I always say that one of the things I want people to know about me is that I’m a technical trader. This means that I find my trades by using technical analysis and analyzing the price charts for stocks indices and major Forex pairs.

It’s important for every technical trader to routinely conduct market analyses so that they can make healthy trades based on informed, education predictions. This comes from studying price charts, looking at key support and resistance levels, and identifying trends.

I break up my price charts into “big picture” higher timeframes (such as the weekly, daily and 4-hour charts) and the lower timeframes (the hourly, 15-minute and 5-minute charts). The higher timeframes are what I use for the overall technical analysis, but I use the lower timeframes to find my trades.

However, I do make sure to look at an economic calendar, which gives you a sense of what’s moving the markets and what’s driving liquidity.

To that end, let’s dive into our weekly market analysis, beginning with the S&P 500.

S&P 500 (SPX)

Big Picture

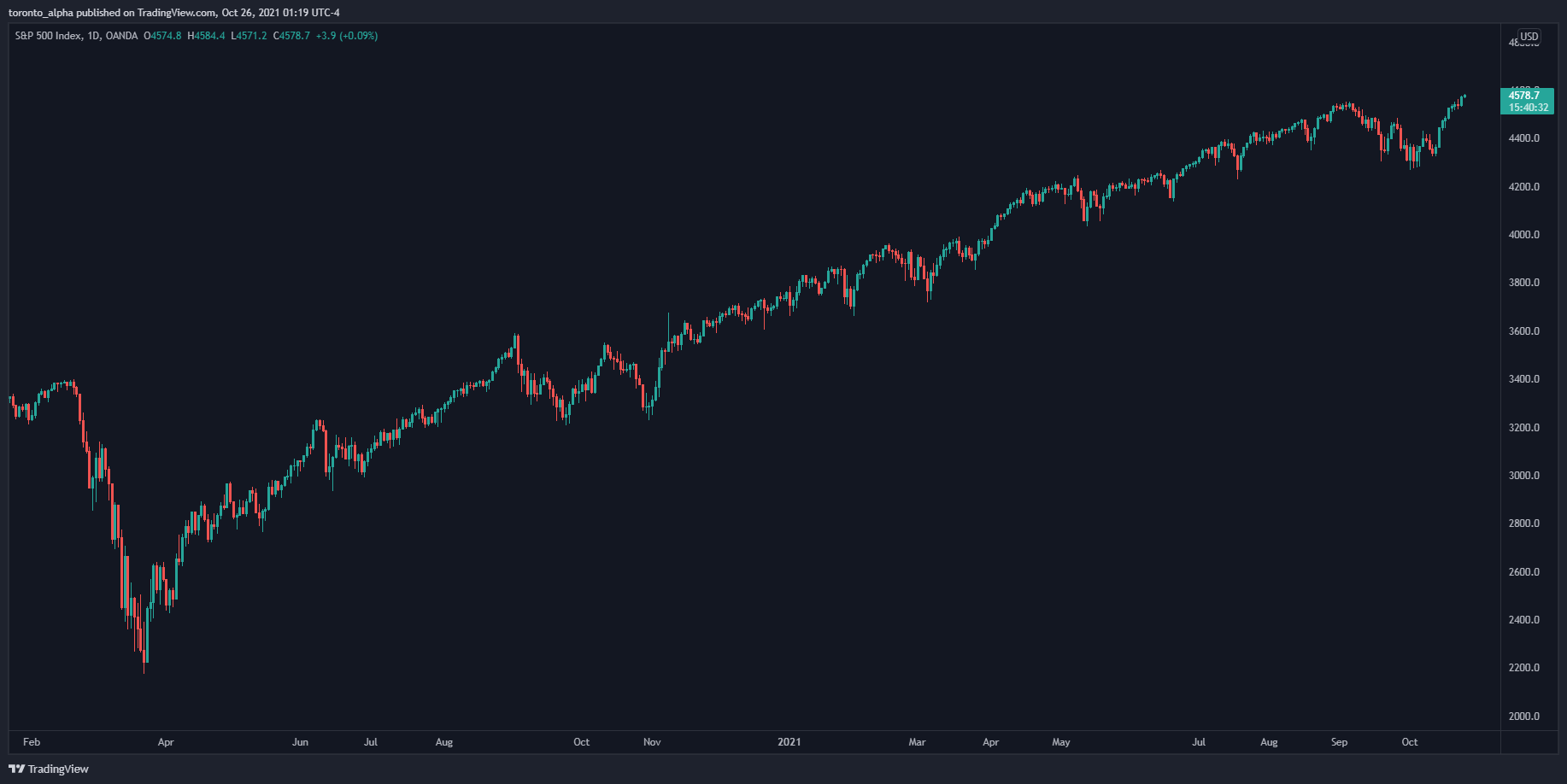

Long-term bullish trend intact after short-term pullback.

The S&P 500 has been in a textbook uptrend since March 2020. Often, resistances made in the uptrend are broken and then tested as supports which offer buying opportunities.

