The best high-leverage Forex / CFD brokers are the ones that deliver high leverage along with an honest and well-regulated service, which let you trade what you want to trade under good execution conditions, and which offer competitive fees.

Of these brokers, the ones that will be best for you will depend upon where you live, what you want to trade, and your trading style and frequency.

Our team of researchers looks at the brokers in the retail Forex / CFD industry offering highly leveraged trading and selects the very best ones. We choose these high-leverage brokers by researching and judging all aspects of their offerings, giving greater weight to the most important factors, such as fees and regulatory status. We only feature the high-leverage brokers that top the list, highlighting the areas where they are especially strong.

For over a decade, DailyForex has been the trusted Forex broker authority, helping traders identify the best platforms to meet their specific needs. Our broker ratings are compiled using a rigorous comparison process that examines regulation, trading conditions, and unique features. Whether you're looking for brokers in your region or those offering cutting-edge tools like copy trading or algorithmic strategies, our curated lists are designed to simplify your broker search.

All Round Best High Leverage Forex / CFD Broker

At DailyForex, we rate the overall best high leverage broker as IFC Markets, because it offers:

- High maximum leverage of 1:400.

- Negative balance protection.

- Very competitive trading fees on major Forex currency pairs.

- A full range of asset classes to trade.

Top Brokers at a Glance

- IFC Markets, 1:400 maximum Forex leverage with floating spreads from 0.4 pips.

- Octa, A commission-free broker with a proprietary copy trading service.

- FP Markets, ECN trading with leverage up to 1:500.

- BlackBull Markets, 1:500 maximum leverage with ultra-low trading fees and deep liquidity.

- Eightcap, 1:500 maximum leverage and cutting-edge trading tools.

Best High Leverage Forex / CFD Trading Brokers Comparison

|  |  |  | ||

Regulators | BVI, FSCA, LFSA | CySEC, FSCA, MWALI International Services Authority | ASIC, CMA, CySEC, FSCA | FMA, FSA | ASIC, CySEC, FCA, SCB |

Year Established | 2006 | 2011 | 2005 | 2014 | 2009 |

Execution Type(s) | ECN/STP | Market Maker | ECN/STP | ECN/STP, No Dealing Desk | ECN/STP, Market Maker |

Minimum Deposit | |||||

Average Trading Cost EUR/USD | $4.00 | 0.9 pips | 1.2 pips | 1.1 pips | 1.0 pips |

Average Trading Cost GBP/USD | $24.00 | 1.3 pips | 1.4 pips | 1.55 pips | 1.2 pips |

Average Trading Cost Gold | $45.00 | $0.30 | $0.16 | 0.12 pips | $0.12 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform, NetTradeX | MetaTrader 4, MetaTrader 5, Proprietary platform | MetaTrader 4, MetaTrader 5, cTrader, Proprietary platform, Web-based | MetaTrader 4, MetaTrader 5, cTrader, Trading View | MetaTrader 4, MetaTrader 5, Trading View |

Islamic Account | |||||

Negative Balance Protection | |||||

| Visit Website | Visit Website | Visit Website | Visit Website | Visit Website |

Broker Review Summaries

IFC Markets

In Summary 1:400 maximum Forex leverage with floating spreads from 0.4 pipsIFC Markets offers a high maximum leverage of 1:400 on Forex currency pairs. This broker employs a tiered leverage model to manage risk: traders with portfolios under $50K receive 1:200, equity between $50K–$100K is capped at 1:100, and above $100K it drops to 1:50; positions exceeding $20 million see a further reduction, to 1:20.

IFC Markets offers floating spreads on Forex from 0.4 pips, and requires no minimum deposit, presenting no barrier to client entry. The broker offers a choice of over 30,000 instruments via their Portfolio Quoting Method (PQM) and traders can use platforms such as MT4, MT5, or the proprietary NetTradeX. IFC Markets is also known for providing free educational content, and commission-free account pricing. The combination of flexible high leverage and choice of trading platforms makes IFC Markets appealing to active traders seeking high leverage.

Pros & Cons

- High leverage up to 1:400 available for Forex.

- Tiered risk management.

- Minimum deposit is only $1.

- Tight floating spreads.

- Maximum leverage decreases with higher equity.

Octa

In Summary A commission-free broker with a proprietary copy trading serviceFounded in 2011, Octa is a “Straight Through Processing” (STP) broker, which means they do not have an internal dealing desk. They simply connect buyers and sellers directly. With this model, Octa aims to be more cost-effective than anyone else in the market. They offer low spreads and claim 97.5% of trades are executed without slippage.

