Anyone who knows me knows I’m a strictly technical Forex trader. That means that I find my trades not so much by trading the news and fundamentals such as interest rate hikes, CPI numbers, etc., but rather by looking at technical price charts.

My price chart method is simple. I divide all charts into two timeframes: higher timeframes and lower timeframes. Charts in the higher category range from the four-hour timeframe and up, while charts in the lower category range from the one-hour timeframe and below. I use the higher timeframe charts to conduct my technical analysis, but I use the lower timeframes to find my trade entries and execute the actual trade.

But whatever kind of trader you are, and whatever your method, always start your market analysis with a good economic calendar.

Let’s dive into the analysis by looking at the price charts of the major Forex pairs.

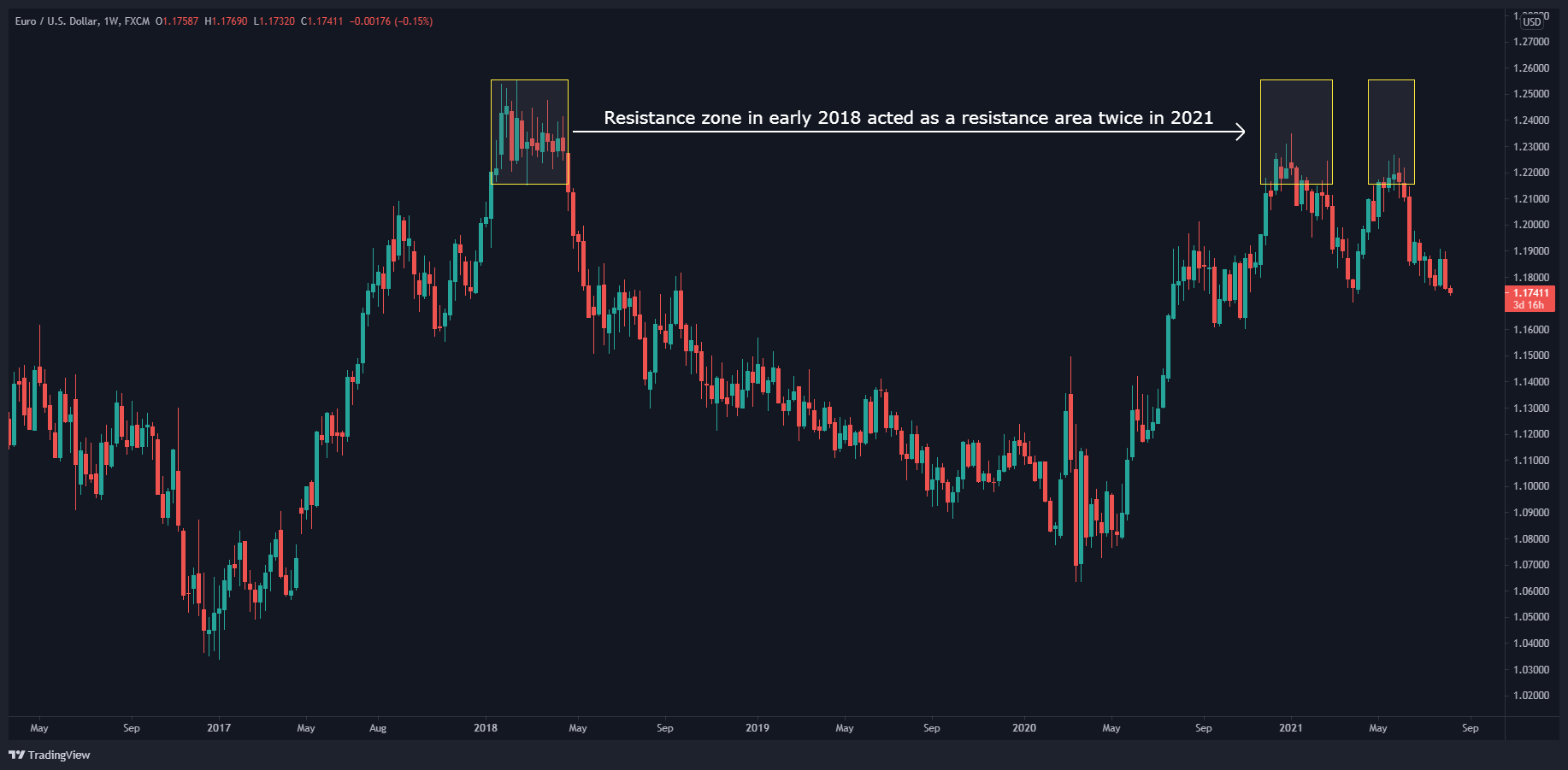

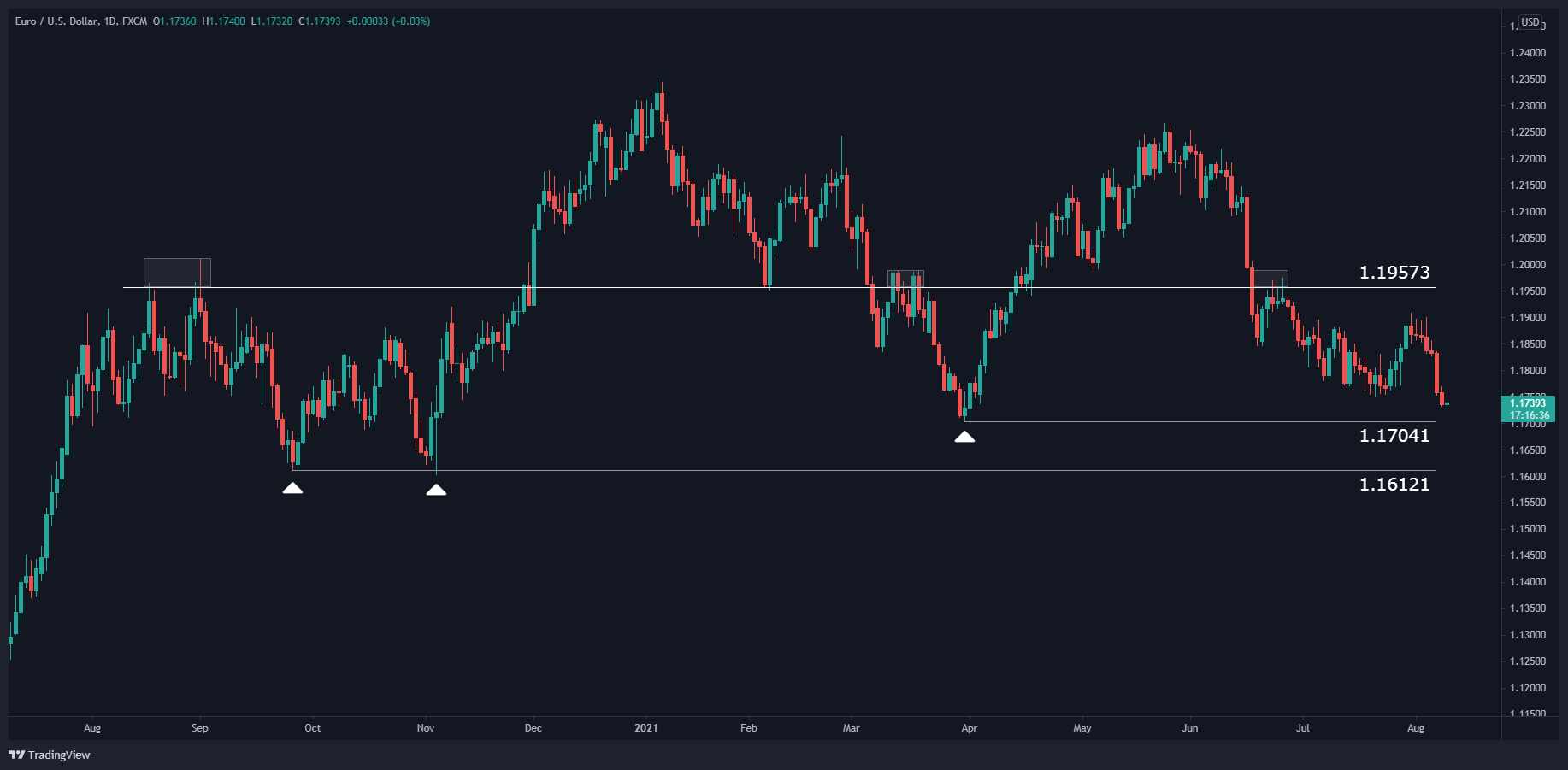

EUR/USD

The uptrend that started in early 2020 has stalled as the price reaches a previous resistance formed in early 2018. The price made two successive lower highs in January and May 2021.

On the daily timeframe, the price is below 1.19573, which has acted as a key level in the sideways move over the last year:

To confirm the price has reversed and started a downtrend, it must break the support at 1.17041. The next support level that the price could reach but still pose a challenge to the downtrend is 1.16121.

