Editor’s Verdict

Overview

Review

Headquarters | Seychelles |

|---|---|

Year Established | 2017 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $10 |

Trading Platform(s) | MetaTrader 4 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

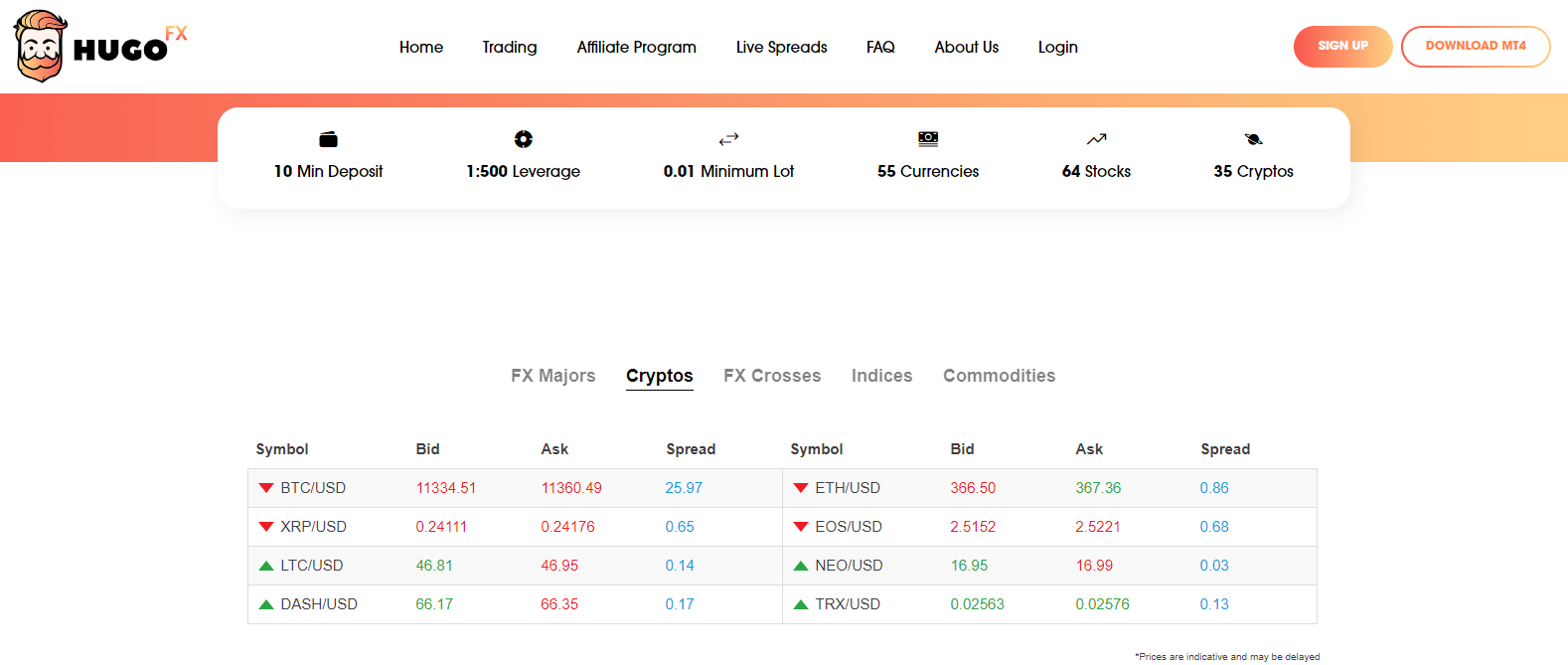

Hugo’s Way is a self-proclaimed ECN broker operating as an unregulated entity out of St. Vincent and the Grenadines. This broker is very opaque when it comes to the ownership structure or the date of its foundation. Some reports suggest Hugo’s Way started in 2017 in Seychelles, but independent verification was not possible. The FAQ section reveals the name of the registered business is Hugo’s Way LTD, but not even the business registration number is available. It does offer a maximum leverage of 1:500 from a minimum deposit of just $10, and with 35 cryptocurrency pairs, Hugo’s Way does maintain an excellent crypto selection for a non-crypto broker. This broker promises institutional grade liquidity with raw spreads from 0.0 pips, but any claims made should be considered carefully amid the lack of transparency and overall secrecy concerning its ownership.

Regulation and Security

Hugo’s Way is an unregulated broker operating out of St. Vincent and the Grenadines and remains opaque about its ownership structure. The website lists a registered address but fails to provide the name of the company which owns this broker; the FAQ section reveals the owner as Hugo’s Way LTD, but no additional information exists. This broker fails to provide a business registration number. If the broker was properly registered as an international business company (IBC) in St. Vincent and the Grenadines, then the financial regulator, the St. Vincent and the Grenadines Financial Services Authority (SVGFSA), would have a record of such. While the SVGFSA does not regulate Forex brokers, proper registration is mandatory.

