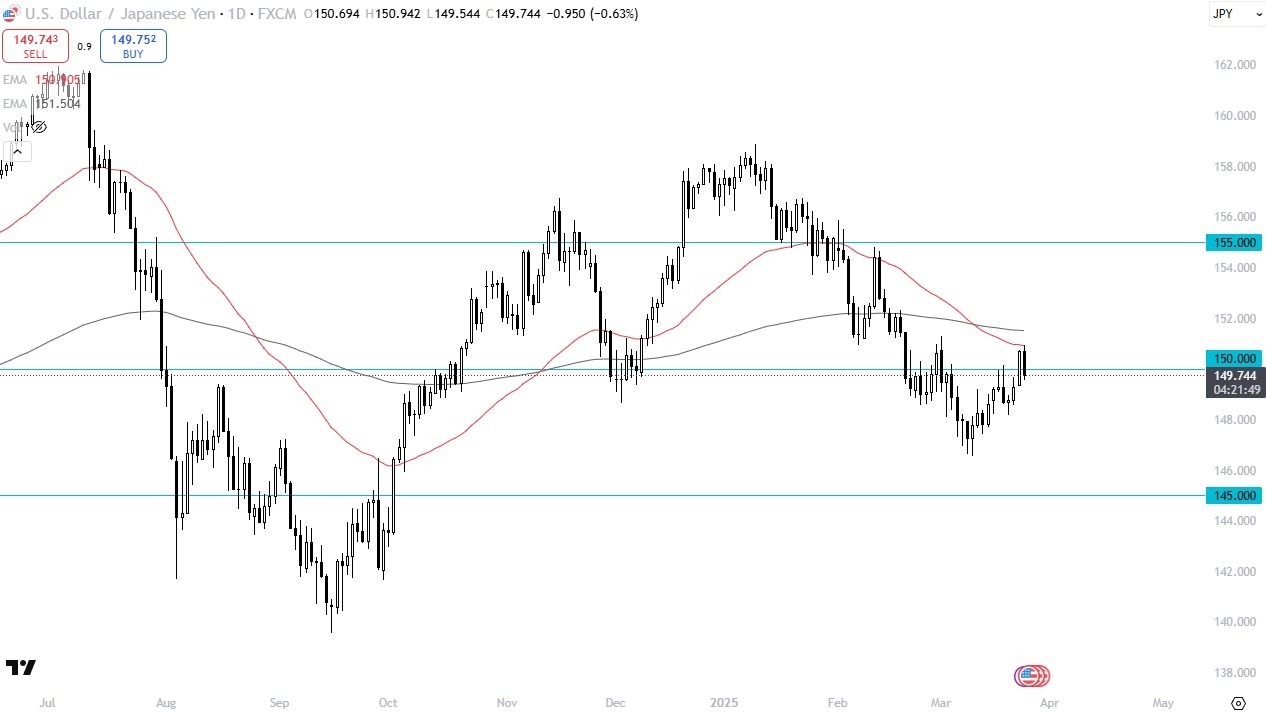

- The US dollar has fallen pretty significantly against the Japanese yen during trading on Tuesday as the 50-day EMA has been tested for resistance.

- That being said the market is likely to continue to be very noisy as we are hanging around the 150 yen level, an area that of course is a large round psychologically significant figure.

- The 150 yen level has been important multiple times in the past, so I think it does make a certain amount of sense that we would at least think about bouncing around this area.

- Now, the question at this point in time is whether or not we can turn around and take out the 200 day EMA above.

On a Move Higher

Top Forex Brokers

Breaking above the 200 day EMA opens up the possibility of a move to the 155 yen level. On the other hand, if we do break down from here, the market goes looking to the 148 yen level, which is an area that previously had been important. Anything below there opens up a move down to the 147 yen level and then eventually the 145 yen.

I do anticipate that we would see a lot of volatility and noisy behavior, but at the end of the day, market participants continue to see a lot of guessing as to where risk appetite is going.

The market will be very noisy as interest rate differentials are somewhat in flux. We've seen interest rates in America drop, and at the same time in Japan, they have been rising ever so slightly. The idea being that the Bank of Japan might end up raising rates. Now, that's never going to be enough to change the interest rate differential as far as who pays more or who pays less.

But my clue to start buying this market is on a break above the 200 day EMA, which is just below the 152 yen level. I think that is where we start to see more momentum pushing towards the 155 yen level. Again though, if we break down below that 148 yen level, it could get rather ugly.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.