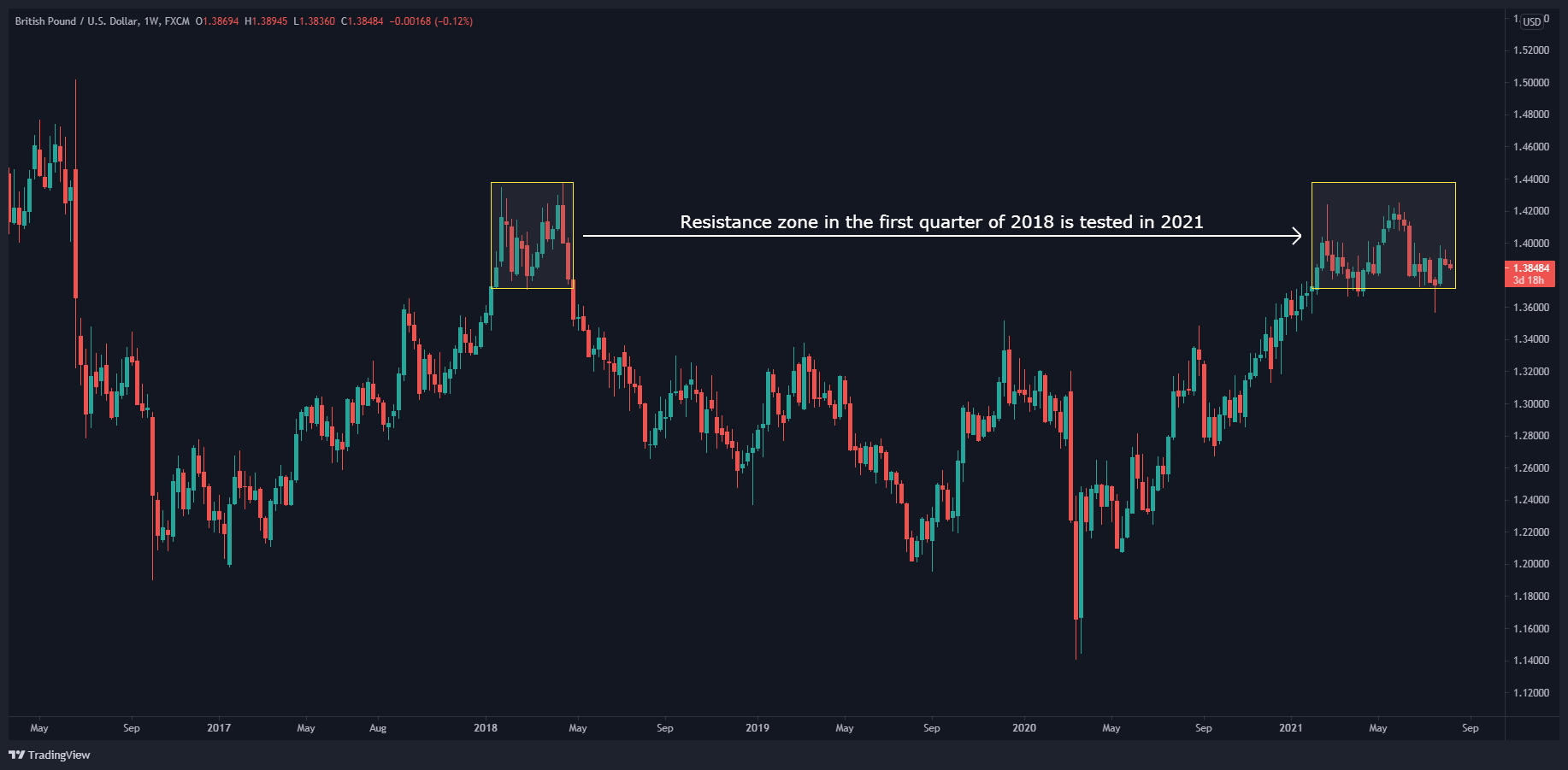

GBP/USD

The uptrend that started in early 2020 is slowing down as it comes in the same region as resistance made in early 2018. The price made a double top in February and June 2021. The second peak formed a rounded top which is a strong reversal sign.

On the daily chart, the price is below 1.4005, which has acted as a key level as the price has moved sideways over the last six months:

