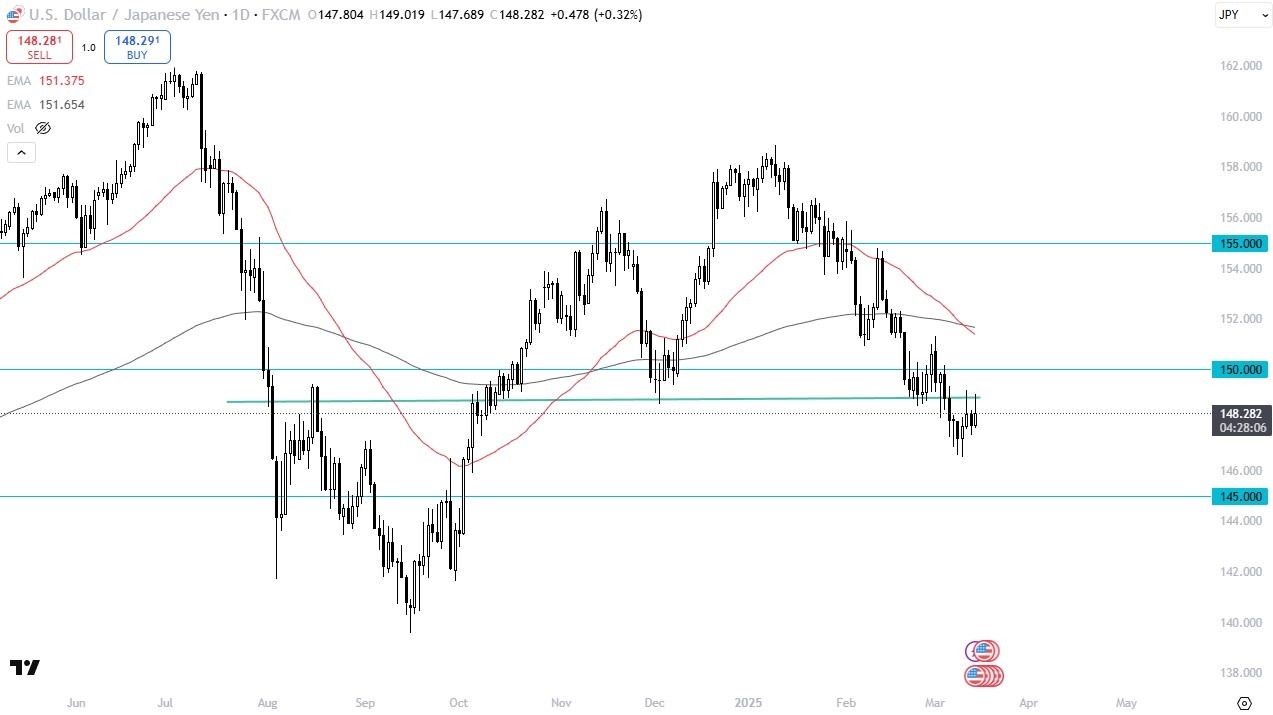

- The US dollar has rallied a bit during the early hours on Friday but you can see we continue to struggle near the 149 yen level.

- This is an area that previously was significant support so I think at this point in time we are trying to determine whether or not the US dollar is going to completely collapse against the Japanese yen or if we can form some type of bottom.

Looking at the weekly candlestick, I can see that it is a bit of a hammer and I'm seeing that across the board with the US dollar against most of its major currency competitors. next week could be interesting for the greenback. In this particular currency pair, I would need to see a daily close above 150 yen to get particularly interested in buying, but it is worth noting that the interest rate differential does favor the United States.

Top Forex Brokers

Risk Appetite?

Furthermore, if there's a little bit more of a risk on feel, then you could make the argument for this pair of rallying as well. Keep in mind that the Japanese yen tends to move in the same direction against most currencies. So, if this one rises, you might be able to find more juice with the British pound against the Japanese yen, or even the New Zealand dollar against the Japanese yen as an example. On the other hand, if we do fall from here, we could very well plunge towards the 145 yen level, which is

All things being equal, the next major support level underneath. I do think that you have a situation where traders are a little hesitant to get overly exposed one way or the other. So, I would like to see a little bit of follow through in one direction or the other in order to get a sizable position right now. think volatility is the one thing you can probably count on in a very choppy tight range.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.