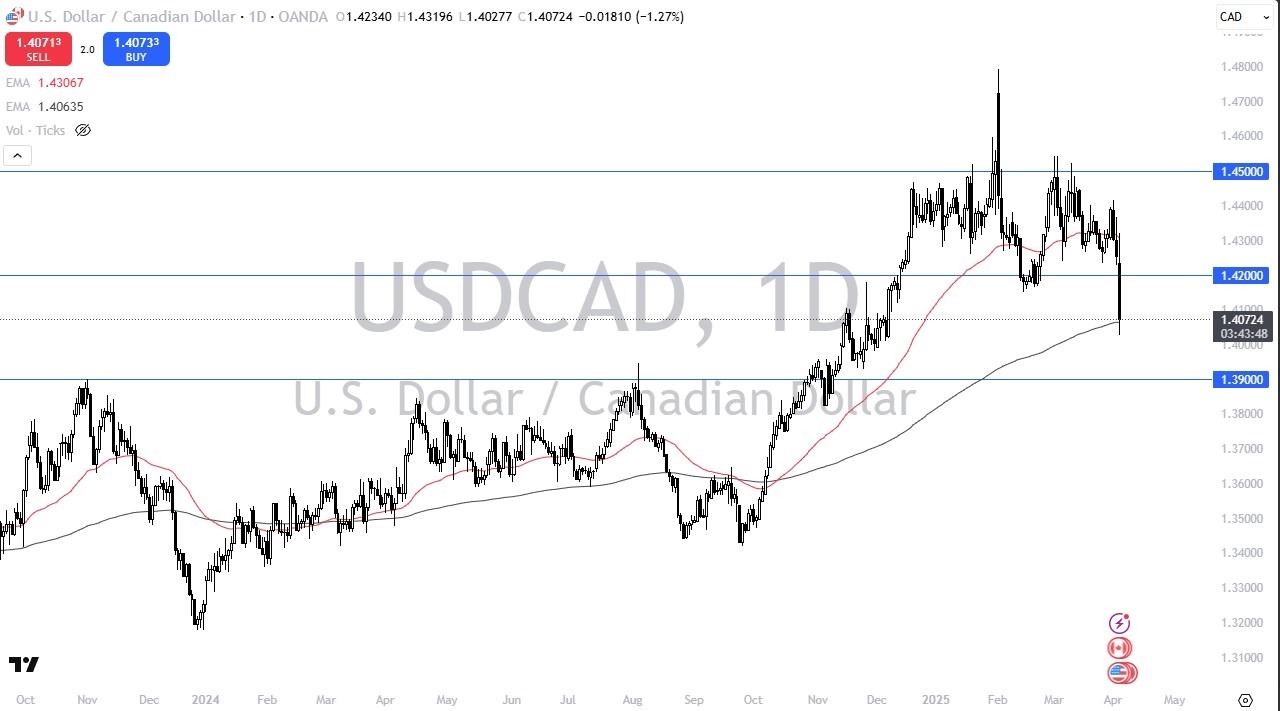

Potential signal:

- I believe that if the USD/CAD pair can break above the 1.4125 level on an hourly close, I will start buying again.

- At that point I would have to have a stop loss near the 1.40 level, aiming for the 1.44 level.

The US dollar has plunged rather significantly during the session on Thursday, after the tariffs were announced by Donald Trump. At this point, the market is testing the 200 Day EMA, which of course is an indicator that a lot of people would be paying close attention to. The 1.40 level is sitting just below, and then again, the 1.39 level has already shown itself to be supported in the past. All things being equal, this is a market that I’ll be watching very closely during the trading session on Friday as I think it is essentially going to be the “epicenter of forex trading” for that session.

Top Forex Brokers

Employment

One of the major reasons that I think this ends up being such an important place to watch is due to the fact that both the United States and Canada release employment figures during the day on Friday, and of course we have a lot of questions out there about the potential tariffs going forward that being said, I think that the reaction was overdone, and therefore would not surprise me at all to see the United States dollar pick up a little bit of momentum.

It’ll be interesting to see how the employment numbers fair out, and I think that we will essentially be looking at what Canada’s numbers are doing more than the US. Quite frankly, if the US numbers end up being somewhat strong, most traders will ignore it due to the fact that the tariffs happened just 2 days ago. However, if Canada’s numbers end up being very weak, that means the Canadian dollar could get absently crushed as things will more likely than not only get more difficult for the Canadians going forward.

Think of this way: Canada sends over 80% of its exports into the United States, and therefore as the US economy goes, so goes Canada’s. The fact that there is going to be a significant amount of tariffs levied on Canada just compounds this problem even further. This could be a very interesting currency pair on Friday.

Ready to trade our USD/CAD Forex forecast? Here’s some of the best regulated forex brokers in Canada to check out.