To confirm the price has reversed and started a downtrend, it must break the support at 1.3670.

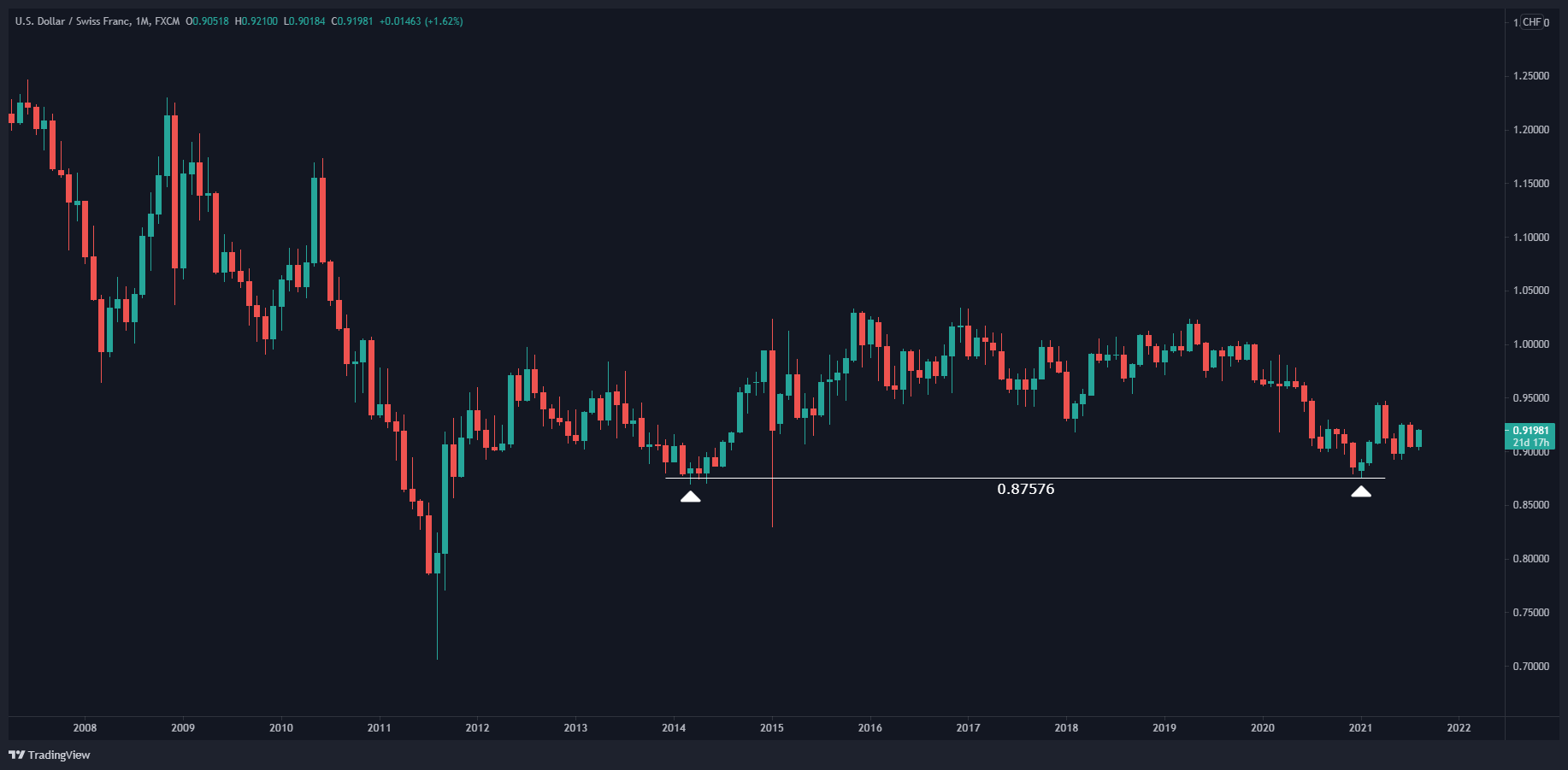

USD/CHF

The price bounced and created a support level at 0.87576 earlier in 2021, which aligns with previous support in 2014.

On the daily chart, a reverse head & shoulders can be seen over December 2020 to January 2021, suggesting the previous downtrend will pause.

