Fondex Editor’s Verdict

Fondex is an online Forex and CFD ECN/STP brokerage launched in 2010. They are headquartered in Cyprus and are regulated by CySEC, in common with many similar brokerage firms who choose a domicile in the Republic of Cyprus.

Overview

Cyprus Unregulated 2010 ECN/STP $0 cTrader 0.5 pips ($5.00) 0.8 pips ($8.00) $0.03 $0.22

Fondex offers traders the opportunity to trade an extremely wide range of instruments wrapped as CFDs (Contracts for Difference), offering over one thousand tradable instruments across six asset classes, even including a selection of Exchange Traded Funds (ETFs). In addition to ETFs, Fondex offer trading in over 80 Forex currency pairs and crosses (including cryptocurrencies), over 900 individual stocks and shares, 15 major global equity indices, the commodities of crude oil, natural gas, and several precious metals. Maximum leverage (on Forex) is restricted to 30 to 1 by ESMA regulations.

Accounts

Fondex differs from most brokers in offering clients a hybrid execution model of ECN/STP, allowing the opportunity of fast execution and natural spreads. A choice between two account types is offered: a Standard Account, or a Swap-Free Account. The Swap-Free Account is an “Islamic Account”, which removes the possibility of interest deductions or payments overnight, in accordance with the mainstream interpretation of Sharia law. In other respects, it is identical to the Standard Account.

