The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The TRY/USD stabilized during early trading on Tuesday morning.

The euro price remained the best performer against the US dollar since the start of trading this week.

The decline in US inflation figures, less than expected, contributed to pressure on the US dollar against the rest of the other major currencies.

Top Forex Brokers

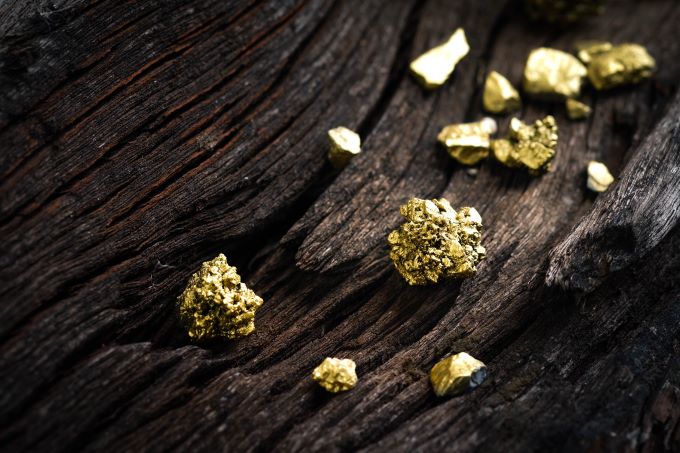

Gold futures settled significantly higher today, as the US dollar fell sharply after weak consumer price inflation data helped calm concerns about the outlook for US interest rates

The US inflation numbers will put pressure on the US Federal Reserve to calm down the pace of raising interest rates in the future.

Spot natural gas prices (CFDS ON NATURAL GAS) fell in early trading on Wednesday, recording sharp daily losses until the moment of writing this report, by -5.10%.

The Dow Jones Industrial Average rose during its recent trading on the intraday levels, to achieve new gains in its last sessions by 0.30%.

The USD/ZAR initially tried to rally during the Wednesday session, as we broke above the 50-Day EMA.

The S&P 500 gapped higher to kick off the session on Tuesday, as the CPI figures before the session opened came in at 7.1% year-over-year.

Bonuses & Promotions

The Hang Seng index has rallied slightly during the trading session on Tuesday, as we continue to threaten a significant chart level.

The twist of irony is that the BTC/USD has proven that it is not immune to financial conditions around the world recently.

The AUD/USD rallied significantly during the trading session on Tuesday as the market reacted to the CPI numbers coming out at 7.1% in the United States year over year, as opposed to the expected 7.3%.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox.The West Texas Intermediate Crude Oil market has rallied a bit during the session on Tuesday, as we continue to see a bit of a recovery in this market that has been so oversold.

The GBP/USD rallied a bit during the trading session on Tuesday as the CPI number in the United States came out of 7.1% year-over-year, as opposed to the anticipated 7.3%.

The NZD/USD has rallied significantly during the session on Tuesday as the CPI never came out to 7.1% year-over-year in the United States, prompting some traders to suspect that the Federal Reserve is getting closer to slowing down its monetary tightening policy.