The last few days have been a wild ride in the cryptocurrency market. Bitcoin hit a new all-time high last Wednesday, but just a few hours ago was already down 30% from this peak. Bitcoin Cash briefly replaced Ethereum as the second largest cryptocurrency. Ethereum had held second place in the capitalization rankings after Bitcoin for a long time. What’s going on?

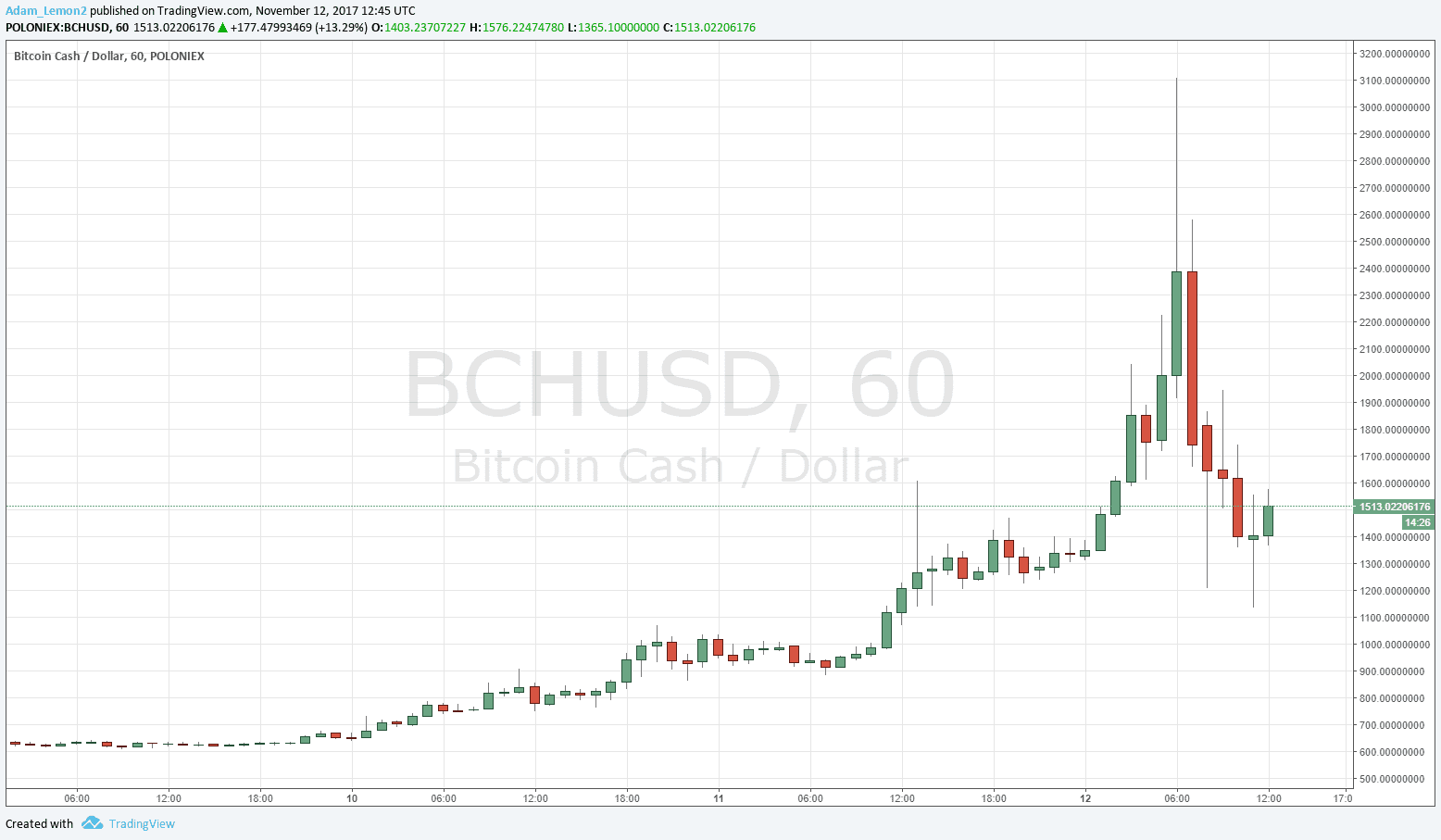

The heart of the story is a very dramatic price move by Bitcoin Cash, which within the past 48 hours alone rose by 300% and then fell by 66% to finish almost exactly where it started. Look at the hourly chart of Bitcoin Cash below:

This meteoric rise correlated with a sharp fall in Bitcoin, and Bitcoin’s recovery over recent hours has conversely been at the expense of Bitcoin Cash. The rivalry between Bitcoin and Bitcoin Cash has exploded as advocates of each currency have mounted loud campaigns over who is the “best Bitcoin”, and there has clearly been a strong money flow from Bitcoin into Bitcoin Cash and then back again this weekend. The struggle has been called a “civil war” by Forbes but it now looks like Bitcoin has won this battle, and maybe also the war.

