For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

IG Editor’s Verdict

IG is a multi-asset broker that ranks as the leading CFD broker. It is also a liquidity provider for other brokers, writes CFDs based on client demand, and maintains a cutting-edge trading infrastructure with an average order execution time of 13 milliseconds and an order fill rate of 100% at the requested price or better. Therefore, I decided to review IG to determine if its commission-free trading environment offers the promised cost advantage. Does IG deserve the praise it gets?

Overview

Traders get an excellent asset selection featuring 17,000+ CFDs covering eight asset classes, a competitive commission-free trading environment, and superb trading platforms. I also recommend the IG Academy to beginner traders, where IG delivers an industry-leading service.

Headquarters | United Kingdom |

|---|---|

Regulators | ASIC, BaFin, CySEC, DFSA, FCA, FINMA, FMA, FSCA, JFSA, MAS |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 1974 |

Execution Type(s) | Market Maker |

Minimum Deposit | €0 |

Negative Balance Protection | |

Trading Platform(s) | Other, MetaTrader 4, Proprietary platform, Trading View |

Average Trading Cost EUR/USD | 0.9 pips |

Average Trading Cost GBP/USD | 1.4 pip |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.30 |

Average Trading Cost Bitcoin | $90 |

Retail Loss Rate | 70.00% |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.6 pips |

Minimum Commission for Forex | Commission-free |

Funding Methods | 3 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

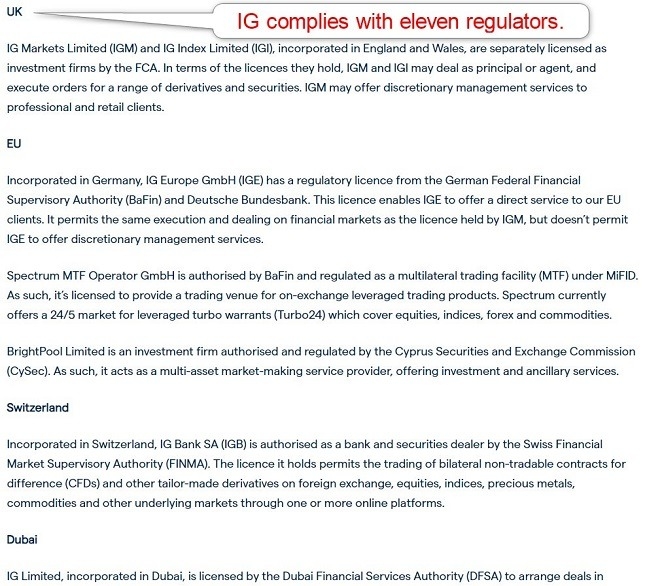

IG Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check regulations and verify them with the regulator by double-checking the provided license with their database. TradeZero has eleven regulated entities with a good track record.

Country of the Regulator | Name of the Regulator | License Number |

UK | Financial Conduct Authority | 195355 |

Germany | Federal Financial Supervisory Authority | 10148759 |

Cyprus | Cyprus Securities and Exchange Commission | 378/19 |

Switzerland | Swiss Financial Market Supervisory Authority | Confirmed, but no regulatory license number |

Dubai | Dubai Financial Services Authority | F001780 |

South Africa | Financial Sector Conduct Authority | 41393 |

Singapore | Monetary Authority of Singapore | Confirmed, but no regulatory license number |

Japan | Japanese Financial Services Agency | Unconfirmed |

Australia | Australian Securities & Investments Commission | 220440, 515106 |

New Zealand | Financial Markets Authority | FSP18923 |

Bermuda | Bermuda Monetary Authority | Unconfirmed |

IG maintains an excellent regulatory track record, segregates client deposits from corporate funds, and offers negative balance protection. I prefer the Bermuda, New Zealand, and Swiss entities, as they provide traders with the best combination of trader-friendly regulation and competitive trading conditions. Regardless of which subsidiary a trader chooses, I can confidently recommend IG, one of the most trustworthy brokers available.