Key Levels

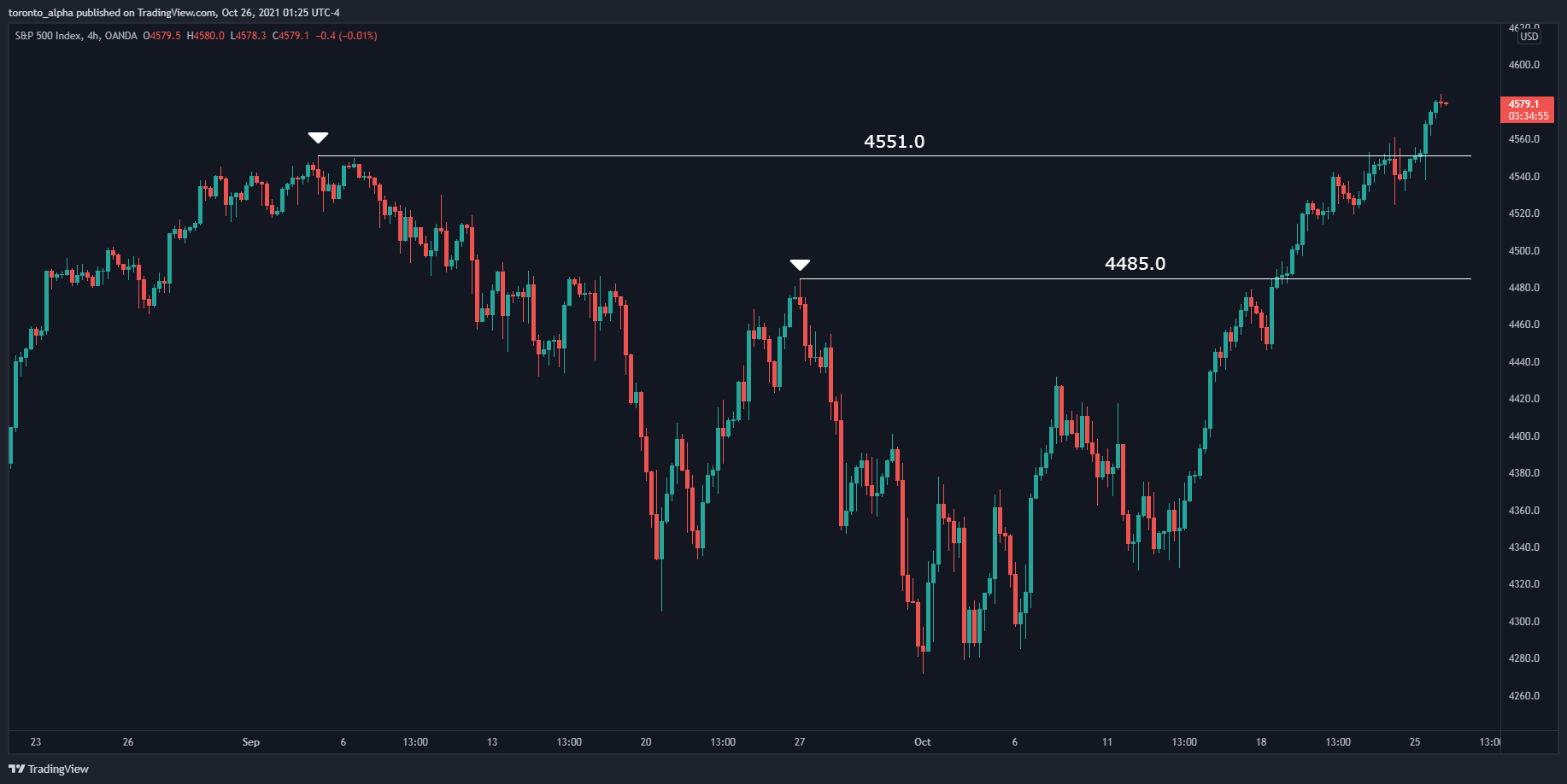

- The price recently broke the previous all-time high which could act as a future support level, 4551.0.

- The next potential support area is 4485.0.

