I didn’t post yesterday as it was a very quiet Monday with not much going on in the market, and I knew anyway that after last night’s debate of the two major U.S. presidential candidates I probably would have something to say, so here it goes.

I didn’t stay up very late to watch it live so I’ve just seen the highlights. Notwithstanding the fact that the media is heavily biased in favor of Clinton out of fear of a Trump victory, I think it is true that most neutral observers would agree that she “won” the debate, so I agree with what nearly all the media is saying.

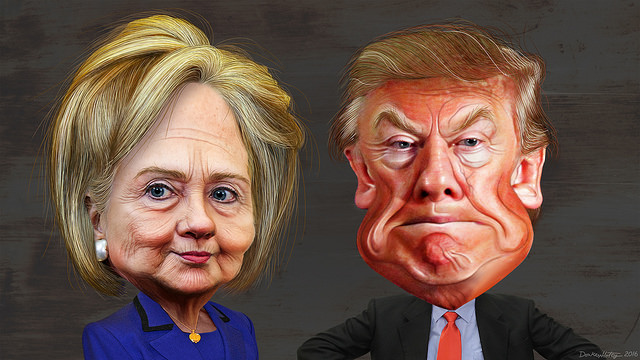

Both candidates managed to mostly put their best face forward, but Clinton seemed to strike the better balance. Trump was trying not to be too aggressive and he did moderate his vocal tone, but he didn’t seem to manage to coolly deliver a few telling blows in the way that Clinton did. Clinton also looked and sounded far healthier and composed that has in most of her recent public appearances. I thought she was much more convincing in this debate format than she was at the DNC rallying before a big crowd, for example.

There is intense interest in the “outcome” of this debate because the opinion polls have been narrowing for some time. Just prior to the debate, Nate Silver was showing if the election were held tomorrow, it could be swung just by the electoral votes of one small state (Colorado was the balance). A few national polls were starting to show Trump taking a small lead in the popular vote. With the odds seemingly narrowing, a clear “win” by one candidate in the debate could provide a decisive push or shift in momentum that could prove crucial in setting the tone of these final weeks.

A CNN poll of viewers gave Clinton a very healthy lead in debate performance, yet this audience is heavily skewed towards the Democrats by a net of approximately 15 point. Nevertheless, it is significant, and we have to wait and see whether Clinton benefits from this by beginning to pull head in the swing states.

What effect will the election result have on the markets? Broadly, a Clinton victory would be seen as “business as usual”, as continuity. A Trump victory would probably provide more uncertainty, fear and volatility as no candidate has won the Presidency without previously holding some kind of high national office for almost 100 years. Eisenhower won in 1952 but had been the commander of the Allied invasion of continental Europe a few years earlier, although he had never been elected to any position.