IG has a 3.9 out of 5.0 rating on Trustpilot based on 7,474 reviews. 55% of the reviews are 5-star reviews, and 17% are 4-star reviews versus 18% as 1-star reviews. IG responded to 79% of negative reviews in less than two days and continues to take a proactive role in customer feedback.

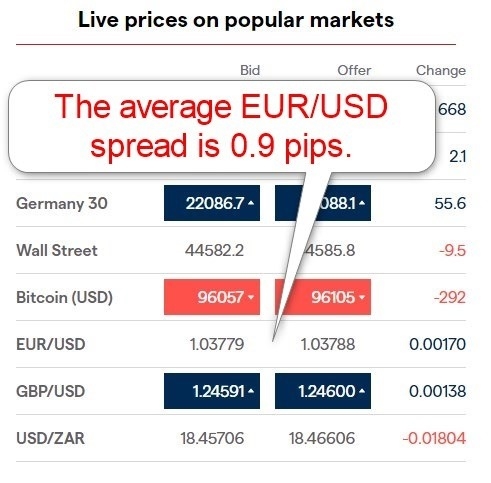

IG Fees

Average Trading Cost EUR/USD | 0.9 pips |

|---|---|

Average Trading Cost GBP/USD | 1.4 pip |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.30 |

Average Trading Cost Bitcoin | $90 |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.6 pips |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | true |

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. IG does not offer commission-based raw spreads, but the commission-free pricing environment remains among the most competitive with deep liquidity. It usually applies to the EUR/USD and the USD/JPY, with few exceptions.

I like that IG offers identical trading costs across all trading platforms. Some brokers try to push their solutions and provide superior pricing. The commission-free Forex spread of 0.6 pips represents a highly competitive cost but only applies to the EUR/USD. The rest of the Forex costs are higher but within a reasonable range. Equity commissions follow established industry averages, and I rank the overall pricing environment as competitive.

Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.8 pips (minimum) | $0.00 | $8.00 |

1.1 pips (average) | $0.00 | $11.00 |

Swap rates on leveraged overnight positions are the most ignored trading costs. Depending on the trading strategy, they may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4 traders can access swap rates from their platform by following these steps:

1. Right-click the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

IG provides examples listing a 0.8% admin fee for Forex transactions and a 2.5% levy on equity trades. IG also charges a 0.50% currency conversion cost where applicable. Broker-assisted phone dealing incurs a £50 fee. Traders may pay additional fees depending on their trading requirements. After 24 months of inactivity, a £12 monthly inactivity cost applies. IG does not levy internal deposit or withdrawal fees, but traders may face third-party charges.

What Can I Trade on IG

IG features the best CFD selection compared to all brokers, with 17,000+ trading instruments covering all asset classes. I like the breadth of assets, and IG writes CFDs based on demand.

Asset List and Leverage Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

In the UK, cryptocurrencies are offered only to qualifying professional traders. Listed options and futures are available only to traders resident in the UK.

IG offers the following choice of asset classes:

- 99 Forex Pairs

- 80+ Indices

- 13,000+ Shares

- IPOs

- 6000+ ETFs

- 35+ Commodities (energies, metals, and agriculture)

- Cryptocurrencies

- Bonds

IG Leverage

Maximum Retail Leverage | 1:200 |

Maximum Pro Leverage | 1:200 |

What should traders know about IG leverage?

- Most international traders have access to a maximum leverage of 1:200 at the Bermuda subsidiary

- Maximum retail Forex and index leverage is 1:200

- Equity traders receive 1:20

- Not all assets within a sector qualify for the maximum leverage

- Negative balance protection exists, ensuring traders cannot lose more than their deposit

- Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses

IG Trading Hours

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Saturday 04:05 | Saturday 24:00 |

Commodities | Monday 00:00 | Friday 24:00 |

I recommend the following steps for MT4 traders to access trading hours:

1. Right-click the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

IG Account Types

All international traders get the same CFD account, which I recommend for most traders. UK-based clients benefit from tax-free spread betting accounts, traditional long-term investments via share dealing, IG Smart Portfolios, ISAs, and SIPPs. Overall, the trading conditions in all IG accounts are competitive, and I highly recommend them to traders and investors alike.

