Saxo Bank Editor’s Verdict

Saxo Bank is a fully licensed European bank and is one of the best-known players in the global brokerage industry. As one of the most transparent and trusted banks as well as brokers in the world, it caters to new traders as well as to professional traders, institutions and hedged funds. The broker’s main focus is on the professional crowd with better offerings from a minimum deposit of €/£50,000, but their Classic Account does come with a minimum deposit of just €/£500.

Overview

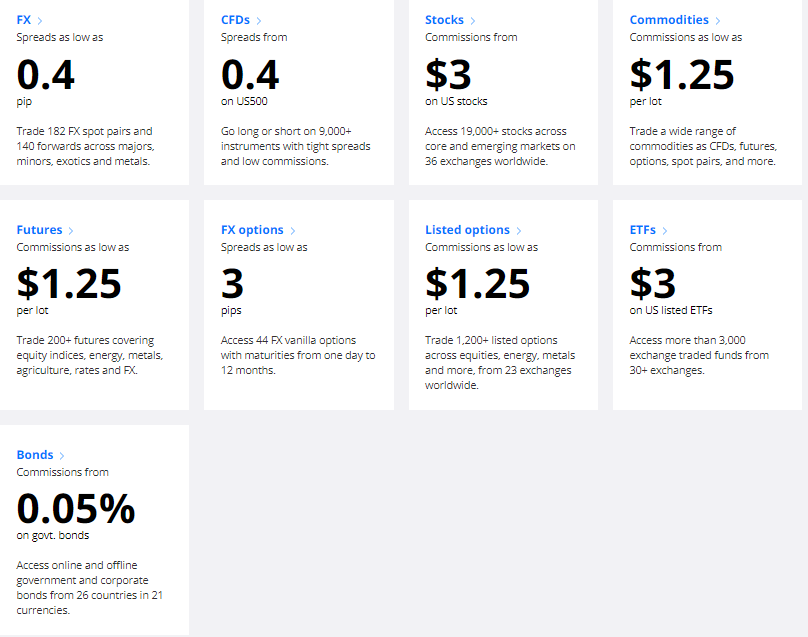

Trading with Saxo Bank gives you access to over 35,000 assets across eight categories and allows for full portfolio diversification.

Denmark 1996 ECN/STP $500 Proprietary platform, Web-based 0.7 pips ($7.00) 1.1 pips ($11.00) $0.05 $0.55 $90.65

Saxo Bank is headquartered in Copenhagen, Denmark. This investment bank and fintech company was founded in 1992 under the name Midas Fondsmæglerselskab by Lars Seier Christensen, Kim Fournais and Marc Hauschildt. In 2001 it obtained its banking license and changed its name to Saxo Bank. It became the first Danish broker to gain approval under the European Investment Directive which came in effect 1996, Saxo Bank received approval on May 2nd 1996. While Saxo Bank has a full banking license, it doesn’t carry out traditional banking business and is focused on brokerage activities as well as White Label Partnerships. In fact, over 100 financial institutions are White Label partners and service their clients through the Saxo Bank platform. It has also offered partnerships to other banks which include Standard Bank, Old Mutual Wealth, Banco Carregosa and Banco Best. In order to service its global client base in over 180 countries, Saxo Bank has also opened offices in London, Paris, Zurich, Dubai, Singapore, India and Tokyo. Saxo Bank is privately held with 52.00% ownership at Geely Financials Denmark A/S, a subsidiary of Zhejiang Geely Holding Group Co. Ltd, 25.71% ownership at co-founder and CEO Kim Fournais, 19.90% ownership at leading Nordic financial services group Sampo Plc and the rest in minority ownership by former and current bank employees. Saxo Bank is regulated in 15 financial centers and is one of the leaders in the global brokerage industry.

Regulation and Security

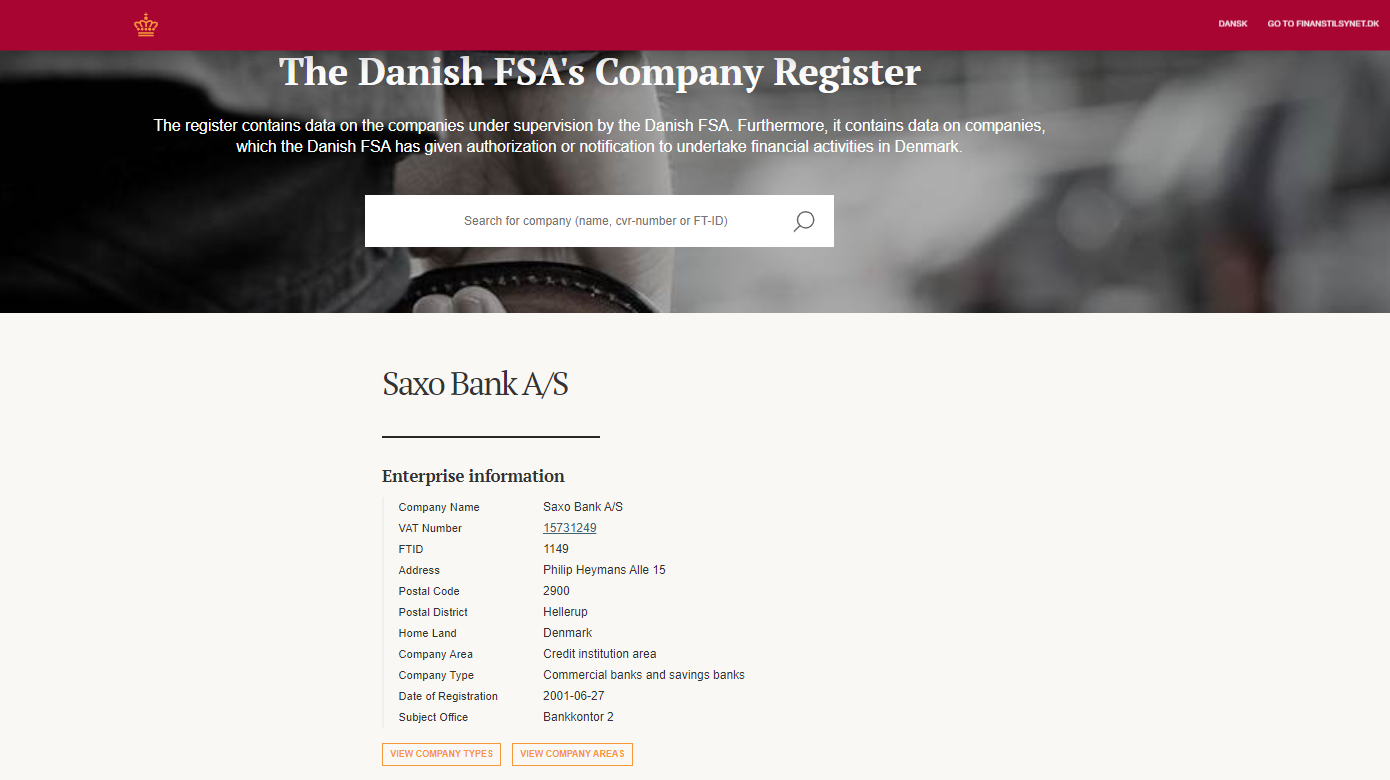

Saxo Bank is regulated in 15 global financial centers and is an industry leader when it comes to transparency. Saxo Bank A/S, Company Registration Number 15731249, is incorporated in Denmark as a licensed bank, License Number 1149. It is regulated, together with its subsidiaries Saxo Bank A/S Italy, Saxo Bank A/S Czech Republic, Saxo Bank A/S Netherlands and Saxo Bank A/S Cyprus, by the Danish Financial Supervisory Authority (FSA). Since Saxo Bank is a member of the European Union, it adheres to the EU Banking and Investment Directives which are incorporated in Danish law.

