A great method to use to put the odds of achieving a long-term profit in Forex in your favor is to try to trade in the direction of whichever currency is the strongest against the weakest. If you do this consistently, using any half-decent trade entry and exit strategy, you will make a profit. Of course, its not an easy thing to do. Defining the “strongest” and the “weakest” is partly just mathematics, but not wholly. For example, if you list the major currencies and calculate their percentage changes in value over the past three to six months and go with the biggest gainer against the biggest loser, then you are onto something. Yet although this is usually a profitable methodology, it will take you into periods where you will miss out on the major action. This is just part of trading, but isn’t there a way to use skill and experience to add some discretion to the methodology? Maybe, but it’s difficult to teach, though it might help looking at the current market.

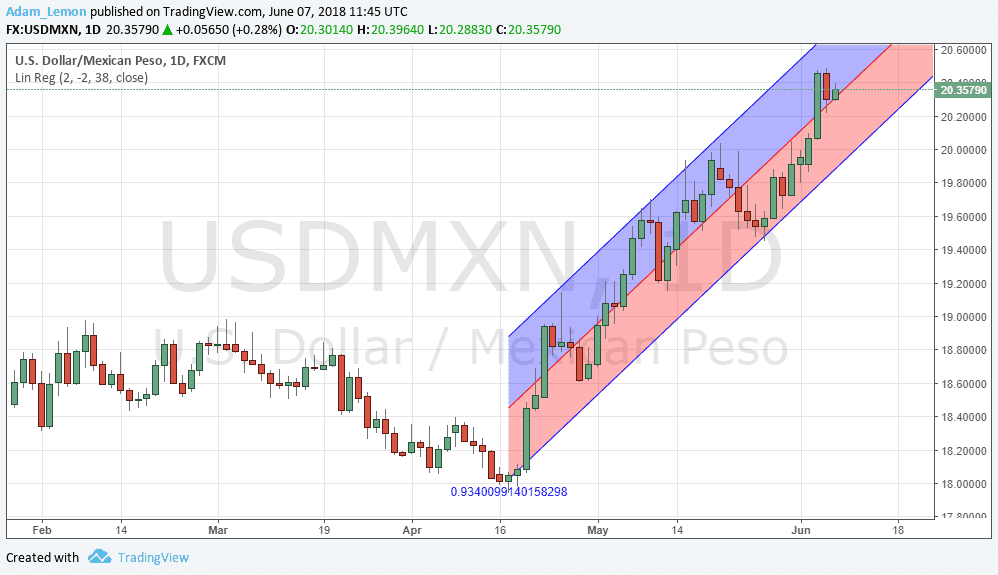

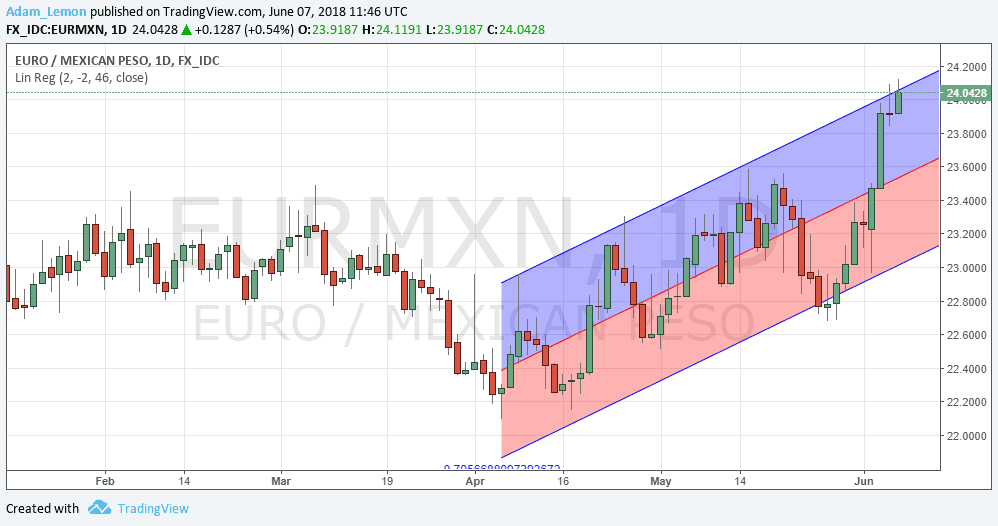

Right now, the “weakest” currency by all good metrics is the Mexican Peso. You can get that result purely on technical grounds, but also by the fact that the trend looks strong and exponentially increasing on a price chart, and the Mexican Peso shows this formation over the recent weeks of price action against all the major currencies such as the USD, the EUR, and the JPY.

Turning to the question of which is the “strongest” currency is much more challenging. The USD is the strong and consistent riser over recent months, but price action today and most importantly for the past few days as well, is bearish against the USD. Are there any useful alternatives? Nothing that is backed up by several months of price action, so it is an arguable question. It is possible to drill down, though it lessons the odds of success. If we look at the past couple of weeks, it is obvious that the strength during this time has been in the Euro and in the Australian Dollar. If we look in the news, we can see that speculation that the ECB may make a major step in tightening monetary policy is boosting the Euro, which is bouncing back impulsively following weeks of losses. When there is no clear long-term trend, short-term “sentiment” and market focus become more important, which is why I choose the EUR as the strongest currency right now.