- The Light Sweet Crude market continues to see a lot of noise just above, and although we are in a major area of inflection, I think we will continue to see a lot of questions asked about the CL contract.

- After all, there are a lot of concerns about the global economy at the moment, and of course crude oil is considered to be the “life’s blood” of economic activity.

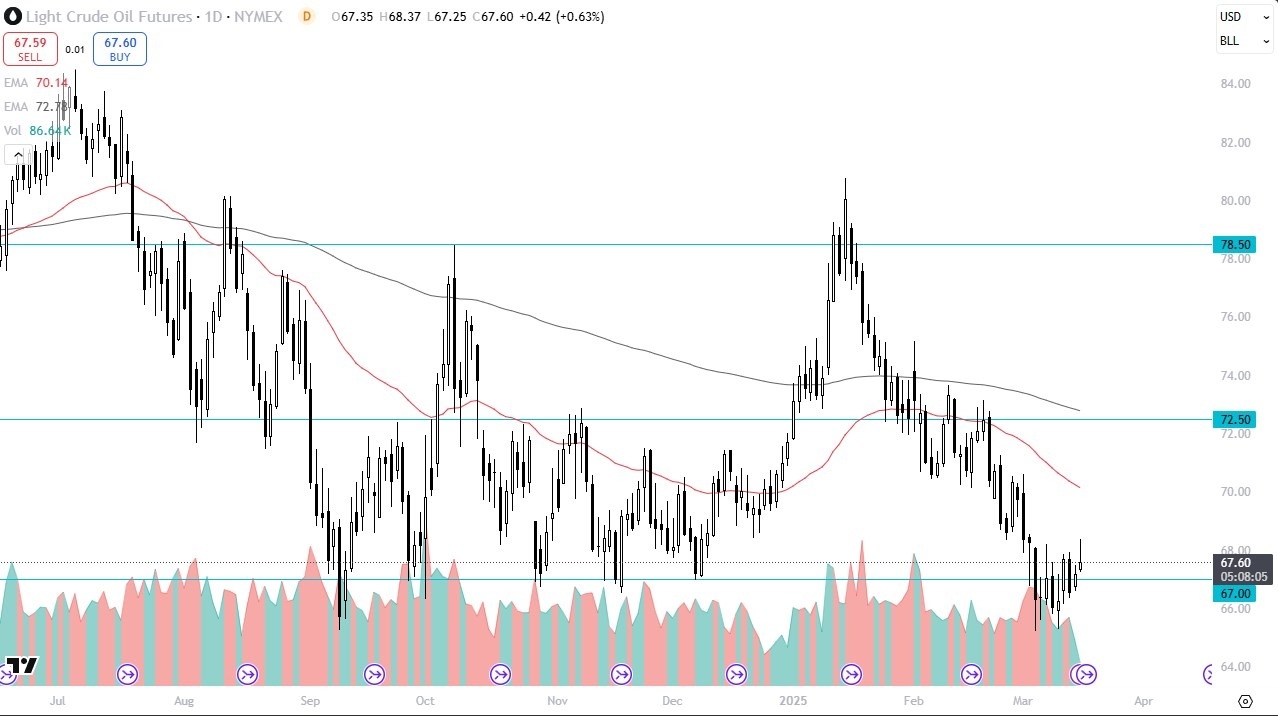

Ultimately, this is a market that I think will take off to the upside, but we just don’t have enough momentum to get this things moving. We did pierce the $68 level initially during the trading session on Monday but have turned around to show signs of exhaustion. The market is starting to form a bit of a shooting star, so that could give you an idea of just how difficult this market is going to be to hang onto. However, there are plenty of opportunities if you are quick enough to take advantage of the well-defined consolidation area that we are obviously stuck in.

Top Forex Brokers

Range of Trading

As things stand right now, the range of trading sees the $68 level as a massive ceiling in the market, but also sees the $66 level, perhaps even as low as the $65.50 level as a major floor. If you are a short-term day trader, this might be an excellent market to trade, until of course it breaks out. Between now and then, I anticipate that this market will go back and forth quite a bit and will probably offer plenty of opportunities.

Having said that, I do expect that the support level, which is the bottom of this range, will hold at this point as it has been important for 3 years. If we break above the $68.50 level on a daily close, at that point in time then I start to shift to a “buy on the dips” type of trading strategy when it comes to crude oil. Keep in mind that economic slowdowns are absolutely toxic for the oil market, but it’s also worth noting that we are heading into a traditionally more positive time of year.

Ready to trade the daily crude oil Forex forecast? Here’s a list of some of the best Oil trading platforms to check out.