EUR/USD

Big Picture

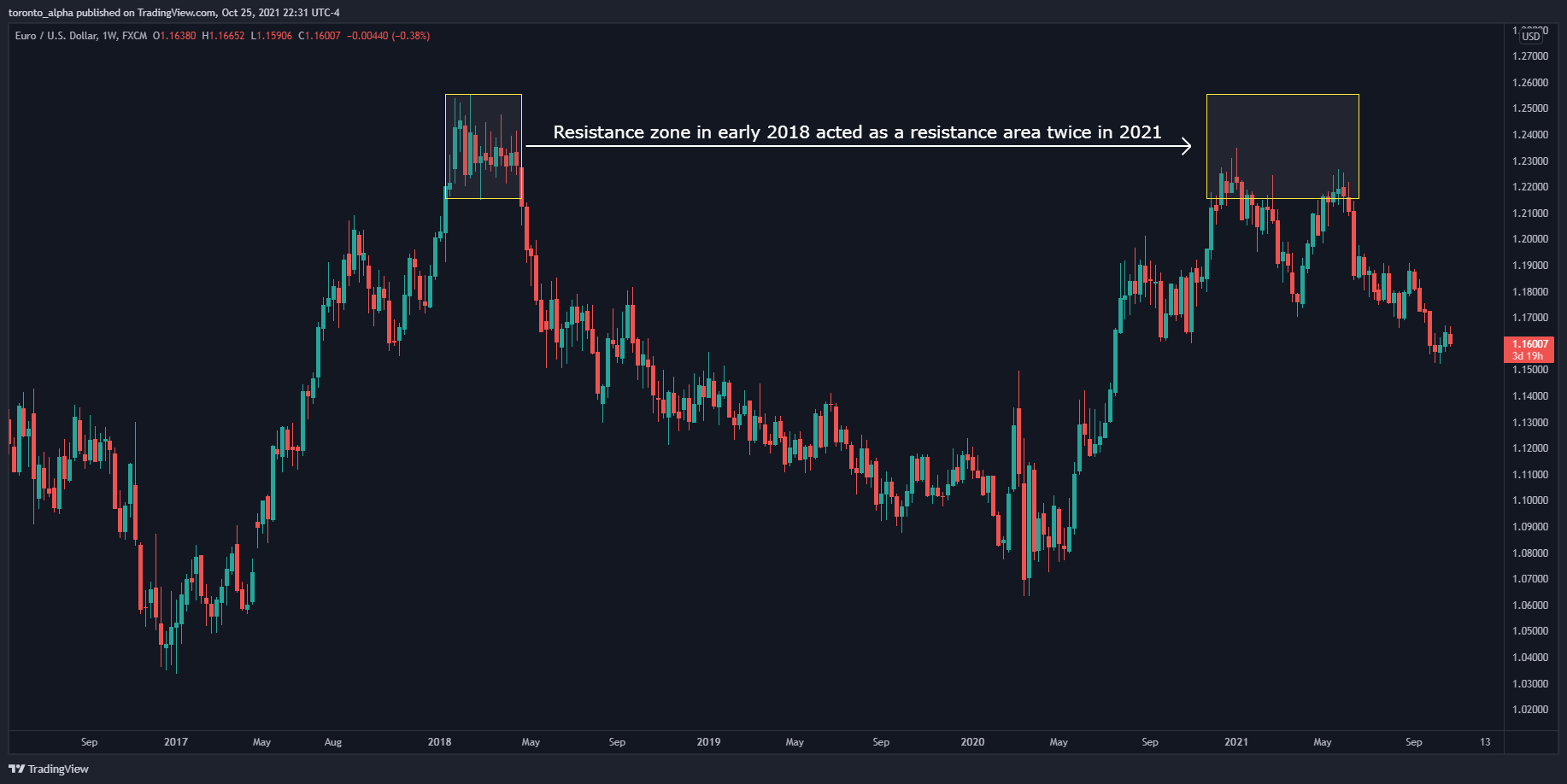

Long-term bearish outlook.

The EURUSD began an uptrend in March 2020 which peaked in January 2021 when the price reached a previous resistance formed in early 2018. The price made two successive lower highs in January and May 2021, visible on the weekly and daily timeframes.

Key Levels

1.19087: minor double-top to continue the bearish momentum.

1.16639: minor support broken and turned into resistance.

1.17041: if price remains below these supports levels, it indicates further bearishness.

GBP/USD

Big Picture

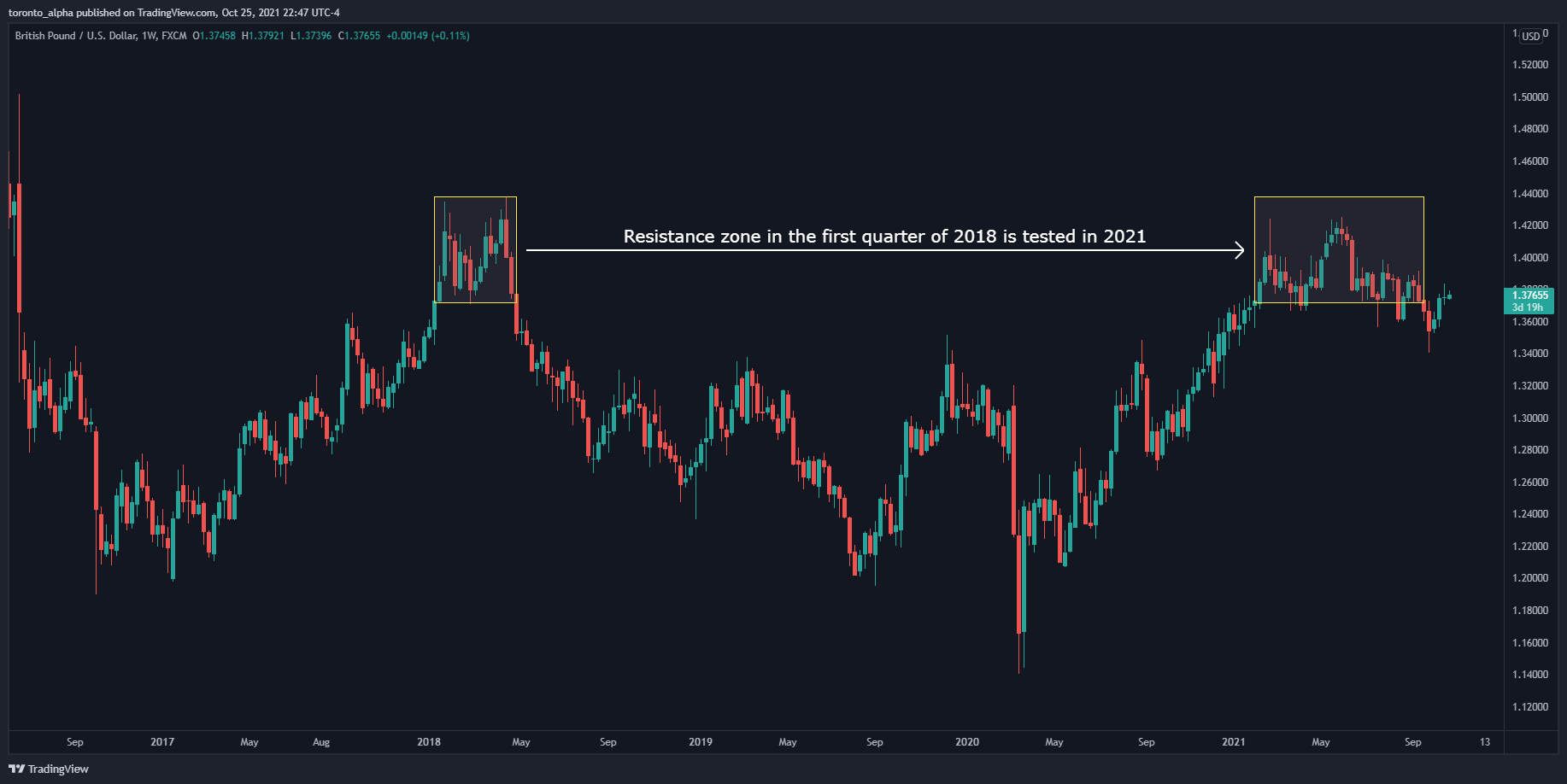

Neutral.

The GBP/USD began an uptrend in March 2020, and it peaked in February 2021 when the price reached a previous resistance formed in early 2018, most easily visible on the weekly timeframe. The price made a double-top between February and May 2021 at 1.42410. However, the price has failed to stay below a key support level, hence our neutral outlook.

Key Levels

1.36686: Price must stay below this level for us to switch from a neutral to bearish outlook.

