AUD/USD

The Australian dollar initially rallied during the past week but continues to see the 0.64 level as a very difficult to get above. If we could break above there, it would obviously be a very bullish sign, but judging by buying the candlestick for the week, and looks more likely that we will continue to see a lot of back and forth. The 0.62 level could end up being support yet again.

USD/CAD

The US dollar did fall pretty significantly against the Canadian dollar during the week but has turned around to form a bit of a hammer. This makes perfect sense, considering that we still see a lot of questions asked about potential tariffs being levied between Canada and the United States. As long as that is going to continue to be the case, I think that is what moves this pair more than anything else. For what it is worth, April 2 is the deadline for Donald Trump to impose tariffs, at least as things stand right now. This is a pair that although I do believe will stay bullish longer term, is more or less going to be moving on the latest tweets.

USD/CHF

The US dollar fell during the week, but did see enough support near the crucial 0.8750 level, to turn things around and show signs of life. By doing so, we have ended up forming a bit of a hammer for the week, which also finds itself near the crucial 50% Fibonacci retracement level. With interest rates in America being so much higher than Switzerland, it does make a certain amount of sense that we would continue to see the US dollar enjoy a little bit of strength against this currency as Switzerland cut interest rates yet again this past week.

The US dollar fell during the week, but did see enough support near the crucial 0.8750 level, to turn things around and show signs of life. By doing so, we have ended up forming a bit of a hammer for the week, which also finds itself near the crucial 50% Fibonacci retracement level. With interest rates in America being so much higher than Switzerland, it does make a certain amount of sense that we would continue to see the US dollar enjoy a little bit of strength against this currency as Switzerland cut interest rates yet again this past week.