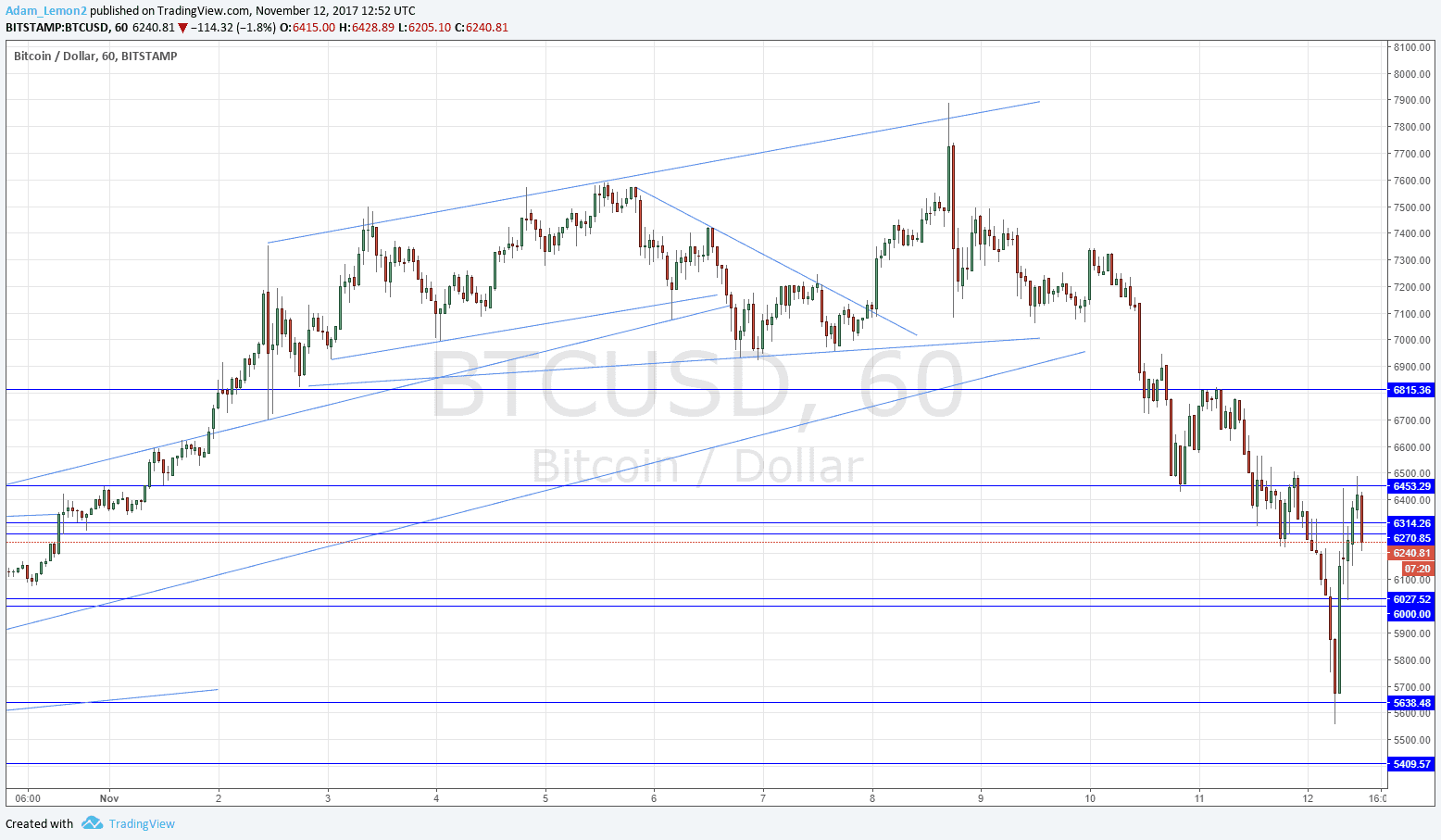

If you are a trader who just looks at the charts and doesn’t worry about all the fundamental factors behind the price movements, there is still something to learn. The major cryptocurrencies are so volatile that by the time headlines have barely been published showing Bitcoin crashing and Bitcoin Cash overtaking Ethereum, the situations are already reversed, or at least significantly different. Bitcoin’s 30% drop from Wednesday to Sunday has turned around quite a lot within just the past six hours at the time of writing, rising by almost 20%! Bitcoin Cash did briefly overtake Ethereum in size, but this has turned around too, with Ethereum now $6 billion ahead of Bitcoin cash (an excess of almost 20%). Volatility has become so extreme, that the headlines are almost meaningless. If you are active in the cryptocurrency market, don’t panic, but you must be aware of the enormous volatility which is producing such wild reversals. You should also be very serious about making sure you are not over-leveraged, and that your stop loss orders are wide enough to fit the prevailing high volatility.

If you are a trader who just looks at the charts and doesn’t worry about all the fundamental factors behind the price movements, there is still something to learn. The major cryptocurrencies are so volatile that by the time headlines have barely been published showing Bitcoin crashing and Bitcoin Cash overtaking Ethereum, the situations are already reversed, or at least significantly different. Bitcoin’s 30% drop from Wednesday to Sunday has turned around quite a lot within just the past six hours at the time of writing, rising by almost 20%! Bitcoin Cash did briefly overtake Ethereum in size, but this has turned around too, with Ethereum now $6 billion ahead of Bitcoin cash (an excess of almost 20%). Volatility has become so extreme, that the headlines are almost meaningless. If you are active in the cryptocurrency market, don’t panic, but you must be aware of the enormous volatility which is producing such wild reversals. You should also be very serious about making sure you are not over-leveraged, and that your stop loss orders are wide enough to fit the prevailing high volatility.

Many analysts have been predicting huge “bubble-bursting” crash in Bitcoin to arrive at any moment. If it happened, it wouldn’t be a great surprise, yet I don’t think that it is happening yet. The large movements have been about the Bitcoin vs Bitcoin Cash struggle, and not about Bitcoin or Crypto itself. In fact, the Bitcoin Cash price chart above looks much more like a classic burst bubble than Bitcoin does. Bitcoin itself looks more bearish, and more volatile, but bulls can argue it has only broken a couple of support levels, while $6000 looks to be holding:

The time to call it a crash will be below $5000, if it happens soon.