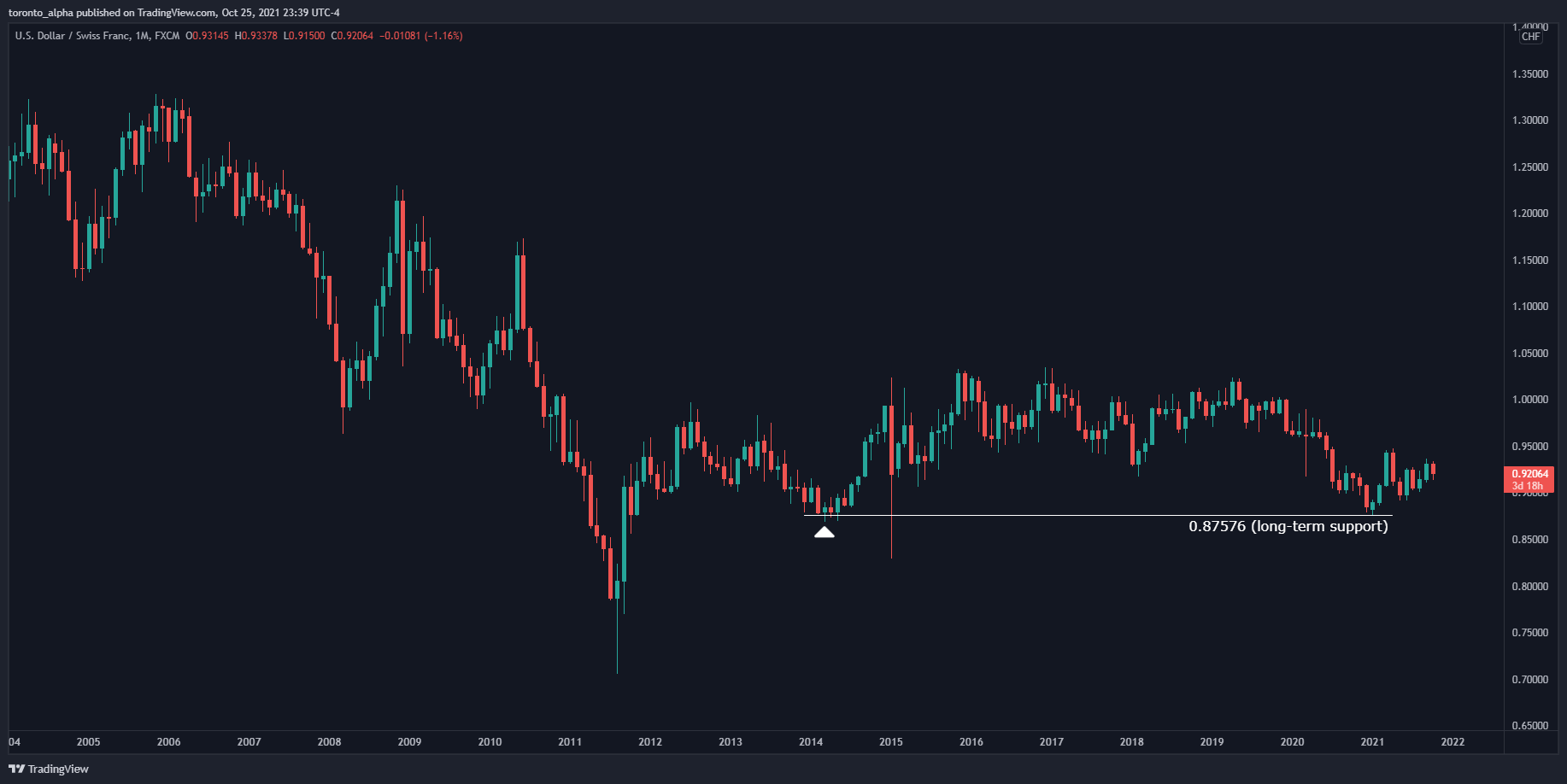

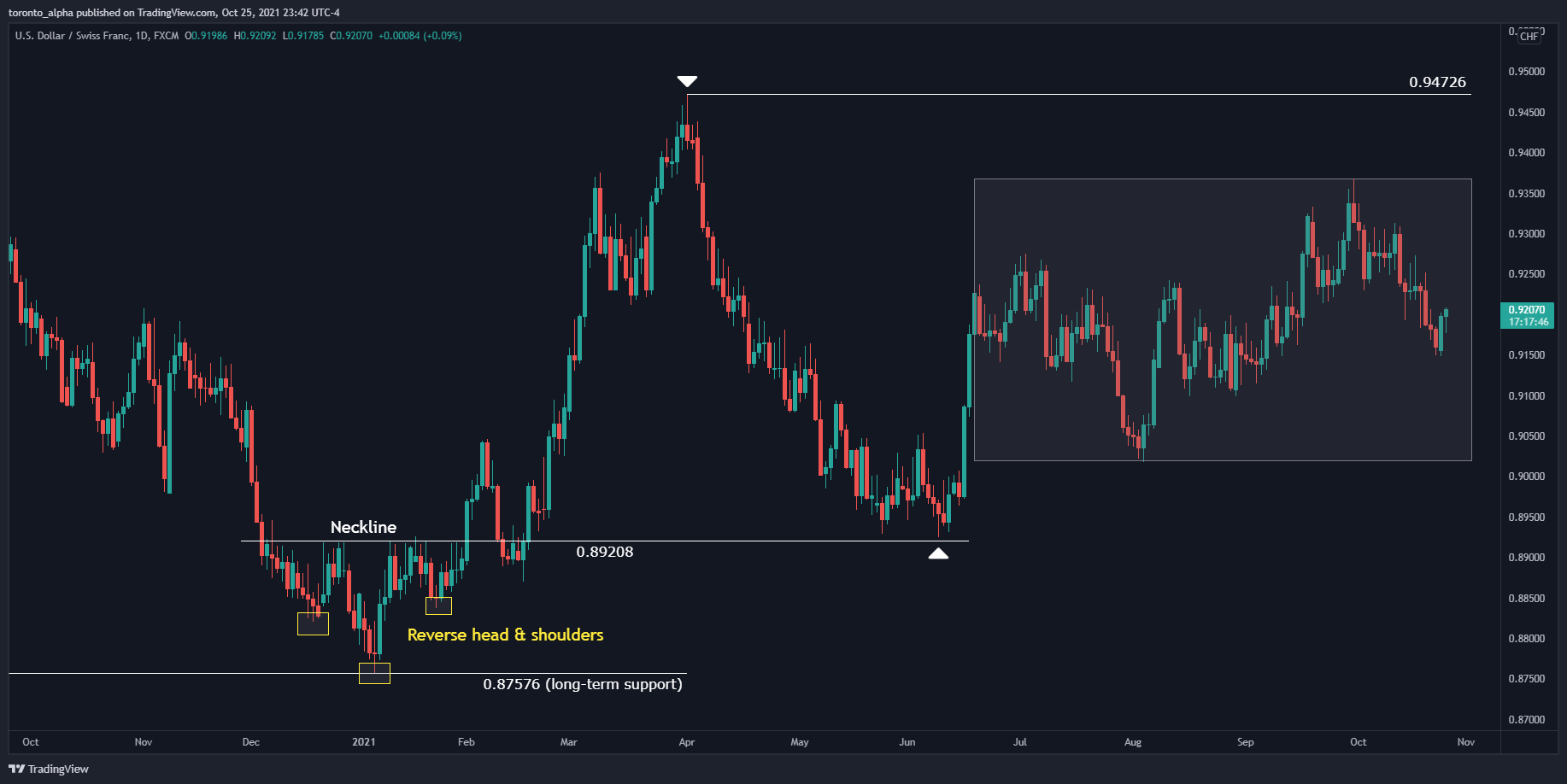

USD/CHF

Big Picture

Long-term bullish outlook.

The USD/CHF made a support at 0.87576 in January 2021, which lines up with a very long-term support area made in the first half of 2014.