Since then, the price has made several bullish impulsive moves, suggesting a new uptrend is on its way. It must break 0.92748 as the next resistance to continue its uptrend.

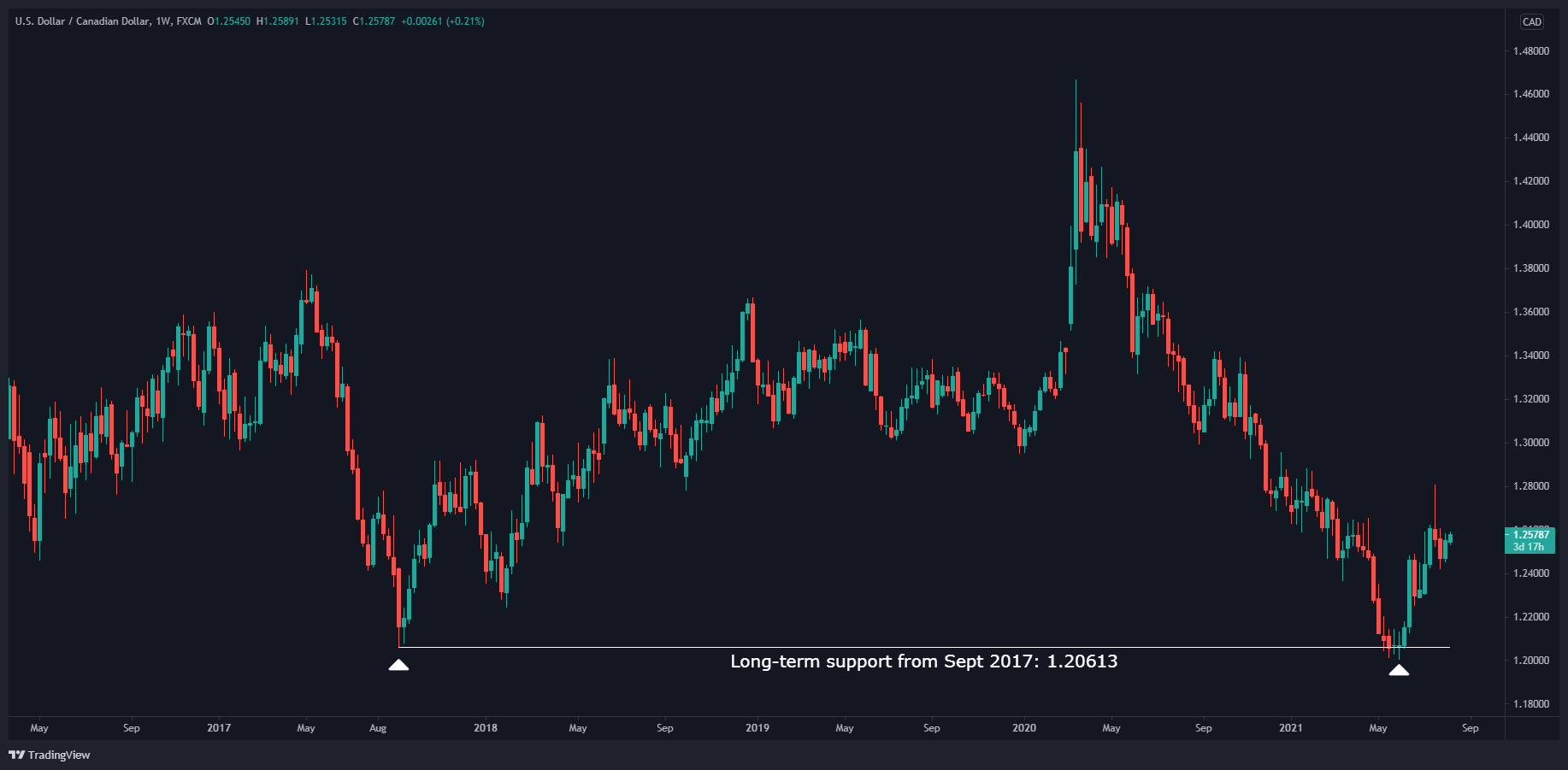

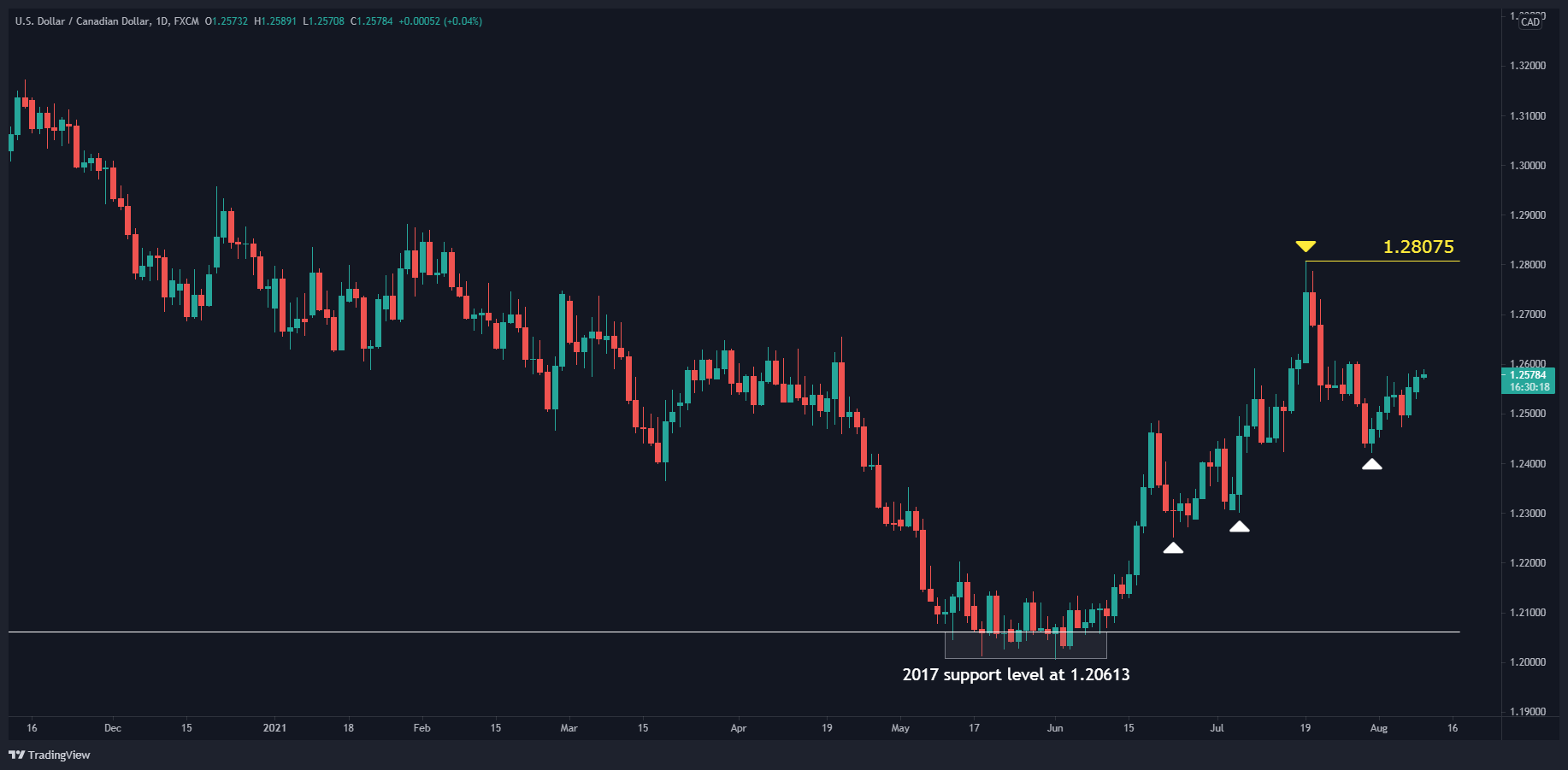

USD/CAD

The pair recently bounced off a support level made in 2017 at 1.20613, and the price could be reversing the previous 18-month downtrend.

On the daily chart, the price has made higher lows, a defining feature of an uptrend.

It must break the 1.28075 resistance for the uptrend to continue.