Most articles in the FAQ section show modifications in 2020, and with little other information to go by, it could offer a hint as to when Hugo’s Way had begun operation out of St. Vincent and the Grenadines. Regardless, there is no concrete information about this company, no legal section, and no supporting documents. It all points towards a questionable operation and raises a significant red flag. No contact phone number is available, and no mention of the payment process exists. Traders must proceed with the utmost caution to avoid financial loss. While there is no direct evidence of malpractice or fraud by Hugo’s Way, too many red flags exist, and potential traders need to consider the lack of transparency and the absence of information before they proceed with funding or the provision of their personal information.

Hugo’s Way is an unregulated and opaque broker, which does not even provide the name of its corporate owner or its business registration number.

The FAQ section reveals the name of the corporate owner as Hugo’s Way LTD, for which no information exists.

This broker's ambiguous response in its FAQ section is clearly an attempt to avoid answering the question concerning regulation.

Hugo’s Way claims to keep client deposits segregated from corporate accounts, for which no guarantee exists given its present structure.

Fees

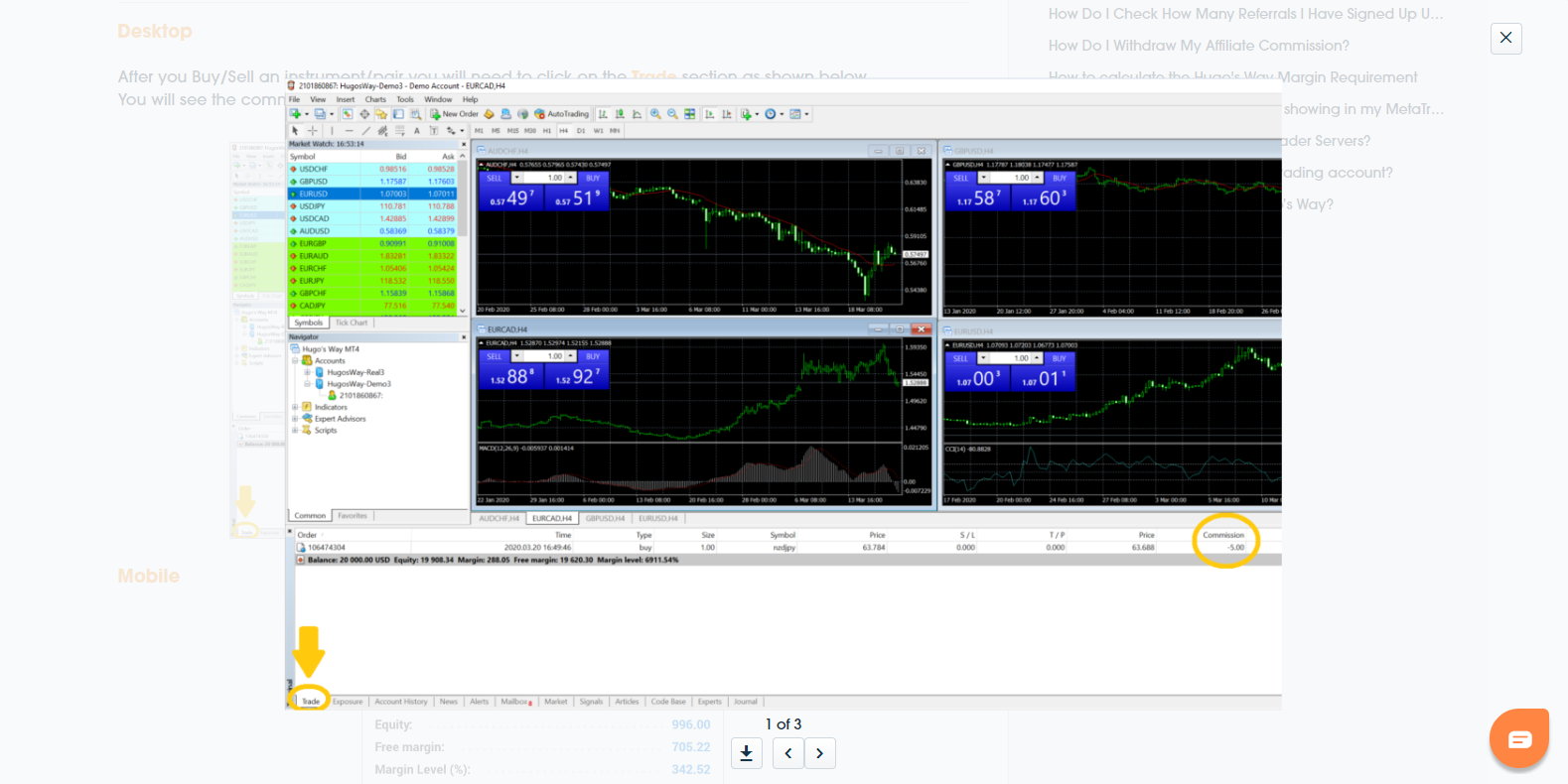

