The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

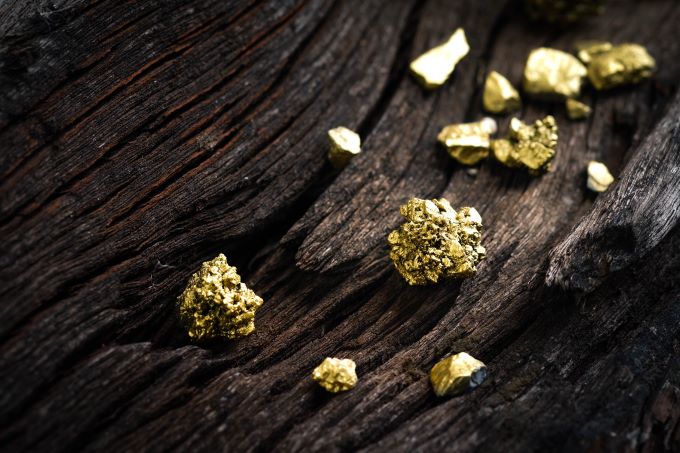

After the announcement of stronger than expected results of US inflation figures, the price of an ounce of gold fell to the level of 1798 dollars.

After the announcement of US inflation figures, the US dollar will be closely watched today due to the testimony of US Central Bank Governor Jerome Powell before the US Congress.

The USD/ZAR has surged higher in the past few days as widespread chaos has hit many of the streets in South African communities.

Top Forex Brokers

The USD/INR has bounced higher this morning after the Forex pair finished yesterday’s trading near short-term lows.

The USD/SGD has tested resistance targets again and is now highly positioned technically within its active and challenging price range.

ETH/USD has produced a strong leg downwards overnight and early this morning as support levels continue to appear vulnerable.

The price is being threatened by a major bearish breakdown.

The UK CPI came in high at 2.5%.

If the US Dollar Index breaks the 93 handle, the euro is going to be absolutely smoked.

Bonuses & Promotions

The British pound tried to rally during the trading session, but then broke down significantly as the US dollar got a push higher during later trading hours.

The Bitcoin market initially tried to rally during the trading session on Tuesday, but then broke down again as we continue to see bearish pressure in this market.

The S&P 500 pulled back just a bit during the trading session on Tuesday as the 4400 level has offered a bit of resistance.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox.The NASDAQ 100 shot higher during the trading session on Thursday as we went looking towards the 15,000 level.

The USD/CAD pair rose again during the trading session on Tuesday as we have broken above the 1.25 level yet again.

The DAX Index did pull back a little bit during the trading session on Tuesday, but it is not much to worry about at this point.

.jpeg)