At the start of this week I identified an opportunity to go long against the Swedish Krona, using four potential currencies as long counterparts. Two trading days into the week, let’s have a look and see how these trades would be going so far.

At the start of this week I identified an opportunity to go long against the Swedish Krona, using four potential currencies as long counterparts. Two trading days into the week, let’s have a look and see how these trades would be going so far.

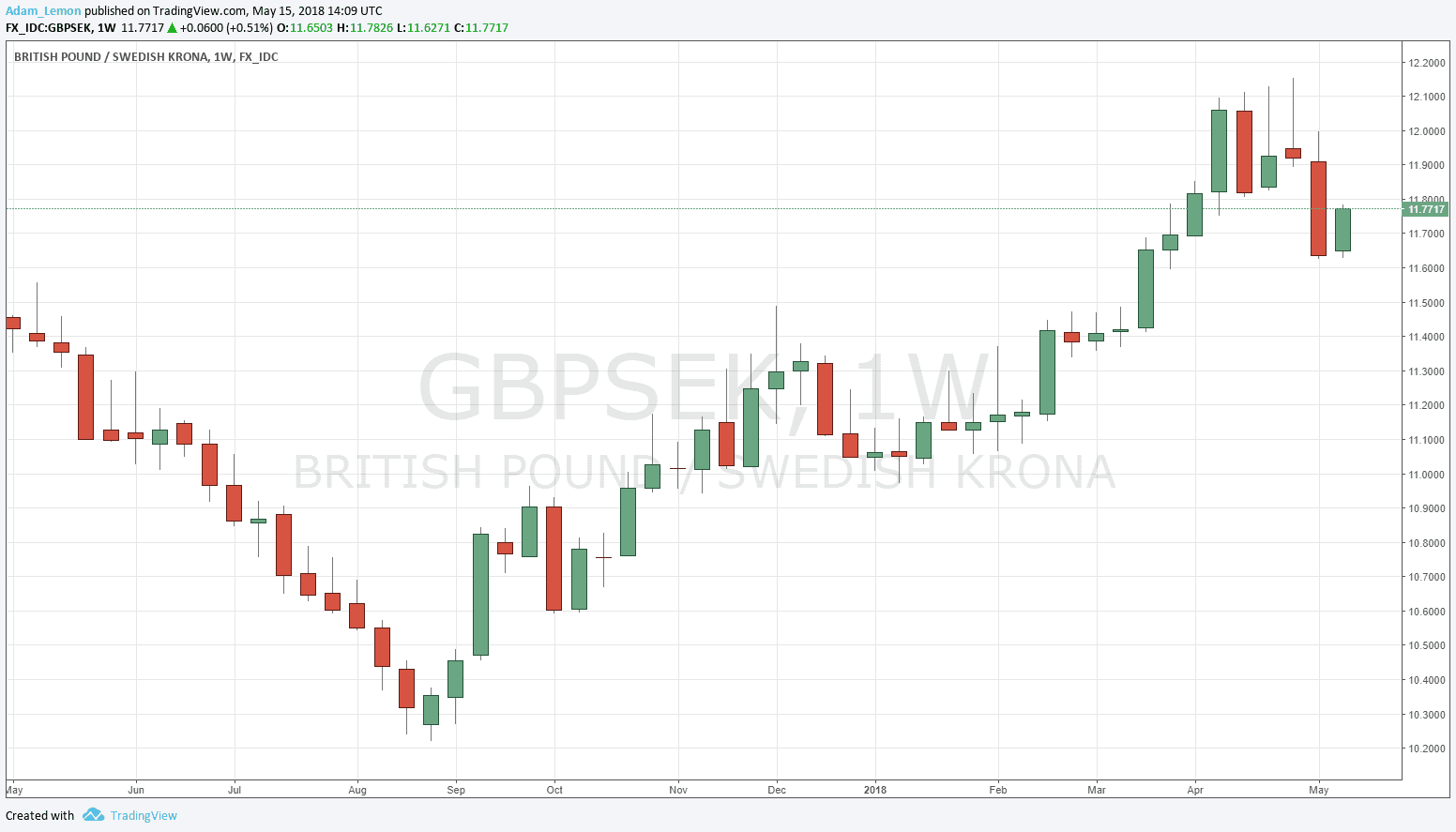

GBP/SEK

This is up by 1.03% already and near its high. The trade looks quite healthy.

