For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

FXTM Editor’s Review Verdict

FXTM established itself as a leading broker for emerging and frontier markets. Traders get upgraded MT4/MT5 trading platforms, and quality research and education. Forextime also delivers one of the best commission-based Forex pricing environments. I reviewed this award-winning broker to evaluate if high-frequency traders and scalpers can achieve a competitive edge here. Is the trading environment at FXTM as good as advertised?

Overview

FXTM Overview - A Leader for Emerging and Frontier Markets with Excellent Education.

Headquarters | Mauritius |

|---|---|

Regulators | CMA, FCA, FSC Mauritius, FSCA, SCA |

Owned by Public Company? | |

Year Established | 2011 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $200 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform |

Average Trading Cost EUR/USD | 0.1 pips |

Average Trading Cost GBP/USD | 0.2 pips |

Average Trading Cost WTI Crude Oil | $0.09 |

Average Trading Cost Gold | $0.18 |

Retail Loss Rate | 77.00% |

Minimum Raw Spreads | 0.0 Pips |

Minimum Standard Spreads | 1.5 pips |

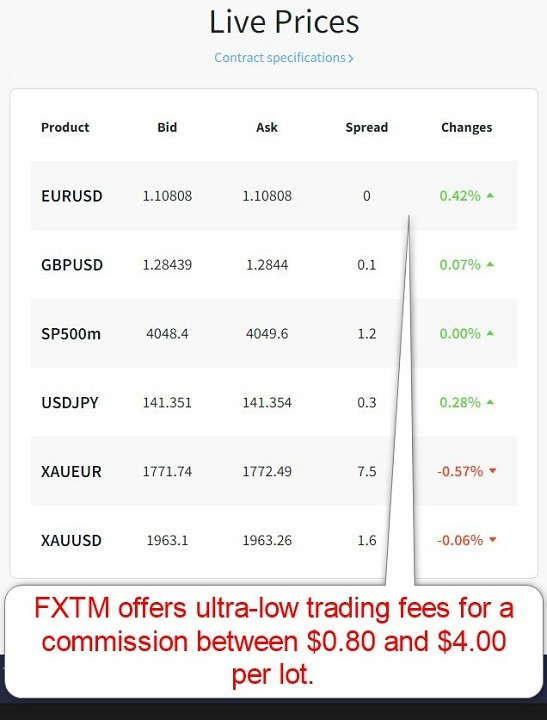

Minimum Commission for Forex | $0.80 - $4.00 per round lot |

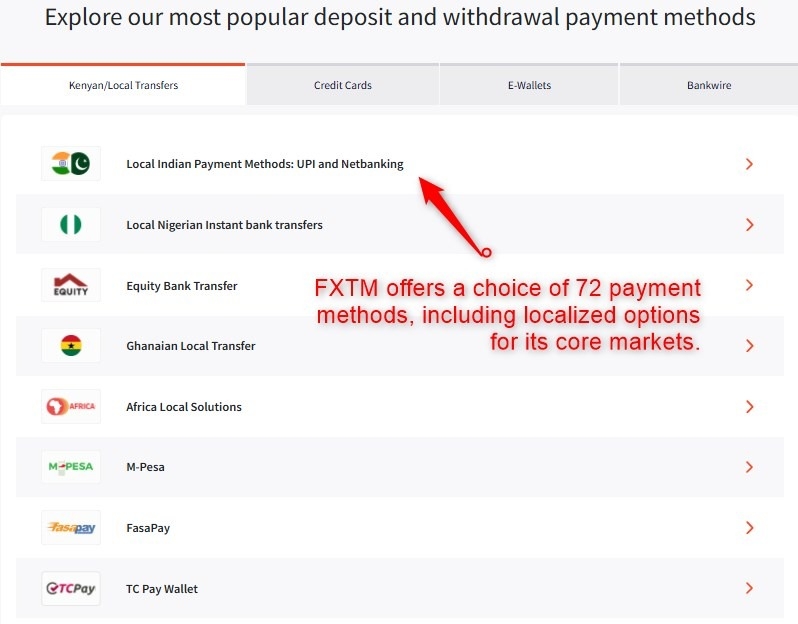

Funding Methods | 72 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like that Forextime continues to adjust to market and regulatory changes, ensuring traders maintain a competitive edge. The degree of transparency is another positive I want to point out. Big Four accountancy PricewaterhouseCoopers Limited (PwC) audits published statistics per International Standard on Assurance Engagements (ISAE) 3000.

