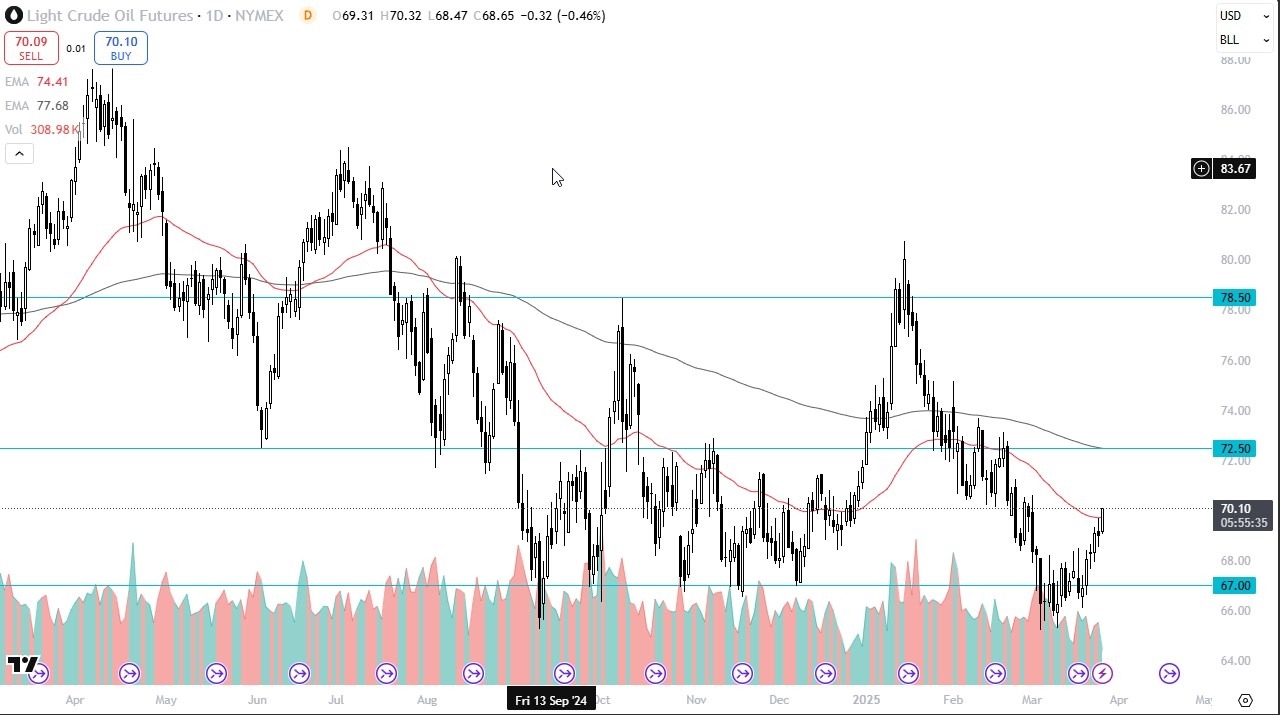

- The light sweet crude oil market, or what some see if the markets will list as “US Oil”, has rallied quite significantly during the trading session on Wednesday to break significantly above the 50 Day EMA.

- This should not be a huge surprise, considering that we have seen so much in the way of relentless upward pressure in this market.

Furthermore, it’s also worth noting that the area just below the $67 level has been support for 3 years, so bouncing from there is not exactly a huge surprise either. Ultimately, this is a market that I think given enough time will continue to pay close attention to this area, because it’s obvious that there is a lot of demand in that general vicinity. In that scenario, I think you have a situation where traders will continue to look at this as the “floor in market.”

Top Forex Brokers

Seasonal Trade?

Quite often, there is a bit of a seasonal trade in this market, as demand will pick up in warmer temperatures as American start driving more. Furthermore, there are some questions as to whether or not the economy in America is not going to head into a recession, and the bond markets are telling us that any recession that we would get would be of the short term variety at worst.

Ultimately, I do think that this is a market that is in the midst of turning around for a longer-term move, and that means that we could be looking at the $72.50 level being targeted. If we can break above there, then we really could start to take off as the oil market would then be above the crucial 200 Day EMA that sits at that level. Because of this, I think short-term pullbacks will continue to attract plenty of attention, and I believe it is only a matter of time before we see a bit of a bounce. In fact, that’s been the play for several weeks now, and I don’t see anything on this chart that would change that.

Ready to trade daily crude oil price analysis? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.