The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

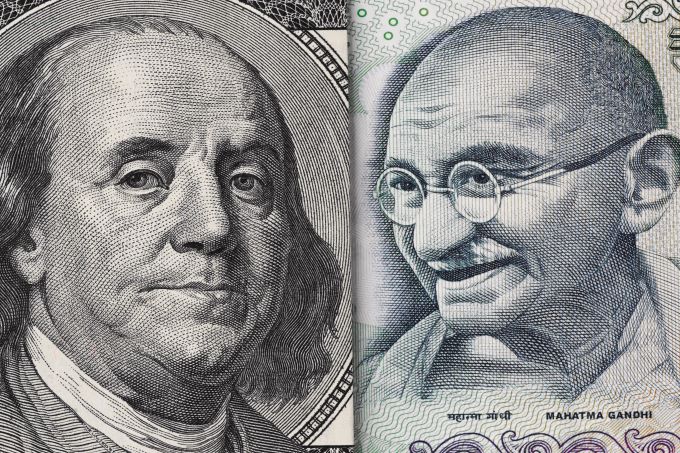

The USD/INR has continued to produce volatile movements within a known range and highlights the need for risk management for speculators.

The S&P 500 has gone back and forth during the day on Wednesday, as we are hanging around the 200-Day EMA.

Gold markets have pulled back a bit after the FOMC statement, as it looks obvious that the Federal Reserve.

Top Forex Brokers

The EUR/GBP continues to construct against the British pound, as we start to head towards the European Central Bank meeting on Thursday.

The GBP/JPY has initially fallen during trading on Wednesday but has turned around to show signs of life as we continue to find buyers against the Japanese yen.

The West Texas Intermediate Crude Oil market rallied again during the trading session on Wednesday, as we have started to recover from extremely oversold conditions.

The Nifty 50 has gapped higher to kick off the day on Wednesday, showing strength yet again.

The Hong Kong stock exchange has been rather resilient over the last several weeks, as we continue to threaten quite a bit of major resistance.

The DAX has been very quiet during trading on Wednesday, as we are trying to figure out what to do with risk appetite.

Bonuses & Promotions

The BTC/USD market has been rather quiet during the session on Wednesday, gaining 2% in the lead-up to the FOMC rate hike and statement.

The AUD/NZD has rallied a bit during the trading session on Wednesday as we continue to see a lot of volatility in the Forex markets.

My previous signal on 28th November gave an excellent and nicely profitable short trade from the bearish hammer candlestick rejection of resistance level which I had identified at $0.6723.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox.The GBP/USD price drifted upwards during the Asian session as focus shifted to the upcoming interest rate decision by the Bank of England (BoE).

The EUR/USD price moved sideways in the overnight session as investors reacted to the latest interest rate decision by the Fed.

The BTC/USD price recovery eased slightly after the Federal Reserve downshifted its policies.