Saxo Capital Markets UK Limited is authorised and regulated by the Financial Conduct Authority (Firm reference number 551422). This broker has been active in the UK since 2006.

In addition, Saxo Bank is regulated in the following jurisdictions:

- BG SAXO Società di Intermediazione Mobiliare S.p.A. is licensed by Italian Market Authority – Consob (Albo SIM - Registration Number: 296).

- Saxo Bank A/S Czech Republic is registered by the Czech National Bank (Registration Number: 28949587).

- Saxo Bank A/S Netherlands is registered by the Bank of the Netherlands (Registration Number: 34357130).

- Saxo Capital Markets Pte. Ltd. Singapore is licensed as a Capital Market Services provider and an Exempt Financial Advisor, and is supervised by the Monetary Authority of Singapore (Co. Registration Number: 200601141M).

- Saxo Bank (Switzerland) Ltd. (UID-Register Number CHE-106.787.764) is a licensed bank regulated by the Swiss Financial Market Supervisory Authority FINMA.

- Saxo Banque (France) SAS is licensed as a Credit Institution by the Bank of France (Registration Number: 483632501 R.C.S. Paris).

- Saxo Bank A/S is licensed by the Danish Financial Supervisory Authority and operates in the UAE under a representative office license issued by the Central Bank of the UAE.

- Saxo Bank - Representative Office is licensed by the Central Bank of the U.A.E. as a Representative Office (Registration number: 2017/995/13).

- Saxo Bank Securities Ltd. is licensed by the Japanese Financial Services Agency (Registration Number: 239).

- Saxo Capital Markets Hong Kong Ltd. is licensed by the Securities and Futures Commission in Hong Kong (Registration Number 1395901).

- Saxo Capital Markets (Australia) Pty. Ltd is licensed by the Australian Securities and Investments Commission (ASIC) (Registration Number: 126 373 859).

Saxo Bank, remaining loyal to its transparency, publishes all documents and information on their website. Traders can rest assured that their capital is in the best hands the global financial system has to offer.

Retail traders can read through the Key Information Document (KID) for each asset class in order to fully understand what it is before committing capital to it.

While Saxo Bank is regulated across the globe and their website is accessible by everyone, the company points out that all clients will deal directly with Saxo Bank A/S and governed by Danish law.

Client funds are held in segregated accounts and Saxo Bank fully complies with all regulations. Each regulator will have different requirement and Saxo Bank fully satisfies all of them. In addition, being a Danish Bank, client deposits are guaranteed by the Guarantee Fund up to €100,000. This only applies to retail clients- institutional clients are not covered.

Saxo Bank is also at the forefront of fighting money laundering as required by its regulators.

Clients, regardless if they just start out or are seasoned professionals, who seek a safe, secure and trustworthy multi-asset broker will definitely find a home at Saxo Bank.

Fees

Average Trading Cost EUR/USD | 0.7 pips ($7.00) |

|---|---|

Average Trading Cost GBP/USD | 1.1 pips ($11.00) |

Average Trading Cost WTI Crude Oil | $0.05 |

Average Trading Cost Gold | $0.55 |

Average Trading Cost Bitcoin | $90.65 |

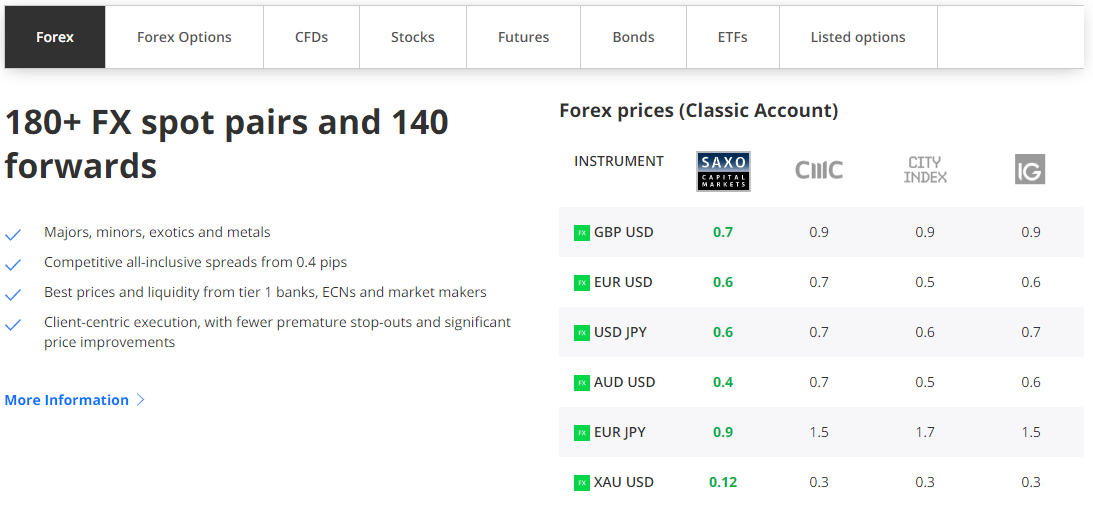

Saxo Banks earns its trading fees primarily from spreads, which are the difference between bid and ask prices, as well as from commissions charged and overnight financing rates on margin positions. Spreads start as low as 0.4 pips and commissions depend on the asset class but are as low as $1.25 per lot. Swap rates also apply and Saxo Bank offers better trading conditions to high volume traders.

Since Saxo Bank offer clients a full range of assets, financing is dependent on the type of asset traded. In order to make the pricing model transparent, clients can access the full range of pricing online where this broker has created a well-organized tool on their website. This makes it simple to navigate complete pricing for each asset class.

In addition, clients can access all trading costs involved from their Saxo Bank trading platforms by accessing “Account”, navigating to “Trading Conditions”, then to “CFD Stock/Index Instrument List” and finally to “Borrowing Rate”.

Other charges at Saxo Bank include the following:

- An account inactivity fee of €/£25 if only cash is held in the account for one quarter.

- Interest rate credit charges on accounts above €/£15,000 when applicable (interest rate debit is also paid).

- A 0.12% annualized fee on Bond, Stock and ETF/ETC positions with a minimum monthly fee of €/£10.

- Manual order fee of €50 for order placed over the phone.

- Transfer Out Fee if clients want to transfer exiting positions to another broker, €50 per ISIN (maximum of €160).

- Currency Conversion Fee at the mid FX Spot rate, plus/minus 1%.

- Carrying Cost at Margin requirement * Days held * (Relevant Interbank rate + Markup) / (365 or 360 days).

- Holding Fee at Nominal Value / 1,000,000 * Underlying Category Fee.

- Reporting Fee of €/£50 for requested online reports asked to be delivered via mail or email.

- FX Options Minimum Ticket Fee at a minimum €/£10 for positions below 50,000.