My observations concerning the IG account types are:

- IG has no minimum deposit requirement

- Credit/debit card deposits have minimums based on the account base currency

- Deposit currencies are GBP, EUR, AUD, CAD, CHF, USD, NZD, SGD, PLN, DKK, NOK, SEK, HKD, ZAR, JPY, CNY, CZK, HUF, and RON

- IG Smart Portfolios, managed in partnership with BlackRock, offer fully managed, diversified investment portfolios tailored to your financial goals and risk profile

- Deep liquidity pools

- An average order execution time of 13 Milliseconds

- 98.99% of all orders filled (between June and August 2023)

- 36M+ filled trades (between June and August 2023)

- €2.65B9+ nominal traded volume (between June and August 2023)

- 100.0% of filled orders are at the desired price or better

IG Demo Account

IG offers demo accounts, and I could not find a time limit. The back office allows traders to add and manage new accounts identically to live ones, including demo deposits. IG has done an excellent job with its demo accounts, granting the flexibility to create them similar to their live account choices.

IG Trading Platforms

IG offers an excellent choice of trading platforms, including its proprietary web-based option, ProRealTime, MT4, and L2 Dealer. I like the 18 add-ons plus the Autochartist plugin MT4 upgrades at IG. Social traders can connect to TradingView and engage with 50M+ peers, share and discuss trades using cutting-edge trading charts, and deploy algorithmic trading solutions using the in-house TradingView scripts.

I recommend L2 Dealer for DMA CFD trading. Manual traders who want a powerful, lightweight solution can trade using the proprietary platform.

Mobile traders benefit from a user-friendly and highly ranked mobile app. Traders rank it 4.4 out of 5.0 on Google Play and 4.6 out of 5.0 on the Apple App Store.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Scalping is only allowed for UK resident traders.

Unique Features

The three unique features at IG that stood out to me are deep liquidity, the extensive upgrade package for MT4, ensuring one of the best MT4 trading environments, and the availability of ProRealTime. I also appreciate API trading, as it allows me to connect my advanced trading solutions to the IG infrastructure, a defining benefit as an algorithmic trader. Another feature I find beneficial for all active traders is that IG writes CFDs if demand exists.

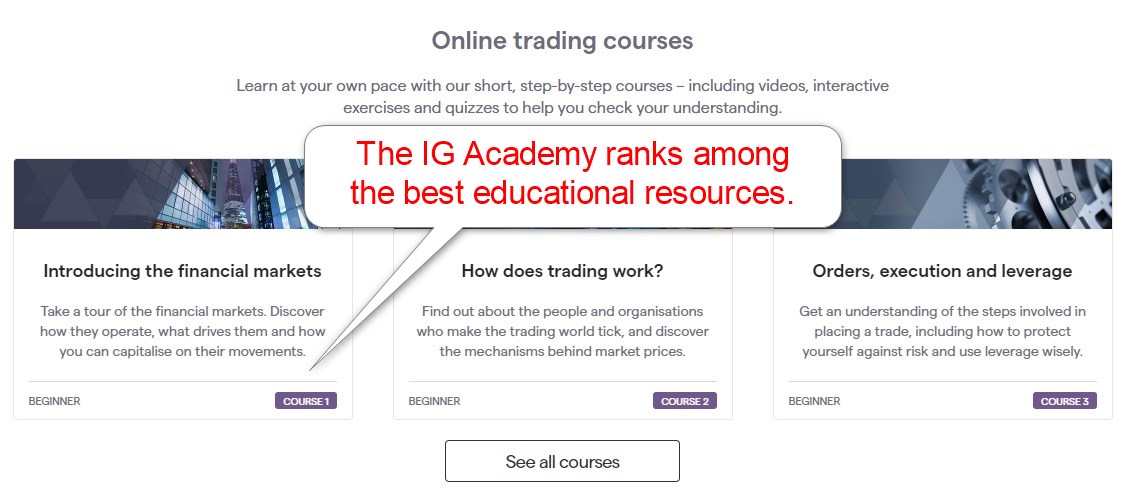

Research and Education

IG does an excellent job with its in-house research, featuring high-quality written and video content. I think it makes a thought-provoking read and grants a different market perspective. Technical trading signals by Autochartist complement the published material. Another service I think many traders can benefit from is IG trading subscriptions. The proprietary web-based trading platform also features free trading signals.

