FxPro Editor’s Verdict

FxPro ranks among the leading Forex brokers offering deep liquidity, fast NDD order, and competitive trading costs in its commission-based cTrader account. MT4 and MT5 are equally available, and FxPro expanded its asset selection, presenting traders with a well-balanced list of trading instruments. Beginner traders benefit from quality education, research, and trading tools. I reviewed FxPro to determine if this broke deserves the title of best Forex broker based on 90+ awards. Is FxPro the best choice for you?

Overview

FxPro delivers well-rounded products and services ideal for demanding multi-asset traders.

Headquarters | United Kingdom |

|---|---|

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2006 |

Execution Type(s) | No Dealing Desk |

Minimum Deposit | $100 |

Trading Platform(s) | Other, MetaTrader 4, MetaTrader 5, cTrader |

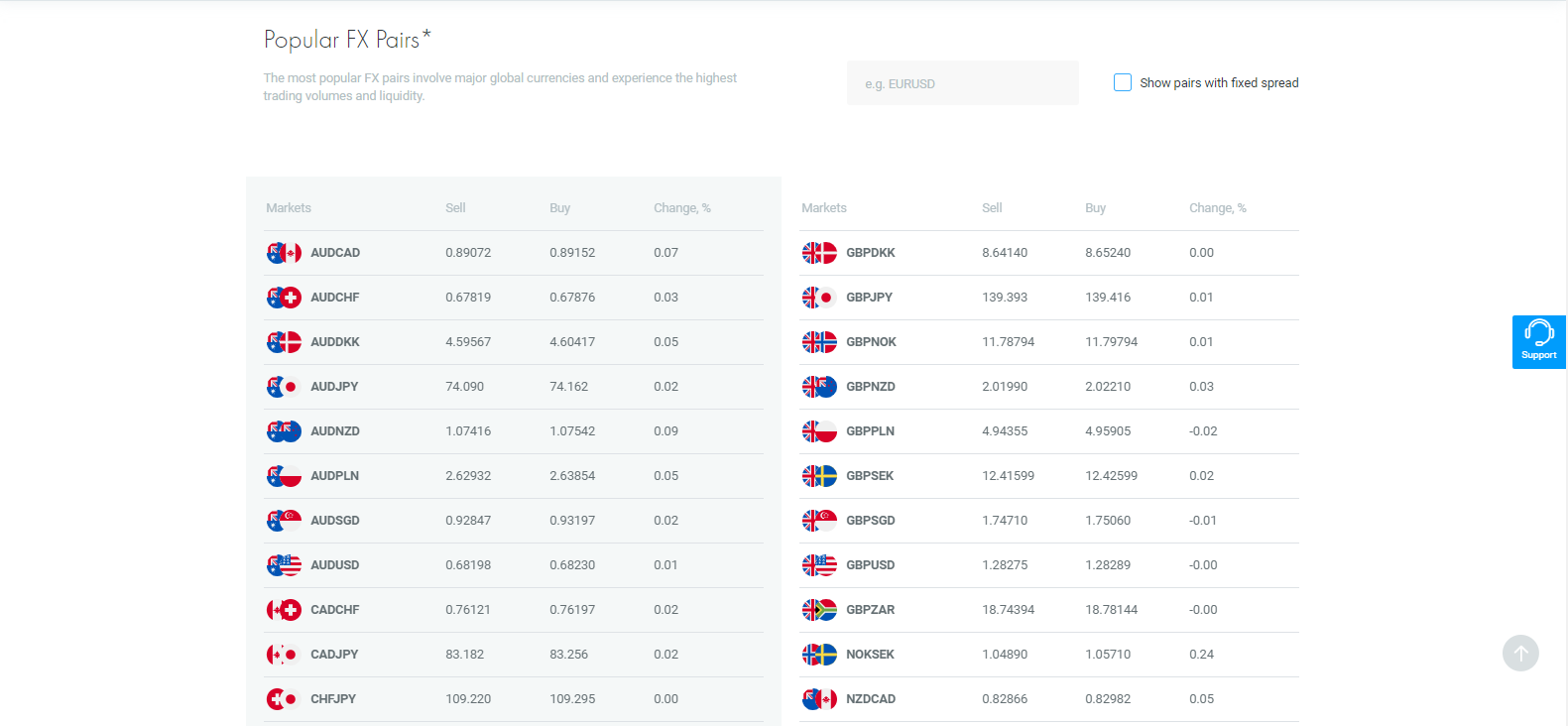

Average Trading Cost EUR/USD | 1.3 pips |

Average Trading Cost GBP/USD | 1.5 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.29 |

Average Trading Cost Bitcoin | $38 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Founded in 2006, FxPro has established a reputation as a global Forex broker that is here to stay. The brokerage had remarkable success and now serves retail traders and institutional clients from over 170 countries. FxPro is a well-regulated company with licenses from four different regulators and continues to grow. During our FxPro review, we found that the broker currently offers CFDs on six asset classes, boasts Tier 1 capital of over €100,000,000, and serves traders with lightning gas execution times of less than 13 ms while execution shy of 7,000 trades per second. FxPro divulges that 83.39% of traders lose money when trading with FxPro.