The opaqueness at Hugo’s Way continues with its cost structure. While this broker claims access to raw spreads from 0.0 pips due to liquidity from over 50 unnamed banks, it does not note a commission for trading on the electronic communications network (ECN), other than a single mention of low commissions for cryptocurrency trading. It is not just another red flag, which hints at some sort of malfeasance, but suggests the distinct possibility of a simulated trading environment. The FAQ section shows a $5.00 commission for 1.00 lot in the NZD/JPY and the NZD/USD in a demo account, the sole direct reference to a commission structure for Forex trading. Contract specifications do not exist, and neither does an explanation about swap rates or how this broker processes corporate actions such as dividends, splits, and mergers that typically impact equity and index CFDs.

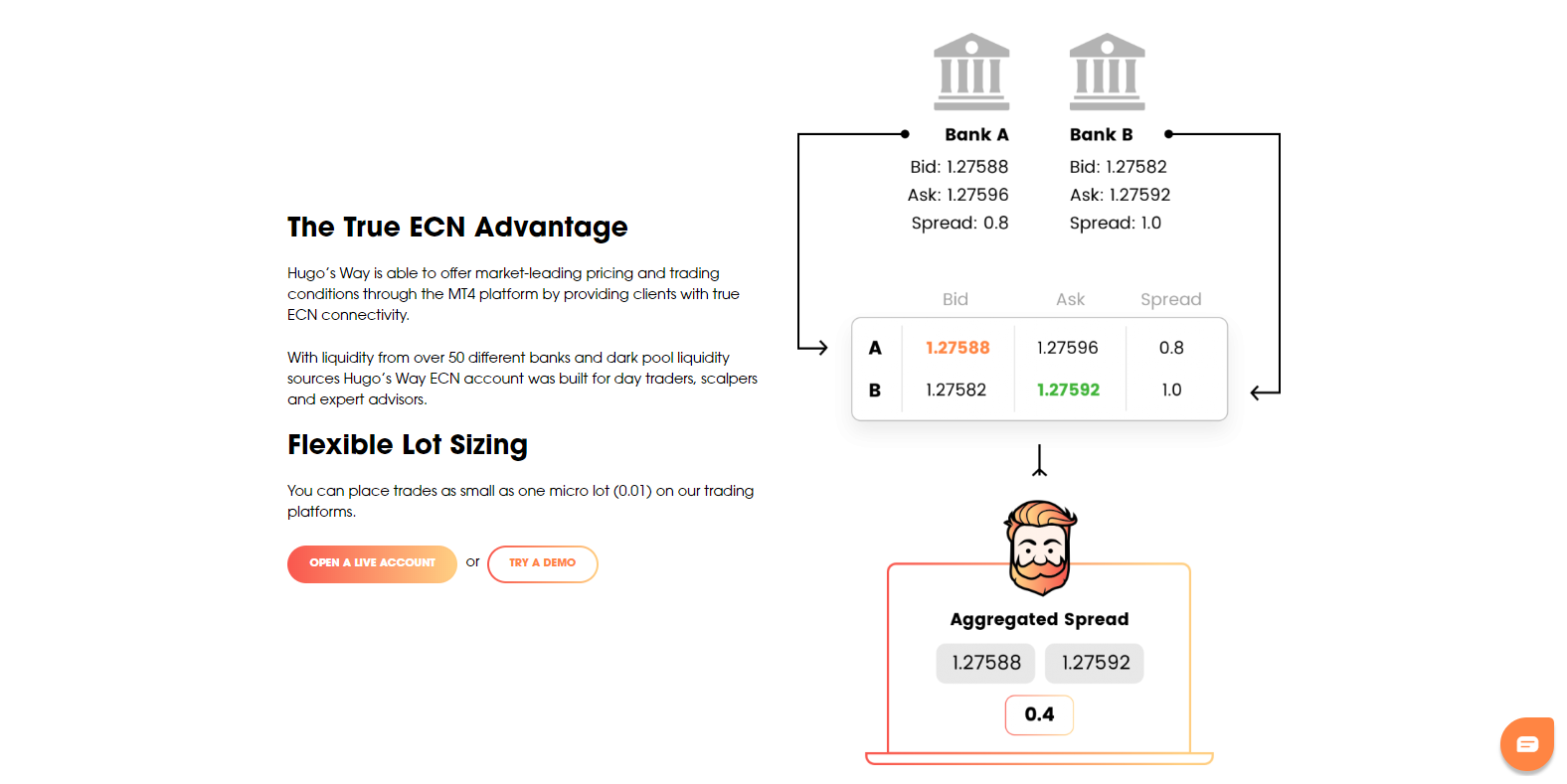

The Terms & Conditions do reveal a $10 monthly inactivity fee after six months, the sole mention of costs, together with a $25 fee for deposits and withdrawals via bank wires. Hugo’s Way offers an excellent description of its aggregated spread pricing system, in line with a real ECN broker, but regrettably, it appears to be only for marketing purposes. The infrastructure required seems to be missing. The lack of transparency remains unacceptable.

