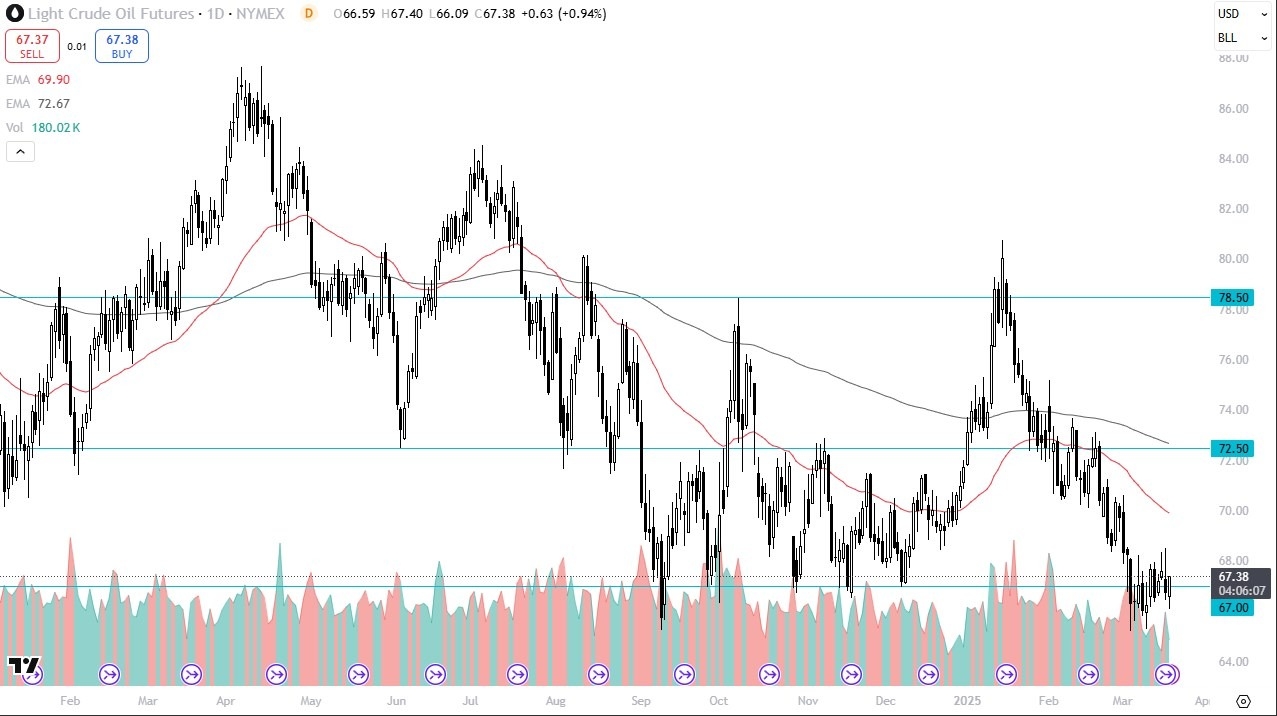

- During the trading session on Wednesday, we saw the Light Sweet Crude oil market pull back a bit, only to turn around and find buyers yet again.

- This is a market that’s been consolidating for a while, and I think that is something to keep in mind as we are at a major point of inflection when it comes to the energy markets overall.

Keep in mind that the area near $65 has been a major support level over the last 3 years, and it certainly looks as if somebody is stepping into the contract in order to keep the market somewhat afloat. To the upside, this $68.50 level should offer resistance, so I think you’ve got a scenario where the market is just simply going back and forth and trying to figure out what it is they are going to do going forward. After all, there are a lot of external pressures right now on the crude oil markets that people will have to figure out at this juncture.

Top Forex Brokers

Forming a Bottom?

At this point in time, we have to ask the question as to whether or not the market is trying to form some type of bottoming. After all, this would be the perfect place to do it, and of course the seasonality of demand is somewhat positive this time of year as traders start to factor in the driving season in places like the United States and Europe. Because of this, it’s quite common to see the market rally this year, but whether or not he and hang on to those gains is still an open question.

The 50 Day EMA is near the $70 level and dropping, and I think that is something that you need to pay close attention to. If we were to somehow break out above the $68.50 level, and then attack that 50 Day EMA, anything above that level could have buyers coming in to chase the “FOMO trading.” On the other hand, if we were to break down below the $65 level, that could lead to massive selling.

Ready to trade the daily crude oil Forex forecast? Here’s a list of some of the best Oil trading platforms to check out.