The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The GBP/USD had initially tried to rally during the session on Wednesday, breaking above the 1.15 level again.

The price of the TRY/USD stabilized during early trading today, investors are awaiting the interest rate decision from the US Federal Reserve.

Today, the sterling dollar is settling around the 1.1511 level.

Top Forex Brokers

All eyes are on the markets and investors are waiting for the decisions of the US Central Bank, which will have a strong reaction on all currencies against the US dollar.

A state of instability dominates the performance of the USD/JPY currency pair.

Gold futures are looking to start November higher, buoyed by a weak US dollar and expectations by the Federal Reserve to slow the pace of US interest rate hikes.

The Dow Jones Industrial Average declined during its recent trading at the intraday levels, to record losses for the second consecutive session, by -0.24%.

Spot natural gas prices (CFDS ON NATURAL GAS) settled lower in early trading on Wednesday, to achieve slight daily gains until the moment of writing this report.

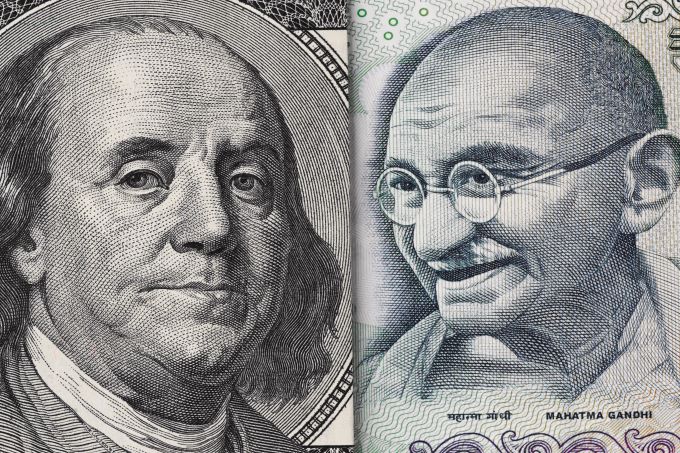

The USD/INR is trading near highs in early trading, maintaining its rather lofty price realms near the 82.7600 vicinity as of this writing.

Bonuses & Promotions

The GBP/USD may prove to be a speculative paradise and dangerous gauntlet over the next two days at the same time.

The USD/JPY initially fell during trading on Tuesday but found buyers underneath to reassert the overall uptrend.

The USD/CAD had initially fallen during the trading session on Tuesday to reach down towards the 1.35 level.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox.The USD/ZAR has been going sideways against the Rand for a couple of weeks now, and now that we head into the Federal Reserve meeting on Wednesday, it does make a certain amount of sense that we are winding up for some type of momentum play.

The S&P 500 E-mini contract pulled back from the crucial 3900 level during the trading session on Tuesday as the market is waiting to see what happens with the Federal Reserve interest rate decision and of course the meeting/press conference/Q&A session.

The NASDAQ 100 has broken significantly lower during the trading session on Tuesday to show signs of serious negativity, as the JOLTS number came out horribly, showing that there are over 10 million unfilled jobs in the United States.