MT4 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Symbols.

2. Select the desired currency and then click on Properties located on the right side.

3. Scroll down until you see Swap Long and Swap Short.

Only a single mention of commissions for cryptocurrencies exist.

The FAQ section reveals a $5.00 commission for Forex trading, but it is unclear if it applies per side or round lot.

Hugo’s Way deploys marketing to present itself as a genuine ECN broker.

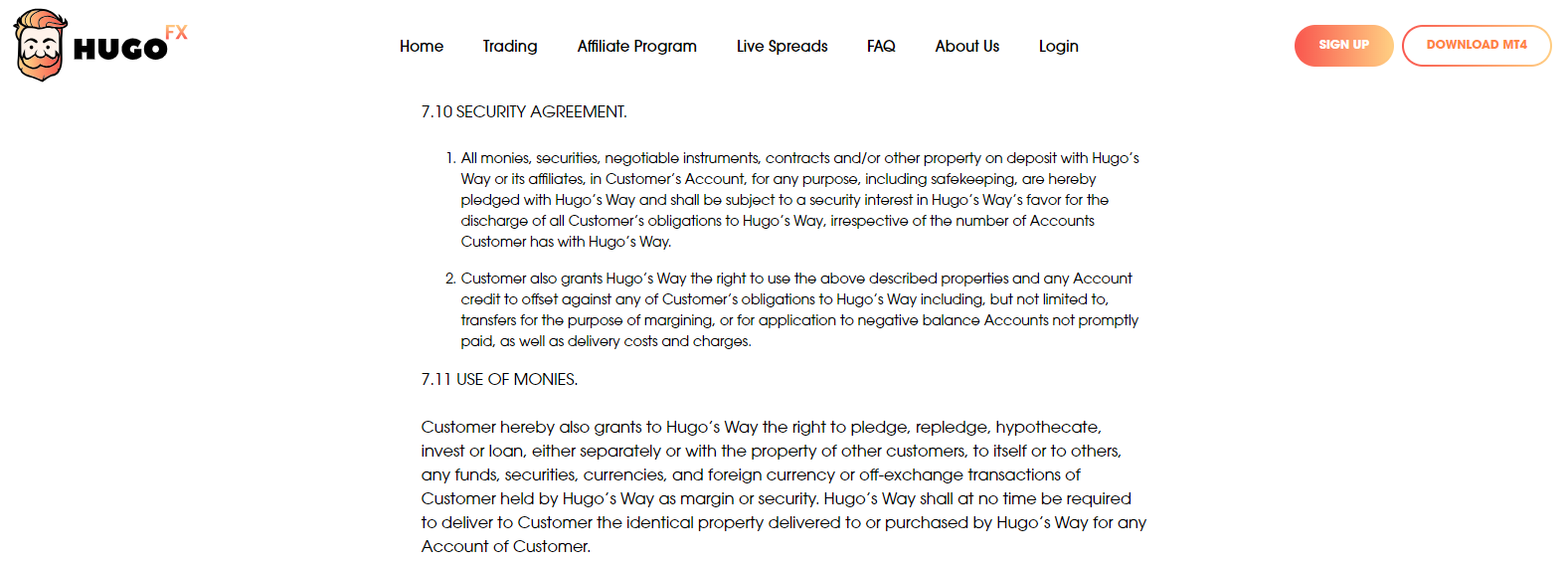

Under the Security Agreement terms, traders should be aware that they grant Hugo’s Way the authority to pledge, repledge, hypothecate, invest or loan, any money or securities held in customer accounts.

What Can I Trade

Hugo’s Way maintains 55 currency pairs but only six commodities. While the homepage lists 35 cryptocurrency pairs, the asset lists reveal 50, which is an excellent choice, and could be the only genuinely offered trading instrument. Concluding the asset selection are ten equity CFDs, 64 equity CFDs, and one futures contract. With 186 assets across six categories, this broker provides an adequate variety to most retail traders.

The final number of tradable assets remains unclear amid contradicting information across various sections of the website.

Account Types

No mention of account types adds to the list of red flags and a lack of transparency at Hugo’s Way. The homepage notes the existence of straight-through processing (STP) trading accounts that require a minimum deposit of $50 with a maximum leverage of 1:500. It also provides the third contradicting number on available assets with just 31 cryptocurrencies and 104 equity CFDs. While treating all clients equally, regardless of deposit size, is a trend gaining traction among brokers, and which seems to be embraced by Hugo’s Way, transparency is missing once again. The FAQ section reveals the availability of unlimited demo accounts, the absence of Islamic accounts, no limitations on hedging and scalping strategies, a margin call level at 100%, and a stop out level at 70%.