FxPro appears to be a true NDD (no dealing desk broker) offering excellent market access to all types of traders. According to the latest data available for 2022, FxPro executed 75.09% of trades at the quote price, 11.80% experienced positive slippage, and 13.11% negative slippage. FxPro filled 98.59% of orders without a requote, 0.66% with a positive requote, and 0.75% with a negative requote. A comprehensive educational and research department complements the dependable trading environment traders enjoy. The remainder of this FxPro review will focus on specific details of what the company offers (or does not offer) its traders. Read on to see if FxPro is right for you.

Regulation and Security

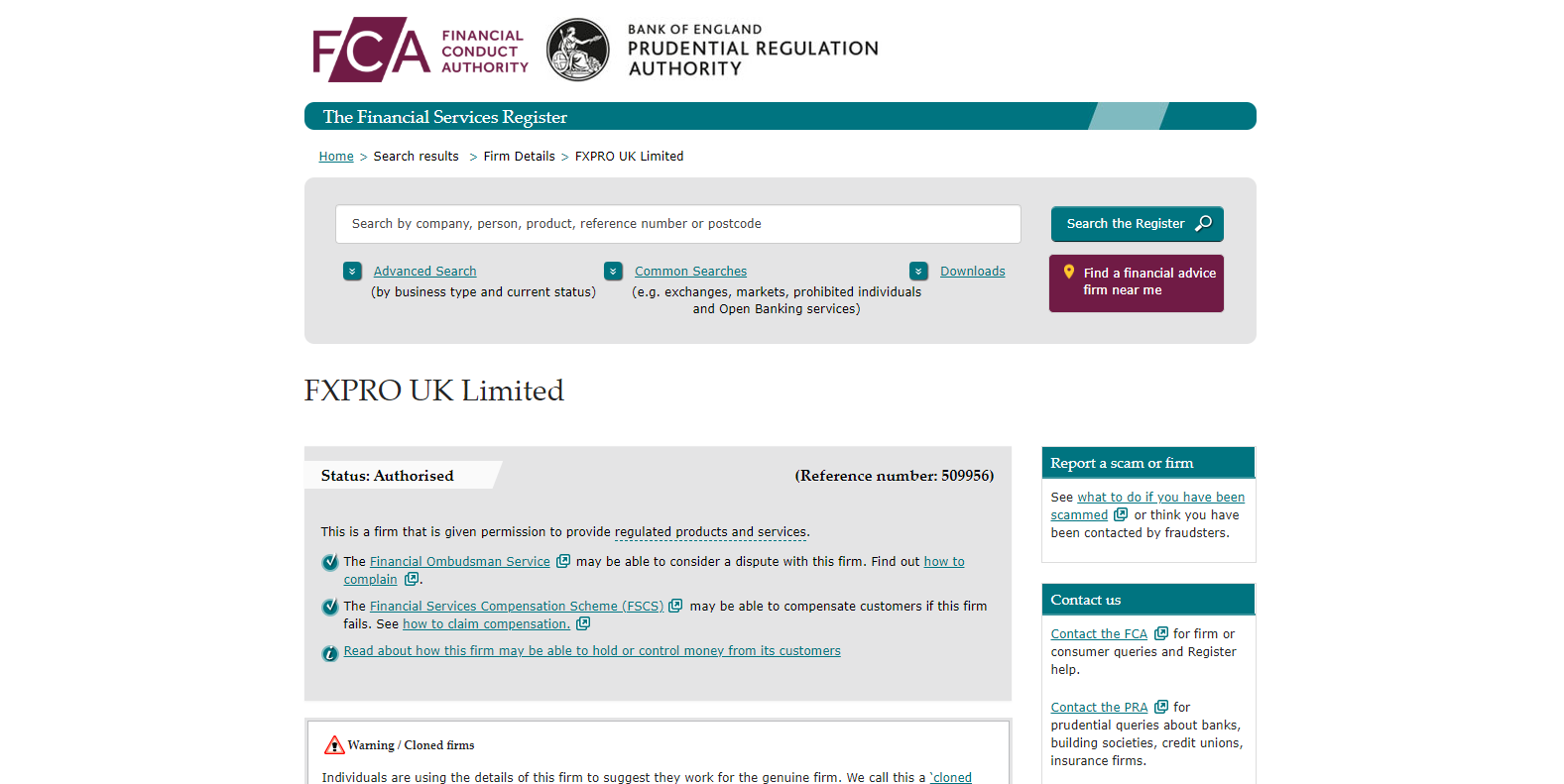

FxPro UK LTD is authorized and regulated by Financial Conduct Authority under registration number 509956. Client funds remain segregated, and traders are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000. The FCA is one of the most respected regulators in the world and clients of FxPro can rest assured that their funds are protected, secured and insured.