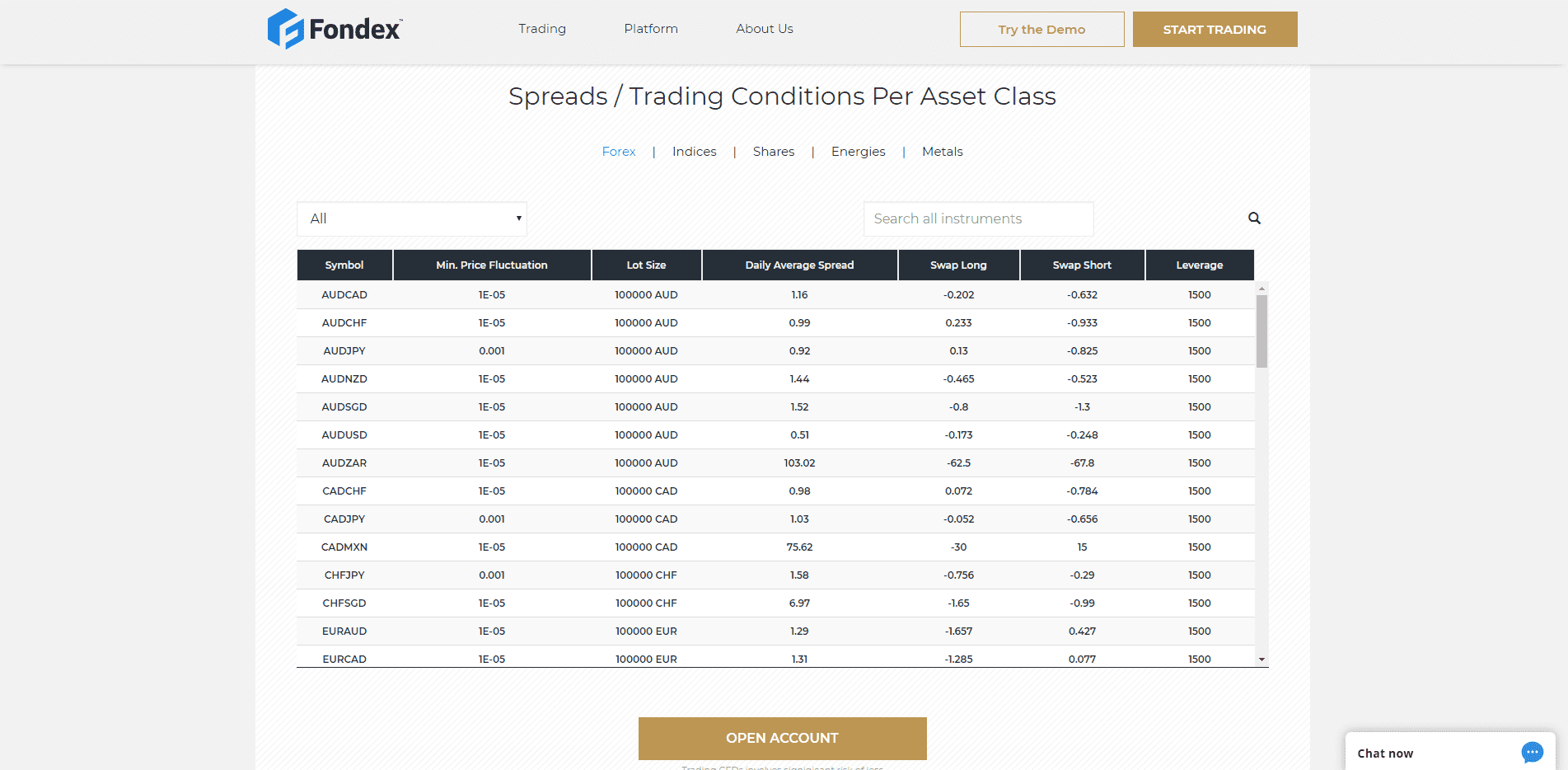

The Standard Account offers variable spreads from a minimum of 0, with no commissions on Shares, Indices, ETFs and Cryptocurrencies. Trades in other asset classes incur commissions of 0.0035% on the nominal values traded. Fondex claims to offer a daily average spread of 0.1 pips on the benchmark EUR/USD currency pair. As the standard commission equates to 0.35 pips, this is an effective round-trip fee of 0.63 pips, which is very competitive if true, especially for a brokerage which requires no minimum deposit.

All accounts offer a minimum trade size of 1 micro-lot (0.01 full lots).

Scalping and hedging are allowed, and automated trading is possible. This combination of advantages is something that is increasingly hard to find.

There is no choice of trading platform: all clients must use cTrader, either as a program or as its web-based or mobile versions.

Features

Manual traders may hedge, scalp, swing or position trade in over one thousand tradable instruments with no restrictions, at relatively low cost. The platform is also ideal for copy traders, strategy providers and algo traders or for clients who want to combine manual, copy and automated trading at the same time. An extremely wide range of assets are offered for trading, especially within the Forex universe.

Fondex, through the cTrader platform, provides the option of copy trading, and in turn allows traders the chance to further monetize their successful trading by registering as a Strategy Provider and choosing how to charge. Performance fees, management fees, and volume-based commissions are all options.

Automated trading may be undertaken through a dedicated capability of the cTrader platform. Fondex offer a selection of cBots with a range of trading strategies.

Education

Fondex offers no education section on its website. This may be interpreted as refreshing, as too often brokerages feel that this is a gimmick they must provide, throwing together some hastily arranged material which will allegedly turn novices into competent traders almost overnight. Fondex make no such claim but focus instead on assets, costs, and execution.

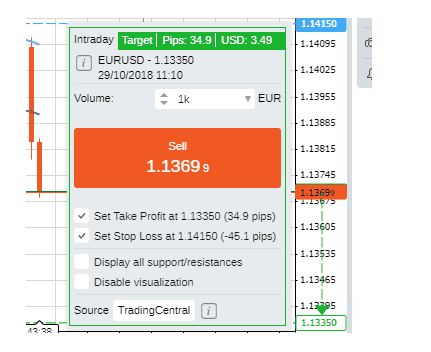

Fondex offer their clients daily technical analysis and market insights from Trading Central and trades can be placed this way with a single click as indicated in the screenshot below:

Bonuses and Promotions

Bonuses and promotions have been prohibited under European Union regulations, so are neither offered nor available to account holders.

Deposits/Withdrawals

Depositing funds into a Fondex account is an easy and secure process. Both may be made using a few different methods, including credit cards, debit cards, bank transfer, Neteller, and Skrill. Withdrawals are generally made through the same channel that deposits have been made through.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |        |

Customer support is based in Cyprus, offering business hours support in a range of languages.

Conclusion

Fondex has a well-rounded and professional offering for traders looking to trade a very wide range of assets in the form of CFDs, particularly in Forex, by use of an ECN/STP execution model. Fondex could be an especially attractive broker for clients with relatively small deposit size who wish to benefit from ECN execution and a low spreads / commissions model. Higher-volume traders may negotiate volume-based commission discounts.

Fondex Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 22:01 | Friday 21:59 |

Commodities | Sunday 23:00 | Friday 22:00 |

Crude Oil | Sunday 23:00 | Friday 22:00 |

Gold | Sunday 23:00 | Friday 22:00 |

Metals | Sunday 23:00 | Friday 22:00 |

Equity Indices | Sunday 22:50 | Friday 22:00 |

Stocks | Sunday 23:00 | Friday 21:00 |

ETFs | Monday 14:30 | Friday 21:00 |

Features

In terms of features, the stand-out strengths of Fondex’s offering are:

- An extremely wide range of instruments available for trading: over one thousand instruments across the asset classes of Forex currency pairs, global equity indices, gold, silver, crude oil, natural gas, ETFs, and individual stocks and shares.

- Competitive spreads, especially for small depositors.

- ECN/STP execution model.

- Choice of Swap-Free account types (Islamic account).

- Negative balance protection.

- Regulated by a major industry center (CySEC).