FXTM Highlights for 2024

- Cutting-edge price improvement technology lowering trading fees by an average of $3.00 per lot, applicable to 97.18% of trades.

- Deep liquidity providing an average execution time of 0.1 seconds.

- Raw spread trading with spreads from 0.0 pips for a commission of $7.00 per 1.0 standard round lot.

- MT4 and MT5 trading platforms for algorithmic trading.

- Trading Central, the upgrade package from FX Blue, and its in-house Pivot Point Strategy plugin upgrade for MT4/MT5.

- VPS hosting for low-latency 24/5 Forex trading.

- User-friendly FXTM Trader.

- External client fund insurance up to $1,000,000.

- Quality education for beginner traders.

- A balanced asset selection of liquid trading instruments, including cryptocurrency CFDs.

FXTM Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. FXTM presents clients with six well-regulated entities.

Country of the Regulator | United Arab Emirates, Cyprus, Kenya, Mauritius, United Kingdom, South Africa |

|---|---|

Name of the Regulator | CMA, FCA, FSC Mauritius, FSCA, SCA |

Regulatory License Number | 185/12, 777911, C113012295, 135, 46614, 20200000270 |

Is FXTM Legit and Safe?

FXTM is a legitimate, safe, and secure broker, as it is highly regulated, holding licenses in several jurisdictions, including the tier 1 financial center of London. Its UK license may entitle account holders to state compensation in the event of broker bankruptcy of up to £85,000.

Forextime is also acquiring a regulatory license in Kenya as it expands across the African continent. On February 26th, 2021, FXTM ceased its retail operations from its CySEC regulated entity. It cited the uncompetitive regulatory framework introduced by the European Securities and Markets Authority (ESMA) for its reason. EEA clients can trade with any of the other subsidiaries.

I like the regulatory framework at FXTM, ensuring traders have access to competitive trading conditions and superior protection. FXTM is a member of the Honk Kong-based Financial Commission, where the Compensation Fund protects traders up to €20,000 per claim. It is identical to what CySEC offers but does not come with regulatory restrictions.

PricewaterhouseCoopers Limited (PwC) also audits select performance statistics, and FXTM remains one of the more transparent brokers. I applaud them for their focus on the trading environment, granting clients a distinct edge.

FXTM Fees

FXTM offers traders a commission-free and commission-based Forex account. The former ranks among the more expensive ones, but the latter account is one of the best ones available. I can highly recommend it for high-frequency traders and scalpers.

Average Trading Cost EUR/USD | 0.1 pips |

|---|---|

Average Trading Cost GBP/USD | 0.2 pips |

Average Trading Cost WTI Crude Oil | $0.09 |

Average Trading Cost Gold | $0.18 |

Minimum Raw Spreads | 0.0 Pips |

Minimum Standard Spreads | 1.5 pips |

Minimum Commission for Forex | $0.80 - $4.00 per round lot |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | $5 monthly after 6 months |

Equity CFD trading is commission-free as Forextime joined the group of brokers catering to millennial and GenZ traders favoring no commissions. I want to stress once again that commission-free does not necessarily equal cheaper trading costs. Spreads are generally higher, often twice as high, than commission-based offers, and FXTM is no exception.

Here is the minimum spread for the EUR/USD and the trading costs per 1 standard lot in both.

Forextime offers excellent spreads in its commission-based account, making it one of the cheapest Forex brokers in the entire retail Forex industry worldwide.

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.5 pips (Advantage Plus) | $0.00 | $15.00 |

0.0 pips (Advantage) | $0.80 - $4.00 | $0.80 - $4.00 |

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission based FXTM account using the lowest and highest commission tiers.