Hugo’s Way appears to maintain only one account type, with the usual absence of information.

Trading Platforms

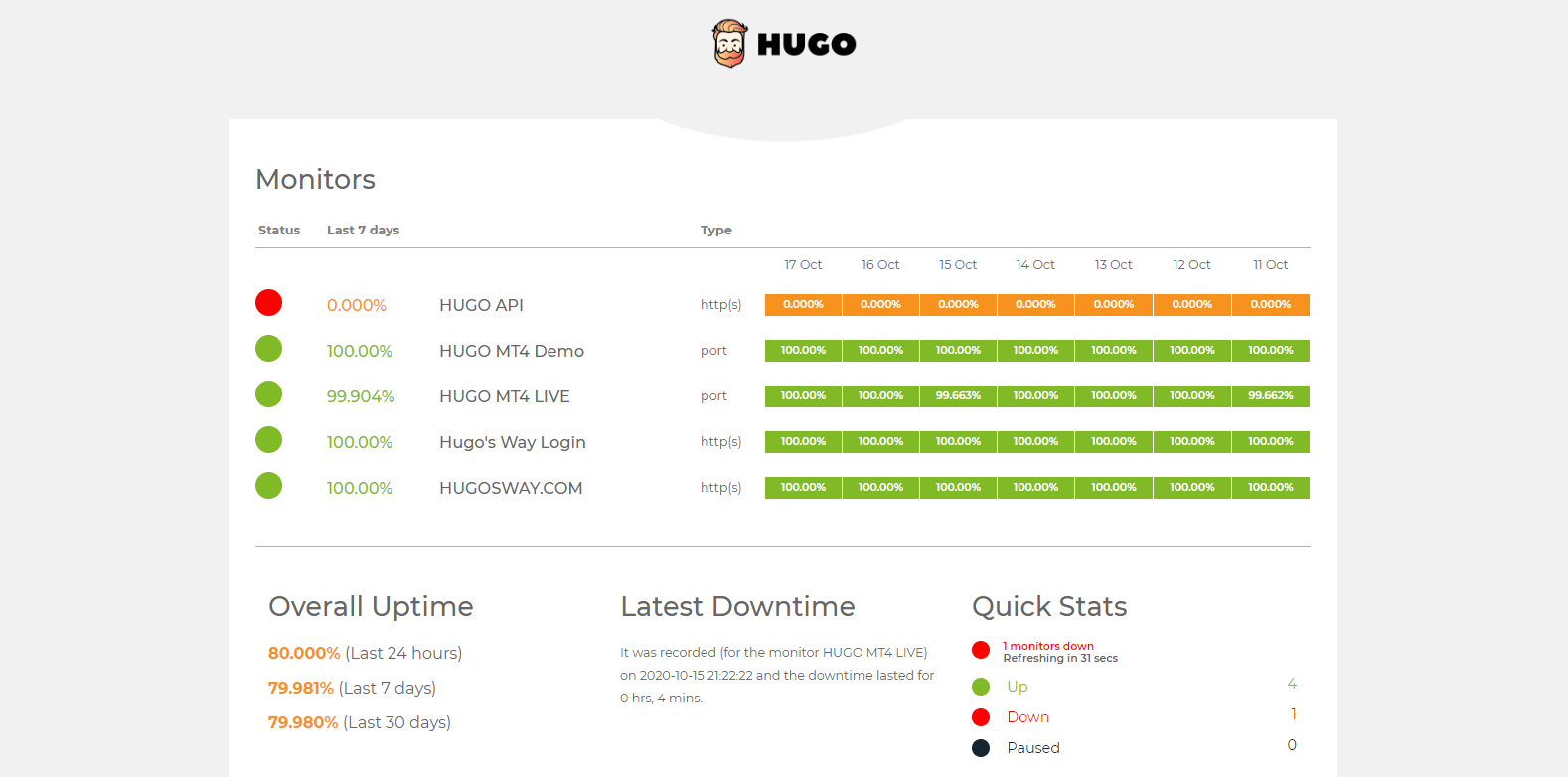

The out-of-the-box MT4 trading platform is available as a desktop client, webtrader, and mobile app. Hugo’s Way fails to properly introduce this trading platform, despite an overwhelming amount of available marketing material. It appears that this broker does not have a full license for it but opted instead for a white label solution. The lack of investment into the technology infrastructure counters claims of lightning fast execution. Interestingly enough, Hugo’s Way is transparent about the lack of reliability. Since ECN requires state-of-the-art technology to deliver desired results, which is clearly not available at this broker, it is simply additional evidence which points towards the absence of ECN/STP trading, or even any live trading.

Hugo’s Way does not introduce the MT4 trading platform and limits it to a few words and an image.

The overall uptime of less than 80% suggests the absence of reliable technology.