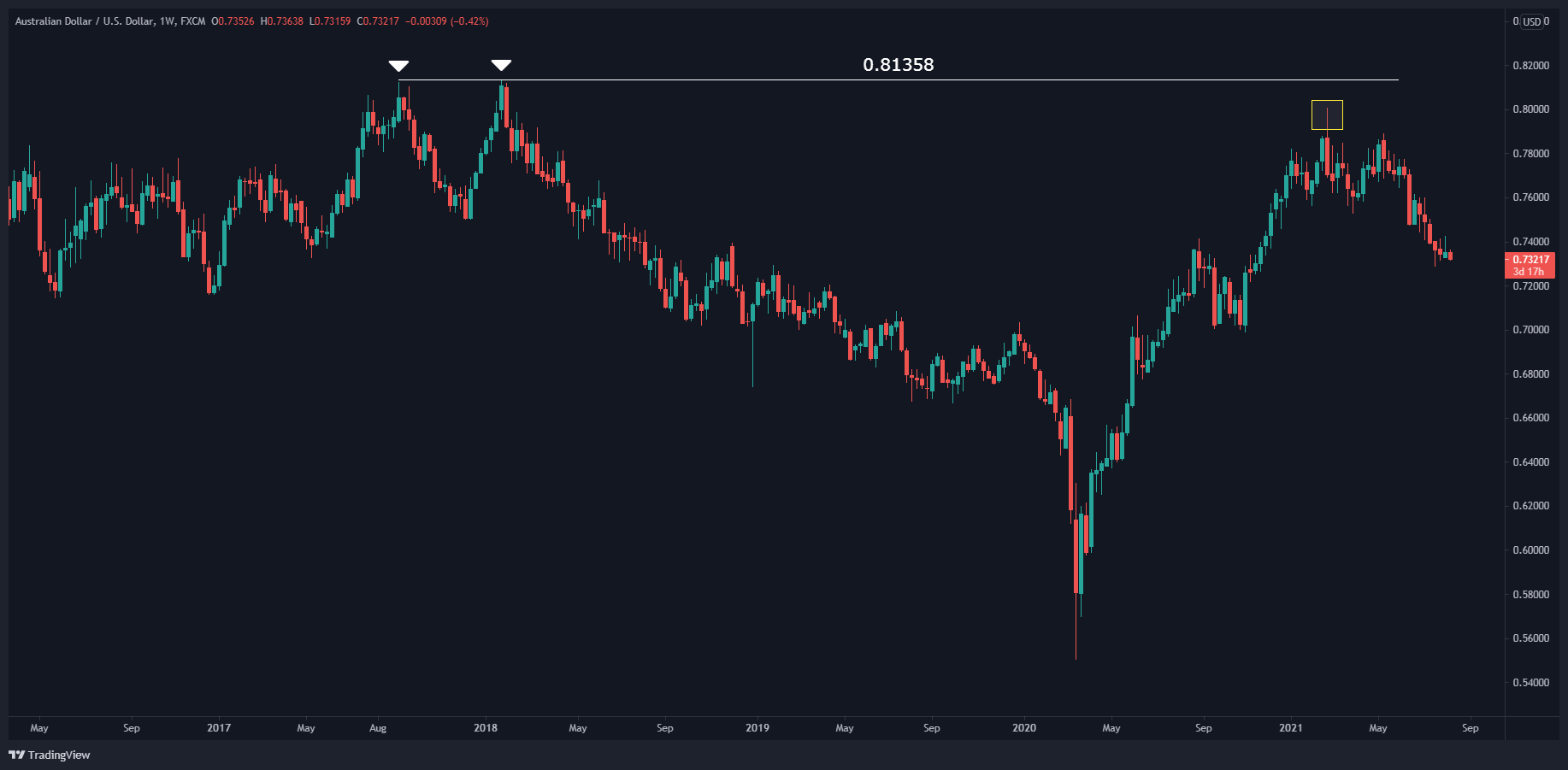

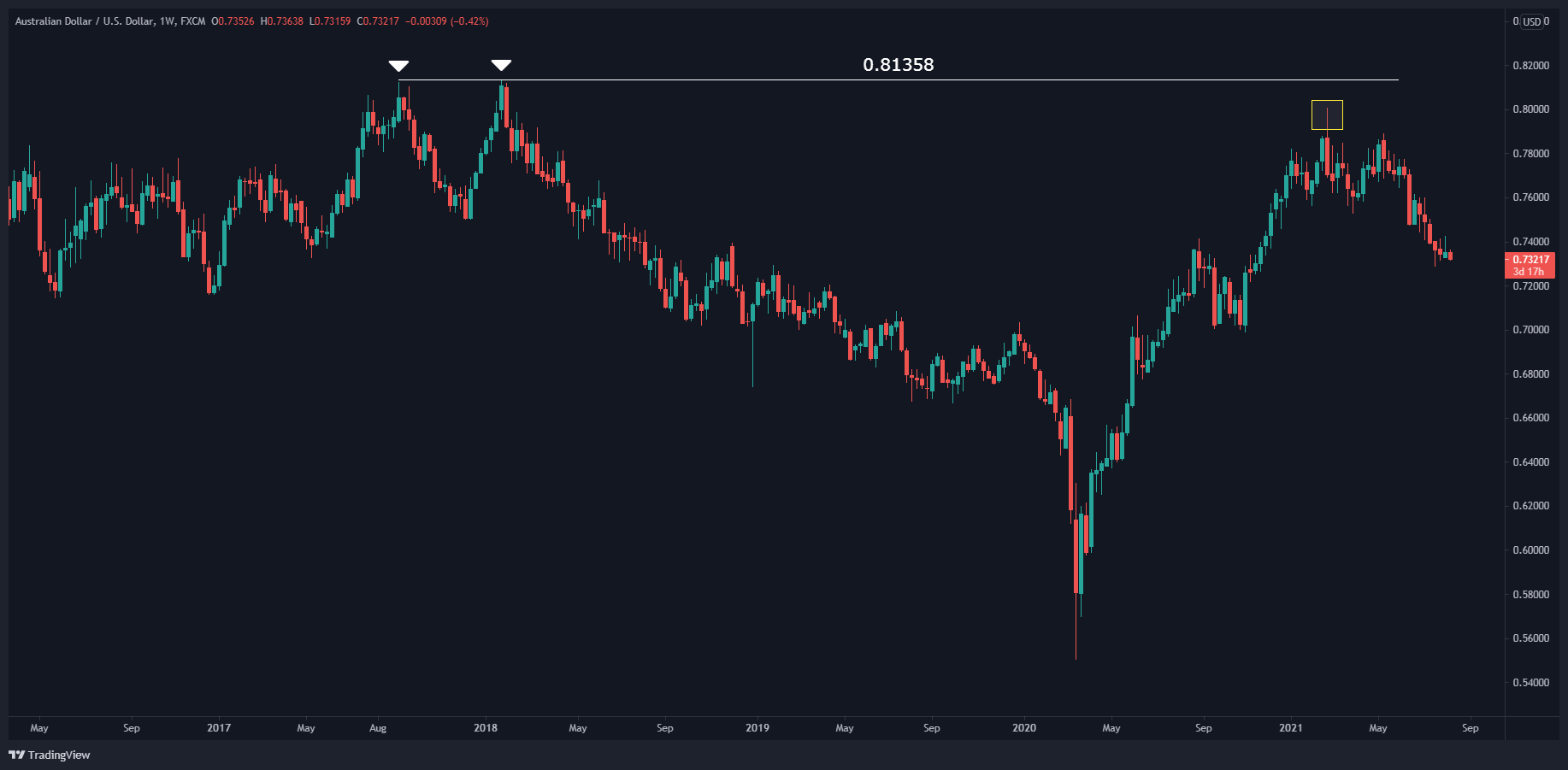

AUD/USD

In February 2021, the price came near a late-2017 resistance at 0.81358.

On the daily chart, the price made a head & shoulders reversal, with a neckline at 0.75812:

The price trended down and respected a previous resistance made on September 1, 2020 on a countertrend move in August 2021. The next support is at 0.70059.