Taking a 1 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips 0.0 pips | $0.80 $4.00 | -$6.90 -$6.90 | X X | $7.70 $10.90 |

0.0 pips 0.0 pips | $0.80 $4.00 | X X | -$0.30 -$0.30 | $1.10 $4.30 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips 0.0 pips | $0.80 $4.00 | -$48.30 -$48.30 | X X | $49.10 $52.30 |

0.0 pips 0.0 pips | $0.80 $4.00 | X X | -$2.10 -$2.10 | $2.90 $6.10 |

Besides offering tight spreads for competitive commissions, FXTM also keeps swap rates on leveraged overnight positions low. Hong Kong equities as CFDs face additional fees, which also remain very low.

A $5 monthly inactivity fee applies after six months of dormancy. I find this reasonable and acceptable, and active traders will never face this cost.

What Can I Trade

FXTM maintains 60 currency pairs, 14 commodities, 21 index CFDs, 802 equity CFDs, and 639 US-listed stocks. The choice of commodities and index CFDs is limited, but the overall selection of trading instruments is competitive. I also like that Forextime offers 639 stocks for direct investments, albeit only US-listed ones. Overall, the tradable assets at FXTM will best suit Forex and US equity traders.

Asset List

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Forextime Leverage

FXTM offers maximum leverage up to 1:2000, but it is a six-tier system. It decreases as exposure per symbol increases, which I determine an intelligent choice. Most retail traders will get between 1:500 and 1:1000, while trading volumes above 60.0 lots gradually decrease to 1:200, 1:100, and 1:25. It remains another industry-leading feature available at FXTM.

FXTM Trading Hours (GMT+1)

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:15 | Friday 23:55 |

Cryptocurrencies | Monday 00:00 | Saturday 24:00 |

Crude Oil | Monday 01:00 | Friday 23:45 |

Gold | Monday 01:05 | Friday 23:55 |

Metals | Monday 01:05 | Friday 23:55 |

Equity Indices | Monday 01:05 | Friday 23:55 |

Stocks | Monday 16:31 | Friday 22:59 |

Stocks (non-CFDs) | Monday 16:31 | Friday 22:59 |

Please note that equity markets open and close each trading and are not operational continuously like Forex and cryptocurrencies.

I recommend the following step for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

