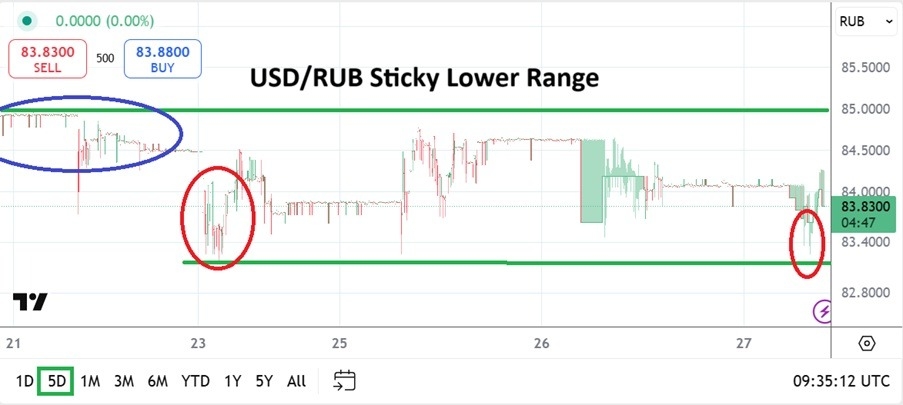

The USD/RUB continues to flirt with lows and its trading range has been rather consolidated the past handful of days, as of this writing the currency pair is near the 83.8300 level and shown some selling this morning.

In early morning trading today the USD/RUB touched the 83.3000 vicinity, and then reversed slightly higher. Intriguingly, the move higher has remained rather polite and the USD/RUB continues to traverse in a known lower price range. On the 18th of March, yes, the USD/RUB did trade near the 81.0000 level and has since moved upwards. But the price action higher has not been volatile and a demonstration of support tests, shows financial institutions are still leaning into more optimistic viewpoints about the Russian Ruble.

Top Forex Brokers

No, there has not been a negotiated end to the war between Russia and the Ukraine. And yes, there still seems to be large hurdles in the way of achieving a meaningful peace. Nevertheless dialogue continues and there are signs that both parties seek an agreement. The U.S has let it be known they are nearing an economic deal with the Ukraine, and the U.S has also suggested it will rollback some sanctions regarding export of Russian commodities if progress is made.

Perceptions and Behavioral Sentiment in the USD/RUB

The open discussions about the Russian/ Ukrainian war have let financial institutions feel more comfortable about the outlook for the USD/RUB mid and long-term. This notion has factored into the bearish trend which has developed since the start of January. However, the past week and a half has seen signs of stubborn support emerge.

Strong support is possibly a result of financial institutions that discounted existing risk premium in the Russian Ruble, now wanting more selling impetus before they seek lower values. Traders who have been looking for ambitious targets lower need to remain realistic regarding short and near-term price targets. Perhaps current support levels near 83.0000 to 82.0000 will remain durable ground for support near-term.

USD/RUB Correlation to the Broad Forex Market

The bearish trend in the USD/RUB remains easy to see via one month technical charts. The past week has seen support stiffen, but moves higher have been met with rather consistent re-tests of known technical lows.

Traders need to use entry price orders with the USD/RUB to insure proper fills, the spread in the currency pair remains wide and patience is needed to pursue price action in a tactical manner.

Lower values may logically remain the wagering choice for traders, but they should also know that financial institutions probably want to hear more optimistic banter about negotiations between Russia and the Ukraine.

USD/RUB Short Term Outlook:

Current Resistance: 83.9980

Current Support: 83.4000

High Target: 84.7000

Low Target: 82.8000

Ready to trade our daily forecast & predictions? Here are the best Russian forex brokers for you to check out.