- Fondex is a well-established firm with a reputation earned reputation to protect.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

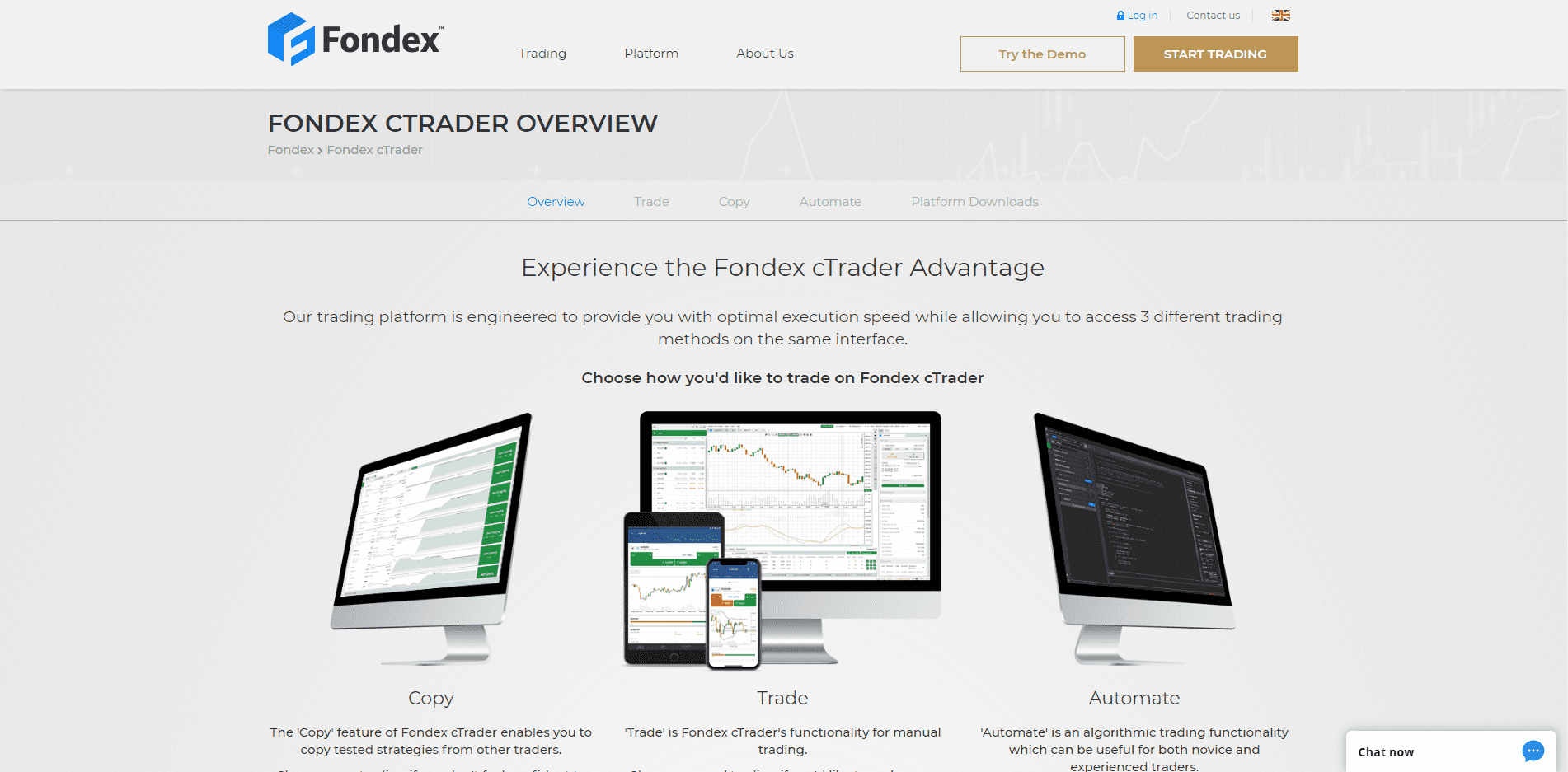

Fondex uses the cTrader, which is an innovative ECN (Electronic Communication Network) platform, designed specifically for FX trading and CFDs on spot gold and silver. cTrader is powerful and user-friendly using proven technology that can enable you to trade at a higher level.

cTrader enables clients to directly access a full range of liquidity. Accessing such liquidity providers ensures clients receive the lowest spreads and best price available in the market.

Features in the cTrader platform include Level II pricing, detachable charts, automated trading through a dedicated platform, next generation user interface and charting techniques and extensive back testing facilities. The newly updated cTrader gives traders access to manual, copy and automated trading from the same interface. The Fondex cTrader has many advantages over other platforms: Live sentiment indicator, 26 standard & 27 tick timeframes per chart type, Advanced Protection, Smart Stop Out, drag & drop trading on the chart, ability to close your positions with one click and double or reverse your positions with one click.

cTrader is a more recent platform in Forex trading. Access is similar to MetaTrader 4, including Apple compatibility, but there are a few additional bells and whistles that make it worth your while to test out on their free demo system. The latest technology in 128-bit SSL protection routines are utilized to encrypt all trading session and personal data, providing peace of mind from any unexpected compromise from the hacking community.