The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

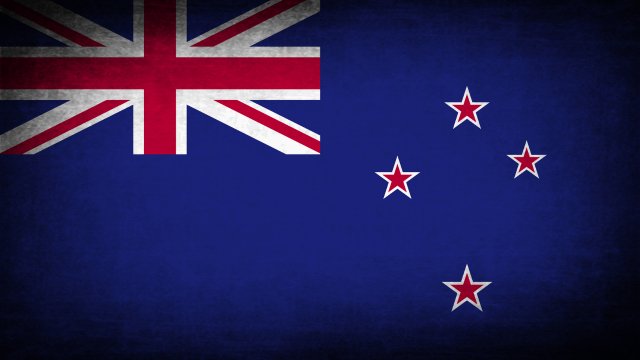

After touching a high of nearly 0.60490 momentarily on Friday within the NZD/USD the currency pair has seen incremental selling.

The US dollar rallied slightly during the trading session on Tuesday, as we continue to try to find some type of basing pattern that we can use to go higher.

Short-term pullbacks will continue to get bought into, despite the fact that we have seen a lot of negativity over the last couple of days.

Top Forex Brokers

The euro initially fell a little bit during the trading session on Tuesday, but then turned around to rally towards the 200 day EMA.

The US dollar initially rallied against the Swiss franc during the trading session on Tuesday but has since given back some of the strength.

The British pound has initially pulled back just a bit during the trading session on Tuesday.

The Bitcoin market initially tried to rally during the trading session on Tuesday, only to turn around and show signs of weakness.

Ethereum markets have gone back and forth during the trading session on Tuesday as we continue to look at the $3000 level with great interest.

The Australian dollar has been back and forth during the trading session on Tuesday

Bonuses & Promotions

Silver has initially fell during the trading session on Tuesday, but then turned around to show signs of life again.

The US dollar rallied a bit during the trading session on Tuesday but has run into a little bit of noise just below the ¥155 level.

The EUR/USD consolidation continued on Wednesday morning in a low-volume environment.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox.Bitcoin price consolidation has continued its consolidation phase this week as concerns about regulations continued.

The AUD/USD exchange rate pulled back even after the Reserve Bank of Australia (RBA) delivered a hawkish pause on Tuesday.

May be long opportunity at support levels.