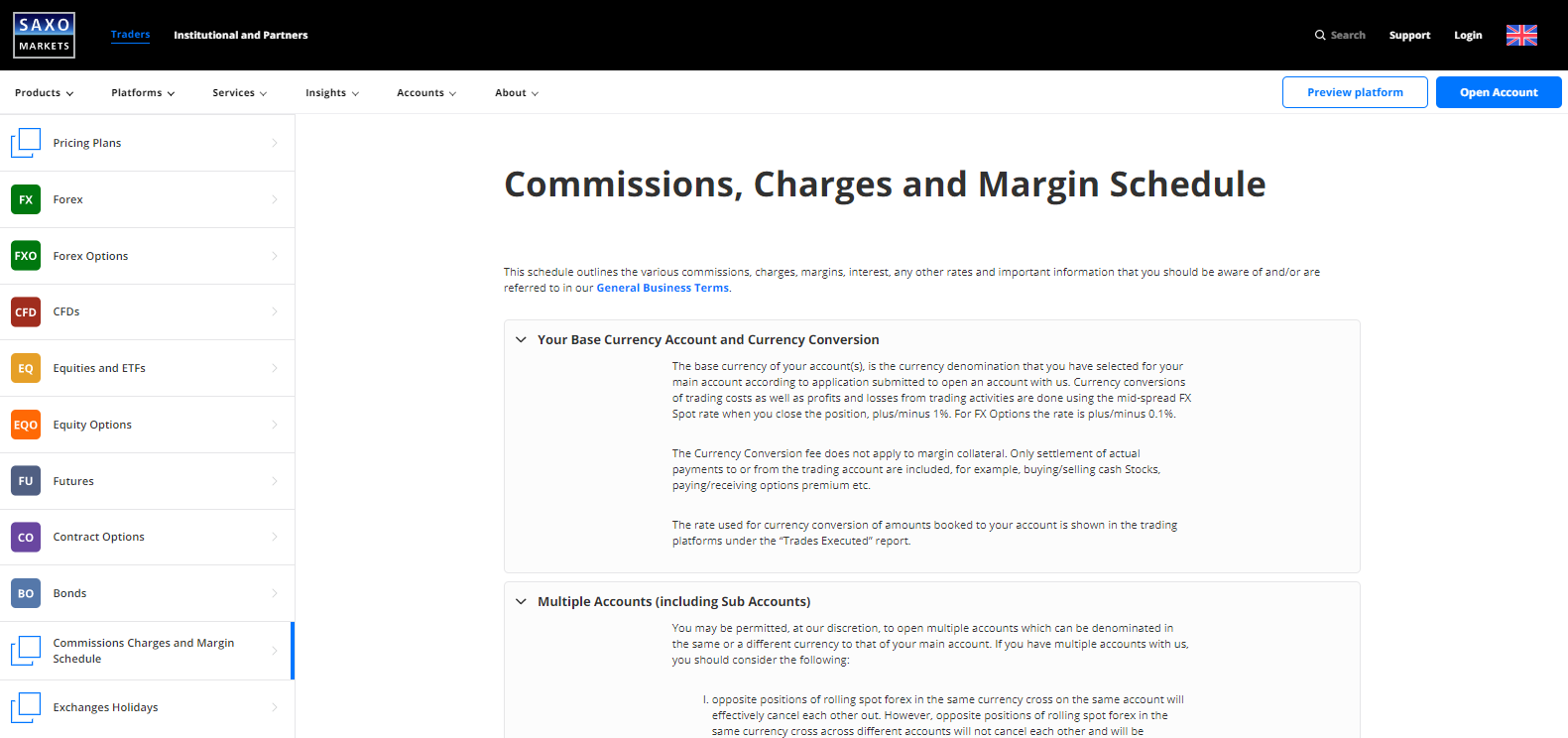

With the complexity and range of available assets for trading, comes a more complex fee structure. This may be very confusing for new traders who should take their time to read through all the provided information. While this may appear overwhelming to most retail traders, Saxo Bank is very transparent and lists all costs with examples under “Commissions, Charges and Margin Schedule”.

What Can I Trade

Saxo Banks offer traders over 35,000 assets in eight different categories and allows traders to operate a fully diversified portfolio.

Given the 35,000+ assets which are offered, traders may feel a bit overwhelmed, but rest assured; not all traders will trade all assets. While the online tools give great and transparent insight to what Saxo Bank offers, inside the trading terminal information will be eve easier to navigate through. Saxo Bank has done a fantastic job when it comes to asset selection, presentation, pricing and transparency. This may be too much for new traders, but a multi-asset broker should be part of any diversified asset management strategy.

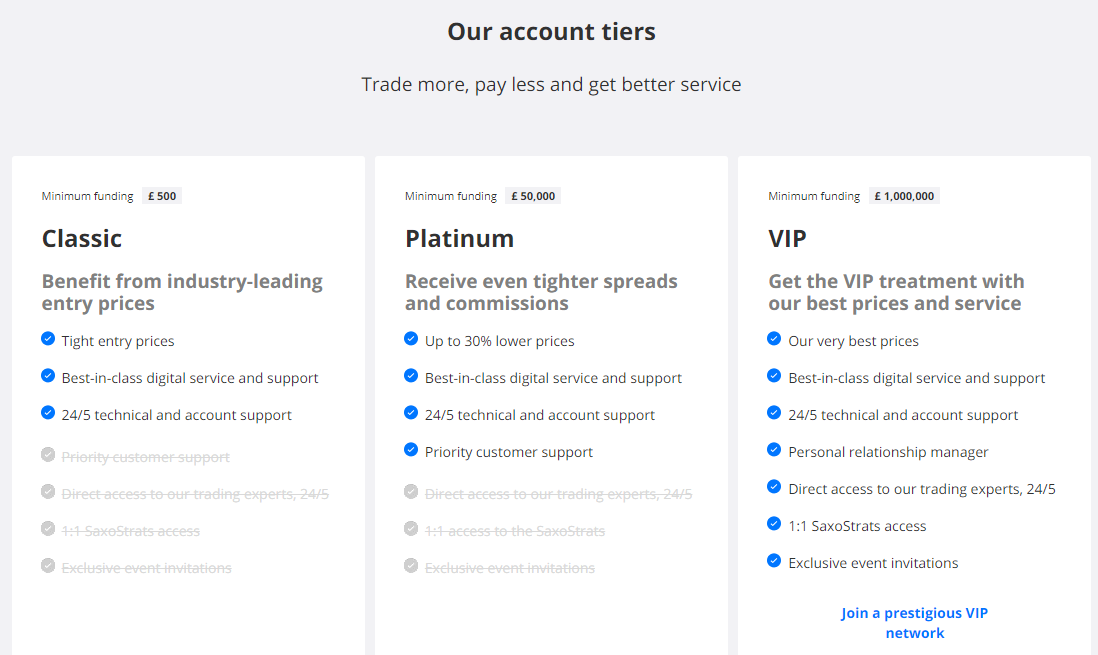

Account Types

Saxo Bank offers three different account types to all retail traders, with a joint account option as well as professional account option; they come with a different pricing model, service approach and additional packages. Different minimum deposits are required and traders can move up various tiers depending on trading frequency and volume. In addition, two specific UK account types are available together with a corporate account options and a trust fund account option for all global clients.

Saxo Accounts- Classic and Platinum

These are the two main account types for retail traders. The Saxo Account Classic comes with a minimum deposit of just €/£500 and will be the one where most retail traders will find their comfort zone at Saxo Bank. In order to qualify for a Saxo Account Platinum Account, a minimum deposit of €/£50,000 is required, but as a result the spreads are decreased by up to 30%. This makes a big difference to the growth of portfolios. Saxo Bank offers a VIP account for deposits above €/£1,000,000.

After an account is opened, the clients is placed in a tier which represents their deposit, but after three months account activity is reviewed and clients may be moved into a higher tier without making an additional deposit. This can allow traders to advance to better trading conditions even if the minimum deposit amount is not satisfied and offers great benefit to active, profitable traders who have smaller starting balances.

The above three tiers of personal accounts are also available as joint accounts between first-line family members.

