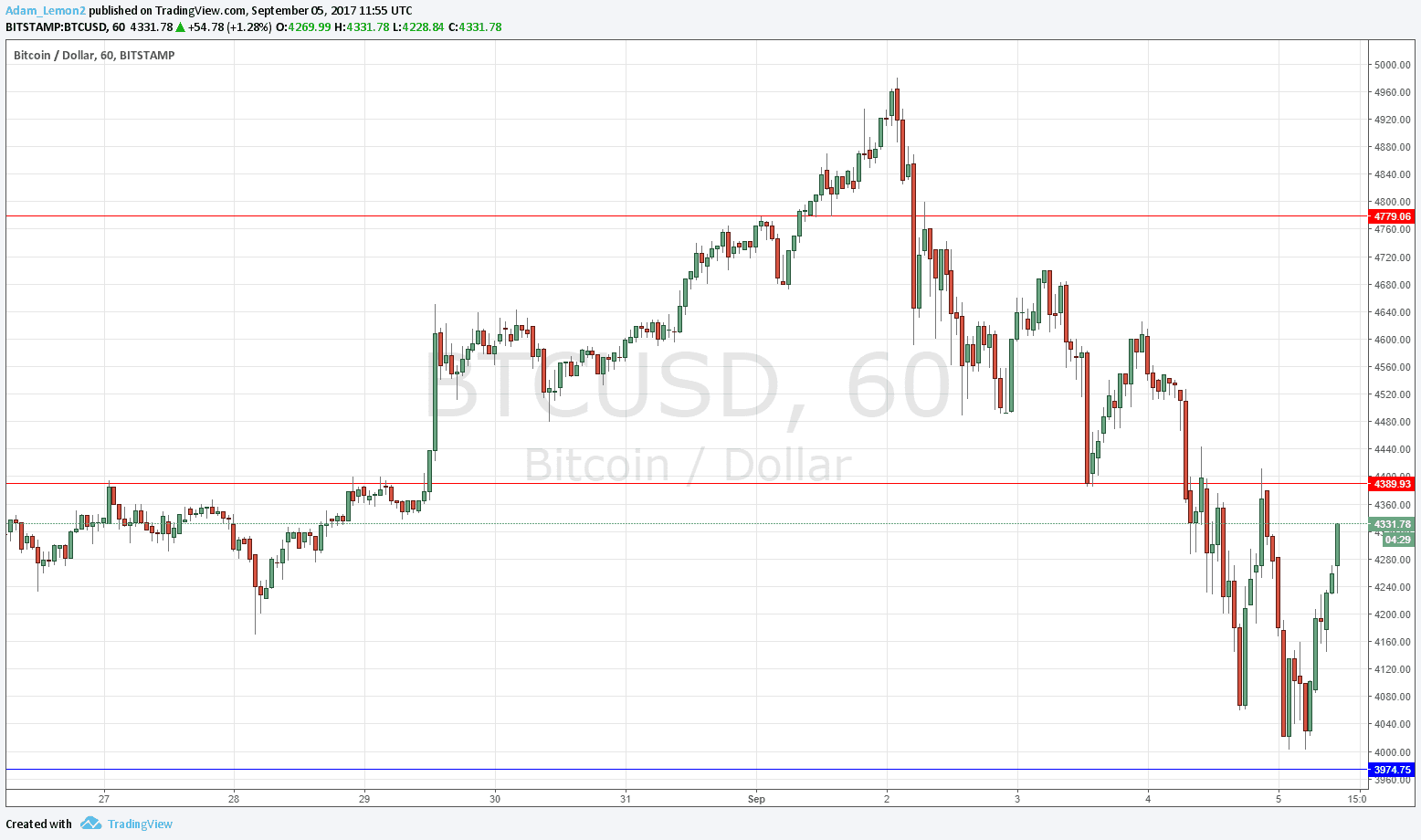

Late in Tokyo trading, Bitcoin fell to a significant recent low price against the U.S. Dollar, just a whisker off $4000.00 per coin. This represented a fall of just under 20% from its high of $4979.90, which was made over last weekend. This doesn’t only show how volatile the price changes in Bitcoin can be in the short term, a 20% fall is also a key benchmark in bull/bear market analysis: when a stock market index falls by more than 20% from a peak, that market is said to have entered a bear market. This is why I wrote earlier today that the support at the $4000.00 was likely to hold, as buyers looking to buy Bitcoin would be attracted by a 20% dip for technical reasons, it being the cheapest you can buy Bitcoin in a technical bull market. Since reaching its daily low at around $4001.00, the price rose within only a few hours by more than 8%, suggesting strong buying is at work. However, there is a technical hurdle not far ahead, in the shape of a key resistance level at $4389.93.

The internet is awash with stories about the Bitcoin bubble and countries like China and India cracking down on ICOs (Initial Coin Offerings) and Cryptocurrencies in general. It is important to remember though that the fall in price started well before any of this publicity, not to mention the fact that Bitcoin fell against the U.S. Dollar by a whopping 37% during June and July before turning around and going on to more than double in price within just a few weeks. If Cryptocurrencies are in a “bubble”, it hasn’t burst yet.

How are the other major Cryptocurrencies doing? Worse than Bitcoin, I believe. Ethereum has fallen by more than 35% over the last few days, and its recovery in recent hours looks less healthy than Bitcoin’s. It has also never exceeded its all-time high made in June. Ripple has fallen by a similar amount to Ethereum, so technically, Bitcoin looks the healthiest.