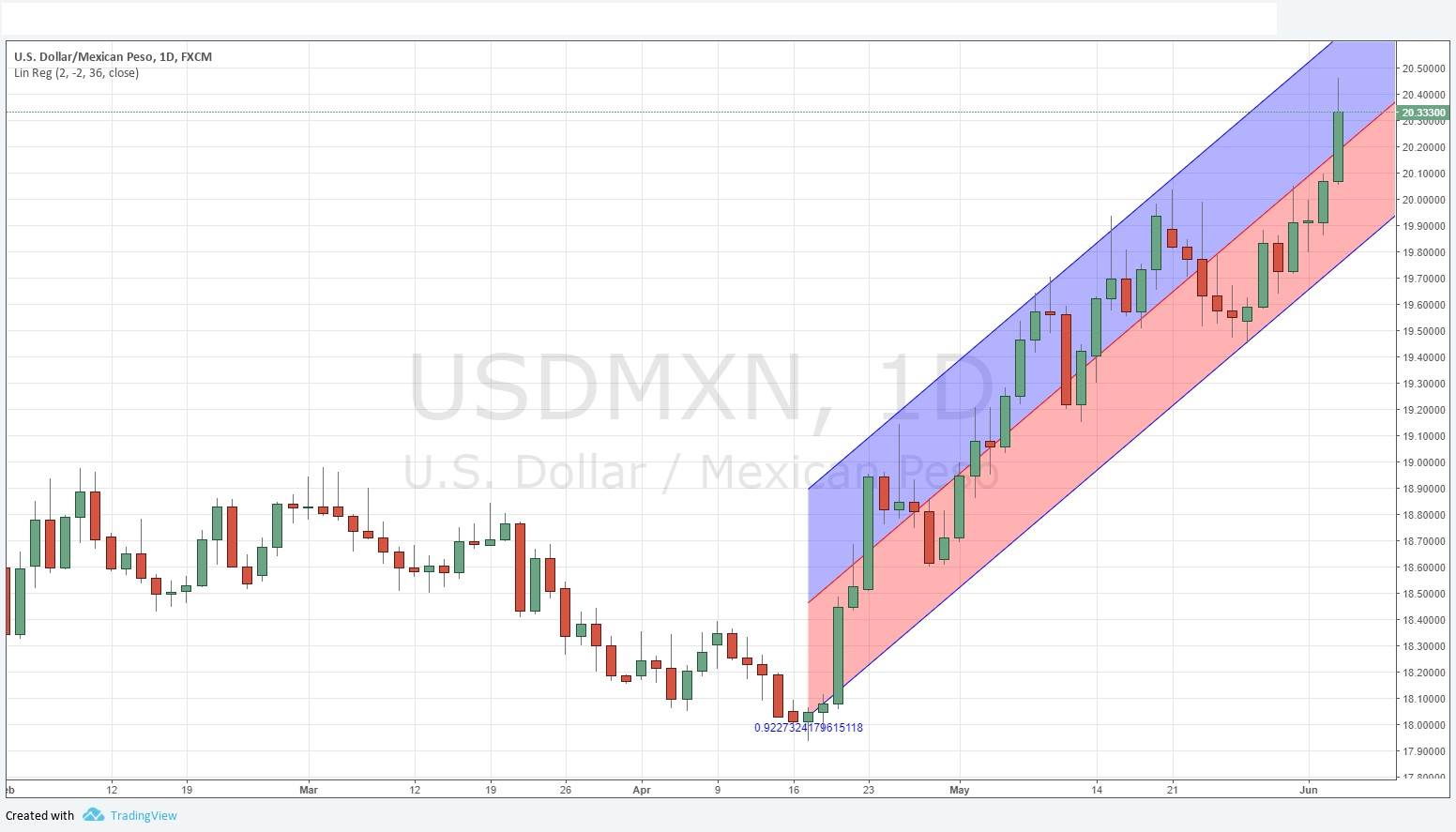

At the start of this week, in my “pairs in focus” item, I highlighted some potential trading opportunities I saw as likely to come along this week, including long USD/MXN (shorting the Mexican Peso). Of all the pairs I looked at, this has been the only trade which has really come to life so far this week, as the USD/MXN broke convincingly above the 20.00 price area and continued to advance with increasing momentum towards a new 1-year high price just under 20.50. At the time of writing, the USD/MXN currency pair is up by 2.21% from its weekly open. It seems as if the latest upwards leg may have peaked for today with a strong climax candle. It looks very possible that it will rise again tomorrow, or later this week.

At the start of this week, in my “pairs in focus” item, I highlighted some potential trading opportunities I saw as likely to come along this week, including long USD/MXN (shorting the Mexican Peso). Of all the pairs I looked at, this has been the only trade which has really come to life so far this week, as the USD/MXN broke convincingly above the 20.00 price area and continued to advance with increasing momentum towards a new 1-year high price just under 20.50. At the time of writing, the USD/MXN currency pair is up by 2.21% from its weekly open. It seems as if the latest upwards leg may have peaked for today with a strong climax candle. It looks very possible that it will rise again tomorrow, or later this week.

What’s behind the move? While it is true that the U.S. Dollar has been strong over the long-term, it isn’t truly rising right now – this movement is all about weakness in the Mexican Peso. Analysts often attribute strong movements to unclear causes for the sake of editorial clarity, but there are times where connections with sentiment and fundamentals can be drawn with great conviction and this is one of them. There is increasing concern that the U.S. will pull out of NAFTA and request to negotiate a customized trade treaty with Mexico. It is likely that, given the economic imbalance between the U.S.A. and Mexico, that the terms of any new treaty would be considerably less favorable to Mexico than the NAFTA rules currently are, and this is causing the relative value of the Peso to fall. Leading Mexican politicians are also taking a tough line against the U.S.A. and have imposed retaliatory tariffs on U.S. goods.

This means that we have a trend with fundamentals and sentiment behind it. Technically, I like trading this kind of trend, where the price is rising with exponential momentum, and is above its price levels from both 3 months and 6 months ago. The daily chart also shows a steady bullish trend, as shown below.