Saxo Professional Account

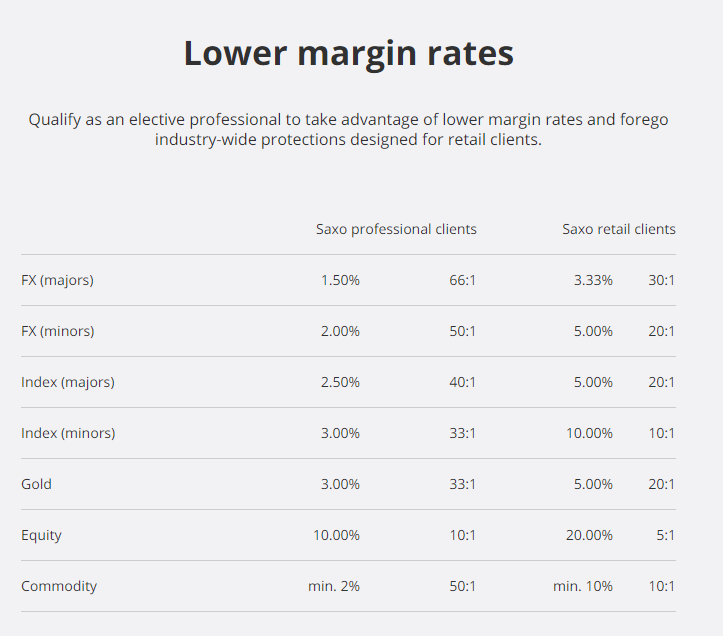

With the latest regulations, enhanced protection is awarded to retail traders which puts them at a slight disadvantage when it comes to certain key trading instruments. Professional accounts come with more leverage, less protection and require a minimum portfolio size of €/£500,000. One year of professional experience in finance is also required as is 10 significant trades placed over the past year. Securities may also be used as collateral for margin trading.

Saxo ISA Account

This account allows traders to take full advantage of the tax-free allowance, but is available to UK residents only. The current ISA allowance for the 2020 tax year is capped at £20,000 for which no capital gains or income tax will be charged. Leftover balances don’t roll over to the new tax year. Traders will have access to over 11,000 qualified assets under this account type.

Saxo Trust Account

This account is for trust fund managers who want access to global markets through the Saxo’s trading platforms and regulatory environment.

Saxo VIP Accounts

These accounts are available for individual as well as corporate clients, come packed with special features and come with a minimum deposit of €/£1,000,000.

Trading Platforms

Saxo Bank offers clients its proprietary trading platform, developed in-house. It comes in two versions, SaxoTraderGO and SaxoTraderPRO. Saxo Bank made a great effort to deliver its global traders a state-of-the-art trading platform, also available as a White Label Solution for partners. Forex traders who have grown used to the MT4 or MT5 trading platforms, as offered by most forex brokers, or who deploy EA’s based on that infrastructure, will be disappointed as Saxo Bank does not support them.

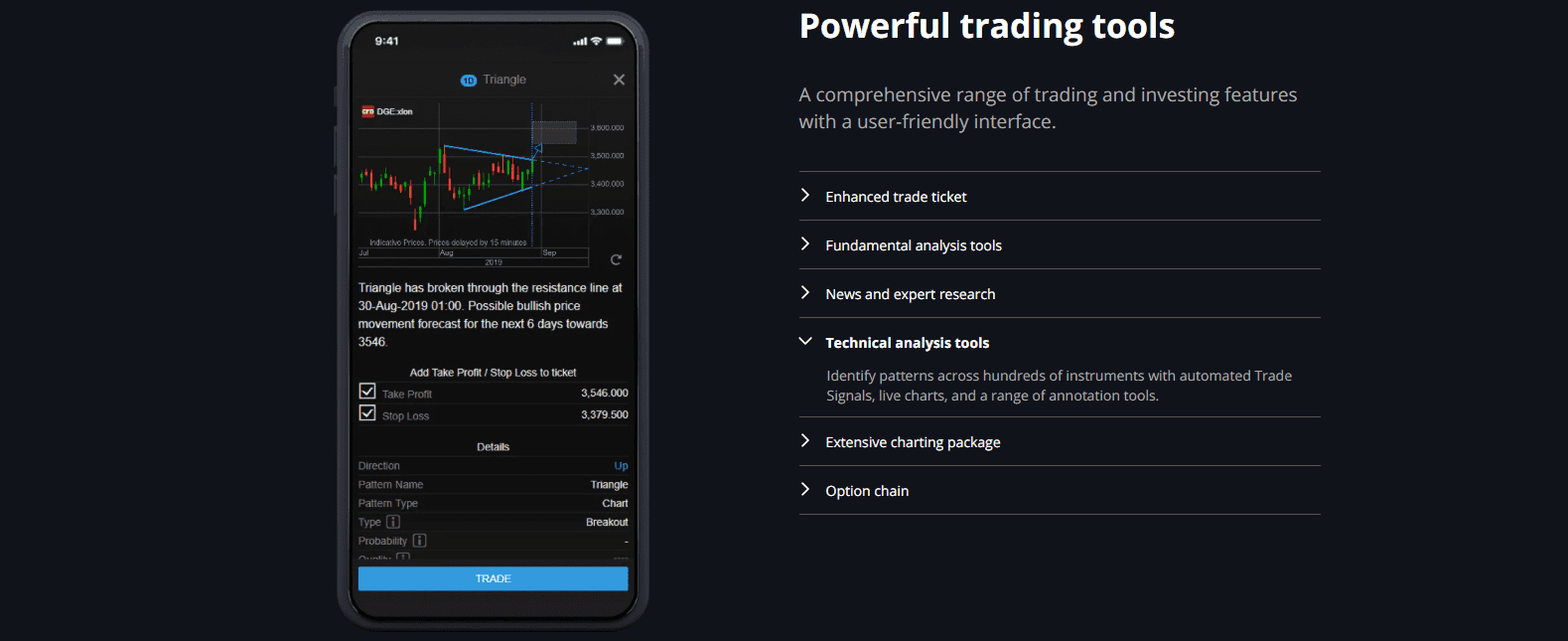

SaxoTraderGO is an award-winning webtrader, fully customizable, and also available as a mobile version. It includes an extensive charting package and fully supports manual analysis of assets with a wide range of fundamental and technical analytics tools. They include equity insights provided by SaxoStrats and third-party TipRanks, streaming news and market commentary, and more than 40 technical indicators. Automated trade signals assist traders in navigating the broad asset selection, while the option chain grants excellent hedging opportunities.