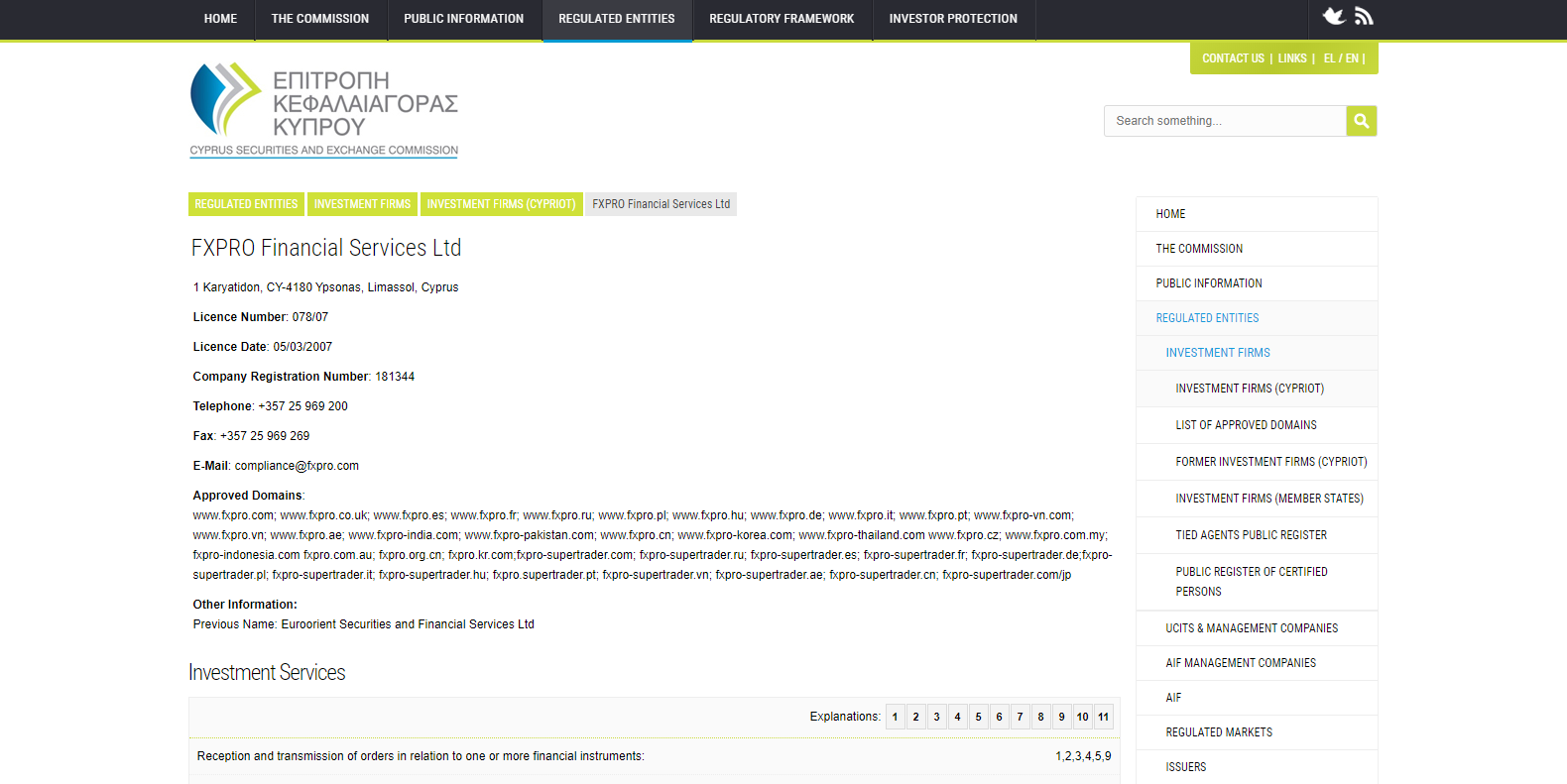

FxPro Financial Services LTD is authorized and registered by the Cyprus Securities and Exchange Commission under license number 078/07. Trader funds are protected by the Investor Compensation Fund (CIF) and as an EU member, the MiFID II regulatory framework as well as the 4th EU Anti-Money Laundering Directive also apply. In addition, cross-border regulation in all EU member countries is also applicable.