Unique Features

Regrettably, the two unique features at Hugo’s Way are the lack of transparency and the apparent absence of a knowledgeable management team. The manner in which this broker presents itself resembles a group of students simulating a broker for a school project, rather than a trustworthy, professional, and reliable multi-asset broker.

Research and Education

Hugo’s Way neither provides research nor education to traders. It does maintain a category labeled Insights, where it publishes news related to operations with isolated general topics and a plethora of quotes by well-known traders. There is little to no value in the content, which appears to focus instead on search engine optimization (SEO), hence the numerous quotes with no follow-through content. The lack of experience by this broker, together with the inability to invest in technology, makes associations with third-party research providers or the licensing of tools impossible. One post reveals the addition of new MT4 servers. Overall, Hugo’s Way struggles to deploy the core trading environment, making add-on services like research and education an unattainable option for now.

The Insights section fails to deliver quality to traders but offers important brokerage-related information.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

Another red flag at this broker is the absence of a contact phone number, but a call back function is available. Clients have access to customer support 24/7, per a statement made on the website via live chat, e-mail, and webform. The live chat appears to be a chatbot, and a surprisingly comprehensive FAQ section does attempt to answer most questions.

While customer service is listed 24/7, a chatbot appears to bear the bulk of it.

The comprehensive FAQ section offers the most valuable support.

Bonuses and Promotions

At the time of this review, Hugo’s Way neither offers any bonuses nor hosts promotions.

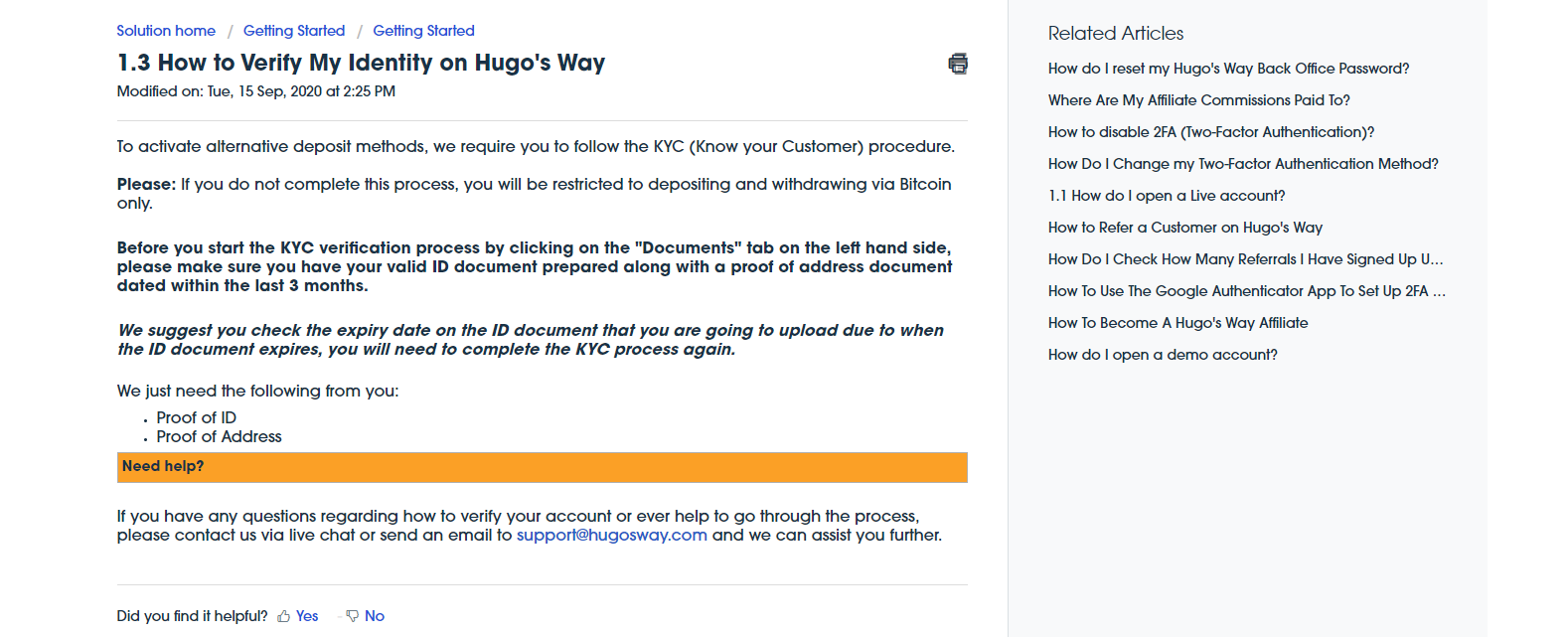

Opening an Account

An online application, per established industry standards, processes new accounts. Hugo’s Way merely asks for a name, e-mail, and password. While no mention exists on the website about anti-money laundering (AML) procedures, the FAQ section notes AML/KYC as a requirement to unlock additional deposit methods. It suggests that accounts are available without a verification process, mimicking a two-tier approach gaining traction among cryptocurrency brokers. Since Hugo’s Way remains unregulated and opaque, each trader needs to assess if they want to trust this broker with identifying documents and deposits.