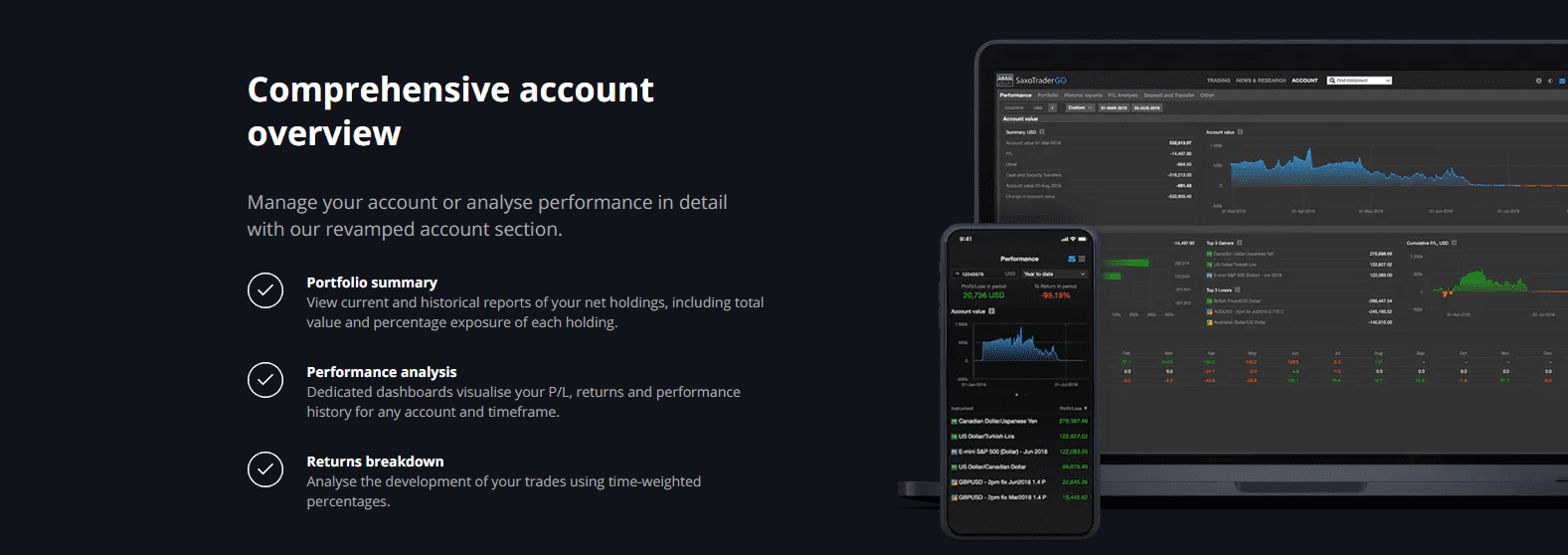

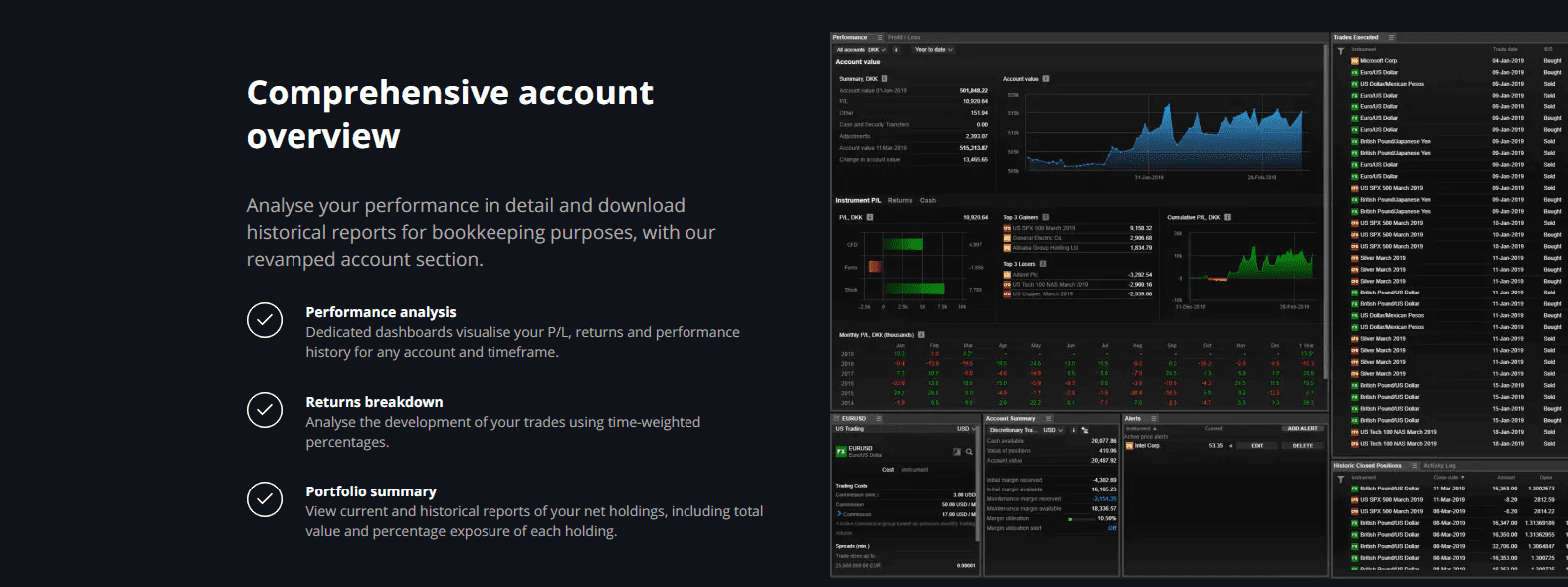

The comprehensive account overview, besides a portfolio summary, includes performance analysis and returns breakdown. It allows traders to identify necessary adjustments to their trading strategy and improve overall profitability. Protecting the bottom line is a set of risk management tools featuring a margin breakdown on each position, margin alerts, and an account shield. SaxoTraderGO represents an excellent trading platform for manual traders, while automated trading solutions are not supported.

SaxoTraderGO offers manual traders a superior trading experience over industry-standard MT4.

The comprehensive account overview allows traders to fine-tune their trading strategy.

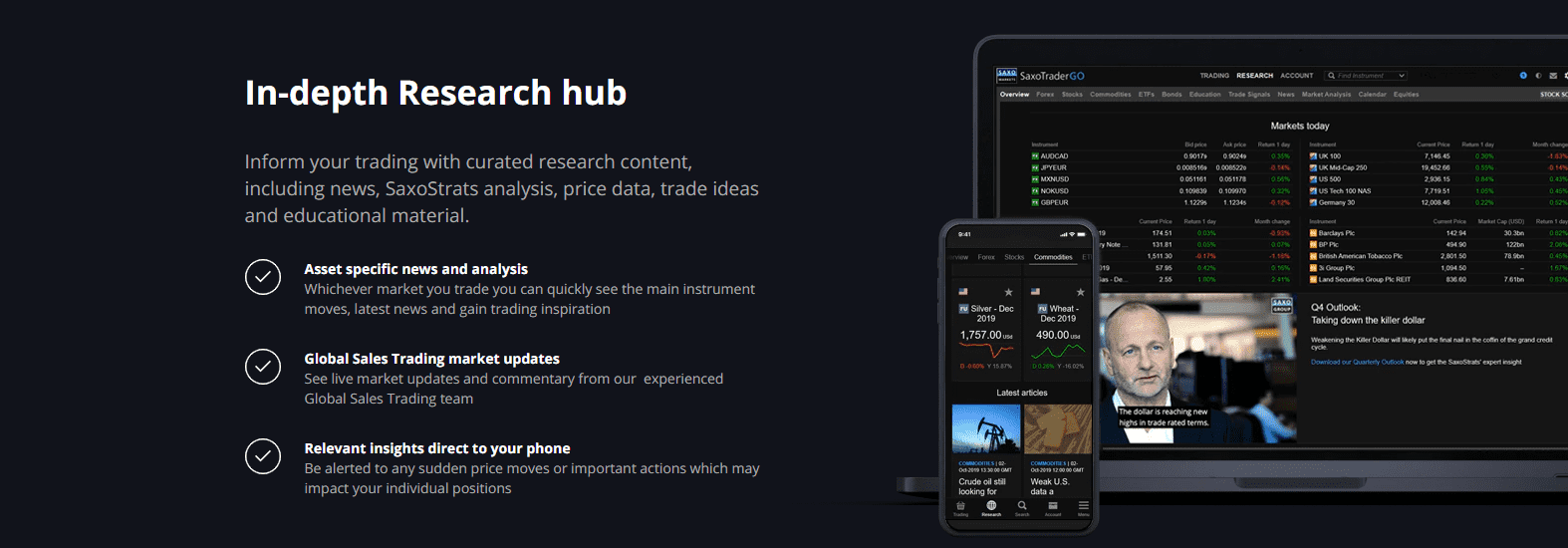

A comprehensive research hub assists traders in taking informed positions.

Risk management tools ensure the protection of the bottom line.

