eXcentral Editor’s Verdict

eXcentral is a South African CFD broker owned and operated by investment firm OM Bridge PTY. It promises fast order execution and professional trading tools in its MT4 trading environment. It relies on account managers who frequently contact clients, and many report a push for deposits. I reviewed this broker to conclude if you should trust eXcentral and their bold marketing slogans. Does eXcentral live up to their promises, or should you avoid them?

Overview

An expensive South African broker

eXcentral is a South African CFD broker owned and operated by investment firm OM Bridge PTY. It promises fast order execution and professional trading tools in its MT4 trading environment. It relies on account managers who frequently contact clients, and many report a push for deposits. I reviewed this broker to conclude if you should trust eXcentral and their bold marketing slogans. Does eXcentral live up to their promises, or should you avoid them?

Headquarters | Cyprus |

|---|---|

Regulators | CySEC, FSCA |

Year Established | 2019 |

Execution Type(s) | Market Maker |

Minimum Deposit | 250$ |

Trading Platform(s) | MetaTrader 4 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

eXcentral – First Look:

- Expensive commission-free cost structure.

- Manipulated swap rates via internal mark-ups, unsuitable for leveraged trading.

- Reports of withdrawal issues and trading restrictions if traders become consistently profitable.

- Services by third-party provider Trading Central.

- eXcentral lacks transparency concerning its management team.

- High leverage.

- Discontinued blog and unresponsive live chat.

eXcentral Main Features

Retail Loss Rate | 80.06% |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 2.5 pips |

Minimum Commission for Forex | Commission-free |

Commission for CFDs/DMA | Commission-free |

Commission Rebates | No |

Minimum Deposit | $250 |

Demo Account | Yes |

Managed Account | No |

Islamic Account | No |

Inactivity Fee | Progressive after two months between €80 and €500 |

Deposit Fee | Third-party |

Withdrawal Fee | Yes + Third-party |

Funding Methods | 4 |

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. eXcentral presents clients with two regulated entities.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Cyprus | Cyprus Securities and Exchange Commission | License Number 226/14 |

South Africa | Financial Sector Conduct Authority | License Number 48296 |

Reasons I prefer the South African subsidiary:

- Higher leverage

- Negative balance protection

- Competitive regulator

- Segregation of client deposits from corporate funds

- Flexible trading conditions

What is missing?

- Third-party insurance

- Financial Commission membership

- Profiles of core management

Noteworthy:

- Despite two trusted regulators, traders continue to allege malpractice and fraud, urging regulators to suspend their operating license.

- Scam reports have surged over the past year, with claims of account managers asking for more deposits before honoring withdrawal requests.

- Transparency remains an issue at eXcentral.

The lack of transparency concerning the core management team of eXcentral, the absence of operational experience, and the alarming allegations of malpractice make me conclude that traders should approach this broker with extreme caution. Both regulators failed to act despite mounting evidence warranting regulatory action.

Fees

I rank trading costs among the most defining aspects when evaluating a Forex broker, as they directly impact profitability.

eXcentral offers traders the following cost structure:

- Commission-free trading costs where floating spreads in the Standard account commence from an expensive 2.5 pips or $25 per round lot.

- The average spread during the most liquid trading time was 4 pips for the EUR/USD.

- The VIP account list minimum spreads at 0.9 pips or $9, but eXcentral fails to provide minimum requirements and support ignores requests.

Noteworthy:

- Forex costs are over 1,500% more expensive at eXcentral versus competitors offering commission-free spreads as low as 0.6 pips.

What is missing at eXcentral?

- A properly priced cost structure, favoring trader profitability.

The average trading costs for the EUR/USD in the commission-free eXcentral Absolute Zero account:

Average Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

4.0 pips | $0.00 | $40.00 |

My recommendation for Forex traders considering eXcentral is to carefully consider the high trading costs and weigh them against the withdrawal issues. The combination of high trading costs, lack of transparency, and absence of trust are not conditions traders should accept from any broker.

Here is a screenshot of MT4 quotes at eXcentral during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- eXcentral manipulates swap rates in its favor, making leveraged trading impossible as the fees will drain the account balance.

MT4 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-free eXcentral Absolute Zero account.

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

4.0 pips | $0.00 | -$39.72 | X | $43.72 |

4.0 pips | $0.00 | X | -$38.39 | $42.39 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

4.0 pips | $0.00 | -$278.04 | X | $282.04 |

4.0 pips | $0.00 | X | $268.73 | $272.73 |

My additional comments concerning trading costs at eXcentral:

- Swap rates are unacceptable with internal mark-ups to drain leveraged trading accounts, rendering any Forex overnight strategy unprofitable.

