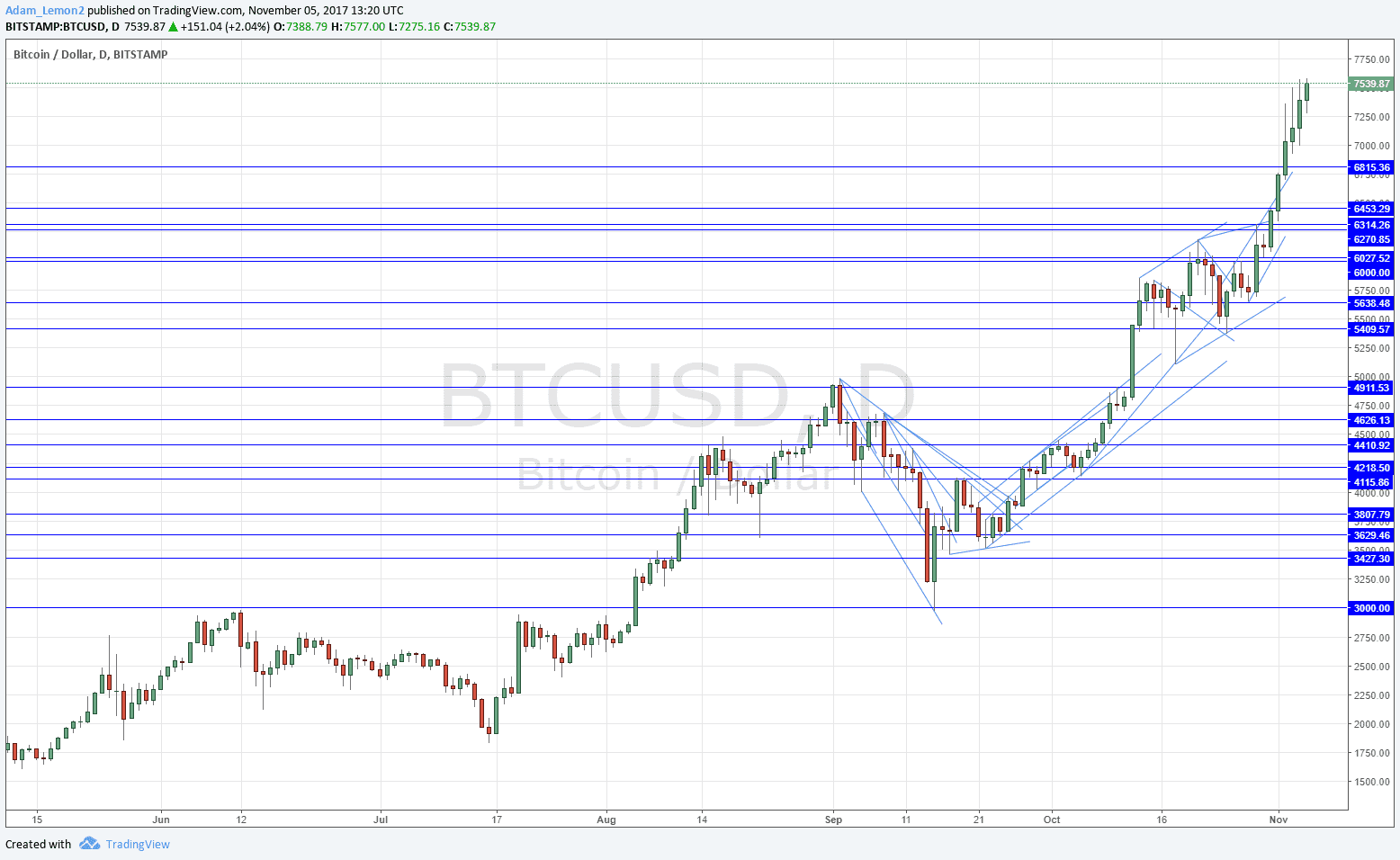

Last week was a strange week. Important USD-related events were scheduled: both the FOMC Minutes release and the Non-Farm Payrolls data. Yet the week ended with the market hardly changed, and it wasn’t the U.S. Dollar that drove the market, but the British Pound, which has been showing a lot of volatility over recent weeks. The American stock market, although still clearly bullish, also barely moved. Yet the astonishing, meteoric rise of Bitcoin to new all-time high prices continues without abatement. It is up against almost every single fiat, national currency by approximately 22% over the last week alone! It has more than doubled in value since the CEO of JP Morgan called it a “fraud”. Just look at the daily chart over the past few months of BTC/USD:

Last week was a strange week. Important USD-related events were scheduled: both the FOMC Minutes release and the Non-Farm Payrolls data. Yet the week ended with the market hardly changed, and it wasn’t the U.S. Dollar that drove the market, but the British Pound, which has been showing a lot of volatility over recent weeks. The American stock market, although still clearly bullish, also barely moved. Yet the astonishing, meteoric rise of Bitcoin to new all-time high prices continues without abatement. It is up against almost every single fiat, national currency by approximately 22% over the last week alone! It has more than doubled in value since the CEO of JP Morgan called it a “fraud”. Just look at the daily chart over the past few months of BTC/USD:

Compare this to currencies such as the U.S. Dollar, the Japanese Yen, or the Euro, which typically move within a range of about 10% to 15% within one year, let alone one week. The price now (you can get a Bitcoin price over the weekend, as it trades all week including Saturdays and Sundays) is above the psychologically important $7500.00 level. How much higher can it go? It is fruitless to attempt to pick a high when the price is making new all-time highs. It would be crazy to try to trade this short with any limit order, or just by picking a price and assuming it is likely to reverse there. Of course, the big numbers often are logical turning points, but you would want to see decisively bearish price action confluent with such a level first.

Assuming the price now continues to rise above $7500.00 as markets come fully online with Monday’s open, the next really big psychological level would be $10000.00. Everyone will sit and take notice if the price reaches that level, which will undoubtedly prompt smarter or less greedy investors to take profits. The party will come to at least a temporary halt eventually, but beyond watching the big numbers and the price action carefully, nobody knows exactly where it will happen.

One last point: when Bitcoin is in one of the strongest trends that has ever been seen, why mess around with fly-by-night ICOs for coins you never heard of? Take a bite, but don’t get greedy, and be where the main action is!