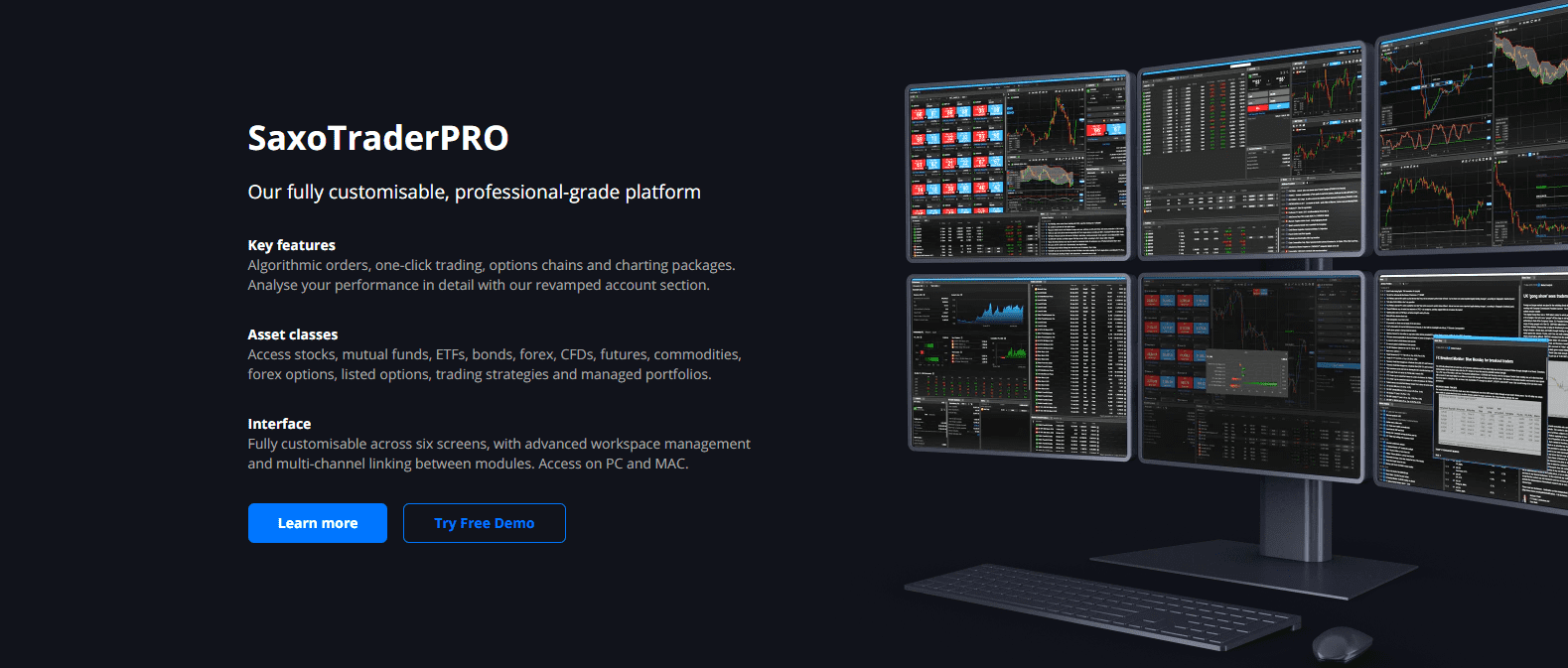

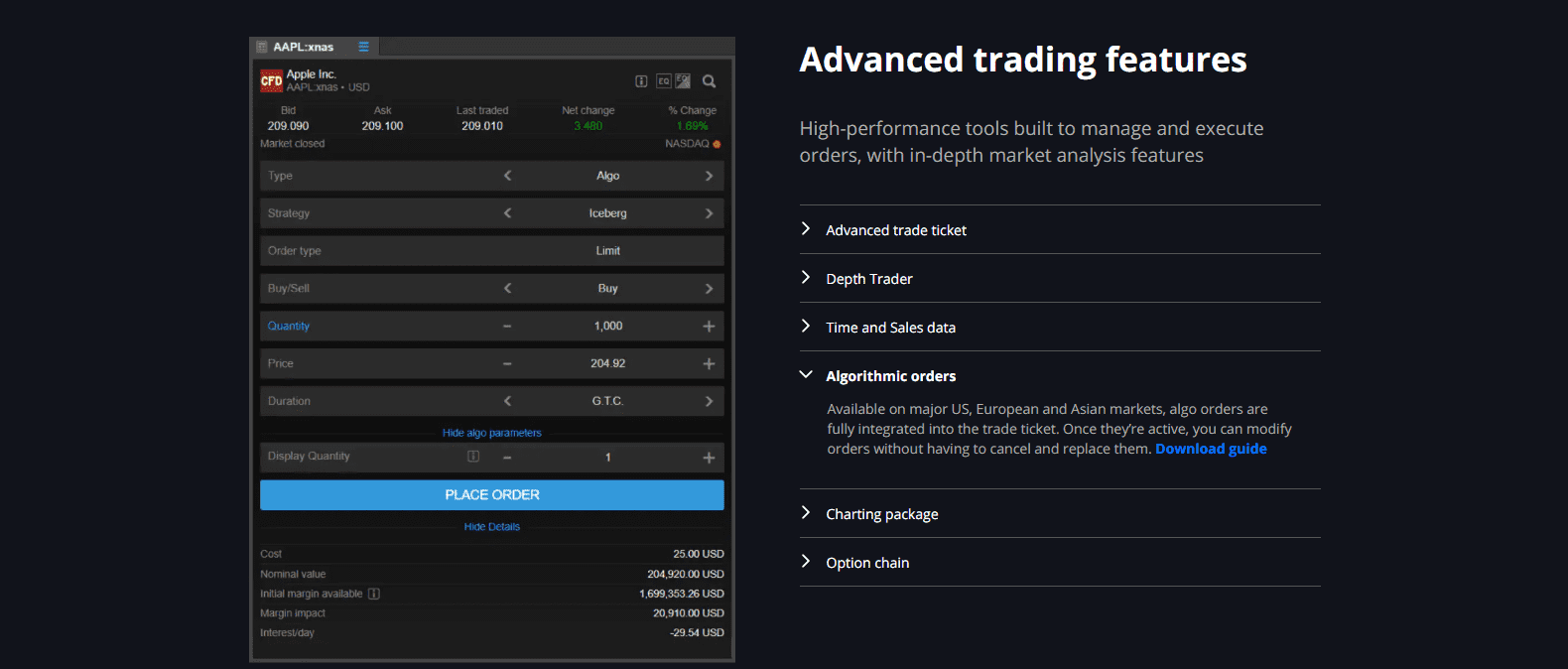

SaxoTrader Pro, the desktop trading platform, offers the same core elements as SaxoTraderGO but can be split to cover six screens. It delivers a professional trading approach and a complete overview of trading operations. Multi-channel liking between modules creates an efficient gateway to financial markets. One of the most significant advantages is the support for algorithmic trading as part of the advanced trading features, while the account overview is enhanced and more detailed. SaxoTrader Pro is one of the most advanced trading platforms available and deserves a genuine consideration by committed traders.

SaxoTrader Pro is fully customizable across six screens.

Algorithmic trading represents a necessary improvement over SaxoTraderGO.

The detailed account overview allows for proper portfolio management.