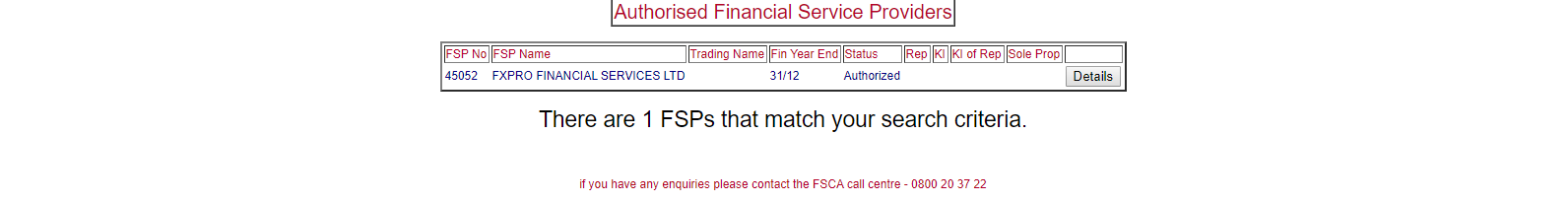

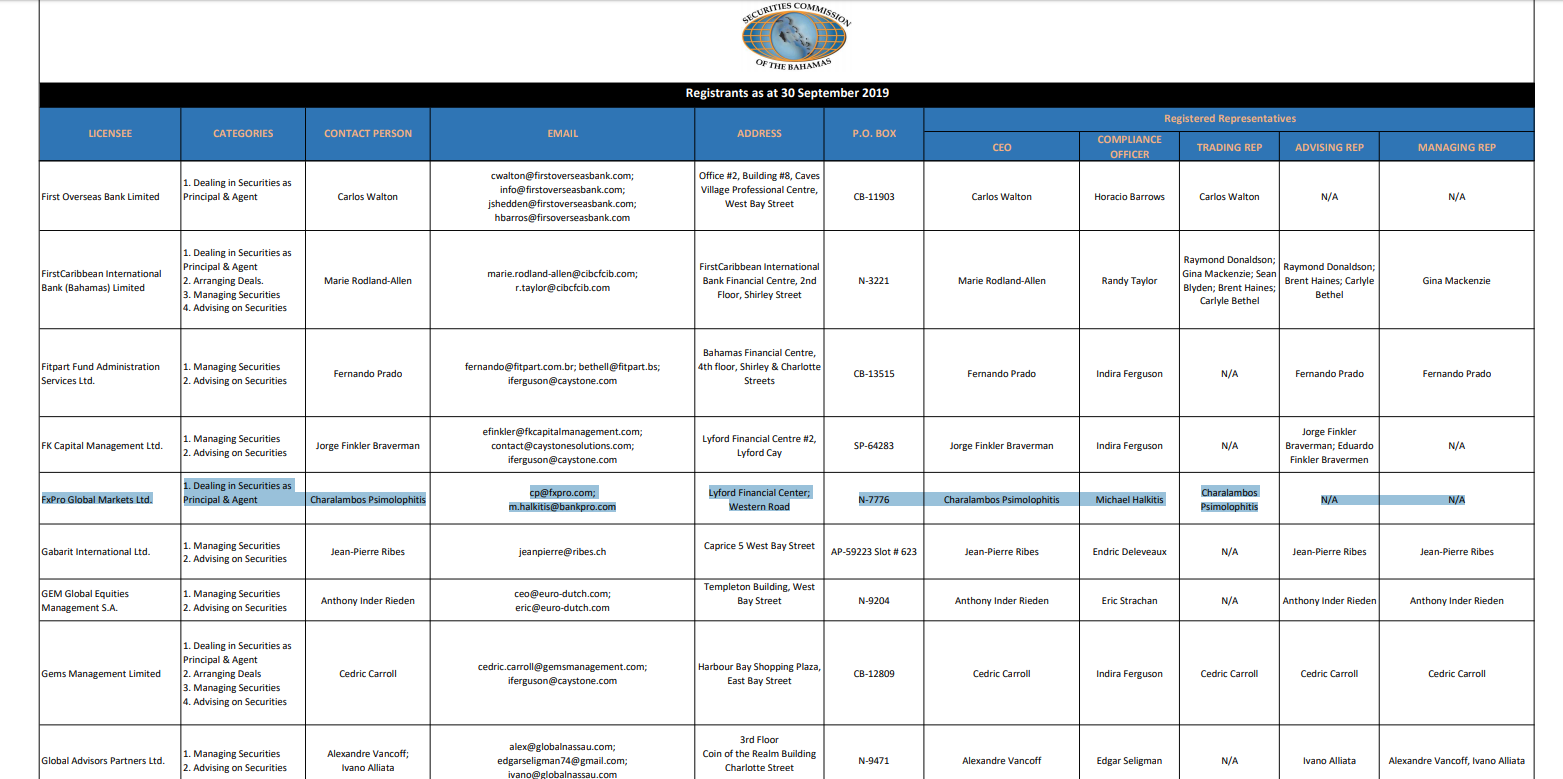

FxPro Financial Services LTD is also authorized and registered by the South African Financial Sector Conduct Authority under authorisation number 45052. FxPro Global Markets LTD is authorised and regulated by the Securities Commission of The Bahamas under license number SIA-F184.

There is no question that the regulation offered by FxPro is respectable and should provide a solid sense of security for traders worldwide. FxPro traders also enjoy negative balance protection in case leveraged positions are exposed to natural market events which would otherwise result in a negative balance.

Financial Conduct Authority regulation of FxPro UK LTD

Cyprus Securities and Exchange Commission regulation of FxPro Financial Services LTD

South African Financial Sector Conduct Authority regulation of FxPro Financial Services LTD

Securities Commission of The Bahamas regulation of FxPro Global Markets LTD

FxPro Fees

Average Trading Cost EUR/USD | 1.3 pips |

|---|---|

Average Trading Cost GBP/USD | 1.5 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.29 |