Key Levels

0.94726: we expect price to break out of the messy range it has been in since June 2021 and test this previous resistance.

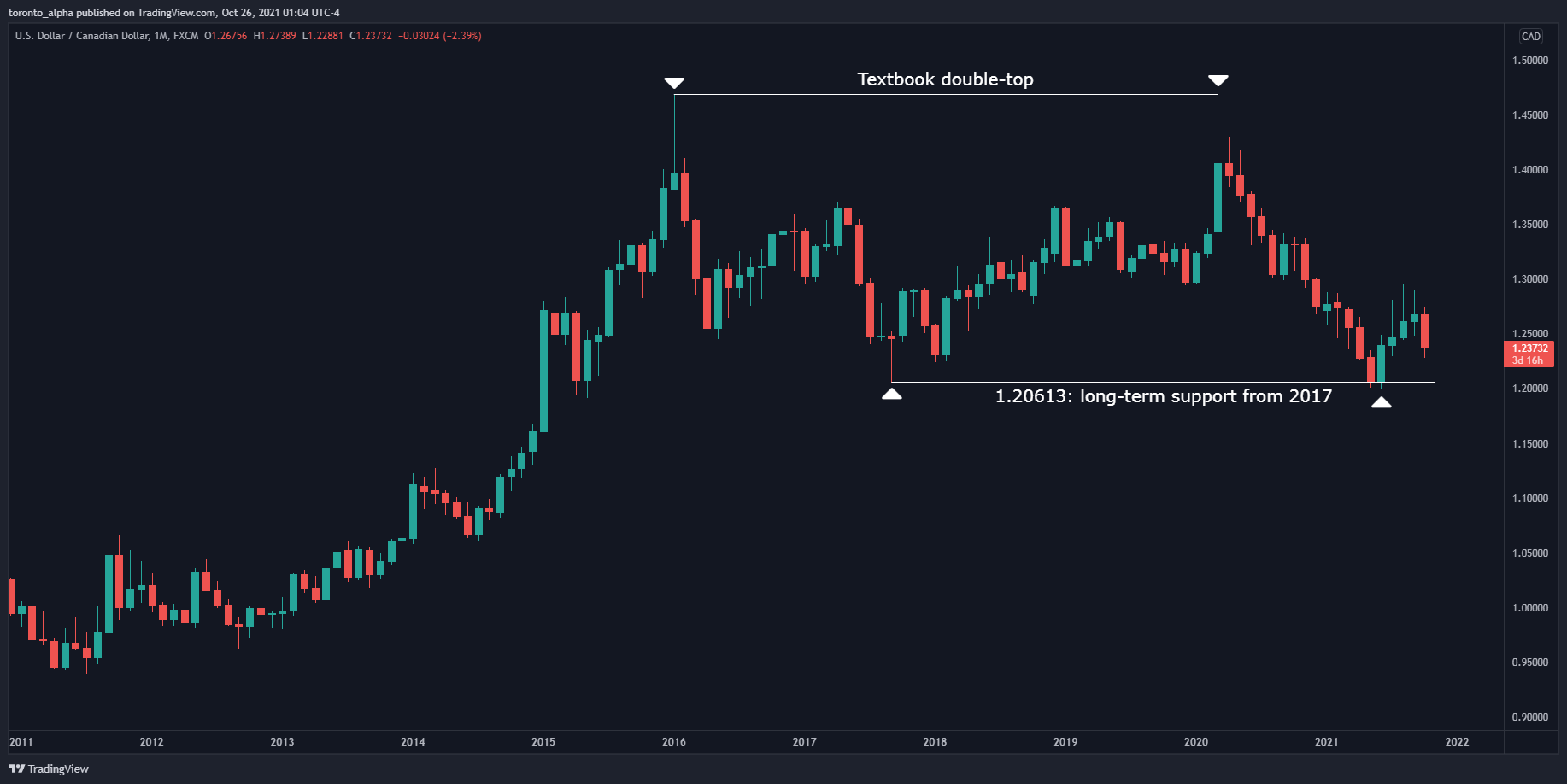

USD/CAD

Big Picture

Bearish.