New traders can open accounts via a quick online form.

Verification does not appear to be mandatory and is only required to unlock additional deposit methods.

Deposits and Withdrawals

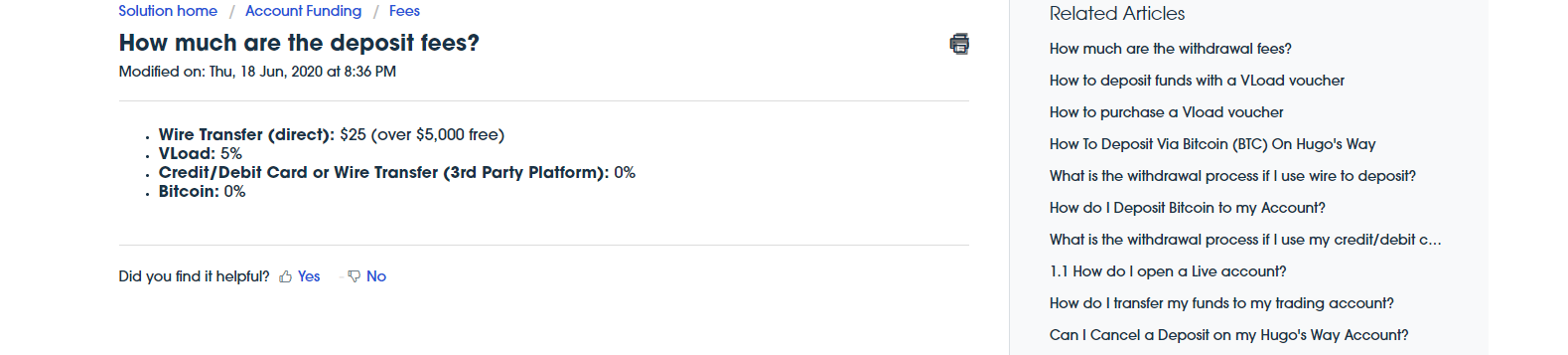

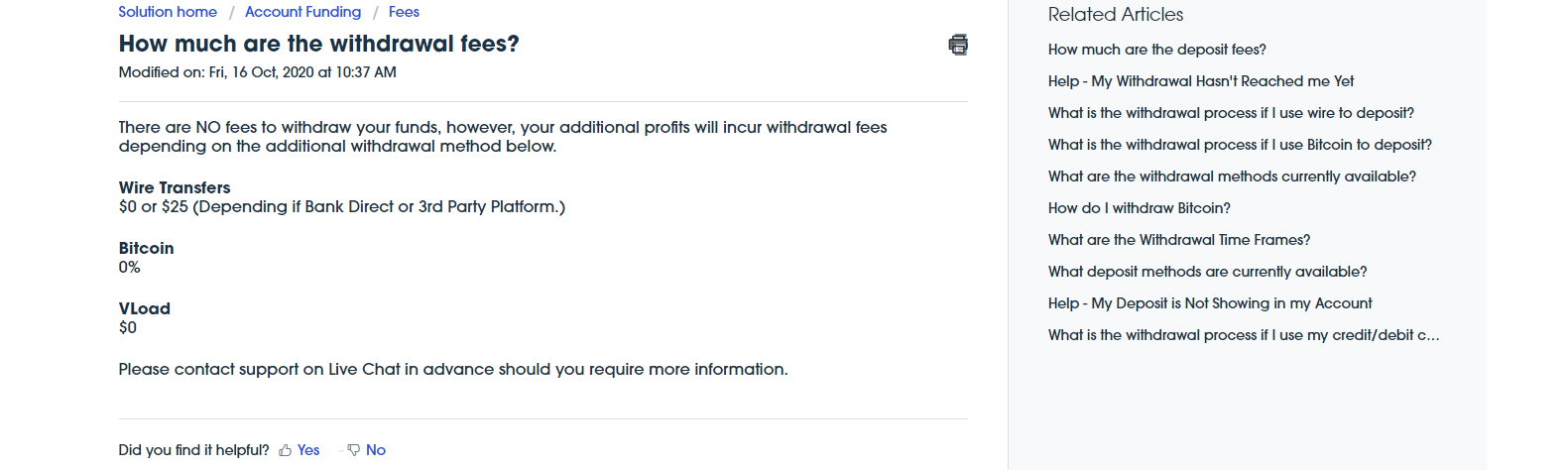

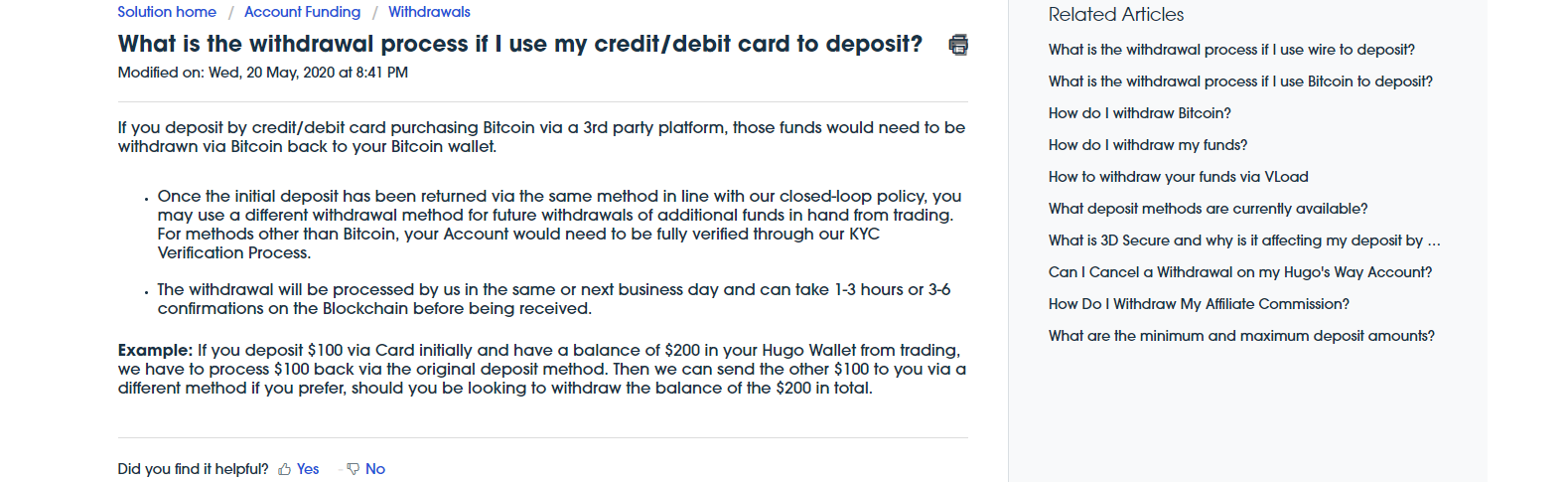

Hugo’s Way supports bank wires, credit/debit cards, VLoad, and Bitcoin as deposit and withdrawal methods. Internal deposit fees for bank wires, up to $25, and for VLoad at 5%, exist, but only withdrawals via bank wires carry an additional cost. The minimum deposit is $50, except for VLoad, where it is $10, while the minimum withdrawal amount is $10 for all methods except for $100 for bank wires. This broker notes processing times within 24 hours, but it can take additional time for funds to arrive, depending on the method used.

Internal deposit fees apply.

Only bank wires incur additional withdrawal costs.

Credit/debit card withdrawals are available, despite not being listed in the previous section.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Summary

Hugo’s Way is an unregulated broker and alarmingly opaque about its ownership structure. The overall presentation raises extensive red flags, though the FAQ section does attempt to answer questions relating to the core trading environment. This broker appears to have almost no operating history and a management team without experience in financial markets. The lack of transparency meets the void of investment into its technology infrastructure, with server uptime below 80%.

While the asset selection is acceptable for most retail traders, only the out-of-the-box MT4 trading platform exists. Hugo’s Way does not offer any additional services such as research or education. The Insights blog provides little to no value.