FXTM Account Types

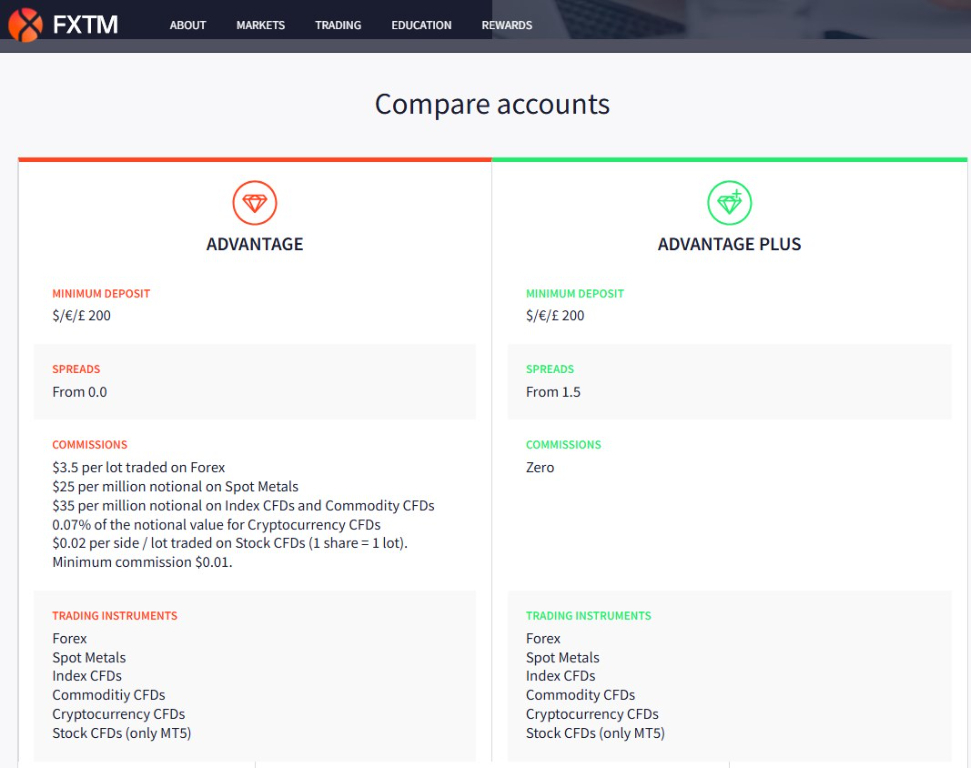

Forextime (FXTM) offers a commission-free trading account, Advantage Plus, and a commission-based alternative, Advantage.

Both account types require a minimum deposit of $200.

I highly recommend the commission-based option as trading costs remain among the best industry-wide, while the commission-based account charges relatively expensive fees.

FXTM Demo Account

A demo account is available at FXTM, which expires after 14 days. Therefore, it is ideal for testing strategies and expert advisors. Forex demo account is available for MT4 and MT5 and allows traders to select the demo account balance and leverage. While no demo account can simulate live trading conditions, the options available at FXTM come as close as possible to doing so.

FXTM Trading Platforms

FXTM offers traders the MT4/MT5 trading platforms and has developed its proprietary mobile app, FXTM Trader. It upgrades MT4 with six plugins plus its Pivot Points Strategy, featuring live updates and commentary from the FXTM Head of Education, and the mobile app is user-friendly and easy to use. I like that FXTM invested in MT4 upgrades. They ensure traders have an edge versus the out-of-the-box versions most brokers offer.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Research and Education

The three-member research team at Forextime provides market commentary and analysis in written format, short YouTube videos,and ebooks for beginners and experts alike and podcasts. They offer a brief overview and an informative take on market events. FXTM also maintains its FXTM Trading Signals service for traders seeking actionable research.

Beginner traders have access to one of the most comprehensive educational offerings, consisting of a video library featuring dozens of videos and written content. I find it well-structured and an excellent starting point for new traders. I also recommend first-time traders seek third-party education covering trading psychology while avoiding paid-for courses.

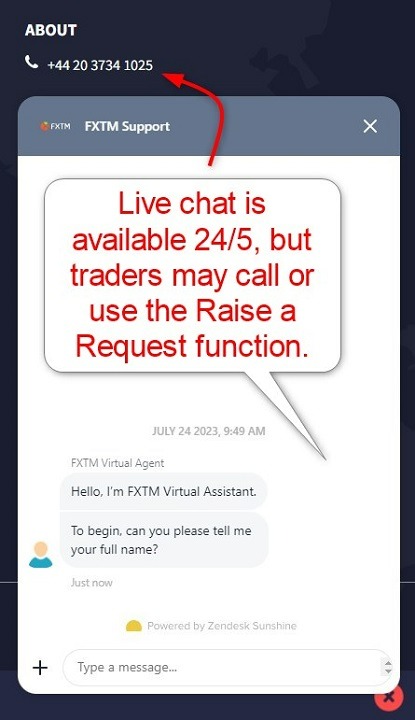

Customer Support

Customer Support Methods |   |

|---|---|

Website Languages |             |

Traders have access to multilingual customer support, Monday to Friday 07:00-02:00 (next day) and Saturday and Sunday: 11:00-15:00 (GMT+4). Hindi, Arabic, Spanish, and Chinese are supported languages. It consists of phone support, e-mail, and an FAQ section. FXTM also provides live chat on its website or via WhatsApp, Telegram, or Messenger. Since the product and services portfolio at FXTM remains well-explained, I doubt most traders will require assistance. FXTM ensures traders have swift access to a representative should the need arise.

Bonuses and Promotions

At the time of this review, FXTM maintains a refer-a-friend campaign. Traders and their referrals can each get $50 for a referral. Terms and conditions apply to this promotion, and I recommend that anyone wishing to participate reads and understands them, although they will be less onerous than conditions which brokers typically attach to bonuses.