NZD/USD

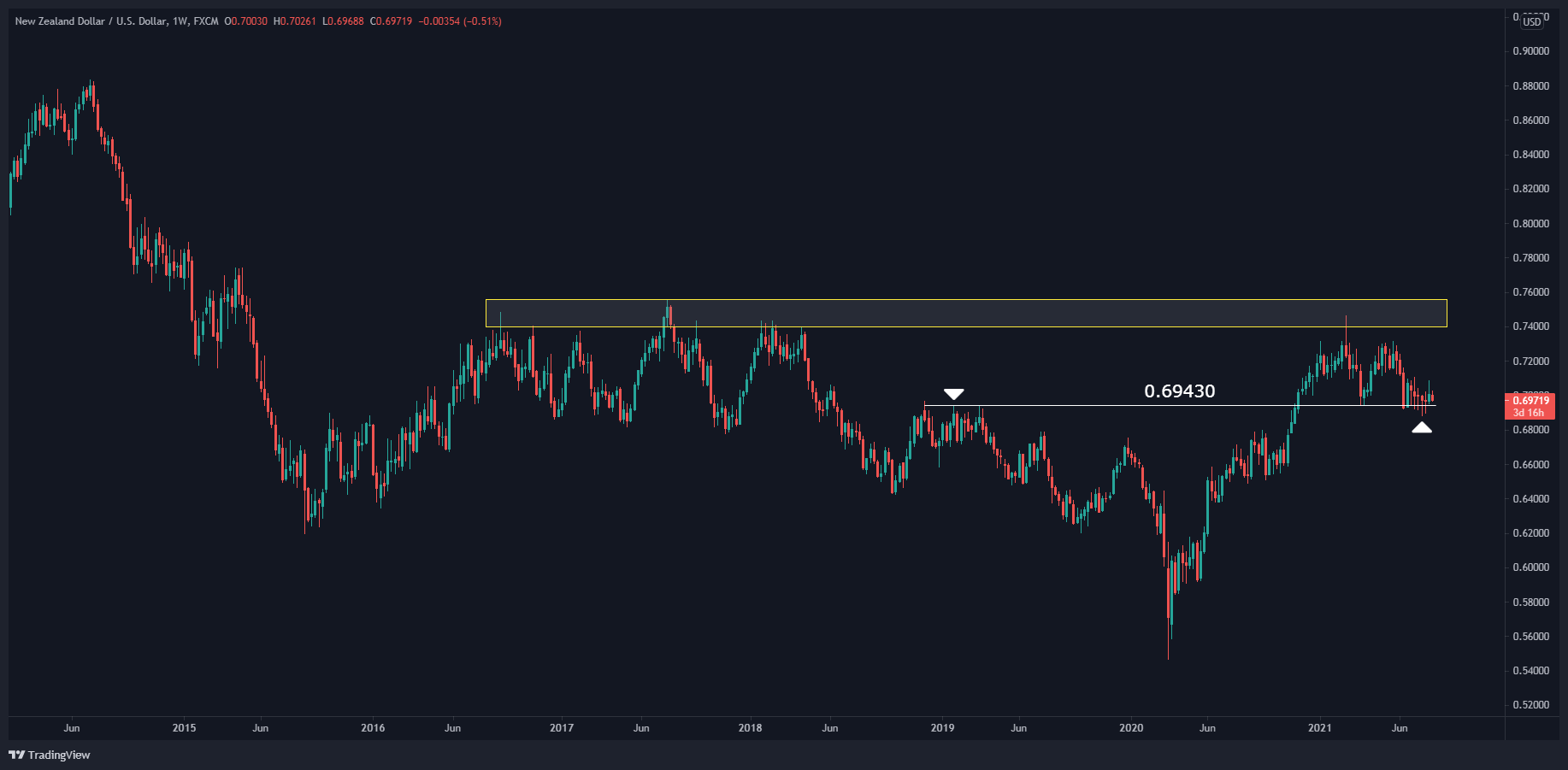

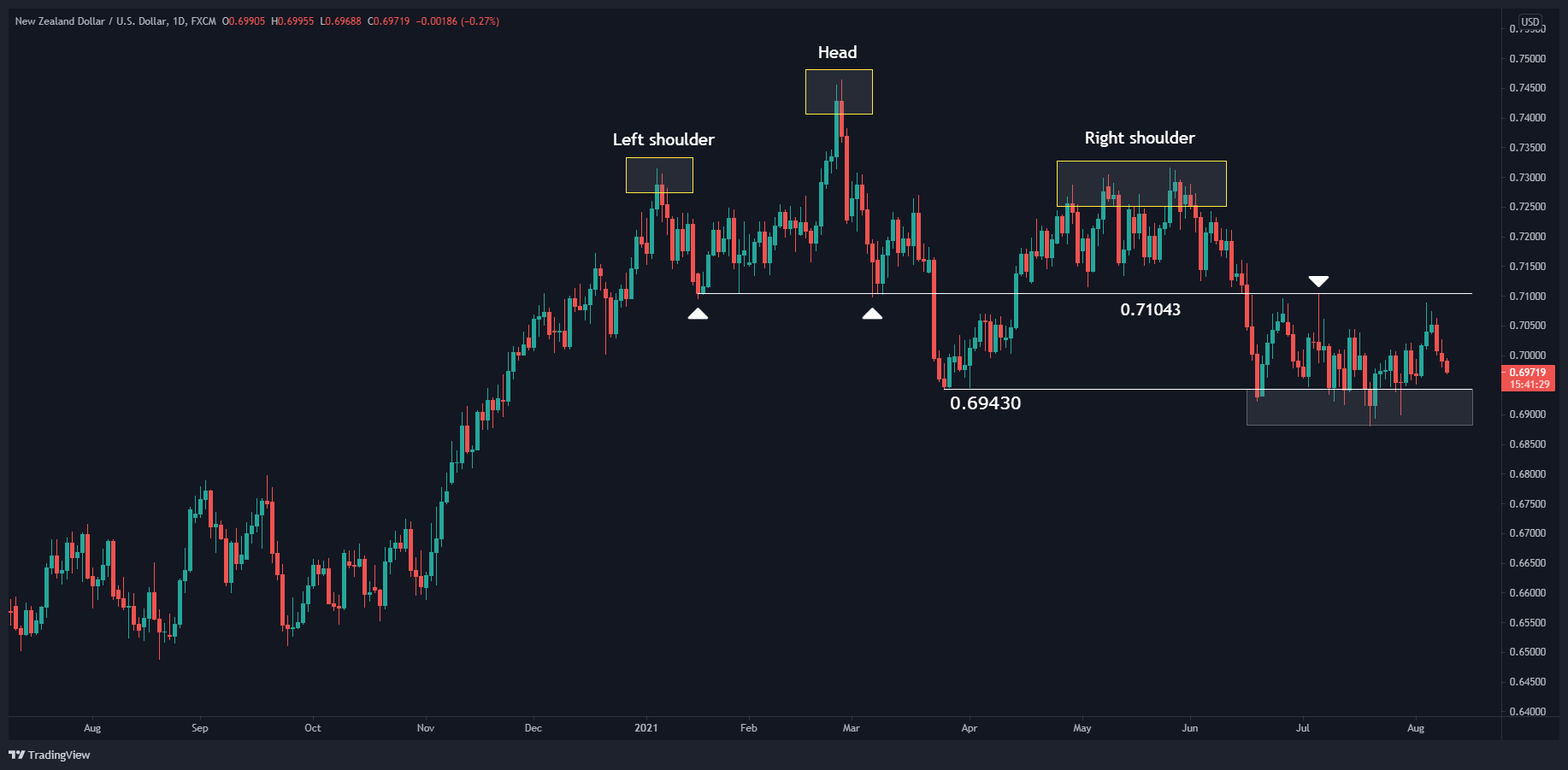

The pair made a resistance level between September 2016 and April 2018, which it then revisited in February 2021 with a strong weekly rejection candle.

The price made a head & shoulders reversal on the daily chart, with a neckline at 0.75812.

The price is below 0.71043, a key level in the head & shoulders pattern. For the downtrend to confirm, the price must break the 0.69430 level, which is visible on the weekly and daily timeframes above.

The price is below 0.71043, a key level in the head & shoulders pattern. For the downtrend to confirm, the price must break the 0.69430 level, which is visible on the weekly and daily timeframes above.