- After two months of dormancy, a monthly inactivity fee of €80 applies, which increases to €500 after twelve months.

- eXcentral does not list a currency conversion fee.

What Can I Trade

Forex traders at eXcentral are offered a selection of 47 Forex currency pairs and 11 cryptocurrency pairs. While this is not enough for demanding traders, eXcentral caters primarily to first-time traders who have a wide enough choice of assets to get started.

Equity traders get access to large-cap names trending on social media, suitable for most retail traders but unfit for demanding traders.

What is missing?

- I am missing mid-cap and small-cap alternatives from the equity CFD list.

- A broader selection of index CFDs.

- eXcentral does not offer ETFs.

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

ETFs |

eXcentral Leverage

eXcentral offers traders maximum leverage of 1:400. While I usually recommend it for active traders as it presents more overall trading flexibility, directly influencing profitability, swap rates at eXcentral make leveraged trading unprofitable.

Other things I want to note about eXcentral leverage:

- The Cyprus subsidiary limits maximum leverage to 1:30 in accordance with local law.

- eXcentral lists contradicting leverage information on its website, with 1:30 on its home page and 1:400 under product specifications.

- Negative balance protection exists, ensuring traders can never lose more than their deposit.

eXcentral Trading Hours (GMT +2 Server Time)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Monday 00:05 | Friday 23:55 |

Forex | Monday 00:00 | Friday 23:45 |

Commodities | Monday 00:00 | Friday 23:45 |

European CFDs | Monday 10:00 | Friday 18:30 |

US CFDs | Monday 16:30 | Friday 23:00 |

Noteworthy:

- Equity markets open and close each trading day and are not operational continuously like Forex and cryptocurrencies.

- eXcentral does not offer 24/7 cryptocurrency trading, making this asset class very challenging to trade.

I recommend the following step for MT4 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

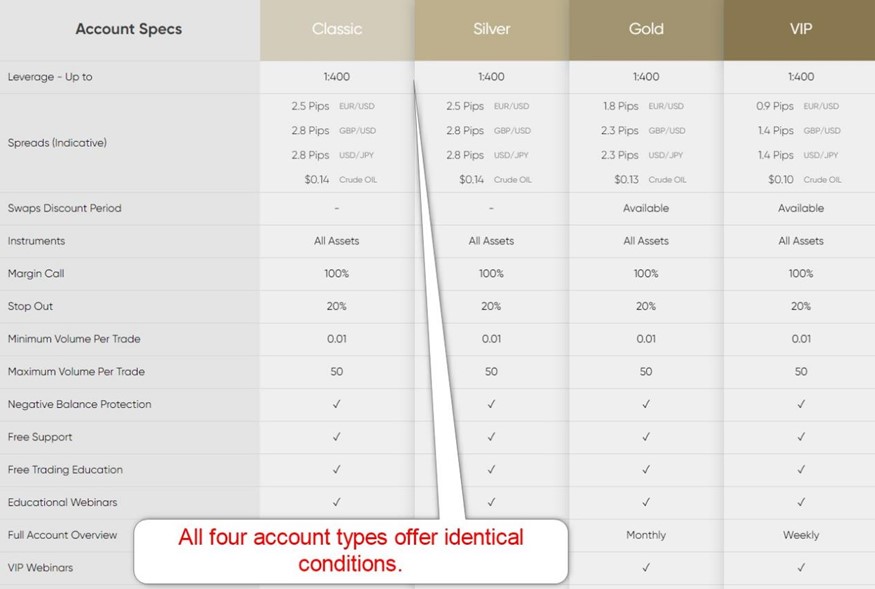

While eXcentral offers four account types on their website, Classic, Silver, Gold, and VIP, they are all identical except that extremely high trading costs decrease to just very high.

My observations concerning the eXcentral account types:

- All four account types favor broker revenues rather than trader profitability, and only beginner traders might accept the conditions due to a lack of awareness.

- The minimum deposit for the Classic account is $250, and eXcentral does not provide information on the other three, preferring to have an account manager cold call and push for higher deposits.

- Additions such as account overviews and VIP webinars attempt to give the account upgrades relevance, ignoring the needs of active traders.

- The benefit of the VIP account is a weekly review from an account manager, an intrusive service, resulting in more phone calls from the sales department to push for more deposits.

- The primary difference in the account types is in the spreads available.

- The educational opportunities available deprive those who need education and offer it to traders who do not need them anymore.

- Leverage remains fixed for all account types, without the necessary risk management tools for active traders with higher deposits.

- Industry-high swap rates make leveraged overnight trading unprofitable, as the financing fees will drain account balances.

My recommendation:

- I can only recommend that traders think twice about the outrageous trading costs at eXcentral, which make this broker unsuitable for committed traders.