Average Trading Cost Bitcoin | $38 |

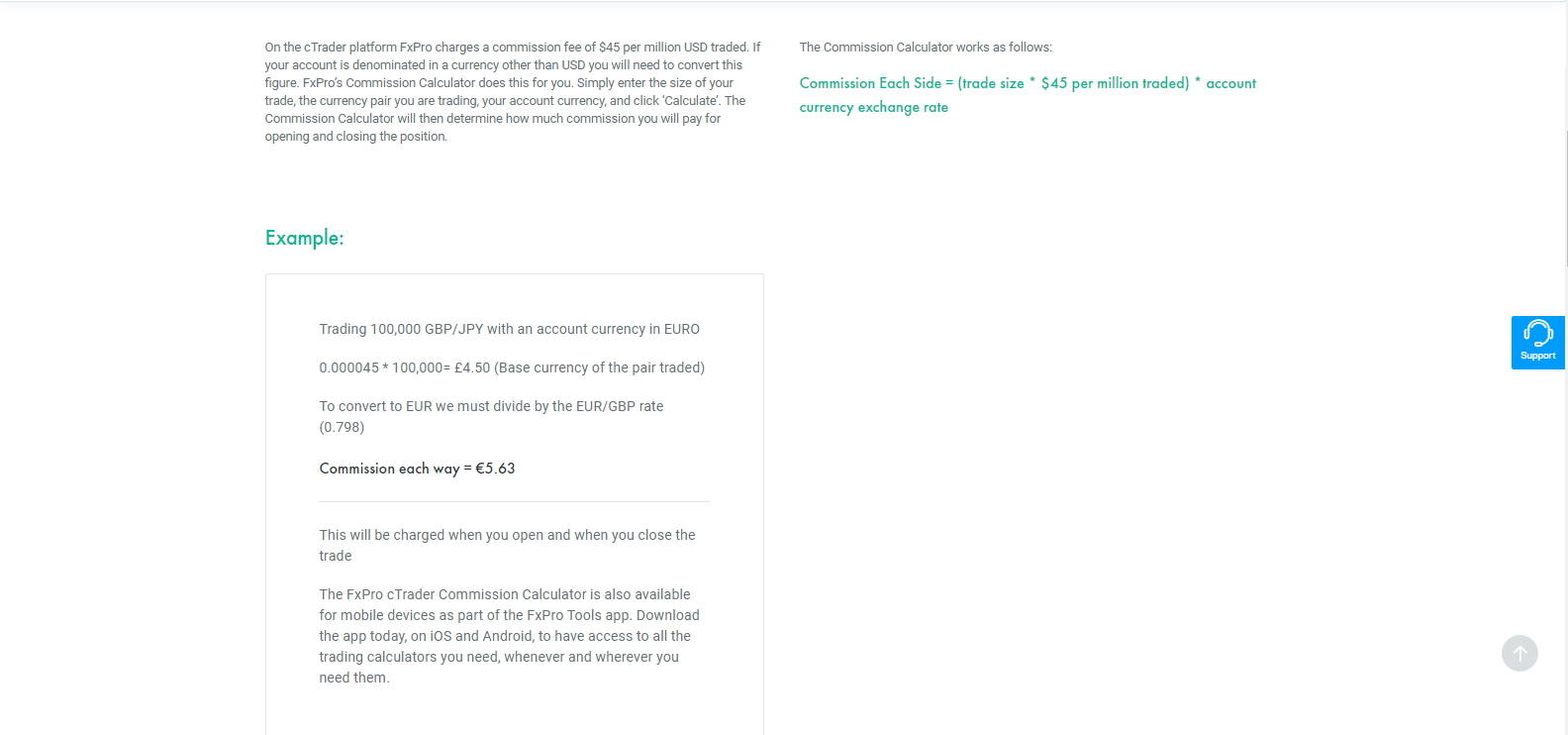

FxPro generates its revenues from a combination of spreads and commissions. Commission-free EUR/USD spreads average 1.2 pips in the MT4 trading platform. Commission-based spreads average 0.2 pips in the cTrader platform for a $7.00 per round lot commission. FxPro is upfront and transparent on all trading costs involved; swap rates, positive and negative, also apply and are passed on to traders.

Swap rates can easily be checked from inside the MT4 trading platform for full transparency at all times.

In the cTrader platform, traders can access all the information from the deal ticket by clicking on the “Information” button when placing a market order. We did notice that the commission for this broker is on the high side of the spectrum.

What Can I Trade

FxPro offers 6 asset classes that allow traders to operate a diversified cross-asset portfolio. With over 70 currency pairs, this broker shines in the Forex market. In October 2021, FxPro greatly expanded its CFD offerings to list over 2,000 different opportunities for CFD trading, including popular assets in Asia, Africa, Europe, and the United States. The genuine NDD execution model is a prime selling point for FxPro, which ensures fast order execution.

Leverage is offered to all traders and depends on which asset is traded as well as on the lot size. The broker’s website has a full list of all the assets and the available leverage so that you can know in advance exactly what you’ll be getting.

FxPro Account Types

FxPro has always been a keen supporter of transparency and fairness in the Forex industry, and it has made every effort to eradicate conflicts of interest between broker and client.

According to FxPro CEO, Charalambos Psimolophitis, “We provide our clients with not only superior educational resources and trading tools but also with a guarantee of their funds’ safety. In an industry where it is taken for granted that slippage almost always goes against the client, we are pleased to demonstrate that this is not in fact the case.”

FxPro is committed to providing its clients with full trade reporting and support. In this regard, it posts its monthly slippage statistics right on the website. Traders can choose between instant execution and market execution a feature not made available by many other Forex brokers. They also offer advanced order-matching and execution technologies that are continuously upgraded.

