation because of Donald Trump’s tariffs. At the same time, the dot plot signaled that interest rates may remain higher for longer. Eight participants believe that the Fed should either implement one or no rate cuts this year. These officials are likely worried about the impact of tariffs on inflation.

Top Forex Brokers

The other key outcome of the meeting was that the Fed will now slow the pace of runoff of its securities holdings. It will do that by cutting the monthly cap on Treasury securities redemption to $5 billion from $25 billion. The bank is expected to end its quantitative tightening program later this year.

Risky assets like stocks jumped, with the Dow Jones index rising by over 500 points and the tech-heavy Nasdaq 100 index rising by over 300 points. Historically, these assets have a close correlation with Bitcoin.

Bitcoin price also rose as investors continued buying spot ETFs. Total ETF inflows this week have jumped to almost $500 million, a sign that Wall Street investors are accumulating.

BTC/USD technical analysis

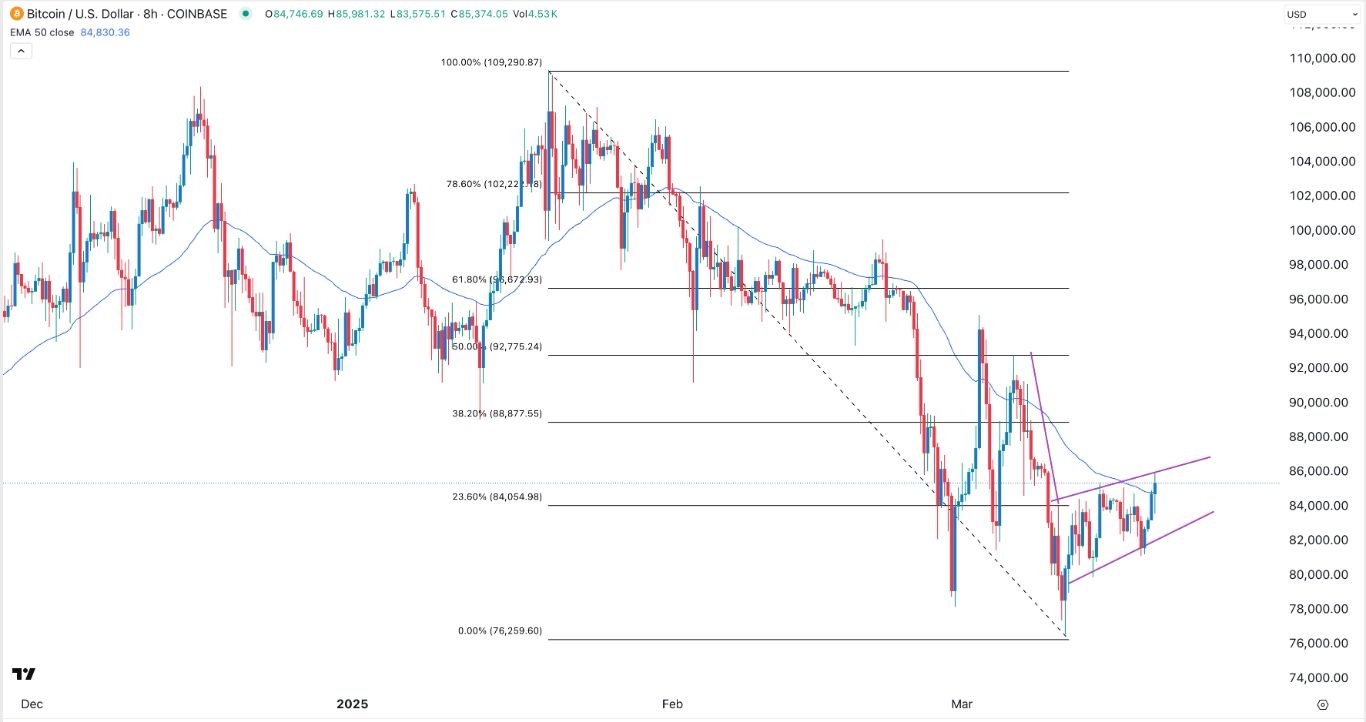

The eight-hour chart shows that the BTC/USD pair bottomed at 76,260 this month and has now jumped to a high of 86,950 after the FOMC decision.

It has jumped above the 23.6% Fibonacci Retracement point at 84,050. Also, the pair has jumped above the 50-period moving average.

However, it has also formed a bearish flag chart pattern, a popular bearish sign in technical analysis. This pattern comprises a long vertical line and a rectangle pattern. Therefore, the pair will likely have a bearish breakout in the coming days, with the next point to watch being at 82,000.

Ready to trade our free Forex signals? Here are the best MT4 crypto brokers to choose from.