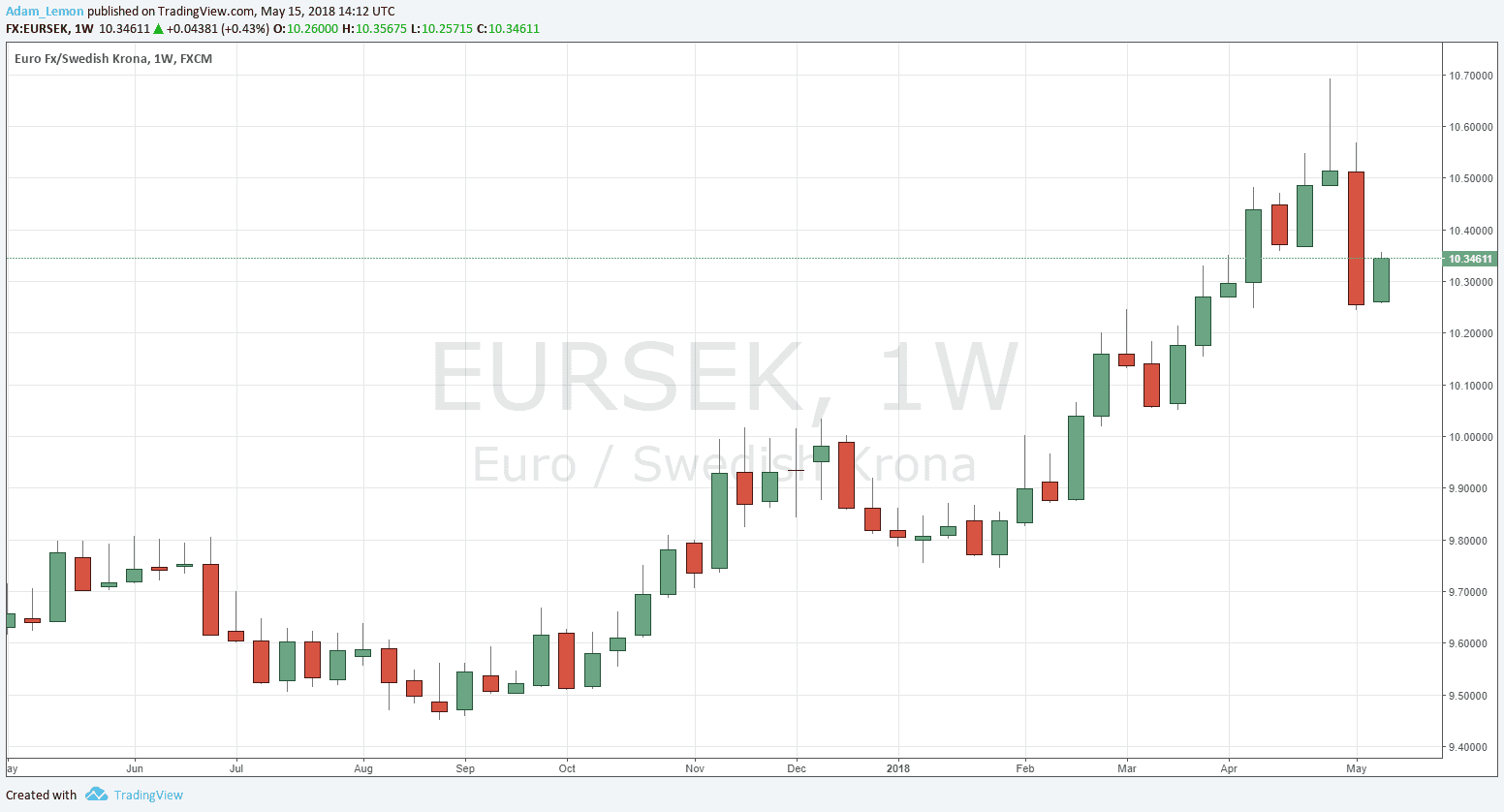

EUR/SEK

This is up by 0.88% and near its high. I took this trade myself as the Euro was looking strong, although it has fallen heavily against the U.S. Dollar today. It is interesting that the Euro is now looking significantly weaker than the British Pound. This cross is so far the third best performer of the four alternatives.