Octa offers their clients a choice of three Forex trading platforms: the world’s most popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5). All of these can be traded as a desktop application, and on Android and iOS devices.

Octa is an unregulated broker but continues to earn the trust of traders around the globe, with more than 1,500,000 accounts opened. One reason for the ongoing success of this market maker is appealing bonus campaigns. This broker paid out almost $3,000,000 in bonus funds. Octa offers traders the MT4 and MT5 platforms, and a proprietary mobile trading platform. Octa additionally grants their clients Autochartist, but traders require a Silver Level in the Status Program. Traders have a choice between fixed and floating spreads, and the overall cost structure remains competitive.

Asset selection remains the distinct weakness at Octa, making it most suitable for new retail traders. A series of short educational articles offers a basic Forex introduction, and this broker maintains an excellent arsenal of research and analytics tools.

Pros & Cons

- Quick withdrawals and deposits

- 0% commission and no overnight charges

- Space with personalised trading ideas

- Customer Support 24/7

- Mobile copy trading services available only for Android

FP Markets

In Summary ECN trading with leverage up to 1:500FP Markets offers high leverage to its traders, up to 1:500 on Forex and certain commodities and indices. Traders in non‑tier‑1 jurisdictions can access the full 1:500, while those under ASIC and CySEC are capped at 1:30, reflecting compliance with local regulations. Cross‑asset leverage limits include 1:500 for forex/commodities, 1:100 for indices, 1:50 for cryptocurrencies, and 1:20 for equity CFDs/ETFs. Users can easily adjust leverage tiers—ranging from 1:1 to 1:500—via their client portal. ECN/STP execution via Raw accounts—all with just a $100 minimum deposit.

Combined with tight raw spreads (from 0.0 pips + $6/lot) and access to MT4/MT5/cTrader with advanced tools and VPS hosting, FP Markets serves both high-leverage seekers and cost-conscious traders. With global regulation (ASIC, CySEC, FSCA, CMA) and negative balance protection, it blends maximum leverage flexibility with strong risk controls.

Pros & Cons

- High leverage up to 1:500 available for Forex.

- Flexible leverage by the asset class.

- Good offering for scalpers and day traders.

- Typical risks of using high leverage.

BlackBull Markets

In Summary 1:500 maximum leverage with ultra-low trading fees and deep liquidityBlackBull Markets is an ECN broker a maximum leverage up to 1:500 on major Forex currency pairs for clients under its New Zealand (FMA) and Seychelles (FSA) entities.

BlackBull allows traders to manually adjust leverage per trade, offering greater control over exposure. Tiered leverage adjustments apply as position sizes grow—for example, smaller BTC/USD trades might be allowed an initial maximum leverage of 1:100 but reduce to 1:50 or 1:20 for larger lot sizes. This combination of high maximum leverage with adjustable and tiered settings allows experienced traders to fine‑tune their risk levels.

Leverage across asset classes follows regulatory limits where applicable. In more highly regulated jurisdictions, minor FX pairs and Gold are usually capped at about 1:20, share CFD around 1:5, and crypto CFDs usually even less at 1:2.

Pros & Cons

- Up to 1:500 leverage on major FX currency pairs and metals.

- Scaled leverage structure for large positions.

- Manual leverage adjustment.

- Leverage offered across all account types.

- High leverage will magnify any losses.

Eightcap

In Summary 1:500 maximum leverage and cutting-edge trading toolsEightcap offers maximum leverage up to 1:500 for Forex clients registered under its offshore entity, Eightcap Global Ltd (Bahamas). For clients with accounts regulated by ASIC (Australia), FCA (UK), or CySEC (EU) jurisdictions, the maximum retail leverage is limited to 30:1 on major currency pairs, according to the relevant local regulation.

The maximum leverage offered by Eightcap varies by asset class: Gold typically can be traded with leverage up to 1:100, commodities up to 1:10, and stock CFDs around 1:5 (depending on jurisdiction). Eightcap is well-known for having a strong crypto CFD offering, which as an asset class may be capped as tightly as 1:2, or be offered as high as 1:20, depending upon the jurisdiction. Dynamic leverage is applied, where larger position sizes are allowed proportionately less maximum leverage.

Traders can manually adjust leverage settings on each trade, which offers a lot of flexibility in risk management.