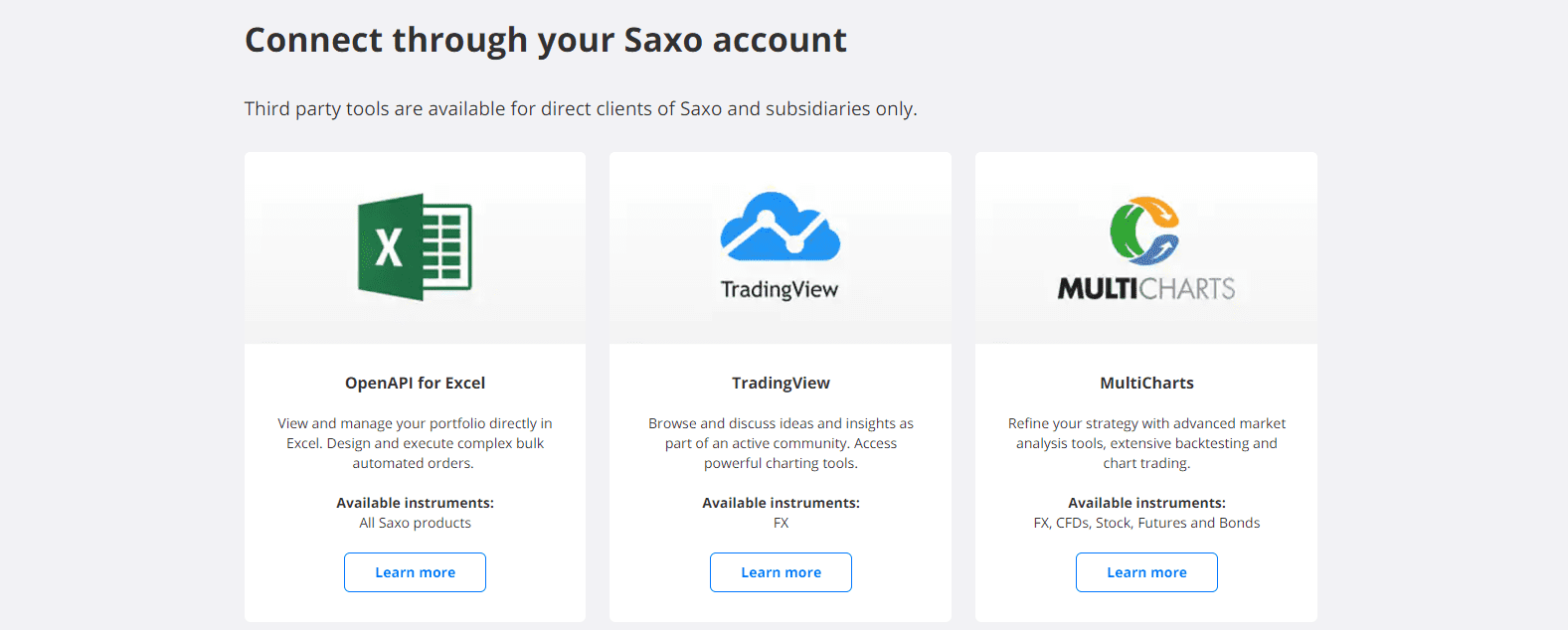

Saxo Bank offers APIs to allow third parties to connect and interact with the SaxoTraderPRO. Direct clients and subsidiaries may manage accounts via Excel, connect through TradingView, or utilize MultiCharts. Saxo Advanced Solutions features FIX and Open API, supporting the development of third-party trading applications with full access to the Saxo Bank market portfolio. The advanced features are not available to retail clients, who have access to algorithmic trading as is available inside of the SaxoTraderPRO platform. SaxoTraderGO does not support automated trading solutions, the sole drawback as compared to the retail-favorite and developer-friendly MT4 trading platform.

Saxo Bank supports integration with Excel, TradingView, and MultiCharts.

FIX and Open API support third-party development of automated trading solutions.

Unique Features

The unique features at Saxo Bank are its transparency, its asset selection and services offer to traders as well as its proprietary trading platform. The Saxo Advanced Solutions, which consist of its API offering as well as support for third party platforms. Saxo Bank has partnered with over 100 global financial institutions who offer services based on the Saxo Bank range of services and technology. This is clearly geared towards the high-end market spectrum of finance.

Research and Education

Saxo Bank comes packed with educational material in the form of video courses, webinars and events while their market research is also superb. Saxo Bank has eight analysts and strategists under their SaxoStrats Experts brand who are responsible for covering the asset classes which are offered to its clients. It is clear that this broker values its research team and understands the importance of this service, not only to clients but as an international investment bank.

The courses are great for beginners to learn the basics and get introduced to the available assets. The simple and clear videos make it easy for new traders to get caught up and build a foundation from where they can grow. The webinars are hosted by the Saxo Bank experts in the field, though no webinars were on the calendar at the time of this Saxo Bank review.

The market research is very well-organized and reflects the professionalism of the brokerage. Market research is published daily and if nothing else, clients get fresh ideas and a different look which adds value to the trading day.

Research

The research is broken down into the following nine different categories: market analysis, forex, macro, equities, quarterly outlook, thought starters, outrageous predictions, recession watch and IPOs. This makes it easy to navigate and traders can find what interest them most without wasting time.

Education

This is divided in the following three categories: courses, webinars and events. Saxo Bank experts host the webinars and events while the video courses are top of the line.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |          |

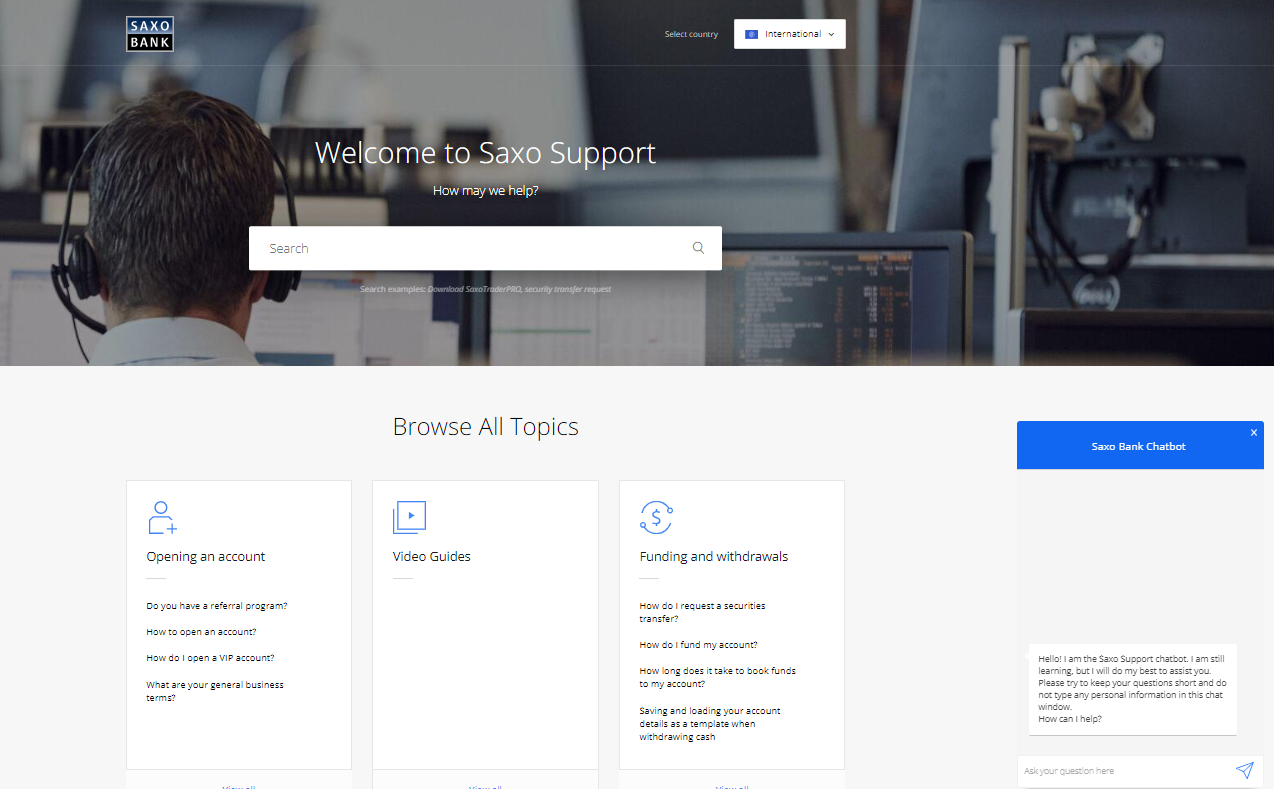

Saxo Bank attempted to create an intuitive trading environment where support is not required. A comprehensive online database has been created which covers all key support topics and a chat bot is also available. A support ticket can also be created from inside the trading platform and if necessary, there is phone support around the world. While the support feature may never be used, clients can rest assured that Saxo Bank stands by in order to address any issues which may arise. Given the overall excellent performance of this broker, support should be expected to match that quality.