- eXcentral deploys practices intended to drain account balances rather than maintain a competitive trading environment.

- Traders who achieved consistent profits reported restrictions on their accounts to prevent execution of their strategies, and I urge all traders to consider this before proceeding.

eXcentral Demo Account

eXcentral offers unlimited MT4 demo accounts. It presents traders with an ideal environment to test EAs and new strategies.

My recommendation:

- MT4 offer flexible deposits, and traders should select a nominal balance equal to whatever they plan to eventually deposit into a live trading account, to ensure maximum authenticity.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

eXcentral offers traders the out-of-the-box MT4 trading platform, available as a desktop client, webtrader, or mobile version. The EU subsidiary, which has a white label solution many Cyprus-based brokers use, also has a web-based trading platform. It features a cleaner user interface and advanced order tickets with detailed information. It is not available for non-EEA traders, which I find disappointing.

MT4, which fully supports algorithmic trading and has an embedded copy trading platform, receives the Trading Central MT4 plugin, which upgrades the substandard core version into a notably superior trading solution.

What is missing?

- API trading is not available

- More MT4 upgrades

My observations:

- Traders with MT4 EAs must use the desktop client

- VPS hosting is not available

Overview of Trading Platforms

MT4 | Yes |

|---|---|

MT5 | No |

cTrader | No |

Proprietary/Alternative Platform | No |

Automated Trading | Yes |

Social Trading / Copy Trading | Yes |

MT4/MT5 Add-Ons/Upgrades | Yes |

Guaranteed Stop Loss | No |

Negative Balance Protection | Yes |

Unique Feature One | Trading Central MT4 plugin |

Unique Feature Two | Research and education by MTE Media |

Unique Features

Unfortunately, the unique feature of this new broker is the lack of transparency and allegations of malpractice, fraud, and cold calls by sales personnel pretending to be account managers.

Research and Education

The Trading Central MT4 plugin provides traders with quality third-party research. eXcentral also partnered with MTE Media, a leader in the financial education market, for a comprehensive research package. eXcentral scatters the content generated by MTE Media over five sections, which I find unnecessary.

Services by Trading Central and MTE Media also account for the educational content at eXcentral, which I find acceptable as an introduction to trading.

My takeaways:

- Services by Trading Central and MTE Media present traders with quality research and educational services.

- The Market Summary and the Live Market Summary sections allow traders to take positions from the screen.

- Traders get several trading videos generated by MTE Media in the Daily Chart Analysis section.

- Market News features written market commentary.

- eXcentral stopped updating its blog many months ago.

My recommendations:

- Traders can evaluate copy trading features embedded in MT4.

- MT4 has thousands of EAs, and traders may explore them to determine if they suit their trading style.

- Manual traders get quality trading signals from Trading Central.

- Beginner traders should source in-depth educational content elsewhere before trading at eXcentral.

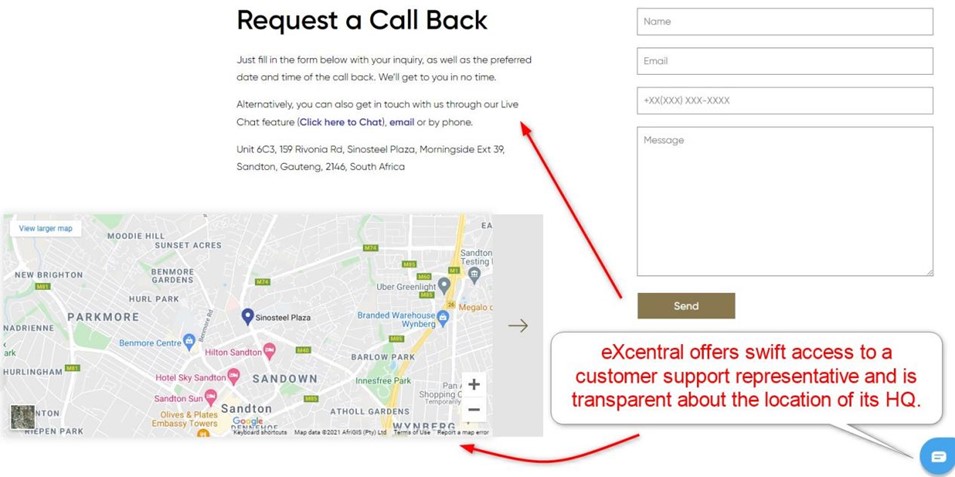

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

eXcentral offers support via live chat, available on each page. Traders may also call, request a call-back, send an e-mail, or fill out the webform. eXcentral does not list support hours, but traders should expect regular business hours.