FxPro offers 4 account types, but the commission-free Standard account features expensive spreads averaging 1.5 pips or $15.00 per 1.0 standard round lot on the EUR/USD, GBP/USD, and USD/JPY. It requires a minimum deposit of $100. The Pro account lowers average costs by 50% to 1.0 pips or $10.00 per lot, but traders must deposit $1,000. Therefore, the commission-based Raw+ option, which also requires a $1,000 minimum deposit, presents the most competitive choice, with raw spreads of 0.0 pips for 90% of the trading day and a commission of $7.00 per round lot.

Traders who deposit $30,000 over two months qualify for the Elite account, which has a similar cost structure as Raw+, but also offers rebates from $1.50 per lot, lowering minimum fees to $5.50 per 1.0 standard round lot.

Read more about FxPro demo account.

FxPro Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

FxPro offers the full suite of MT4/MT5 trading platforms. It includes desktop versions, mobile apps, plus a lightweight web trader. MT4 remains the most popular trading platform, as companies invested millions to create custom solutions that enhance the trading experience. A comprehensive suite of automated trading solutions, called EA (expert advisors) in the MetaTrader universe, are also available, with countless more being created. For online Forex trading, MT4 has established itself as the market leader, and with available additions, it can become a powerful gateway to financial markets.

MT5 is the failed successor of MT4, and due to the absence of cross-platform support for existing MT4 solutions, it has never been able to achieve the success of MT4. For new traders who have no existing MT4 applications, the MT5 platform may be worth consideration. Despite a fresher-looking interface, MT4 remains the dominant trading platform by MetaQuotes. MT4/MT5 also have integrated copy trading services.

Traders who don’t have trading solutions based on the MT4 code should take advantage of cTrader. This platform offers the best out-of-the-box experience. It manages automated trading solutions, and traders can easily create their own from inside cTrader. It also features a copy trading service. The best available bid and ask prices are offered as the cTrader platform is the preferred choice for ECN operations, and traders get better market depth through the cTrader platform. The analytics tools are superior to unmodified MT4/MT5 solutions.