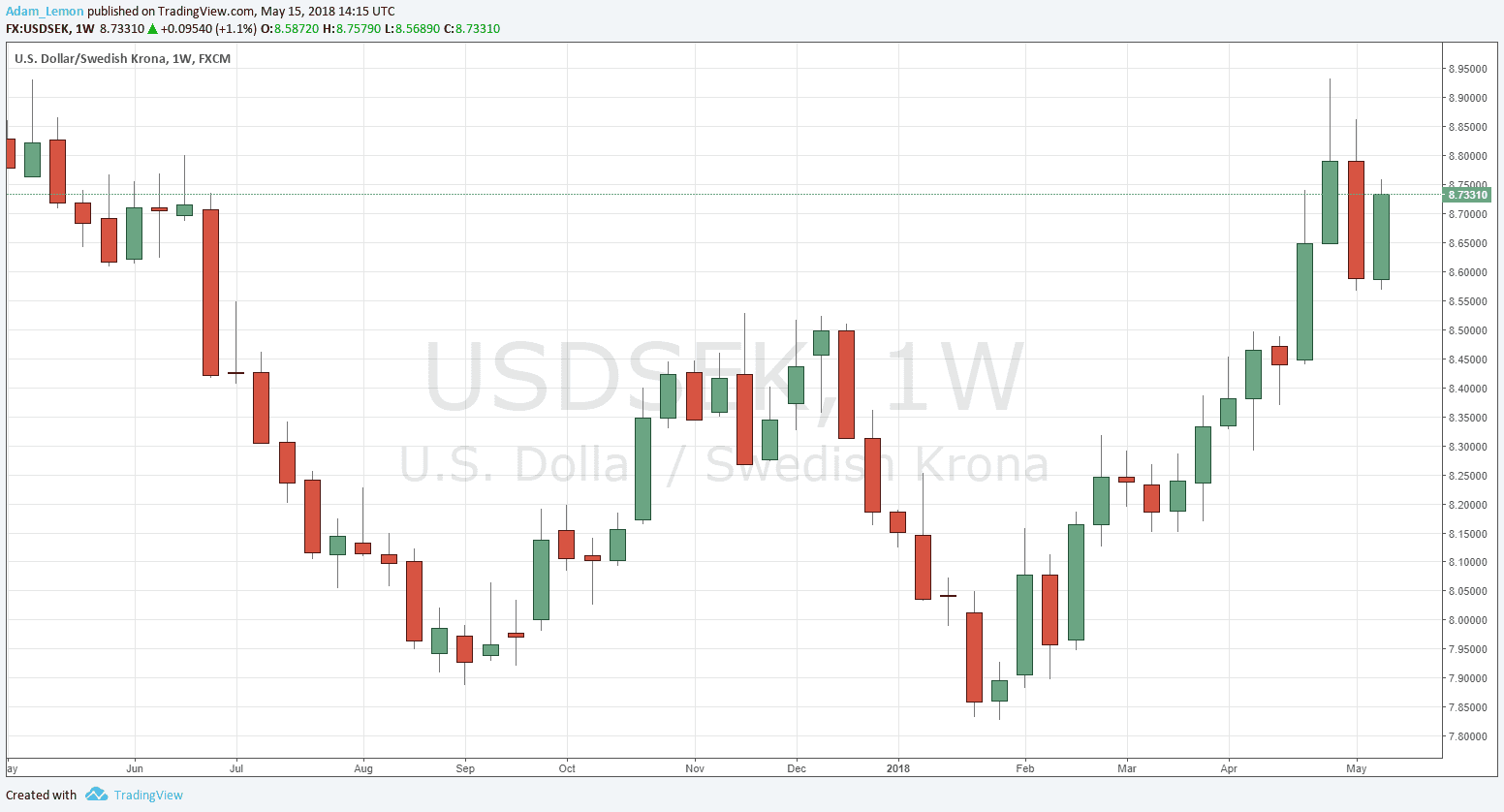

USD/SEK

This is up by 1.75%, by far this is the best performance. The chart was really looking quite healthy and I wish I had used this pair to make the short SEK trade. Although there is a long-term trend in favor of the USD, I was expecting it to pause this week, which is one of the reasons why I chose the EUR/SEK cross as the best vehicle for the trade.