An FAQ section helps for the most common queries. Most traders are unlikely to require assistance, but it remains easily accessible.

My observations:

- Traders should read the FAQ section before reaching out to a customer service representative.

- For non-urgent questions, I recommend live chat.

- Phone support is ideal for urgent questions.

- eXcentral fails to provide access to its finance department.

Bonuses and Promotions

At the time this review of eXcentral was written, no bonuses or promotions were available. eXcentral does maintain an affiliate program for traders interested in a passive revenue stream.

Opening an Account

The eXcentral online application form takes less than 20 seconds to complete, offering new traders access to the back office. In compliance with AML/KYC requirements, account verification is mandatory. Most traders will be able to satisfy it by sending a copy of their ID and one proof of residency document.

Minimum Deposit

The eXcentral minimum deposit is $250. eXcentral maintains higher account tiers but fails to provide information on their requirements which is strange.

Payment Methods

eXcentral offers bank wires, credit/debit cards, Skrill, and Neteller.

Accepted Countries

eXcentral caters to most international traders, including the UK, Singapore, New Zealand, and India. Like most international brokers, eXcentral does not accept traders from the US.

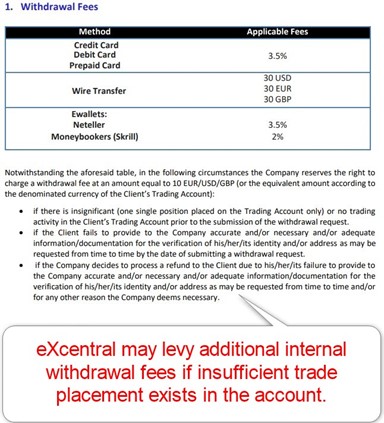

Deposits and Withdrawals

Traders will conduct all financial transactions from the secure back office of eXcentral. The deposit and withdrawal options remain notably limited, which I find disappointing.

The worryingly high number of traders alleging withdrawal issues or requests by account managers to deposit more money before they honour a withdrawal request is something traders should consider before opening an account and depositing with eXcentral.

My observations:

- Accepted deposit currencies are EUR, USD, GBP, CHF, JPY, RUB, and ZAR.

- The minimum withdrawal amount is $50 for credit/debit cards and $100 for bank wires.

- An account manager will reach out no later than the eighth day of a withdrawal request to confirm it, which is when traders report requests for more deposits or refusal to honor it.

- eXcentral reserves the right to levy a $10 internal withdrawal fee plus third-party costs.

- Cryptocurrency deposits and withdrawals are not available.

- The transparency, processing times, and overall withdrawal procedure remain unnecessarily complex, and many traders report issues with receiving withdrawals.

My recommendations:

- Traders should select the payment processor with the lowest fees.

- I also recommend checking the costs from the payment processor to the bank account unless a debit/credit card is available.

- It is ideal to use an option besides the bank or credit/debit card used for day-to-day financial operations.

The Bottom Line

I cannot recommend the trading environment at eXcentral due to high trading costs and the large number of allegations by traders alleging malpractice, fraud, and withdrawal delays. eXcentral offers services by Trading Central and MTE Media, but they do not suffice to cover the shortfalls at this broker. Asset selection is OK for new traders who get started in their first trading account, while even advanced retail traders will run into limitations rather quickly. eXcentral is a broker with licenses from two regulators. eXcentral offers swift access to customer support, but the availability and response times remain unacceptable. eXcentral operates as a duly registered broker within the legal framework. The secure back-office handles all financial transactions, but the process remains complex, and many traders report withdrawal issues. eXcentral has its headquarters in Gauteng, South Africa. eXcentral earns its money from spreads and as a counterparty from clients' losses. Traders can deposit into their eXcentral trading account through bank wires, credit/debit cards, Skrill and Neteller. The minimum trading size is 0.01 lots. eXcentral initiates a margin call at a 100% equity margin level and closeout at a 50% equity margin level. OM Bridge PTY, the owner and operator of eXcentral, is authorized and regulated by the South African Financial Sector Conduct Authority (FSCA) under FSP license number 48296. The CySEC license number is 226/14. The maximum leverage is 1:400. eXcentral has an online application form which is the standard operating procedure. Yes, eXcentral offers the MT4 trading platform.FAQs

Is eXcentral legit?

Is eXcentral support legit?

Is eXcentral legal?

How do I withdraw from eXcentral?

Where is eXcentral based?

How does eXcentral make money?

How can I deposit into an eXcentral account?

What is the minimum lot size at eXcentral?

When does a margin call take place at eXcentral?

Is eXcentral regulated?

What is the maximum leverage offered by eXcentral?

How do I open an account with eXcentral?

Does eXcentral offer the MetaTrader Trading Platform?