One of the best features at IG is the IG Academy, which I rank among the best industry-wide. The step-by-step courses feature video content, videos, and quizzes, and I highly recommend beginner traders take full advantage of the IG Academy. Webinars, seminars, and other educational material complement the superb educational offering at IG.

Customer Support

Customer Support Methods |    |

|---|---|

Support Hours | Saturday 8 am through Friday 10 pm GMT |

Website Languages |           |

Customer support at IG is available from Saturday 8 am through Friday 10 pm GMT. Traders may use live chat, WhatsApp, call, or e-mail, but I recommend the FAQ section first, as it answers most questions. IG explains its products and services well, and I believe most will never require customer support. A forum is also available. I like the phone trading service, which is excellent during emergencies.

Bonuses and Promotions

IG has a three-tier volume-based cash rebate program, but the conditions remain challenging with a limited payout. The first tier requires a nominal trading volume of 25 million or 250 lots for a payout of $5 per 1 million, resulting in a cashback rebate of $125. It ranks towards the bottom of incentives for active traders, and I recommend traders read and understand the terms and conditions.

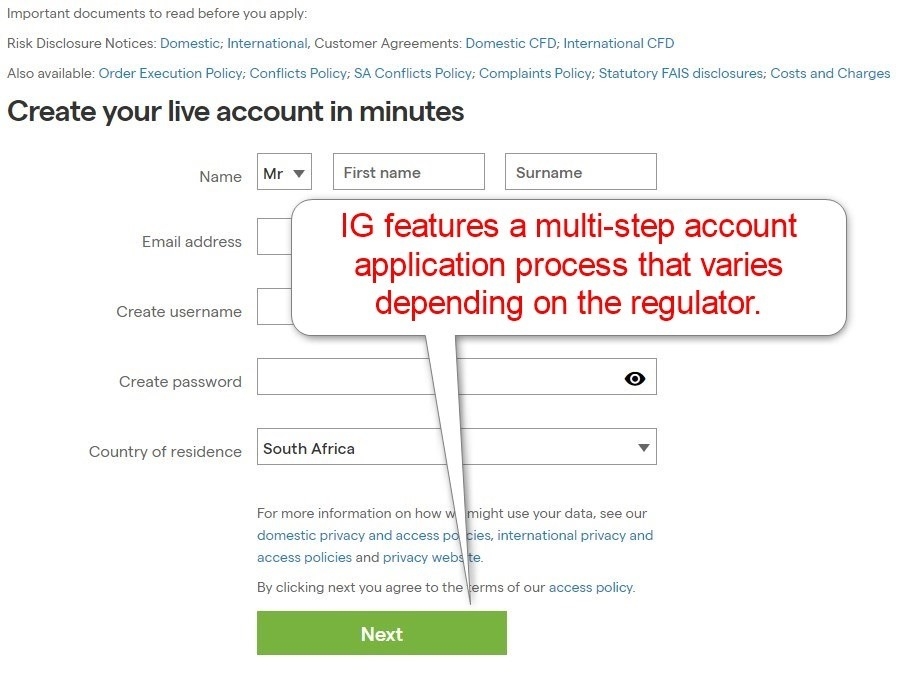

Opening an Account

While the IG account opening process is fast, two sections collect unnecessary information, often due to regulatory data collection mandates. Traders can fill them out at will without verification, making them pointless. New traders must verify their accounts according to KYC/AML stipulations. A copy of the ID and one proof of residency document generally completes this step.

Minimum Deposit

IG has no minimum deposit requirement for bank deposits, but credit/debit card transactions have minimum and maximum requirements based on the account base currency.

Payment Methods

Withdrawal options |     |

|---|---|

Deposit options |     |

IG offers bank wires, credit/debit cards, PayPal, and FPS Hong Kong. It is a limited selection, and not all methods are available to all traders, severely restricting choices.