Bonuses and Promotion

Saxo Bank doesn’t offer any bonuses or promotions to traders on deposits, but their multi-tier classification system offers incentives for frequent and high-volume traders.

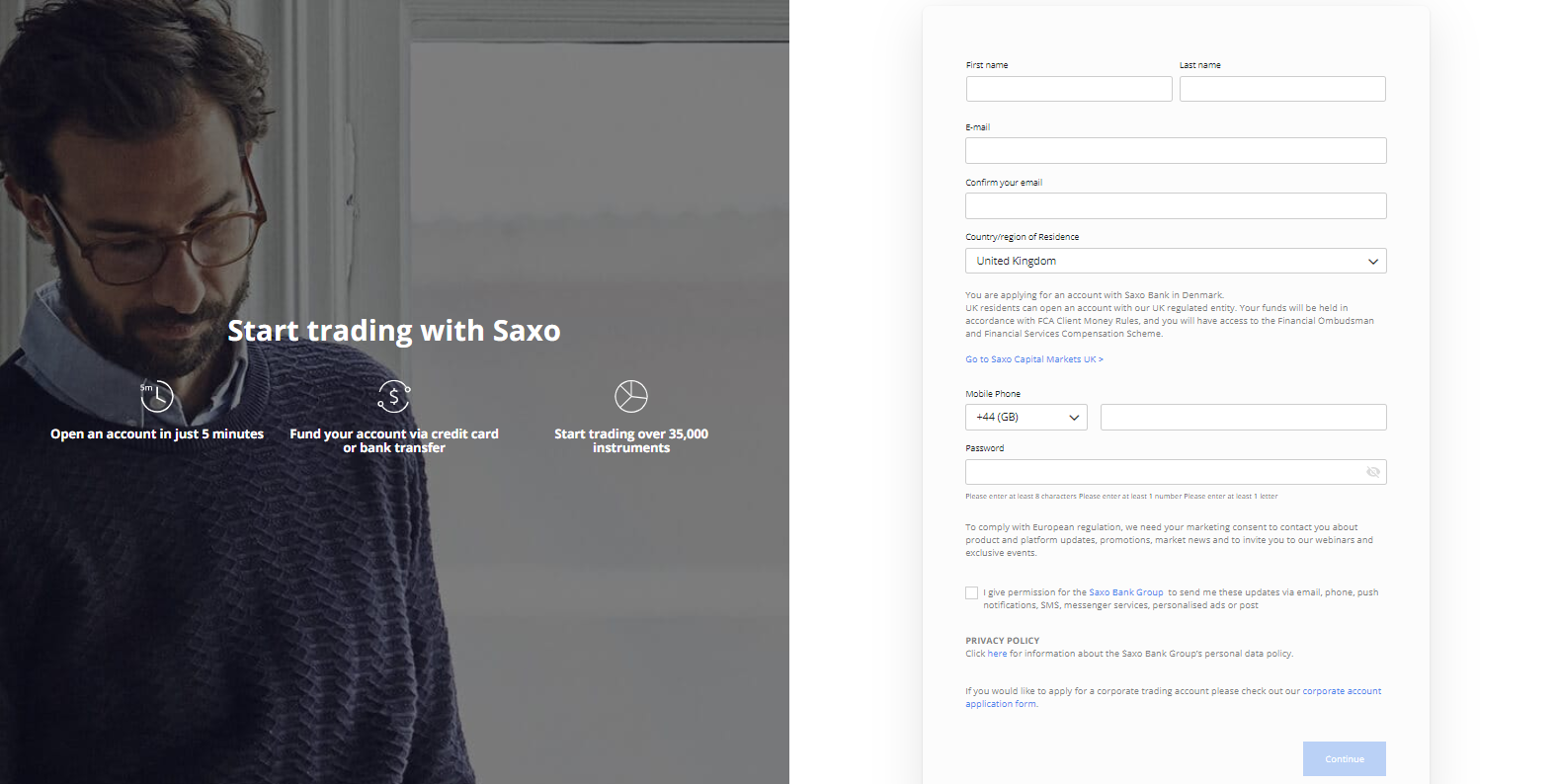

Opening an Account

Opening an account is done through a very simple online form and takes roughly five minutes. Normal verification documents need to be submitted in order to comply with KYC and AML regulations, but the entire process should go very smooth and clients will be able to access their account within minutes.

Deposit and Withdrawals

Saxo Bank offers credit and debit card deposits as well as wire transfers. Third-party payment processors are not supported. The process is handled entirely from inside the trading platform. Saxo Bank doesn’t charge for deposits. Withdrawals are handled free of charge through the Online Cash Withdrawal Module, unless a manual funds withdrawal form is submitted which is subject to a $40 charge. Correspondence banks may also charge fees. The way Saxo Bank handles this aspect remains the only weak spot. There is nothing wrong, but this seemsrather outdated and given that Saxo Bank is a fintech company it would be nice if they implement methods of asset transfers which are leading the industry.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Summary

Saxo Bank is as good as it can get from any type of brokerage. It is a well-regulated investment bank, brokerage and fintech company and developed its own proprietary trading platform which is far superior to the standard MT4/MT5 trading platforms. A true global brokerage with an outstanding multi-asset selection, traders have over 35,000 assets to trade across eight asset classes. While Saxo Bank is definitely geared towards more sophisticated traders, professionals and institutional clients, retail traders can get in with a relatively small deposit of just €/£500.

The multi-tier classification is a great incentive for frequent and high-volume traders. Saxo Bank is well capitalized, clients enjoy great protection and an innovate educational course as well as top class research team make this broker a go-to choice for over 800,000 clients across the world. Thanks to its honest and transparent nature, Saxo Bank continues to expands globally every trader who is serious about managing a long-term and well diversified portfolio should make Saxo Bank part of their daily trading operations. Saxo Bank is a fully licensed European bank with its headquarters in Copenhagen, Denmark. Saxo Bank makes money from spreads and commissions charged across asset classes. It also charges for financing and custodial fees. Saxo Bank offers credit and debit cards as well as bank wires. Saxo Bank has a minimum lot size requirement of 0.01 standard lots for currency pairs (1,000 units in their trading platform). All minimum trade sizes can be obtained from the trading platform. Saxo Bank will issue alerts depending on assets. There is an initial margin and maintenance margin, details can be obtained from the trading platform and are visible in each order ticket. Yes, Saxo Bank is regulated across several different global financial centers with its main regulator the Danish Financial Supervisory Authority (FSA). Leverage depends on account type and asset class, there is no universal leverage level. Saxo Bank offers a quick and digitized online application form. No, Saxo Bank offers its proprietary trading platform.FAQs

Where is Saxo Bank based?

How does Saxo Bank make money?

How can I deposit into a Saxo Bank account?

What is the minimum lot size at Saxo Bank?

When does a margin call take place at Saxo Bank?

Is Saxo Bank regulated?

What is the maximum leverage offered by Saxo Bank?

How do I open an account with Saxo Bank?

Does Saxo Bank offer the MetaTrader Trading Platform?