The market right now is not a great place for trend traders. Everyone has their preferred method of defining trends, and I’ve shown that judging the quality of trends over periods of 3 months or longer produced the best track record historically. No matter what precise method you use, it is hard to find trends now, except in stocks with the S&P 500 Index, for example, being just shy of an all-time high.

In the Forex market, the U.S. Dollar has produced some great bullish trends in recent years, and the took off again following President Trump’s surprise election victory last November. However, for several weeks now it has mostly been selling off.

So, what do you do? A lot of traders shorten their time horizons and look for trends that are only a few days or weeks old. The problem with this course of action is that such “young” trends are statistically less reliable. Of course, if the action looks more solid and directional, even if the trend is young, it tends to give better results. Keeping this thought in mind, if you are really determined to find a trend right now, you could do much worse than consider long trades in spot Gold and Silver.

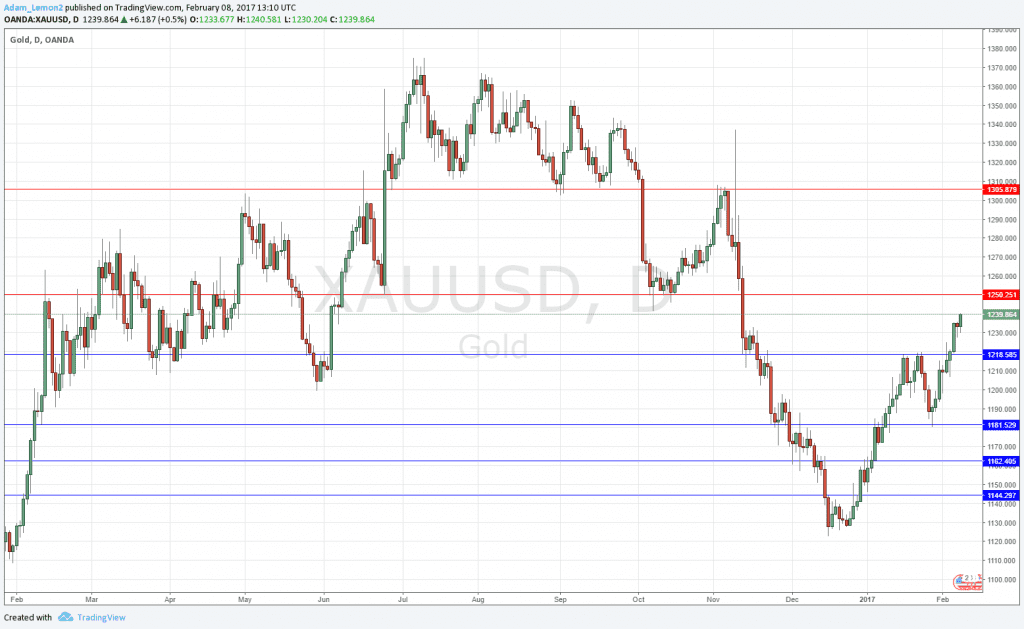

A daily chart of spot Gold in U.S. Dollars shows the price has been rising quite steadily for almost 2 months, although it is approaching what looks to be a key historical and psychological resistance level of $1,250:

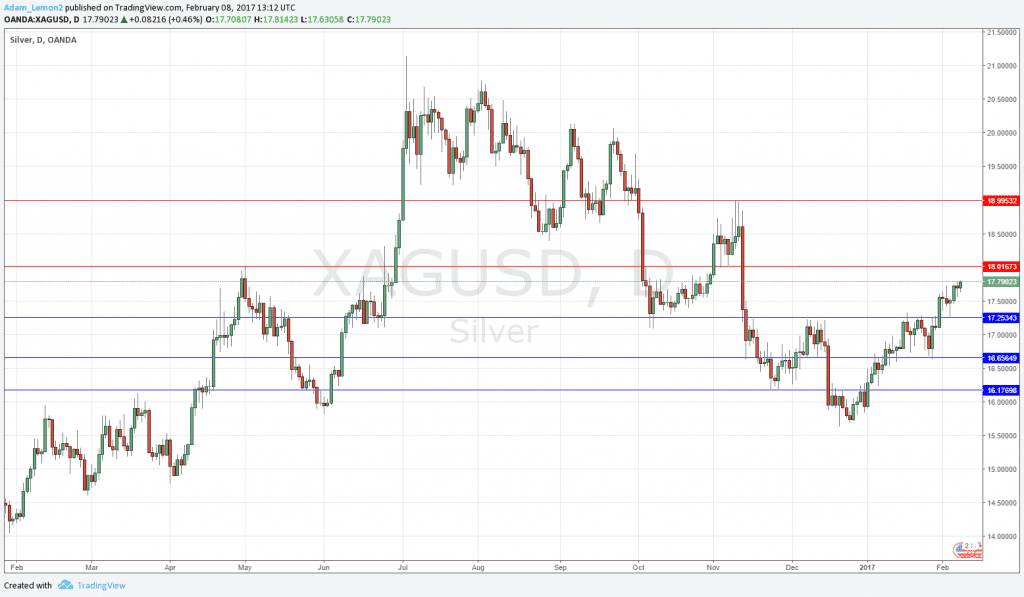

A daily chart of spot Silver shows an almost identical situation (the two precious metals have a very high positive correlation against the U.S. Dollar and other currencies). Here, the nearest resistance level of concern lies very close to $18:

One nice thing about trading spot Gold and Silver is that they tend to move by larger amounts than Forex currency pairs, giving greater potential for profit – though of course also for losses, so be careful!