The USD/CAD made a textbook double-top on the monthly chart and has since made a support at 1.20613. However, the price has struggled in the last 3-4 months to continue a clean uptrend.

Key Levels

1.24221: price is below this support level indicating bearishness.

1.20613: we expect price to move towards this previous support level, perhaps for another test.

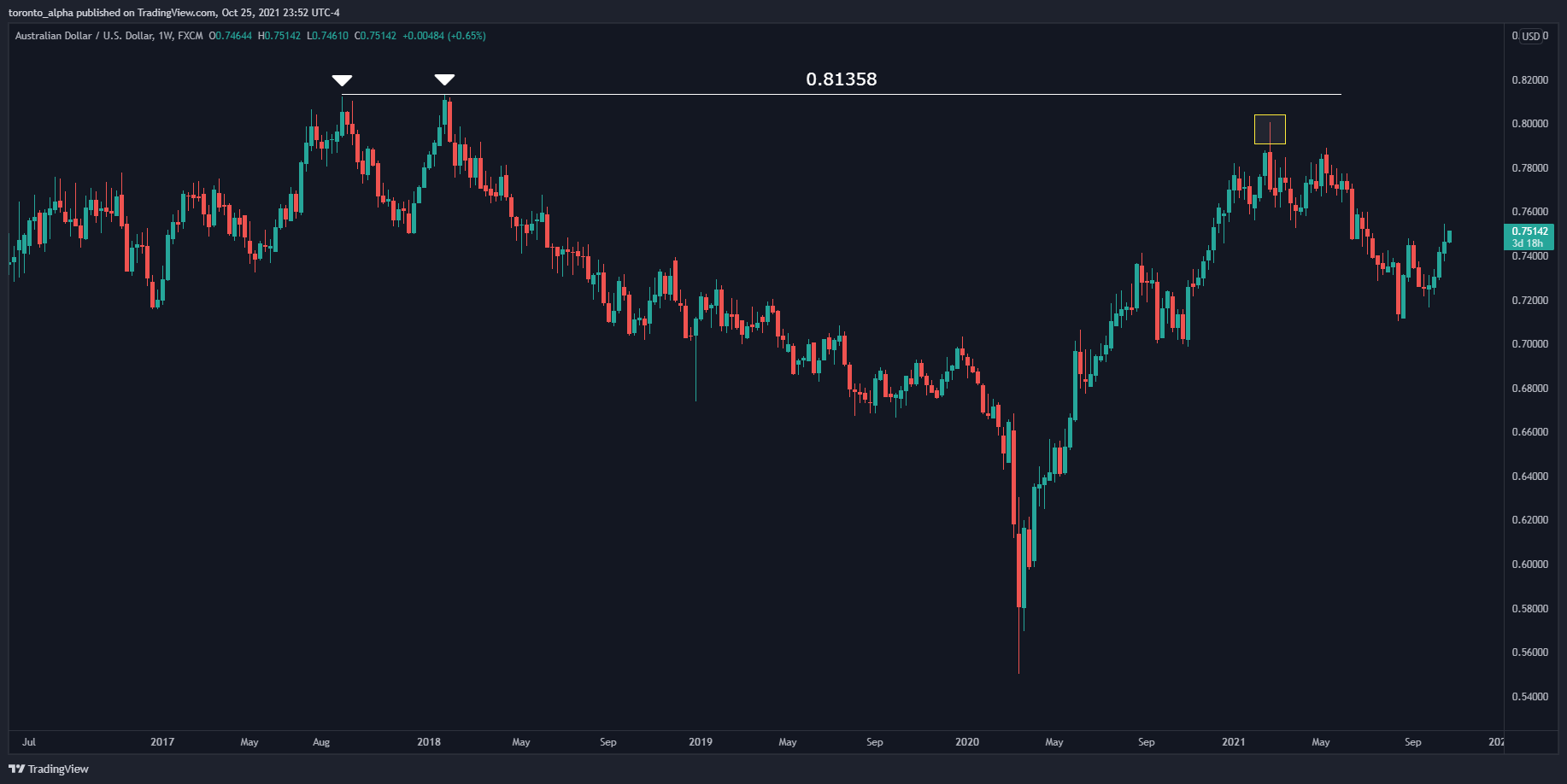

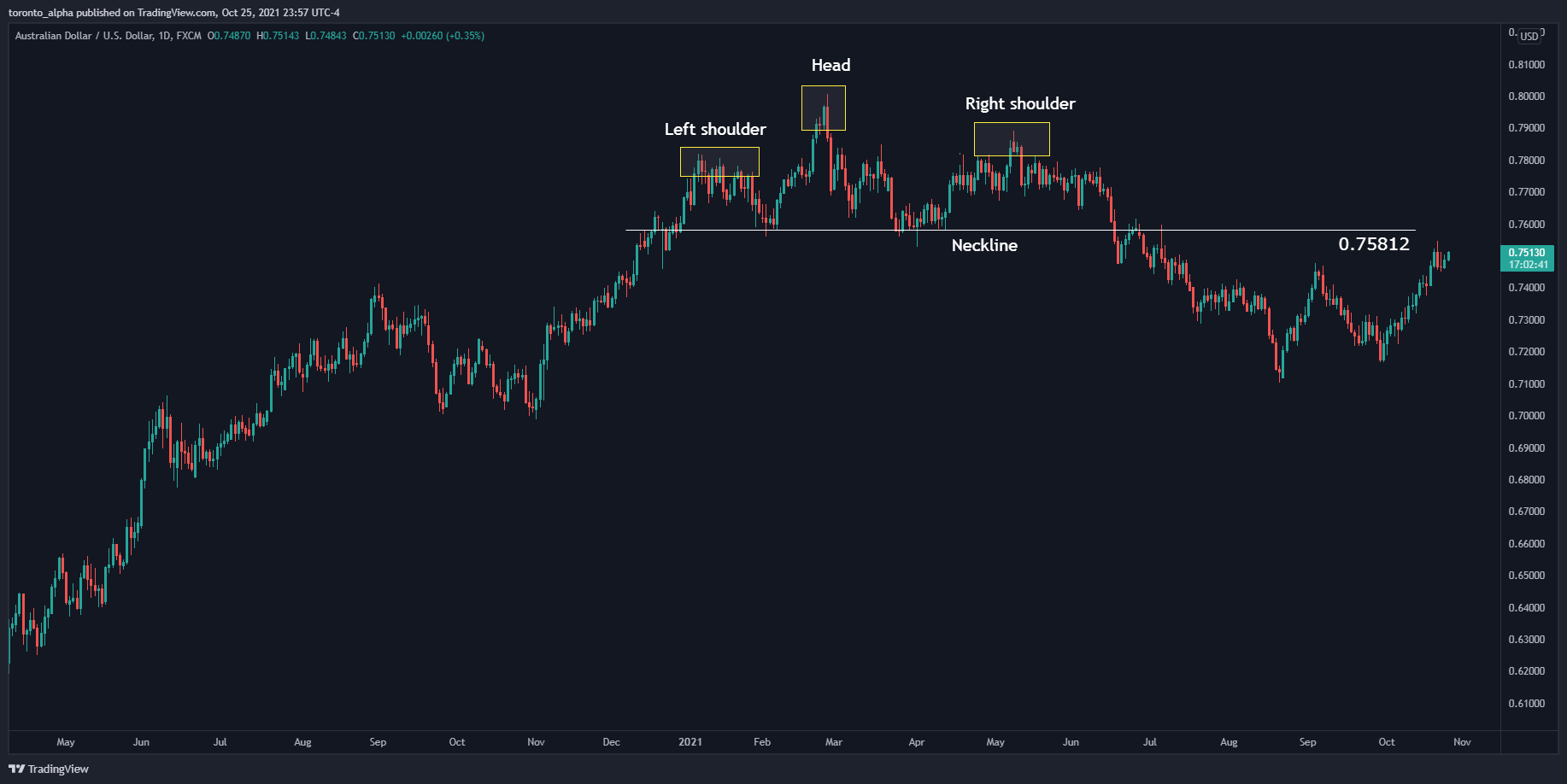

AUD/USD

Big Picture

Short-term bullish.

The AUD/USD was in a strong uptrend that began in March 2020, until it made a high in February 2021, near a resistance that it made In September 2017 and January 2018, at 0.81358.

Key Levels

0.75812 neckline of the head & shoulders reversal made shown on the daily chart.

0.74782: price has been in a strong uptrend since the beginning of October 2021, and recently broke this resistance seen on the 4-Hour chart, hence our short-term bullish bias.