Top Forex Brokers

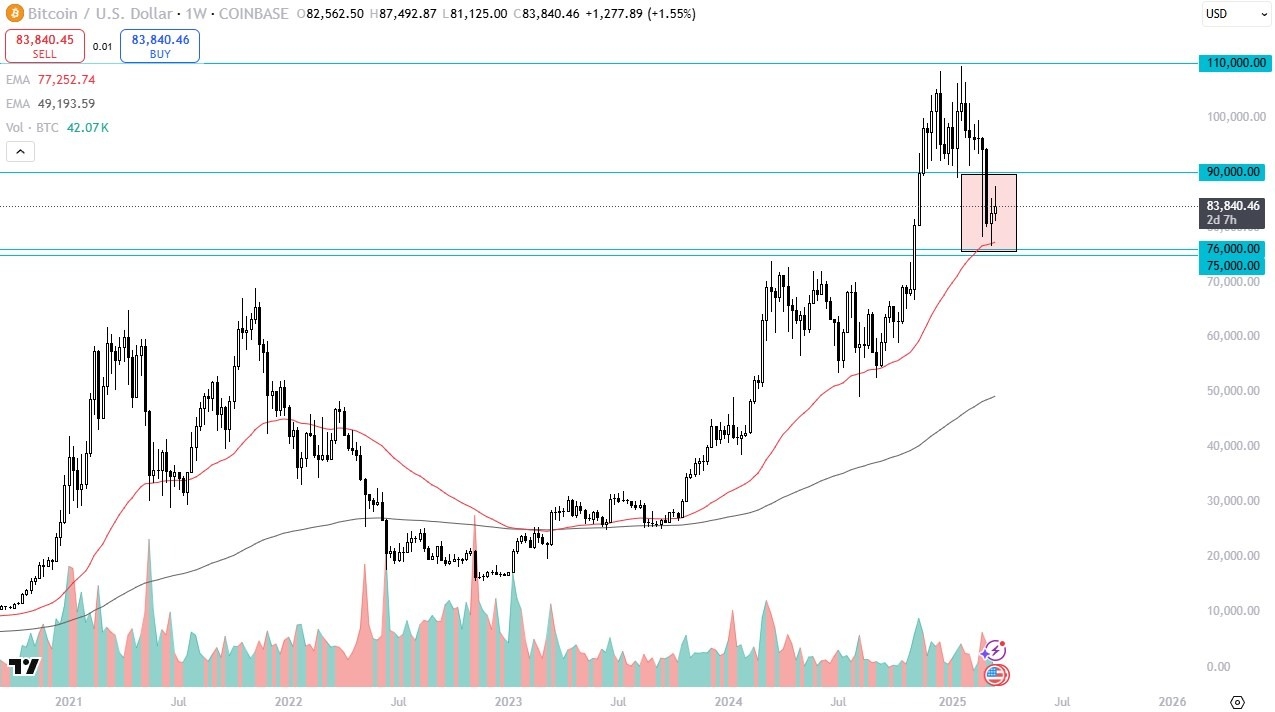

BTC/USD

Bitcoin has rallied a bit during the week, after forming a hammer during the previous one. While this is a positive turn of events, you cannot overlook the fact that we did pull back rather significantly. The fact that we formed a hammer during the previous week and a shooting star during the one just past, suggests that perhaps we are in an area that might end up being a nice consolidation area. This would make a certain amount of sense, as Bitcoin has been hammered over the last couple of months. All things being equal though, it needs more of a “risk on appetite” around the world to get going to the upside. I suspect this next week will be more of the same back and forth action.

Dow Jones 30

The Dow Jones 30 has rallied during the course of the week and even broke above the 42,000 level at one point. It is currently dancing around the 50 Week EMA, so it’ll be interesting to see if this can hold. Conversely, we just formed a massive “M pattern”, which of course is a negative turn of events. We are right at the neckline of this pattern, so I suspect the next week or two will be crucial as to where we go next. I would stay away from this market, but I would also pay close attention to it, as it could give you a bit of a “heads up” as to how the US indices are going to behave. The market is still very much in an uptrend, but we still have a lot of uncertainty as well.

The Dow Jones 30 has rallied during the course of the week and even broke above the 42,000 level at one point. It is currently dancing around the 50 Week EMA, so it’ll be interesting to see if this can hold. Conversely, we just formed a massive “M pattern”, which of course is a negative turn of events. We are right at the neckline of this pattern, so I suspect the next week or two will be crucial as to where we go next. I would stay away from this market, but I would also pay close attention to it, as it could give you a bit of a “heads up” as to how the US indices are going to behave. The market is still very much in an uptrend, but we still have a lot of uncertainty as well.

Gold

Gold had a positive week, but it’s probably worth noting that we gave back quite a bit of the gains. Because of this, we could be getting ready to enter a bit of a pullback, but this pullback should also end up being a nice buying opportunity. After all, all of the same fundamental reasons are out there for gold to go higher, not the least of which of course would be the US dollar shrinking over the longer term. That being said, the US dollar is trying to bounce a bit, so that has put downward pressure on this market as well.

Gold had a positive week, but it’s probably worth noting that we gave back quite a bit of the gains. Because of this, we could be getting ready to enter a bit of a pullback, but this pullback should also end up being a nice buying opportunity. After all, all of the same fundamental reasons are out there for gold to go higher, not the least of which of course would be the US dollar shrinking over the longer term. That being said, the US dollar is trying to bounce a bit, so that has put downward pressure on this market as well.

USD/JPY

The US dollar has rallied a bit against the Japanese yen during the course of the week, forming a bit of a shooting star as we give back quite a bit of this gains. At this point, the set up a clear line of demarcation, with the ¥150 level being important. If we can break above the ¥150 level, then I think the US dollar goes much higher. On the other hand, if we fall from here then we will probably stay in this range that we have been in over the last three weeks.

USD/MXN

The US dollar has rallied rather significantly against the Mexican peso over the course of the last week, using the 20 MXN level as a massive support level. This sets up an easy trade, assuming that we it kicks off. If we were to break down below the lows of the last couple of weeks, I believe the US dollar would fall rather significantly from there, perhaps down to the 19 MXN level. On the other hand, if we recapture the 20.50 MXN level, this could be very negative for the Mexican peso not only here, but around the Forex world as well.

Ready to trade our Forex weekly forecast? We’ve made a list of some of the best regulated forex brokers to choose from.