Pros & Cons

- High maximum leverage up to 1:500.

- Wide asset coverage across classes.

- Dynamic margin adjustment.

- Manual leverage control.

- Local regulatory limits reduce maximum leverage in some countries.

What is High Leverage?

The first question is, what is leverage?

Leverage is when your broker lends you money to trade with, and you trade a position size bigger than the money or value (account equity) in your account.

For example, let's say I have $1,000 cash in my account. I buy 0.01 lots of the USD/CAD currency pair, where 1 lot is worth $100,000. I have purchased $1,000 worth of USD/CAD, the same as my account size, so I am unleveraged.

Now let’s image I still have $1,000 cash in my account, but I buy 1 lot of the USD/CAD currency pair. My real leverage now is 1:100, because for every $1 I have in my account, I bought $100 worth of USD/CAD, up to the total amount of $100,000.

I would lose my entire account if the trade went against me with just a 1% move. On the other hand, if the trade moved in my favour by 1%, it would double my account equity.

The second question is, what is high leverage? Consider that in the corporate world leverage of only 1:1.3 is considered normal. In the Forex industry, some traders consider anything over 1:3 as high, but it is more accurate to say Forex leverage higher than 1:30 is generally considered high.

Unfortunately, the Forex/CFD industry has a reputation of offering excessive leverage. The good news is, you don’t have to trade with extremely high leverage – it is under your control.

What Effect Can High Leverage Have?

Using leverage magnifies both your losses and wins – it is a double-edged sword.

For example, if your real leverage on a trade is 1:2, if you win, your win will be doubled. If you lose, your loss will be doubled.

What are the Risks of High Leverage?

- Amplified losses – at very high rates of leverage, it is possible to lose a quarter, half, or even all of your account on a single trade.

- Margin calls and forced liquidation – if you are highly leveraged and the trade goes significantly against you, your broker might ask you to close the position, and if you do not, your broker can close it for you.

- Increased sensitivity to market volatility – in volatile markets, high leverage can be catastrophic.

Tips for managing risks in high-leverage trading

- Consider using a guaranteed stop loss order. This can stop negative slippage causing you to lose more than you expected to. However, guaranteed stop losses can be quite expensive at the brokers which offer them.

- Always use a hard stop loss.

- Err on the side of caution. Be careful and always know exactly how much your real leverage on a trade is. If your trade position size is larger than your account equity, you are leveraged. Dividing trade size by account equity gives your real leverage factor.

- Do not enter high-leverage trades just before high-impact news events or when volatility is unusually high.

What are the Advantages of High Leverage?

There is one real advantage of high leverage: when you win, you can make a lot of money quicky compared to your account size. However, this is not without an equal risk of large losses.

Many traders who seek to generate large profits through prop firms might consider using a high leverage broker instead of a prop firm. After all, if you can trade in a way that passes the typical challenge of a prop firm, you could probably make just as much money trading your own money using high leverage.

Are there fees associated with high-leverage trading?

There are no special extra fees in high leverage trading, but keep in mind that as trade position sizes are unusually large for your account size when you use high leverage, proportionate trading fees are going to be high, such as:

- Spreads / Commissions

- Overnight Financing (Swap)

Note that by using a commission-based account, you might be able to get a better deal than by using an account which charges spreads alone.

How Much Leverage Should I Use?

It depends on your risk tolerance. One method many traders use to make this call is to calculate a worst-case scenario of losses and then scale that, so at most, it would cause a 20% loss. The scaling ratio then gives you your leverage.

For example, let's assume that I have an account with $1,000 and that the worst maximum drawdown (consecutive loss) I think I might have is 5%. I just divide 20% by 5%, which gives me a leverage ratio of 1:4.

Note that in corporate finance, a maximum leverage ratio of only 1:1.3 is typically considered a suitable maximum. Generally, most traders are too aggressive with leverage – you do not need to trade Forex at a relatively high 1:30 leverage to make money unless you are undercapitalised, which is a separate problem.

Remember that if you do not use a guaranteed stop loss – which is expensive – you should use a hard stop loss, if you are leverage. Yet slippage, where the price moves so quickly through your stop loss that it is only executed at a notably worse price, when combined with high leverage, can be very deadly.

If your account is small and represents only a fraction of your liquid wealth, if your broker offers negative balance protection, you might be relaxed about losing the entire account. In this situation, you might afford to use very high leverage.