Accepted Countries

IG accepts traders from most countries except Anjouan, Belgium, Bulgaria, Burma/Myanmar, Canada, Central African Republic, Chad, Comoros, Congo, Cote d’Ivoire (Ivory Coast), Cuba, the Democratic Republic of the Congo, (DRC), Equatorial, Guinea, Ethiopia, Guinea, Haiti, Iran, Iraq, Kosovo, Liberia, Libya, Mauritania, Montserrat, Niger, Nigeria, North, Korea, Palestinian, Territory, Poland, Sierra, Leone, Somalia, Spain, Sudan, Syria, Turkmenistan, Venezuela, Western, Sahara, Yemen, Zaire, and Zimbabwe.

IG Deposits and Withdrawals

IG does not charge internal deposit or withdrawal fees but implements a minimum withdrawal amount of $100 unless the account balance is lower. Most international traders must use credit/debit cards or bank wires, which rank among the most expensive and time-consuming, especially for withdrawals. The process is hassle-free from the back office, but I dislike the lack of options, which is the most significant drawback at IG.

IG in the UK

Here are a few things traders in the UK should know about IG:

- UK resident traders can now trade UK equities commission-free, as well as US, EU, and Australian shares. Other fees may apply.

- An impressive benefit for UK traders is now offered: IG will pay out an impressive 4.5% AER variable interest on uninvested GBP balanced up to £100,000.

- The FX conversion fee charged on trades which are not denominated in the holder’s base account currency has increased from 0.5% to 0.7%.

Bottom Line

I like the trading experience at IG as it features competitive trading costs, a broad range of trading platforms with API trading support, and the best CFD selection. Adding to IG’s competitive advantage is deep liquidity and fast order execution, making it an ideal choice for all traders. Completing the product and services portfolio is quality research and one of the best educational platforms for beginner traders.

I highly recommend IG, as it offers demanding traders the tools to increase trading opportunities and profits. IG caters to retail traders and institutions alike, and the sole drawback for me is the limited payment processors. Overall, I rank IG among the best brokers.

FAQs

Is IG trading available in Australia?

IG caters to Australian clients from its Australian subsidiary regulated by the Australian Securities & Investments Commission(ASIC) under AFSL Number 220440 and AFSL Number 515106.

Is IG regulated by the UAE?

IG manages a subsidiary in the UAE with oversight from the Dubai Financial Services Authority (DFSA) under reference number F001780.

How long do IG withdrawals take?

IG processes withdrawal requests received before noon (UK time), but it can take up to five business days for a client to receive funds, dependent on the payment processor.

Is the IG platform safe?

IG offers traders a choice of secure trading platforms, including its proprietary web based CFD platform and L2 Dealer for investors, MT4, ProRealTime, and API trading.

What is IG leverage?

IG leverage depends on the operating subsidiary and asset, with a maximum of 1:200.

Who owns IG ?

IG is a publicly listed company in the UK and a constituent within the FTSE 250. Therefore, investors own IG.

What type of broker is IG?

IG is a market maker and liquidity provider to other brokers.

Is IG good for day trading?

IG offers day traders ideal conditions, including excellent order execution, low trading costs, and deep liquidity.

What is the minimum deposit for IG?

IG has no Minimum Deposit

Is IG trading free?

IG offers commission-free CFD trading and share dealing in US-listed equities, but leveraged traders must consider financing costs, while a competitive commission structure applies to non-US stocks. Overall, IG is one of the cheapest brokers industry-wide.

Is IG good for beginners?

IG is an outstanding choice for beginners due to its high-quality educational content, with the IG Academy at its core. It also publishes special reports, features podcasts, webinars, and seminars, has a subscription-based service, and delivers in-house trading recommendations.

Is my money safe with IG?

IG remains one of the safest brokers globally with an exceptional track record, maintaining a highly secure environment with an industry-leading infrastructure.

Is IG good for investing?

IG offers an excellent investment portfolio with direct share dealing with highly competitive costs, internally managed IG Smart Portfolios, and Flexible ISA accounts for UK-based retirements planers.