- This pair might be the epicenter of the Forex world over the next couple of days, because as I write this article, the reality is that we don’t know what the tariff announcement will be.

- Nonetheless, there has been a few headlines out there that could move the market over the longer term.

Doug Ford, the Premier of Ontario, announced that during the trading session on Wednesday has announced that he be willing to drop all tariffs against American goods if the Americans were willing to do the same. The odd thing about Canada is that we haven’t really seen a coordinated voice yet, because this is one of the more hawkish Canadian politicians out there, while the Premier of Alberta, Danielle Smith, has been much more willing to negotiate in the past. Canada is a Confederation, which makes it a little bit difficult to get a grip on where we go next, but it certainly looks like the Canadians are about to cave. Mexico already has.

Top Forex Brokers

Going Forward

It’ll be interesting to see how this plays out, because there are lots of different things moving this pair at the moment. For example, the Canadians desperately need exports into the United States to survive. It’s over 80% of what they send out of their own country. If Americans were to stop buying Canadian goods, it would absolutely decimate an already fragile economy. Because of this, you can make an argument that this could end up being somewhat positive for the Canadian dollar, but the Canadian economy itself is a major problem as well. With this, you have essentially what is known in contact sports as a “medicine ball”, meaning that it is basically a 50-50 shot.

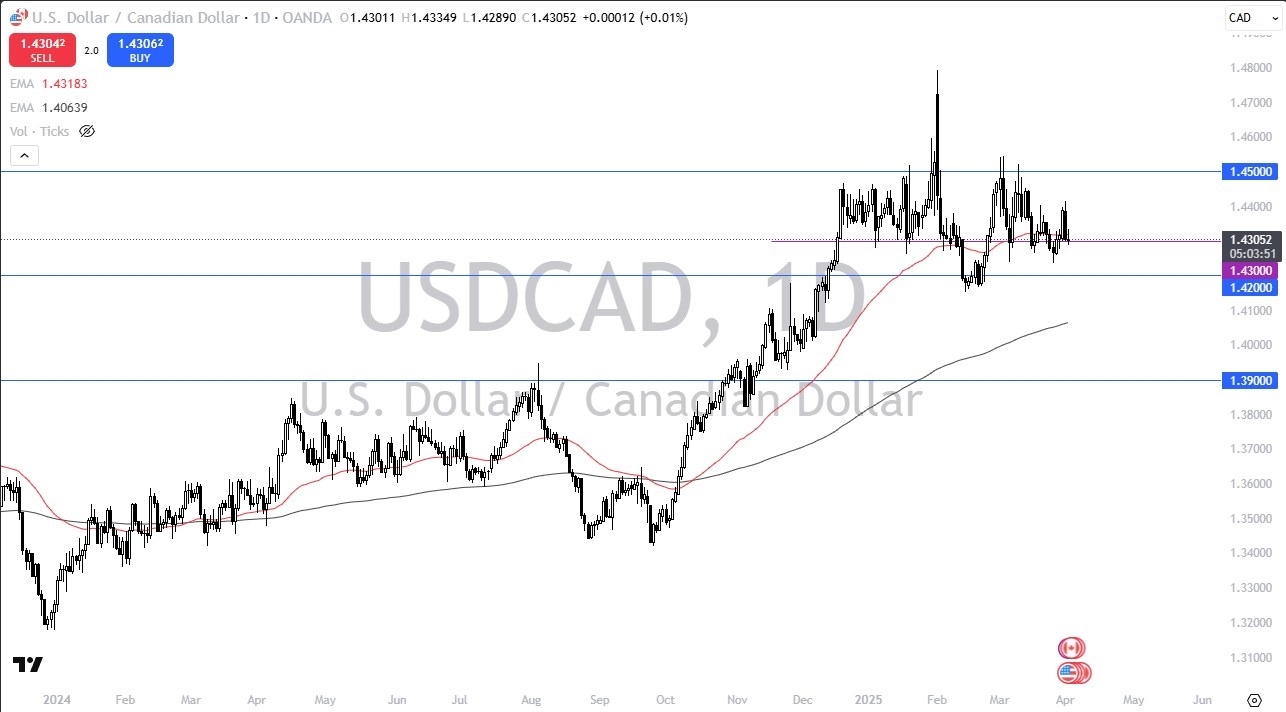

When looking at a “medicine ball”, 2 players will generally slam into each other, and there’s no real way to assess what’s most likely to happen, except for there’s a high possibility of somebody getting hurt. That’s how I look at this market, and I suspect that we will probably stay in the range we have been in for a while, unless of course Trump decide to go somewhat nuclear against Canada, something that he may do just for the shock value. In that environment, the Loonie gets crushed. That being said, this pair drops below the 1.1450 level on a daily close, we may have a massive trend reversal.

Ready to trade our USD/CAD daily analysis and predictions? Check out the best currency exchange broker Canada for you.