MT4 comes as a desktop client, mobile app, and web-based alternative. MT5 suits traders without existing MT4 trading applications but with a preference to remain within the MetaQuotes offering.

cTrader offers traders the best trading conditions and remains the recommended platform for all traders without existing trading solutions on the MT4 infrastructure.

Unique Features

The primary unique feature of FxPro remains its NDD execution model, which is at the core of its trading environment. FxPro is home to over 2,188,500 trading accounts that have trusted this broker with their capital and helped grow it into one of the best brokerages available today. Another core feature for Forex traders who manage their accounts with automated trading solutions is the FxPro VPS service, but the price tag of $30 per month is unfortunate. Traders who qualify as premium account holders will get it for free.

The tremendous growth of FxPro has led to numerous sponsorships, which include three Formula1 teams, four football clubs, two rally championships, and over 22 events. It is more of a marketing gimmick than anything else, as it provides no real benefit to the traders but confirms the financial health and stability of FxPro.

Research and Education

FxPro offers in-house research and has partnered with Trading Central to provide a third-party solution to its clients. The educational section is comprehensive and an excellent starting point for new traders. FxPro has done a fantastic job in both departments. Research and education complement the quality core trading conditions offered. The strong diligence and fresh content are respectable.

Research

The research section features an Economic Calendar, Earnings Calendar, Market Holidays, FxPro Market News, and Technical Analysis by Trading Central. The Economic Calendar is very straightforward and gives traders an overview of all events scheduled for the session and their potential impact. It is well structured, easy to navigate, and offers explanations with limited historical data.

Since FxPro offers share trading and spot indices, it is nice that this broker maintains an Earnings Calendar. It features the following categories: Earnings, Shares Ex-Dividends, and Spot Indices Dividend Adjustment. It is a simplistic but well-thought-through calendar. Market holidays often lack attention, but committed traders want to be aware of them as they can influence assets. The FxPro Market Holidays section is very detailed and highlights the impacted assets.

This brings us to the two prime sections of the research department, the in-house FxPro Market News, and the third-party Technical Analysis by Trading Central section. Plenty of fresh research and analysis updated several times during each trading day makes the FxPro Market news section a quality read during a trading break. The content remains divided into sections, such as Daily Outlook, Market Snapshots, and Crypto Review.

Each analysis under the Market Snapshots section is quick, and traders looking for a more detailed analysis will be disappointed. The Daily Outlook is brief and touches on the core aspects without details. The Crypto Review offers the most content but remains far from comprehensive.

A more detailed analytics service exists through the FxPro Partnership with Trading Central, a leader in independent research. Traders can access hundreds of trading ideas each session as Trading Central covers over 8,000 assets. It is a solid service, and many new traders will make it a staple of their daily trading routine. Trading Central is one of the premier services for brokers to outsource capital-intensive, time-consuming analytics and research.

A much more detailed analytics service is offer to clients through the FxPro Partnership with Trading Central, a leader in independent research. Traders get access to hundreds of trading idea each session as Trading Central covers overt 8,000 assets. This is a solid service and many new traders will make it a staple of their daily trading routine. Trading Central is one of the premier services for brokers to outsource capital-intensive, time consuming analytics and research.

Education

The comprehensive educational section is divided into Basics, Fundamental Analysis, Technical Analysis, Psychology, Trading tests, video tutorials and Webinars & Events. It is a well-designed, interactive course and new traders are highly recommended to take advantage of it in order to broaden their knowledge base. The courses offered do a great introductory job to trading.

The Basics section is further divided into Beginner and Advanced and consist of nine sections with a test at the end.

The Fundamental Analysis and the Technical Analysis sections follow the same format, are split into Beginner and Advanced and come with cards as well as videos. The progress bars give traders an idea of where they are on their educational path.

One thing that we really appreciated during this FxPro review was that the broker dedicated an entire section to trading psychology, which may be the biggest challenge for all traders to master.

The Trading tests section offers a nice finish to the educational course.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |                |

FxPro customer support is best accessed through the Live Chat feature, but traders can also request a call back, contact them via phone, send an e-mail or stop by at one of their office locations. The multi-lingual support team is available 24/5, but it is highly unlikely that many traders will require their assistance. The FAQ section handles all major questions, but it is good to know that in case of an emergency, a qualified support team stands by to assist.

Bonuses and Promotions

At the time of this review, no bonuses or promotions were offered by FxPro.

