About three weeks ago I identified a trading opportunity in the GBP/SEK currency cross which played out to end as a profitable trade. The essence of the strategy is to wait for a week where the price of a currency pair or cross closes against the trend by more than 2% in value and bet that the price will snap back the next week. This has worked very well historically, as a trading strategy. The set-up only comes up rarely, but after the success of a couple of weeks ago we have another set-u already, and it is more or less the same.

About three weeks ago I identified a trading opportunity in the GBP/SEK currency cross which played out to end as a profitable trade. The essence of the strategy is to wait for a week where the price of a currency pair or cross closes against the trend by more than 2% in value and bet that the price will snap back the next week. This has worked very well historically, as a trading strategy. The set-up only comes up rarely, but after the success of a couple of weeks ago we have another set-u already, and it is more or less the same.

The trade is really in the Swedish Krona, as it is the only currency that has made a very large movement over the past week. What this means is that we could now take the trade using almost any currency against the Swedish Krona, which has been in a long-term bearish trend and has fallen relatively to just about everything else. The Krona rose sharply this week as Swedish inflation data finally seems to signify it is more under control. It is likely to fall next week, but which currency to choose to be long of against it? It is not an easy answer. Below are the weekly charts for the four main candidates:

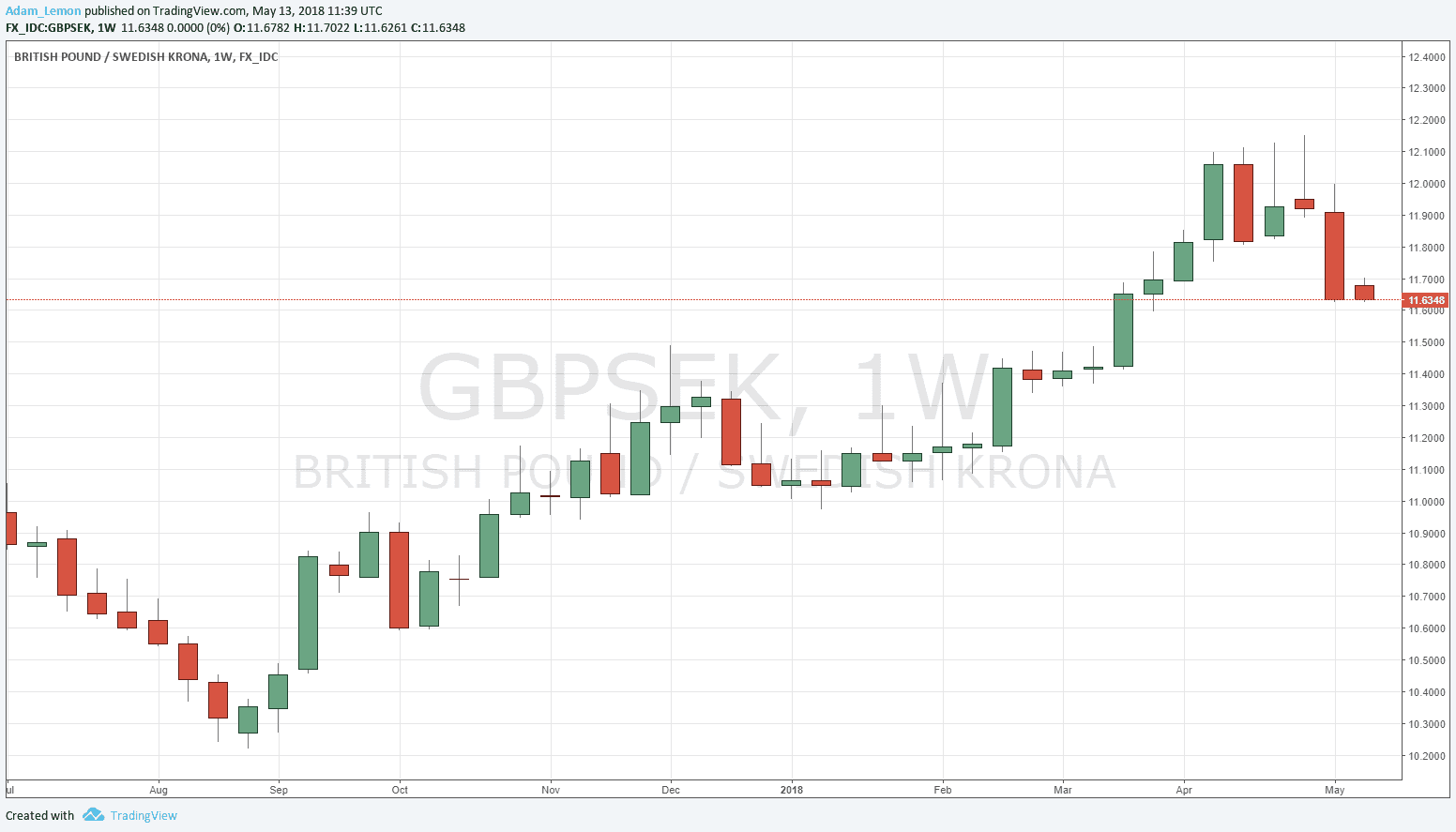

GBP/SEK

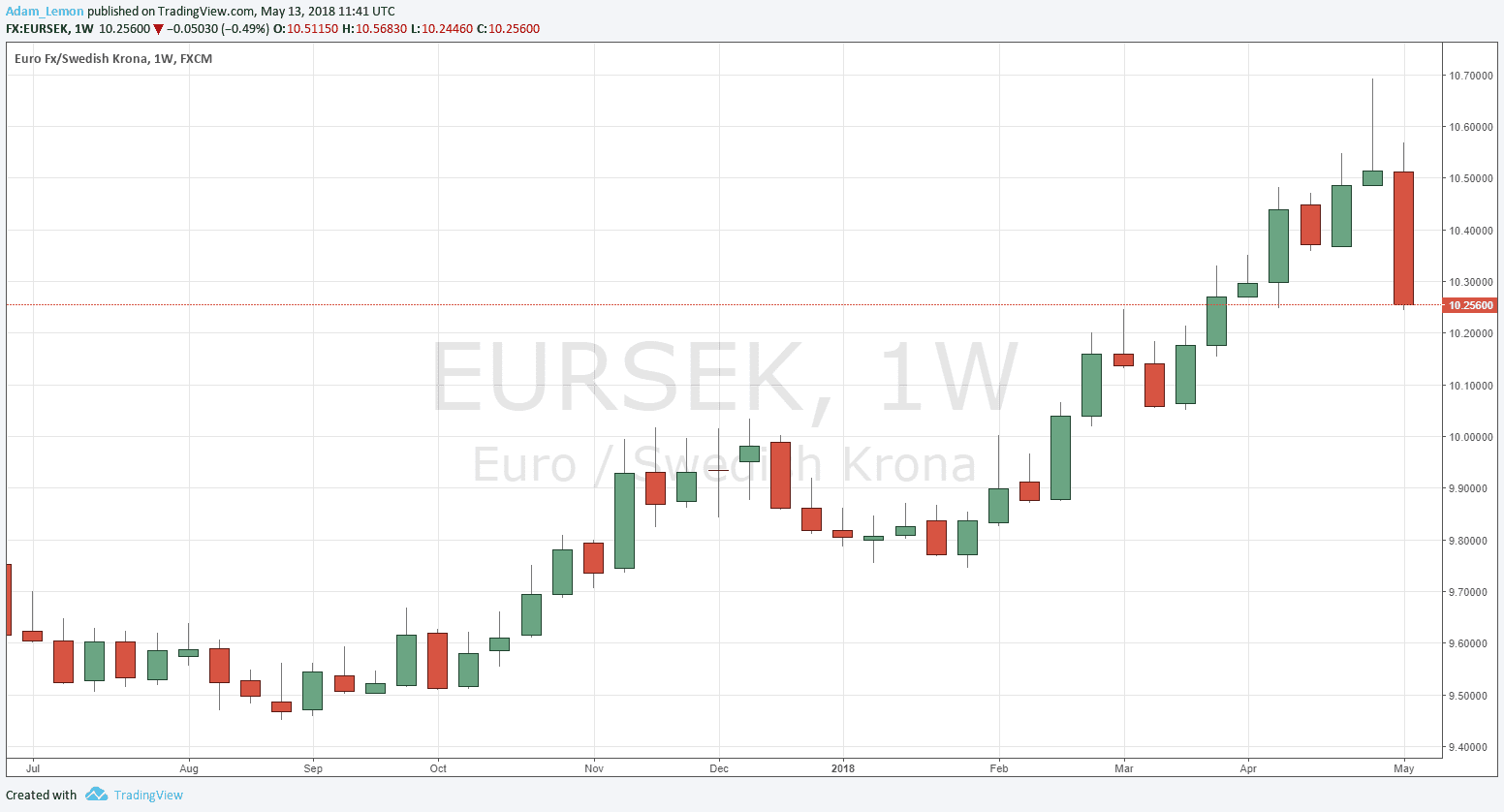

EUR/SEK

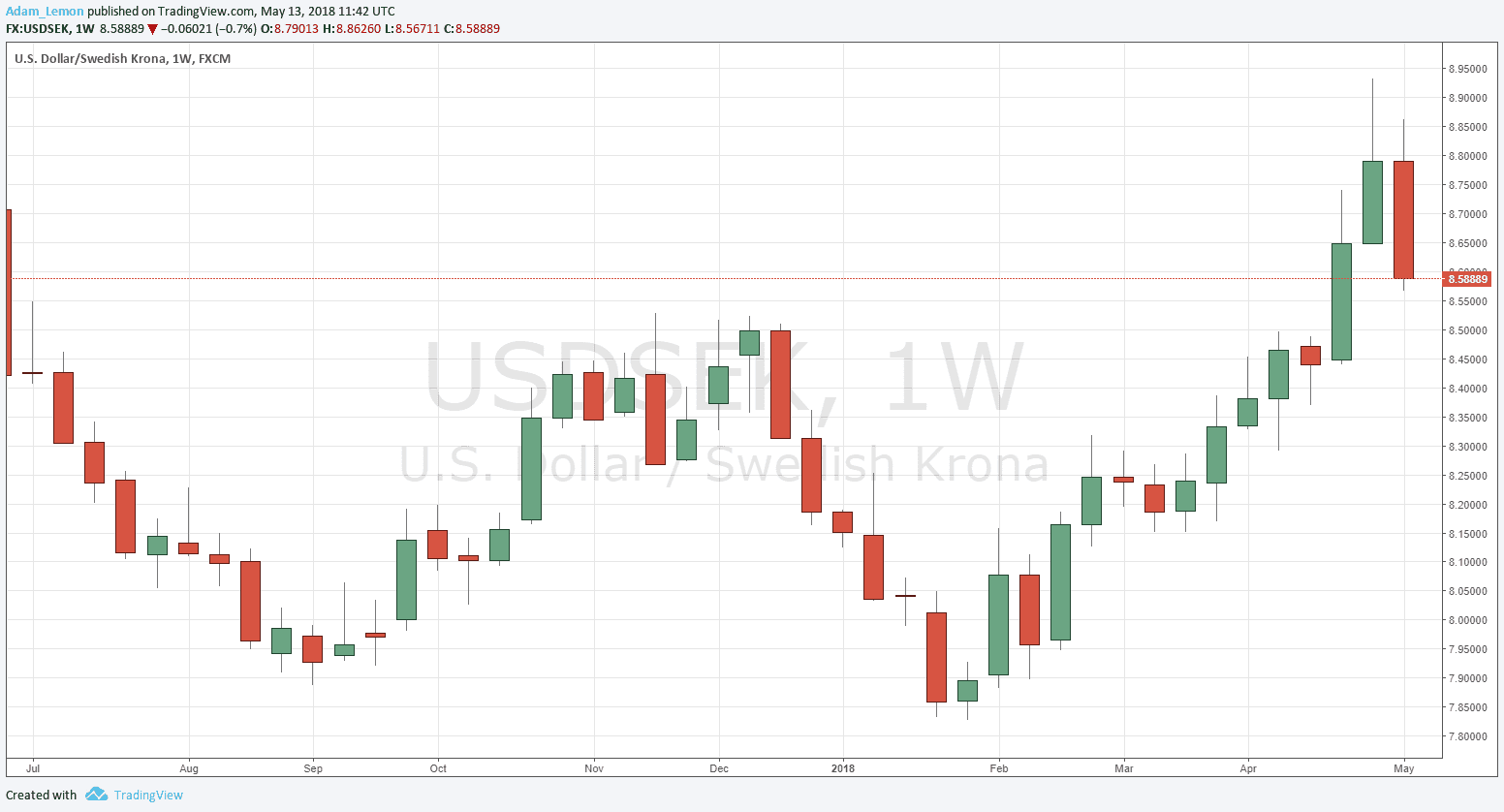

USD/SEK

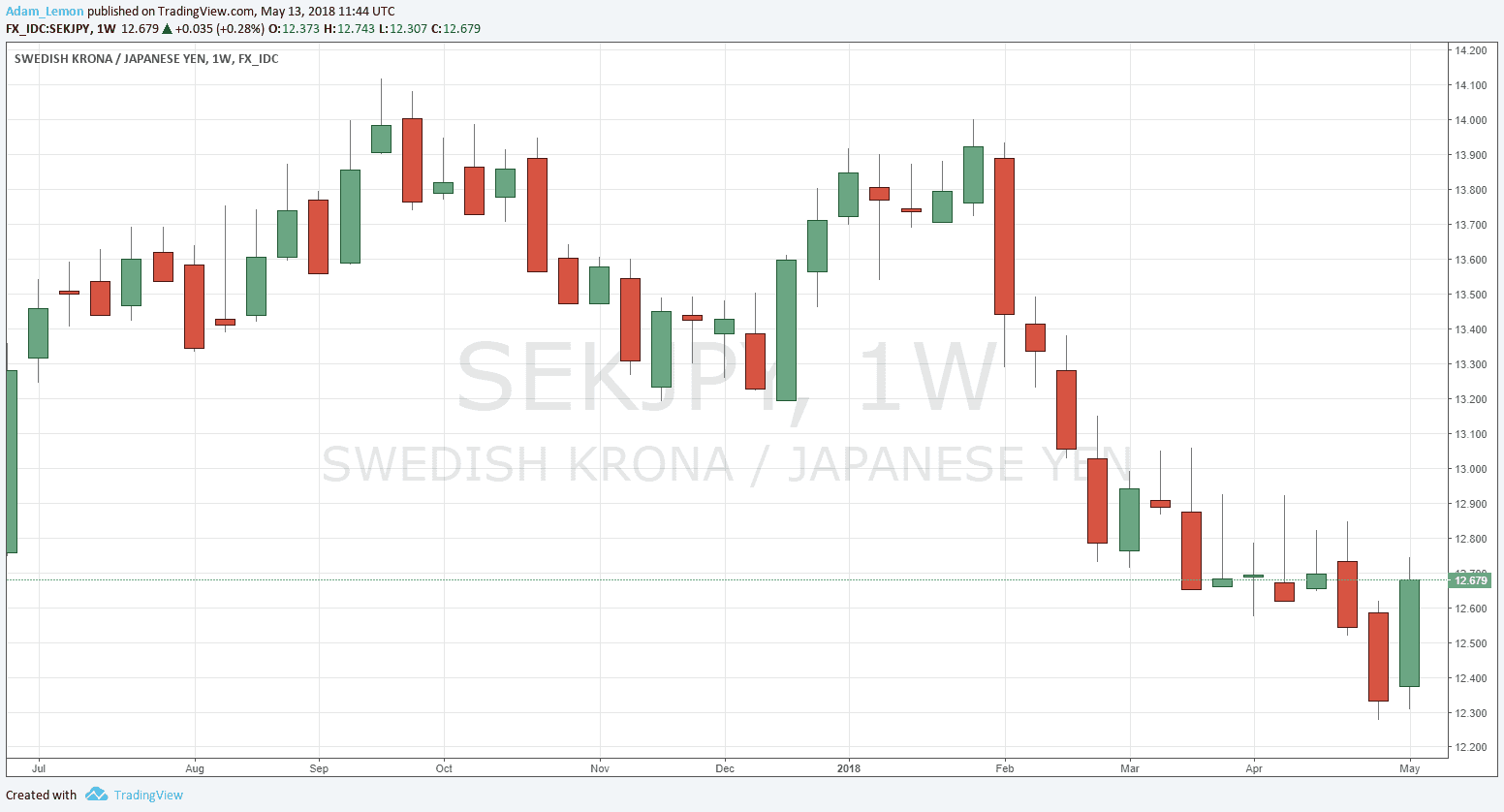

SEK/JPY

There are a few options which can be tried in trading this potential opportunity. There are two styles: either open a very small sized trade (deleveraged, even less than unleveraged) without a stop loss and close it at the end of the week is the first option. The second option is to drill down to lower time frames and try to find a more precise entry, using a stop loss. Both styles have their respective advantages and disadvantages.

The second question is, which SEK currency cross of the four shown above should be traded? One possibility could be to trade all of them, hoping that an averaged result will be profitable. Another option is to rank them technically. In my opinion they all look good except the GBP, which has been turning for a while and so looks less likely to snap back. In my “pairs in focus” piece published earlier, I selected SEK/JPY as the best option, partly due to the healthy technical chart, and partly due to the fact that both the Euro and the USD seem less likely to advance over the coming week than the Japanese Yen.