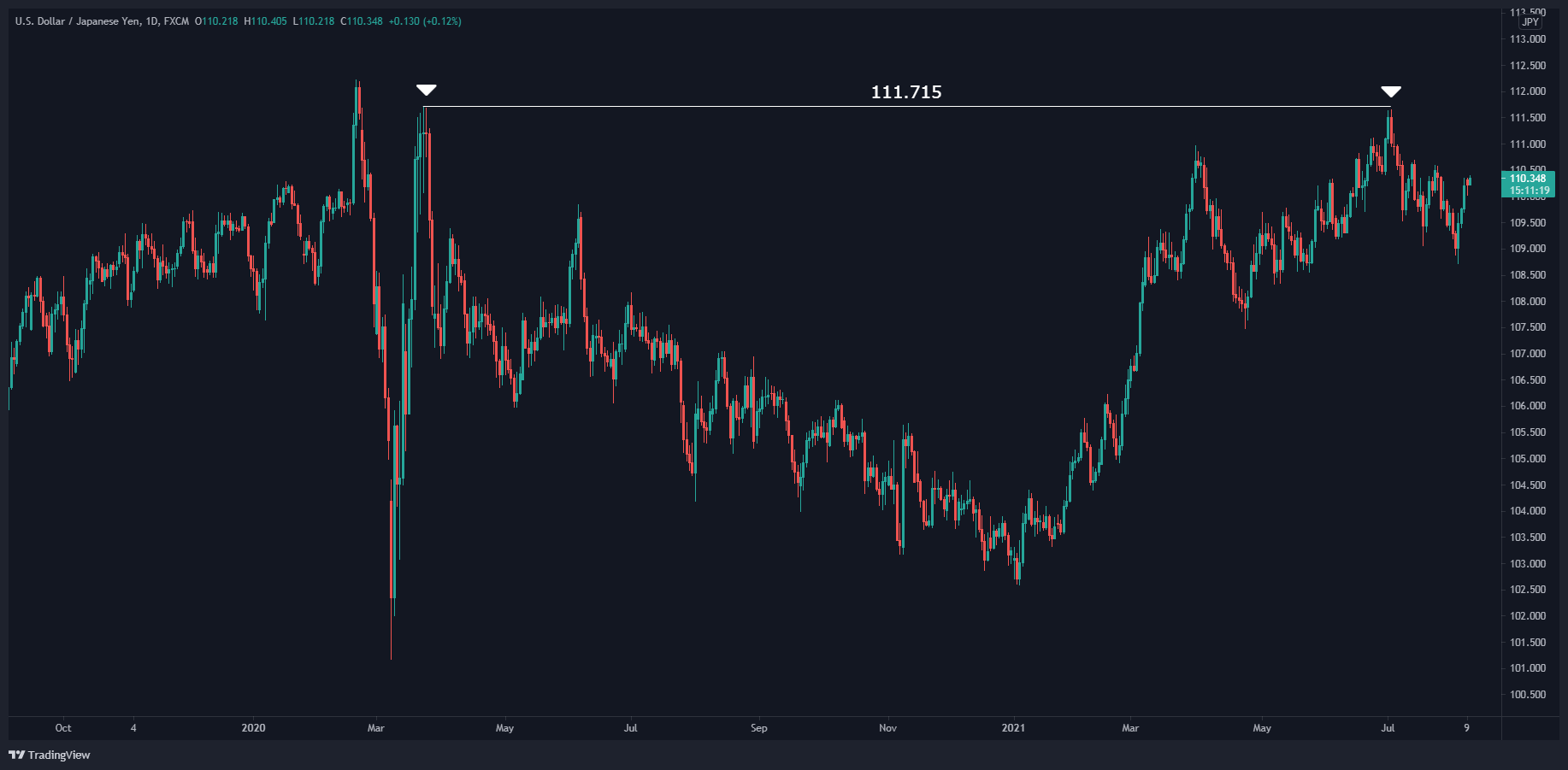

USD/JPY

After a strong uptrend that began in January 2021, the pair feels directionless. A key level to watch is 111.715. The price may break it and begin trending again, but we would only be bullish if this is confirmed.

Final Thoughts

An important thing to keep in mind when conducting a technical analysis is that if a chart isn't clear to you, move on. Find a different chart or wait until it clears up, but the more you have to guess the more at risk your account will be. And as always, when trading, make sure to mind your risk and have a risk management strategy in place.