Opening an Account

Accounts are opened fast through an online application, the standard operating procedure in today’s marketplace. After the quick application, which asks for country of residence, desired e-mail, and password, traders need to submit a copy of their ID and proof of residence document as mandated by regulators to address AML/KYC compliance.

FxPro Deposits and Withdrawals

FxPro offers a range of payment options inside its FxPro Wallet. Payment options include wire transfers, credit/debit cards, PayPal, Skrill, and Neteller. The choices are location-dependent, and FxPro has created a great page explaining the entire process in detail. FxPro does not charge for deposits and withdrawals, except for a 2.6% fee if traders request a withdrawal without any trading activity. The processing time ranges from instantly to just one working day. It also applies to wire transfers with restrictions based on location. Third-party bank charges and currency conversion fees may apply. Traders can swiftly move funds between multiple trading accounts inside their FxPro Wallet.

Summary

A well-regulated broker across four jurisdictions, FxPro has enjoyed phenomenal growth over the past decade thanks to its excellent trading conditions. Traders can benefit from genuine NDD execution with tight spreads and deep liquidity. FxPro offers an expanding asset base across six classes, a transparent pricing approach, and an excellent educational section.

The FxPro Wallet makes intra-account transfers quick and easy, a great customer support team stands by if needed, and FxPro has collected over 105 industry awards for its services. Research exists through an in-house team that provides basic research, while a partnership with Trading Central offers a more in-depth analysis of financial markets.

FxPro will professionally cater to your needs, irrelevant to whether you are a new trader, an established one, or an institutional client. VPS hosting is available at a charge, which is the only unfortunate fact about this broker, while FxPro should lower commissions, given the overall success of this firm. Despite this, the bottom line remains that FxPro is a world-class broker with an expanding asset and client base. An account with FxPro should be part of any trader seeking an excellent gateway to financial markets or who needs to diversify portfolios across different brokers. FxPro executes its business model perfectly and is a prime example of how a successful brokerage operates. FxPro is headquartered in London, UK. FxPro generates its revenues through spreads, commissions and a monthly fee for their VPS service. FxPro offers wire transfers, credit/debit cards, PayPal, Skrill, Neteller and UnionPay The minimum trading size depends on the asset traded, but currency pairs start out at 0.01 lots. Regrettably, FxPro does not accept Canadian residents as traders. For the best brokers in Canada, see the list of the top Forex brokers in Canada. FxPro initiated a stop-out when the equity-margin ratio drops to 50%. FxPro UK LTD is authorized and regulated by Financial Conduct Authority under registration number 509956. FxPro Financial Services LTD is authorized and registered by the Cyprus Securities and Exchange Commission under license number 078/07. FxPro Financial Services LTD is also authorized and registered by the South African Financial Sector Conduct Authority under authorisation number 45052. FxPro Global Markets LTD is authorised and regulated by the Securities Commission of The Bahamas under license number SIA-F184. The maximum leverage is dependent on the asset traded as well as the total position size, but is capped at 1:200, 1:500 only for pro clients. FxPro has an online application form which is standard operating procedure. Yes, FxPro offers the MT4/MT5 trading platforms as well as the cTrader platform and its own FxPro Edge. Navigate to the FXPro website, log in with your credentials, and then go to the account section. Select which one you wish to delete from the drop-down menu. Alternatively, you may reach out to customer support to assist you with the deletion process. FxPro accepts PayPal through its CySEC-regulated subsidiary. Verified traders can withdraw via bank wires, credit/debit cards, Skrill, Neteller, or PayPal. The secure and user-friendly back office handles all financial transactions, and the availability of payment processors depends on the operating subsidiary. FxPro processes all withdrawals within one business day, but it can take longer for funds to arrive, dependent on the payment processor. The FxPro minimum deposit is $100, but traders should consider $1,000 to qualify for the Raw+ account, where trading fees are significantly lower. FxPro charges $3.50 per side or $7.00 per 1.0 standard round lot. Elite clients qualify for rebates, which lower fees by at least $1.50 per lot. Yes, FxPro ranks among the most trusted brokers, operational since 2006, compliant with four regulators, and home to over 2.1M traders.FAQs

Where is FxPro based?

How does FxPro make money?

How can I deposit into an FxPro account?

What is the minimum lot size at FxPro?

Is FxPro available in Canada?

When does a stop-out take place at FxPro?

Is FxPro regulated?

What is the maximum leverage offered by FxPro?

How do I open an account with FxPro?

Does FxPro offer the MetaTrader Trading Platform?

How to delete FXPro Account?

Does FxPro accept PayPal?

How do I withdraw money from FxPro?

How long does it take to get money out of FxPro?

How much is the FxPro minimum deposit?

How much commission does FxPro charge?

Can FxPro be trusted?