Markets seem livelier that might have been expected this week, with so few economic data releases on the calendar. Today the headlines are being made concerning two assets” the British Pound and Crude Oil.

British Pound

The Governor of the Bank of England George Carney gave a delayed speech today against a febrile backdrop of a nation with a minority government opening unprecedented exit negotiations with the European Union suffering multiple terror attacks. In his speech, he stated in no uncertain terms that the time is not right to thinking of a rate hike, with consumer spending weak and a drop-off in foreign investment. The Pound had already been selling off on Monday, but following the speech fell to an area close to its recent lows, and continues to look weak as at the time of writing.

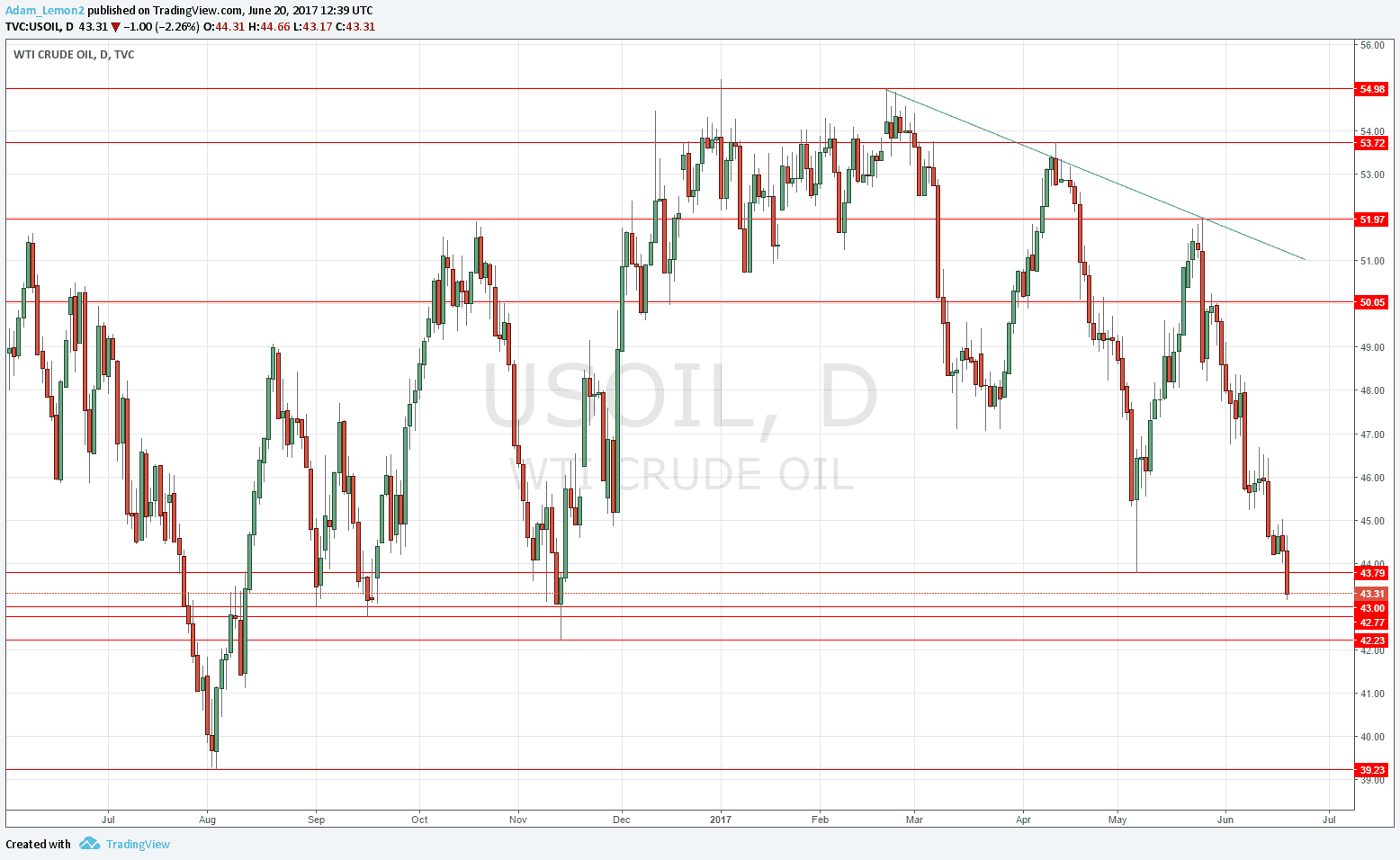

Crude Oil

Even before New York opened, the price made a new 6-month low, and is not far from prices representing even longer-term lows. So far, there is no sign of a bullish turn, but a strong bounce between here and $42.23 per barrel could attract speculative long positions.