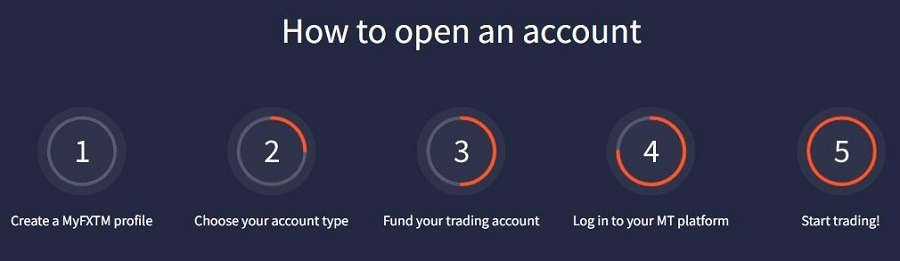

Opening an Account

Opening an account at FXTM is fast, and the first step requires only a few seconds. Traders must submit their name, country, a valid mobile phone number, e-mail address, and desired password. FXTM will send a confirmation PIN to the entered mobile number to complete the process. We were able to complete this within 24 hours which was speedy and satisfactory.

As a regulated broker, account verification at Forextime is a mandatory final step. Most traders will satisfy this by sending a copy of their ID and one proof of residency document. I found the entire process to be swift and hassle-free. I like that FXTM does not incorporate unnecessary steps or questionnaires.

FXTM Minimum Deposit

The minimum deposit at FXTM for the Advantage and Advantage Plus accounts is $200 or its currency equivalent.

Payment Methods

Withdrawal options |       |

|---|---|

Deposit options |       |

FXTM offers 16 payment options. They include bank wires and a broad range of domestic banking solutions for countries, which I find excellent. Traders may also use Skrill, GlobePay, Pay Redeem, Perfect Money, Neteller, FasaPay, and M-Pesa.

Accepted Countries

FXTM caters to most international traders, including the UK, India, Malaysia, and the Philippines. It does not accept traders resident in the USA, Mauritius, Japan, Canada, Haiti, Iran, Suriname, the Democratic People's Republic of Korea, Puerto Rico, the Occupied Area of Cyprus, Quebec, Iraq, Syria, Cuba, Belarus and Myanmar.

Forextime Deposits and Withdrawals

The MyFXTM back office is where traders make all their deposits and withdrawals. Forextime does not levy internal deposit fees but charges for withdrawals, which is unfortunate. Traders may also face third-party processing costs and currency conversion fees. I recommend checking them to determine the most convenient and cost-effective solution. Processing times vary based on method and rank from instant to ten business days.

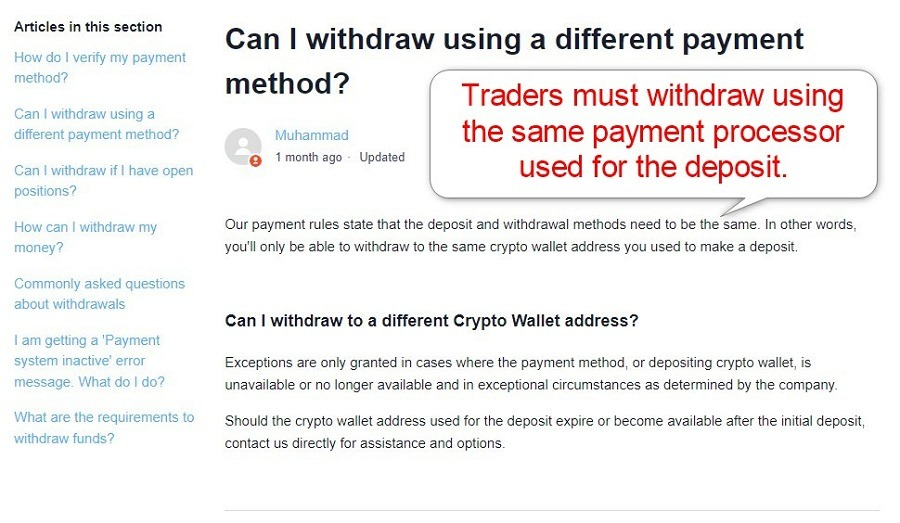

I want to point out that only verified trading accounts may request a withdrawal and that FXTM enforces a withdrawal hierarchy. FXTM will return funds to the payment processors used for deposits, and it appears that traders must withdraw profits exceeding them via bank wire only, which is expensive.

