- The US dollar initially tried to rally against the Indian rupee but gave up gains pretty quickly on Thursday as we continue to see a lot of back and forth technical trading.

- We are below the 87 rupee level, which in and of itself isn't remarkable, but it is worth noting that it's an area that's been a bit of a fulcrum for price, perhaps fair value in the recent consolidation.

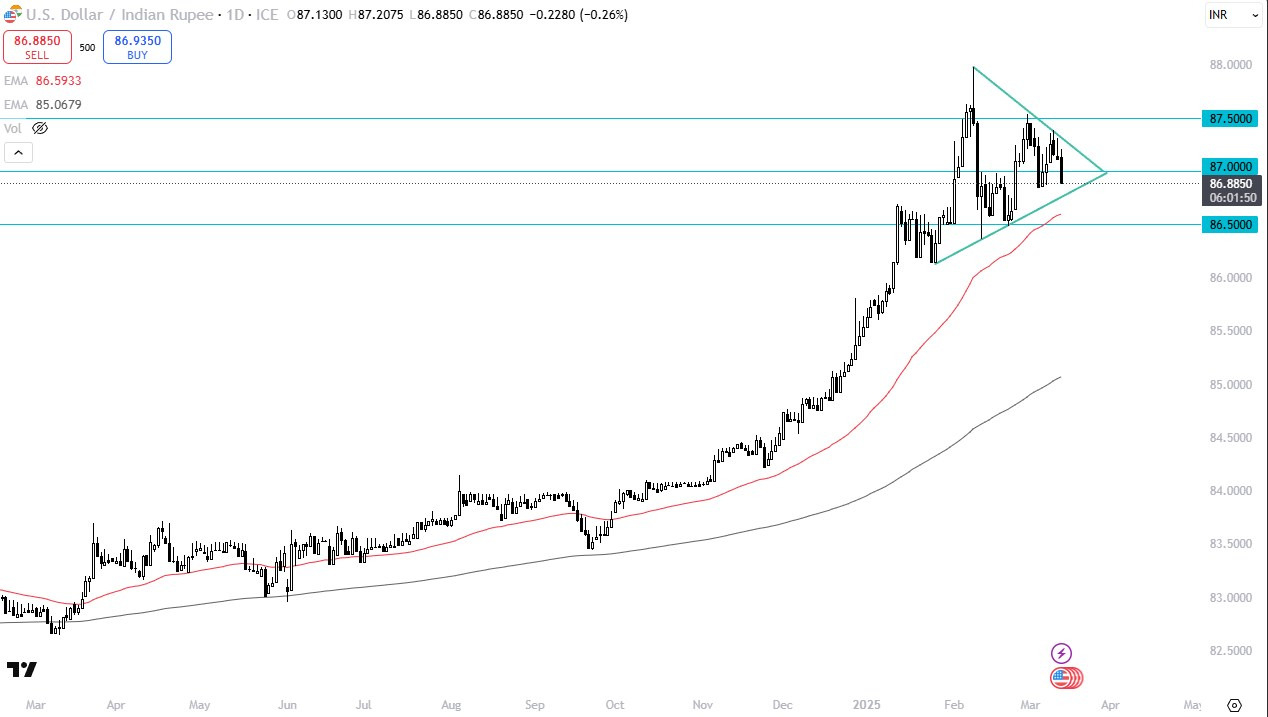

- On the chart, you can draw a couple of trend lines and see that we are in the midst of a triangle.

But when you look at the longer term chart, it's obvious that we've been in an uptrend for what seems like a lifetime and the market digesting and going sideways for a while does make a certain amount of sense. Keep in mind that the Bank of India is rather hands-on when it comes to the Indian rupee. So, this isn't necessarily like trading in a lot of other currencies.

Top Forex Brokers

Technical Analysis

The 50-day EMA is currently right around the 86.60 rupee level and rising so that it can get parallel with the uptrend line that's the bottom of the triangle on the chart. This adds more credence to the idea of support and it's probably worth noting that the US dollar has shown strength against a handful of currencies during the day. So, we may see that return here. I do think that you have to be very patient. The USD/INR is a currency pair that ends up being more or less an investment most of the time you get involved. But right now, the Indian rupee is very weak from a longer term perspective, and it'll be interesting to see what the RBI does for protection of its currency. The US yields have been rising and the fact that the Indian rupee strengthened during the day actually flew in the face of that. So that's kind of interesting and worth watching. All things being equal though, I do suspect that this ends up being a buy on the dip type of scenario.

Ready to trade our Forex daily analysis and predictions? Here are the best forex trading apps in India to choose from.