In yesterday’s posting, I anticipated how the market might react to yesterday’s US economic data and the minutes of the most recent FOMC meeting. One key element which I highlighted was how the minutes might be seen to strengthen the likelihood that the Fed will shrink its debt program, which would then decrease the odds of a rate hike. Lower future rates make a weaker U.S. Dollar more probable, logically speaking.

This came to pass, and after initially rising, the U.S. Dollar fell, particularly against the Japanese Yen. However, as I also predicted, it probably was not going to be the major move of the week, which would be most likely following Friday’s Non-Farm Payrolls data release. I think this is still looking likely, as yesterday’s moves, although fast and sharp, were not very large in terms of the price changes.

There is no reason why, if you have a lack of time and experience, you can’t trade a solid system, and ignore the calendar and market conditions, and just take every trade. IF it’s a solid system. However, it helps if you have some idea of when the major movement of the week is most likely to happen, if you are trading in a more discretionary way. There’s no reason why you can’t take a trade beforehand, but you might want to make it a relatively smaller position size, for example, let alone be more conservative on when and where you are thinking to take any floating profit off the table.

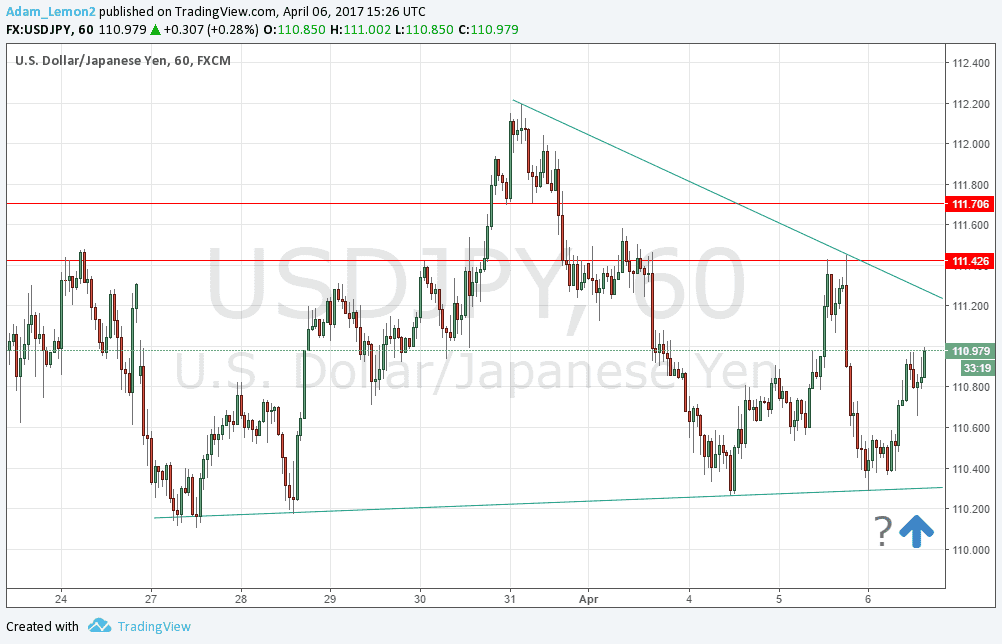

The focus now shifts to the Non-Farm Payrolls tomorrow. If the result comes in much higher than the expected number, we can expect the U.S. Dollar to get a good boost, as well as the stock market. If the number disappoints, then probably on recent form, that will be expressed in a rise in the Dollar spot prices of Silver and Gold. If it’s a strong Dollar, which currency will it rise most against? My hunch is that it could be the Japanese Yen for two reasons: firstly, the chart is suggesting the beginning of a major bullish reversal, floored by the big whole number at 110.00; secondly, the Yen has been acting as something of a risk-off currency, and a booming U.S. economy would tend to shift sentiment away from risk-off mode.