Bottom Line

I like the trading environment at Forextime, as the trading costs in the commission-based trading account remain among the best industry-wide. FXTM is an ideal broker for high-frequency traders and scalpers. It has also established itself as a market leader for traders from emerging and frontier markets. I also like the upgraded MT4/MT5 trading platforms and overall transparency at FXTM, which I confidently rank among the very best Forex brokers.

FAQs

Does FXTM offer a welcome bonus?

No, FXTM does not offer a welcome bonus.

Does FXTM allow scalping?

FXTM has no restrictions on scalping and maintains ideal trading conditions for it.

What is FXTM’s minimum deposit in South Africa?

FXTM’s minimum deposit for residents of South Africa is only $200.

How do I open an FXTM account?

A swift online application onboards new clients, and the process takes less than 20 seconds, as FXTM does not collect unnecessary information. A valid mobile phone number is necessary to open an account.

Does FXTM accept US-person clients?

Forextime does not accept US-based traders, as it would violate regulations.

How much does FXTM charge per trade?

The costs depend on the account type, asset, and trading volume, where the commission-based option features the lowest trading costs starting from $4.00 per 1 standard lot in the EUR/USD down to $0.80.

How long is FXTM withdrawal?

FXTM processes most withdrawals within 24 hours, but it may take up to five business days for clients to receive their funds, dependent on the payment processor. Most online payment processors will credit accounts instantly after FXTM has completed the withdrawal.

Does FXTM take Perfect Money?

FXTM accepts Perfect Money, but a 0.50% commission applies.

Is FXTM a legit broker?

FXTM is a legit company, operating with four regulatory licenses and acquiring a fifth. It is also one of the most transparent brokers.

What is FXTM leverage?

FXTM deploys a dynamic six-tier leverage system with a maximum leverage of 1:3000 and a minimum of 1:25 for Forex traders.

Where is Forextime based?

Forextime has its headquarters in Cyprus.

How much does FXTM charge for withdrawal?

FXTM does not charge internal fees, but third-party payment processor costs may apply.

What is the spread at FXTM?

The minimum spread at FXTM is 0.0 pips in the commission-based account and 1.5 pips in the commission-free alternatives.

Does FXTM use MT4?

Yes, FXTM offers MT4 and upgrades the core version with six plugins.

Does FXTM use PayPal?

No, FXTM does not offer PayPal.

Does FXTM have an inactivity fee?

Yes, FXTM levies an inactivity fee of $5 monthly after six months of dormancy.

What is the minimum deposit for FXTM?

The minimum deposit at FXTM for the Advantage or Advantage Plus accounts is $200 or its currency equivalent.

How old is FXTM?

FXTM opened its doors in 2011.

Can I withdraw from FXTM?

Yes, FXTM allows all verified traders who submit a valid withdrawal request to withdraw their funds. FXTM offers 16 payment processors, ensuring many localized options for its core markets.

Can FXTM be trusted?

FXTM complies with four regulators, is a member of the Hong Kong-based Financial Commission, publishes audited performance reports, and has a clean operational record spanning fourteen years. Therefore, traders should consider FXTM among the most-trusted brokers industry-wide.

Does FXTM have fees?

FXTM has fees like any broker. Opening an account is free, but trading fees like spreads and commissions apply. Leveraged traders also pay swap rates on leveraged overnight positions, and currency conversion fees may apply.

Is FXTM legal?

FXTM is legal, complies with four regulators, and has a clean track record. FXTM established itself among the most trusted Forex brokers industry-wide.

Can I withdraw all my money on FXTM?

Verified traders must close all open positions and wait for funds to settle. Once the account shows a cash-only balance, they can withdraw all their money from FXTM.

What is the minimum deposit with FXTM?

The FXTM minimum deposit is $200.