It’s a cliché, but “buy the dip in an uptrend” is one of the oldest sayings in the trading world. Within my own trading journey, I have found reasonable cause to doubt some pieces of conventional trading wisdom, but not this one. I tested it and found it works well. Moreover, it works better the stronger the trend and the stronger and faster the dip. The problem is that it is difficult to know where to place a stop loss. One possible solution to this is to buy sudden dips in very small quantities – deleveraged is best – and use a time-based exit. This is a different method to trading with a trend using tight stops, where you usually get best results by waiting for the price to be close to making new highs or actually making new highs before entering.

It’s a cliché, but “buy the dip in an uptrend” is one of the oldest sayings in the trading world. Within my own trading journey, I have found reasonable cause to doubt some pieces of conventional trading wisdom, but not this one. I tested it and found it works well. Moreover, it works better the stronger the trend and the stronger and faster the dip. The problem is that it is difficult to know where to place a stop loss. One possible solution to this is to buy sudden dips in very small quantities – deleveraged is best – and use a time-based exit. This is a different method to trading with a trend using tight stops, where you usually get best results by waiting for the price to be close to making new highs or actually making new highs before entering.

As an example of what I mean, I’ve written before that the three major Forex pairs tend to trend in the direction of how the price has moved over the past 3 months / 6 months. I like to use both look-backs as filters simultaneously. The best results you can get on a weekly time frame is by wait for a strong dip against the trend, that does not invalidate the trend. I like to define this as a move from weekly open to weekly close of at least 2% against the direction of the long-term trend. Most of the time, the price will bounce back in the direction of the trend over the next week. It is rare to find a trend-following strategy with a high win rate, but the historical results of applying this strategy on the 3 majors from 2001 to 2017 are impressive:

Currency Pair | EUR/USD | GBP/USD | USD/JPY |

No. Trades | 28 | 21 | 40 |

Expectancy Per Trade | +0.17% | +0.48% | +0.19% |

Win % | 57.14% | 61.90% | 52.50% |

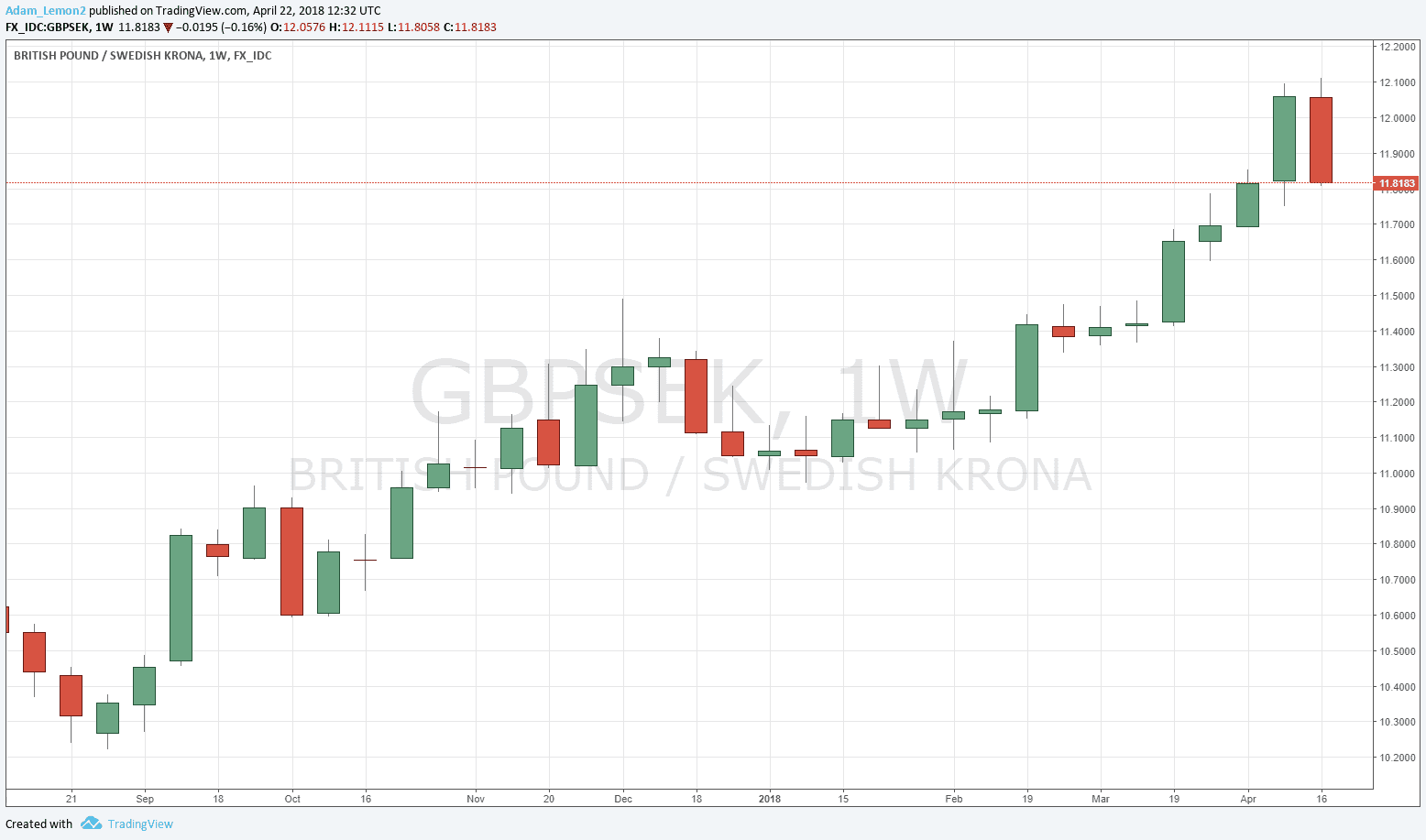

That’s great, you might say, but the trade hardly ever sets up! You get an entry in only 5% of weeks, or something like that. This is true, and I can reply with two pieces of good news: 1) rarer trade set-ups tend to be better trade set-ups; and 2) the GBP/SEK currency cross fell by 2% last week against its strong long-term bullish trend.

You could try to trade this by either opening a very small long position as the week opens, closing it at the end of the week, or instead of trying to fine-tune sharper long trade entries while paying attention to the technical state and support and resistance levels of GBP/USD, USD/SEK, EUR/SEK, and EUR/GBP.