Is It Important to Find a Regulated Broker When Trading with Leverage?

It is always important to use a regulated broker, and even more so when trading with high leverage, as your account is more vulnerable to losses. So, it will pay off to make sure your broker is not working against your interests, and this will probably be easier to ensure with well-regulated brokers.

Can I Lose More than my Initial Deposit in High-Leverage Trading?

Not if your broker, or at least the regulator regulating your account, offers negative balance protection. This has become more commonly offered since the 2015 Swiss Franc flash crash.

Are Spreads and Commissions More Important When Trading with High Leverage?

If you are trading position sizes which are large for your account, you will also be paying trading fees which are large for your account, such as spreads and commissions. Some brokers offer commission-based accounts which are capped, and this type of account might give better value on trading fees for highly leveraged traders.

Does Execution Speed Matter in High Leverage?

Execution speed itself is not especially important when trading with high leverage, but slow execution can allow slippage to happen. Slippage can be either negative (your trade is executed at a worse price) or positive (your trade is executed at a better price). Beware of negative slippage, which is more likely to happen in volatile or news-driven market conditions.

Which Countries Restrict Maximum Leverage?

There are several countries whose regulators have imposed limits on the maximum leverage that a broker can offer. These tends to be more developed countries. There are some other countries, which are often offshore centres, that allow brokers to offer any maximum leverage they want.

Brokers that are regulated in a country imposing maximum leverage will impose those limits on their clients.

Some brokers are regulated in different countries with different rules on maximum leverage. In these cases, much will depend upon where the client lives, with most brokers not allowing offshore accounts to traders living somewhere else where the broker is regulated.

If you live in a country with a maximum leverage cap, and you want to trade at a higher leverage, your best chance is to look for a broker that is not regulated where you live.

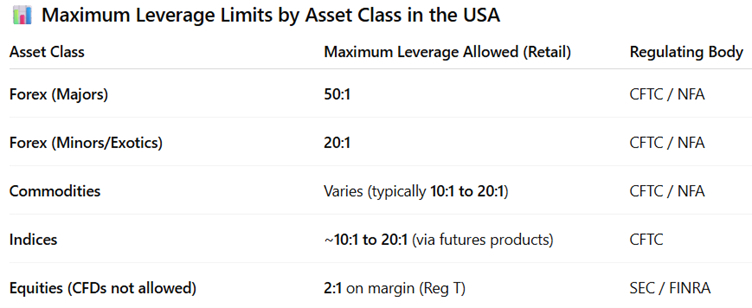

Note that where maximum leverage limits exist, they differ by asset class.

Let’s look at the most important jurisdictions where the regulator limits the maximum leverage.

Leverage in the USA

Leverage limits in the USA are quite strict and subject to several regulators:

- SEC (Securities and Exchange Commission)

- FINRA (Financial Industry Regulatory Authority)

- CFTC (Commodities Futures Trading Commission)

- NFA (National Futures Association)

Leverage in the EU / UK / Australia

Leverage limits in the UK are very strict and subject to regulation by the FCA (Financial Conduct Authority). The limits shown below are the same in the European Union, although each EU country has a separate regulator. The Australian regulator ASIC (Australian Securities and Investments Commission) copied the same limits, so the data below applies to all these jurisdictions.

How to Choose the Best High-Leverage Forex Brokers

The first step is to decide what maximum leverage you need and for what asset classes. Next, as you compile a shortlist of candidate brokers, this is the first criteria you should check.

Once you are clear on how much leverage you need, check your shortlist and narrow accordingly by the following extra criteria:

- Regulation & Safety – Well-regulated brokers are the safest, and brokers which are regulated are safer than unregulated brokers, which you should never use. Check whether client money is properly segregated accounts, and whether the broker offers negative balance protection.

- Leverage by Asset Class – Brokers typically offer different maximum leverages on different asset classes. Look beyond the headline rate a broker quotes and drill down to the detailed maximums, so you don’t get disappointed later.

- Trading Costs – With high leverage, trading costs can become very significant because your position sizes will tend to be relatively large. Compare typical spreads, commissions, and swaps on whatever you want to trade. It might make sense to go for a broker offering a little less leverage than you ideally wanted if that broker is cheaper than the other option.

- Trade Execution – High-leverage trading usually requires sharp execution, so investigate the broker’s record on that.

- Suitable Account Types – The choice of account types offered should have at least one solution which makes sense for your trading style.