The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The continuous downward momentum of the US dollar against the Japanese yen pushed it during this week’s trading to the 108.55 support level.

In the recent period that every time the GBP / USD currency pair tries to stabilize above the 1.4200 resistance, it is subjected to profit-taking selling.

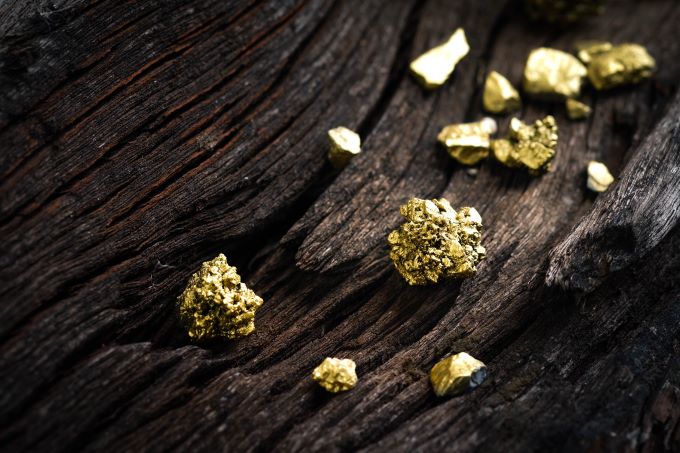

The continued decline of the US dollar is an important factor for the price of gold to move upwards, surpassing the level of psychological resistance of 1900 dollars an ounce.

Top Forex Brokers

Now that we've concluded that Dogecoin is strongly bullish, what happens next?

Volatility in Bitcoin remains extreme, which is what makes this asset class so striking.

The US dollar went back and forth during the trading session on Tuesday as we continue to sit just above the 1.20 handle against the Canadian dollar.

The West Texas Intermediate Crude Oil market fluctuated during the trading session on Tuesday, as we are at the top of a massive ascending triangle.

The DAX Index initially rallied during the trading session on Tuesday as the German Ifo numbers came out at higher-than-anticipated levels.

The NASDAQ 100 initially rallied during the trading session on Tuesday but gave back the gains in order to show signs of exhaustion.

Bonuses & Promotions

The market looks as if it is trying to build up the momentum to finally break out for a bigger move.

The euro rallied a bit during the trading session on Tuesday to break above the short-term resistance barrier.

What we are simply doing is trying to “chip away” at the selling pressure.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox.The Bitcoin market went back and forth during the trading session on Tuesday as the market continues to hang around the 200-day EMA.

Gold markets initially pulled back during the trading session on Tuesday as we continue to see gold get a bit of a boost.

The Australian dollar has nowhere to be in the short term, as we seem to have no idea as to what we are going to do for the next big move.