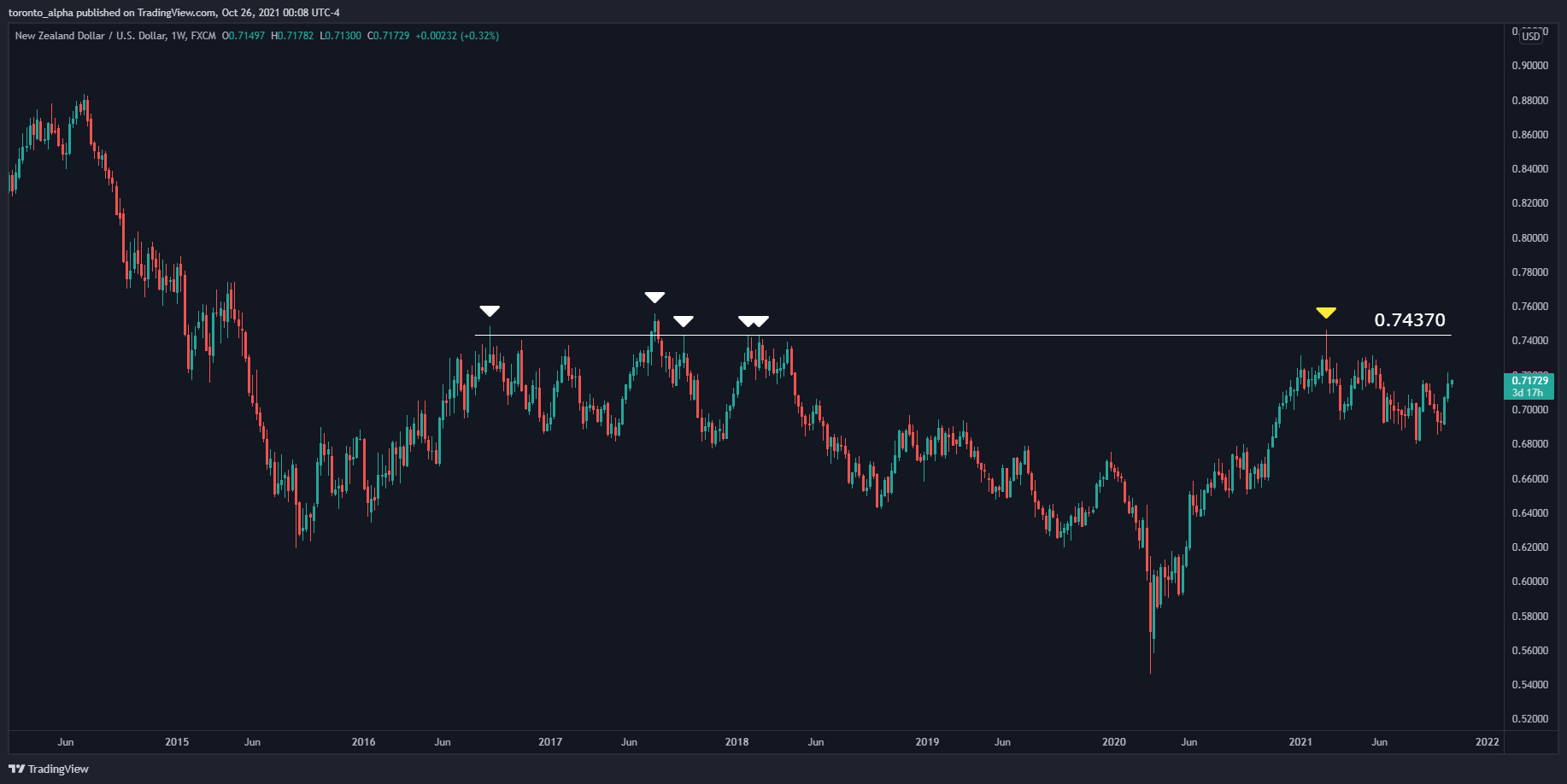

NZD/USD

Big Picture

Neutral.

Although the price bounced off a multi-year resistance in February 2021 at 0.74370, and produced a head & shoulders reversal pattern, the price has essentially been in a range for all of 2021.

Key Levels

0.71043 was the neckline of the head & shoulders reversal made between January and June 2021.

0.67978: bottom of the range made in 2021.

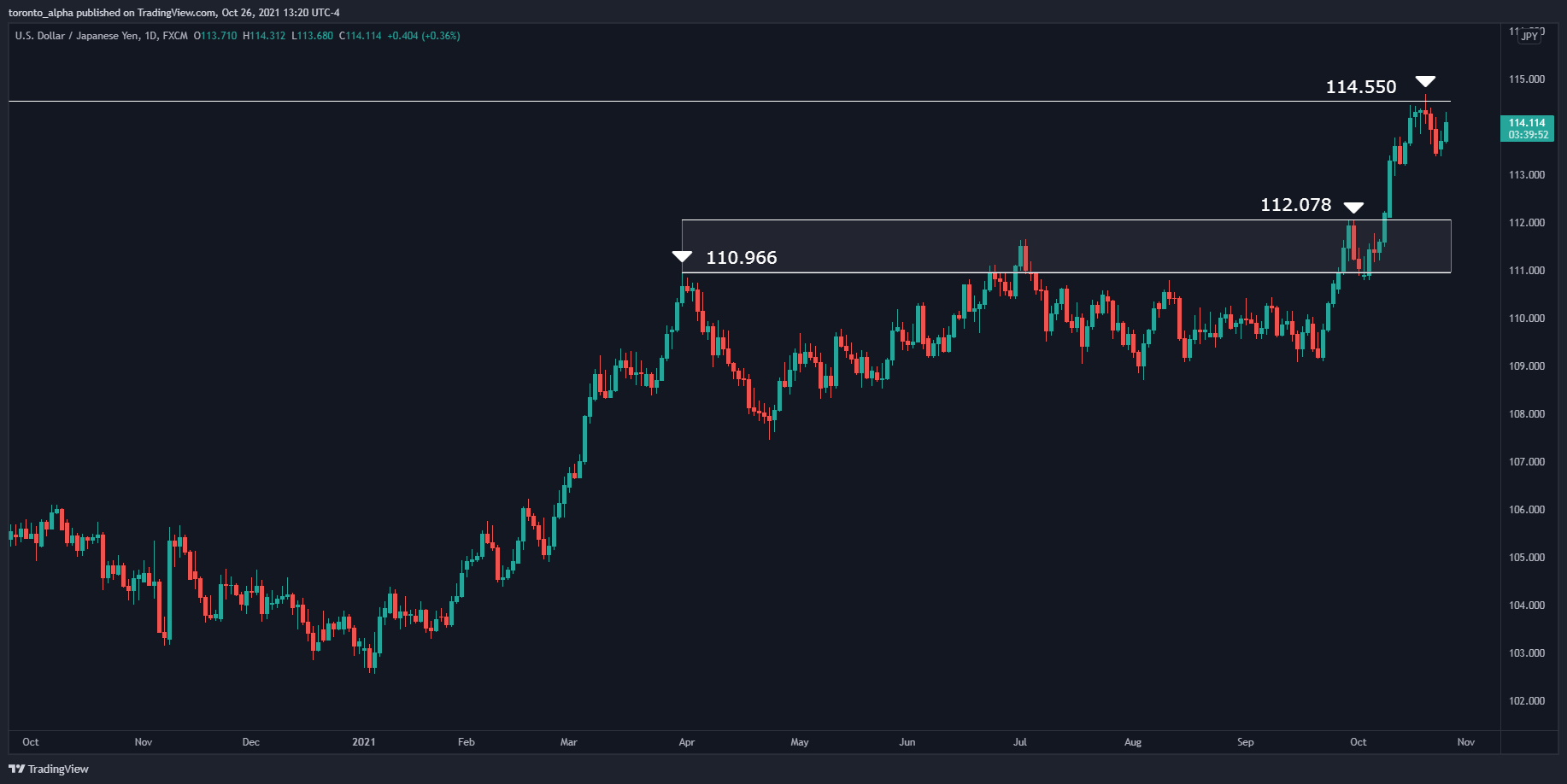

USD/JPY

Big Picture

Bullish.

The price has been in an impressive uptrend in 2021, after spending 4 years prior in messy ranges.

Key Levels

114.550: key resistance if broken will probably lead to a further uptrend.

112.078 & 110.966: price could retrace back to these levels for a buying opportunity before resuming its uptrend.

Final Thoughts

Make sure to stay away from charts that aren’t clear to you, because that’s a quick way to lose money. Also, be sure to have a risk management strategy in place, such as stop losses, so that you don’t risk too much of your account on any one trade.

Want to put these trades to the test? Start trading now!