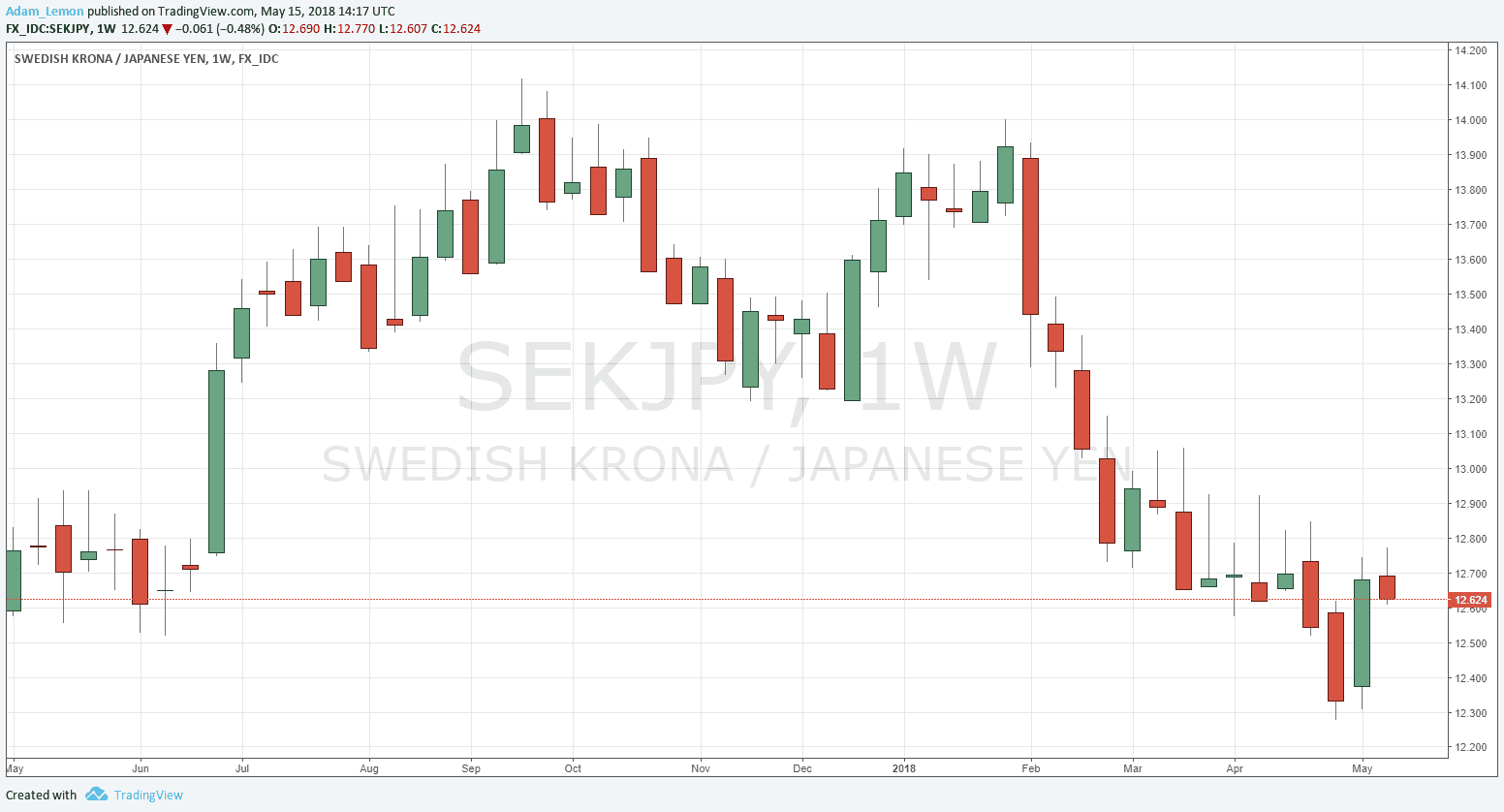

SEK/JPY

This is the worst performer of the four alternatives: up by only 0.55%. Yet this is the one I expected last Sunday to be the best choice. Of course, it is only Tuesday, and a lot could happen over the remaining three trading days! It just goes to show that there is an unpredictable element in trading and it often helps to trust the statistics instead of your feelings about whether a currency can go higher or lower or not. If you had taken equally weighted trades in all these pairs/crosses, you would be up now by 1.05% - a relatively good result.