The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The USD/ILS has maintained a tight range the past handful of days and this morning’s price action is within the middle of its one week and one month realms.

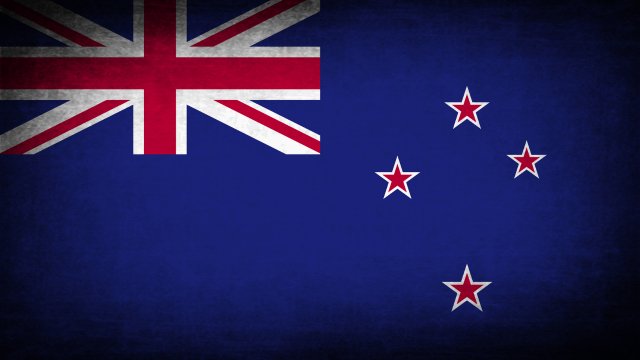

After touching a low of nearly 0.58370 on Monday the NZD/USD begin to climb and in early trading today approached the 0.59225 ratio, and then likely to no one’s surprise a reversal lower took place.

In my daily analysis of the GBP/USD pair, the first thing that I notice is that we have been consolidating around the 1.2650 region, an area that seems to be important from a short-term perspective.

Top Forex Brokers

In my daily analysis of the NZD/USD pair, the market had initially pulled back just a bit only to turn around and show signs of life.

In my daily analysis of the USD/CAD pair, the market has been all over the place.

During the trading session on Tuesday, we saw the Parisian CAC 40 fall rather drastically to reach the €7150 level.

During my daily analysis of exotic currencies, the USD/RUB currency pair has caught my attention as we have now broken above the psychologically important 100 RUB level.

The GBP/USD exchange rate stabilized ahead of several important economic numbers from the UK.

Bitcoin price continued soaring in the overnight session, reaching a record high of over $93,200.

Bonuses & Promotions

The post-US election rally in the US seems to have run out of steam, as many assets including the Euro start to form a potential bullish double bottom against the greenback.

The AUD/USD exchange rate rose for three consecutive days as the recent US dollar index surge took a breather.

During the trading session on Tuesday, we have seen the Japanese yen strengthen quite sharply in the early hours, only to see a turnaround and give back its gains.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox.You can see that the US dollar has been all over the place against the Swiss Franc during the trading session on Tuesday as we have tested the crucial 0.88 level.

The US dollar has rallied rather significantly against the Chinese Yuan during the trading session here on Tuesday to slam into the 7.25 level.

During my analysis on Tuesday, I've been paying close attention to this pair. This is mainly due to the fact that we had seen a major risk off type of move early in the session with the Japanese yen picking up quite a bit of strength.