Why Trade the Stock Market?

Before getting into the nitty-gritty of stock trading, let’s first answer the question of why trade stocks in addition to Forex?

Long-Sustained Trends

Individual stocks and entire indices can present multi-year trends that you can ride for profit. Look at companies like Amazon and Apple for the last 5-10 years as great examples:

As you can see in the above chart, Amazon has been going up for years, as far back as 2017.

Apple has also been in a long-term uptrend for years:

Around 2017-2018, Apple stocks were $20 a share. Now, they’re $146 a share.

Multi-year trends are often not the case in Forex pairs.

Broad Array of Opportunities

Depending on the stock market you wish to focus on, there can be hundreds, if not thousands, of trading prospects. This high number of opportunities means you can pick the very best trends or trading setups. In contrast, Forex is limited to a couple of tradeable pairs.

How to Trade Stocks

You can access the stock markets (also known as the equity markets) in numerous ways:

Buy and Sell the Underlying Shares

Buying and selling the underlying shares is the most basic way of trading the stock markets. You own the shares, which means you own a piece of the company. Most common shares carry voting rights. But buying the shares usually means you have little to no leverage. Also, it’s not always possible to short a stock. If you do short a stock, your losses can be unlimited as there is no ceiling to how much and how quickly the trade can go against you. Institutional investors experienced this reality when they were short the U.S. stock, GameStop, and the price rose multi-fold, causing huge losses for short investors.

Stock Options

There are two types of equity options: calls and puts. Call options give you the right to buy a stock; put options give you the right to sell a stock. Call options can provide leverage to long positions. Put options make it easy to profit from falling stocks without the risk of unlimited losses. Options can be complex and require a learning curve. When you are long an option, dissipating time value can work against you.

Contracts for Difference (CFDs)

CFDs allow for leverage, but you don’t own the underlying stock, which means no voting rights. CFDs carry overnight financing costs. Whenever you have a leveraged position, you risk multiplying your losses and facing margin calls. CFDs can be a low-cost way to access non-domestic stocks.

Equity-Based Exchange Traded Funds (ETFs)

ETFs are low-cost and can focus on different indexes, geographies, sectors, and investing styles. They provide a way to diversify or concentrate on a particular area of the economy. There aren’t many downsides to trading ETFs.

Equity Index Futures

Equity index futures are highly leveraged and very liquid with low spreads. They usually trade through central exchanges, such as the Chicago Mercantile Exchange (CME). There aren’t many downsides to trading index futures, either.

Where Can You Trade Stocks?

The below infographic shows that globally, the U.S. equity markets dominate.

.png) As of April 2020, the New York Stock Exchange and NASDAQ comprised 45% of the world’s equity markets.

As of April 2020, the New York Stock Exchange and NASDAQ comprised 45% of the world’s equity markets.

The most prominent U.S. equity indices are the S&P 500, NASDAQ 100, Dow 30 and Russell 2000.

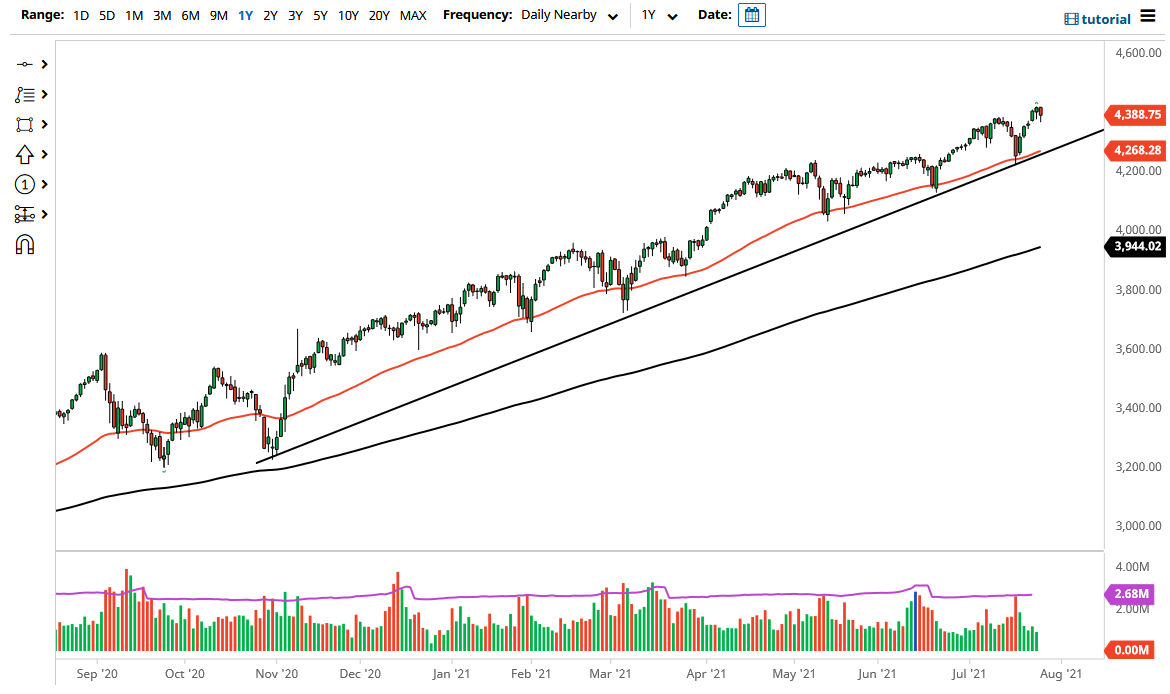

Let’s look at some examples of stock indices, starting with the S&P 500:

The S&P 500 has been in a long-term uptrend. You can see where the market dipped when the impact of COVID-19 became apparent, but the market has since recovered and continued its overall upward trend.

Bottom Line

Make sure to always be expanding your opportunities for the best available trades. Sometimes that means waiting for the setup or looking at different charts to expand the trade possibilities.

Also, make sure to always mind your risk. Good risk management is the key to profitable trading.

If you want to learn more about stock trading, there’s no better place than FXAcademy.com, where you can expand your knowledge of the stock markets with hundreds of articles and videos.