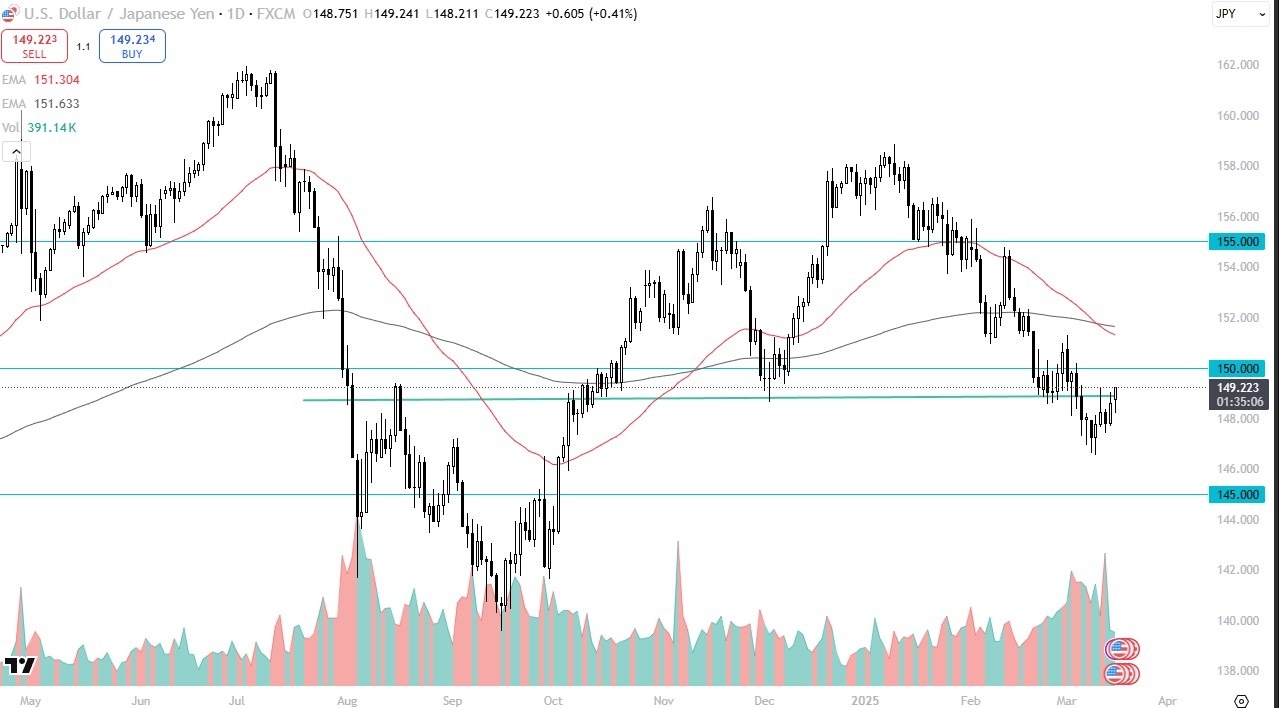

- The US dollar has been rather bullish during the trading session on Monday against the Japanese yen as we continue to see plenty of noise.

- But I also recognize that at this juncture, we are starting to see a little bit of a recovery, and this does make sense because both of these central banks have interest rate decisions this week.

- And the last thing somebody wants to do is get caught ahead of that with the wrong position.

Short Covering?

Top Forex Brokers

So, I think you are starting to see a little bit of short covering. It does make quite a bit of sense. And I think that ultimately, we could make a run towards the 150 yen level. Whether or not we can break above there, that might be a different question altogether, but I do recognize that this is a scenario where traders are most certainly going to be looking at this through the prism of the differential between statements from Japan and the United States.

If this USD/JPY pair can break above the 50 day EMA, then it's very likely that what we will then see is a significant run towards the 155 yen level. I don't expect that to happen easily because quite frankly, most things are working against the US dollar at the moment. And of course, you never know what's going to happen with the FOMC.

That being said, a short-term pullback at this point in time does make a certain amount of sense as well. And I think we're supported all the way down to about 147 yen. Anything below there has his pair running to the145 yen. level, but it must be stated that the session on Monday was rather impressive in favor of the US dollar. But again, I think a lot of what you're seeing here is short covering.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out