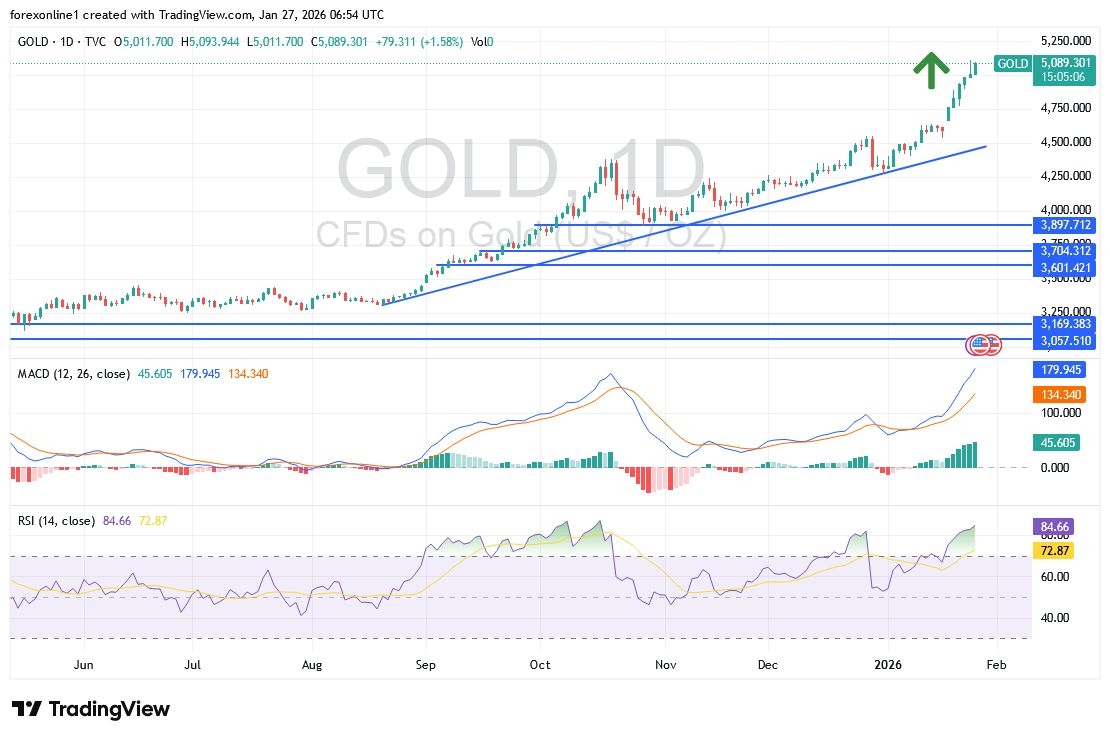

Today’s Gold Analysis Overview:

- The overall Gold Trend: Strongly bullish.

- Today's Gold Support Points: $5,000 – $4,920 – $4,830 per ounce.

- Today's Gold Resistance Points: $5,100 – $5,210 – $5,300 per ounce.

Today's Gold Trading Signals:

- Sell gold from the resistance level of $5,140 with a target of $4,800 and a stop-loss at $5,220.

- Buy gold from the support level of $4,920 with a target of $5,200 and a stop-loss at $4,870.

Top Regulated Brokers

Technical Analysis of Gold Price (XAU/USD) Today:

Gold prices have surged past the $5,000 per ounce threshold, driven by global market volatility fueling a historic rally. According to gold trading platforms, prices continued their ascent, crossing the $5,000 mark for the first time in history and reaching a resistance peak of $5,111 before stabilizing near $5,000 at the start of Tuesday’s session. This movement confirms the bulls' strong grip on the current trend.

Per analyst forecasts, the gold index gains are fueled by escalating geopolitical tensions and increased investor appetite for "safe haven" assets amid financial concerns in major economies. This surge represents one of the most significant long-term achievements in the history of precious metals trading, bolstering gains that have lifted prices by more than 17% since the beginning of the year.

Silver and other precious metals also reached record highs in tandem with gold's rise, underscoring the overall strength of the sector as the US dollar weakened against major currencies. Factors contributing to this remarkable rise in gold include persistent macroeconomic uncertainty, unclear central bank policies, and escalating geopolitical tensions. Consequently, many institutional investors have increasingly allocated their capital to gold as a hedge against inflationary pressures and potential monetary instability.

While forecasts from late last year predicted gold would approach or cross $5,000 in 2026, breaking this psychological and technical barrier now represents a significant acceleration of those expectations. Commodity analysts will be watching closely to see if risk sentiment continues to support prices at these record levels, or if profit-taking and shifts in general financial conditions will trigger a pullback. Regardless, gold surpassing $5,000 is a defining moment for the precious metals market, reflecting the growing influence of macroeconomic forces reshaping commodity markets in early 2026.

As previously noted, gold investors appear indifferent to technical indicators reaching "strongly overbought" levels; their focus remains on the persistent fundamental factors strengthening the market. However, it is worth noting that a de-escalation of global tensions could provide the most immediate catalyst for a round of profit-taking selloffs.

Trading Advice:

Dear TradersUp trader, we still recommend investing in gold. Generally, the current momentum suggests a buy advantage on dips as long as the price remains above key support levels.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.