Overall, this broker resembles more of a school project than a trustworthy, professional, and reliable multi-asset broker. While there has been no confirmed malpractice or fraudulent activity by this self-proclaimed ECN/STP broker, traders should be aware that numerous red flags and an inferior infrastructure exist. Given its current state, Hugo’s Way appears to be at least one year and a significant amount of investment short of being operational, on any basis. As such, interested traders may wish to monitor the progress of this juvenile broker moving forward; for now, though, they will be better served at a broker elsewhere. No, given the current state of this broker, the lack of transparency, and the absence of essential information, Hugo’s Way does not fulfill the criteria of a legit operation. Hugo’s Way remains opaque about its commission structure, but the FAQ section reveals a demo account where a $5.00 fee applies per 1.00 lot, presumably per side, for a total of $10 per round lot. Cryptocurrencies may face a different cost structure, not specified by Hugo’s Way other than noting a low commission. It depends on the payment processors, but Hugo’s Way states 24 hours for internal processing times. The minimum deposit is $10, but it only applies to VLoad. Other methods are $50, which is also the requirement to open a new trading account. There are no restrictions on scalping, per information displayed in the FAQ section.FAQs

Is Hugo’s Way legit?

How much does Hugo’s Way charge per trade?

How long does it take to withdraw money from Hugo’s Way?

What is the minimum deposit for Hugo’s Way?

Does Hugo’s Way allow scalping?