The XAU/USD pair rose %0.55 over the course of the week as concerns over escalating conflict between Ukrainian troops and pro-Russian rebels in eastern Ukraine increased desire for the relative safety of gold. However, the bulls continue to suffer as a direct result of a strengthening American dollar. It seems that the gold market is caught between safe-haven bid from the geopolitical tensions and improving economic data from the United States. Obviously, the precious metal has been reacting positively to the fear factor, but the gains because of the safe-haven buying are not sustainable.

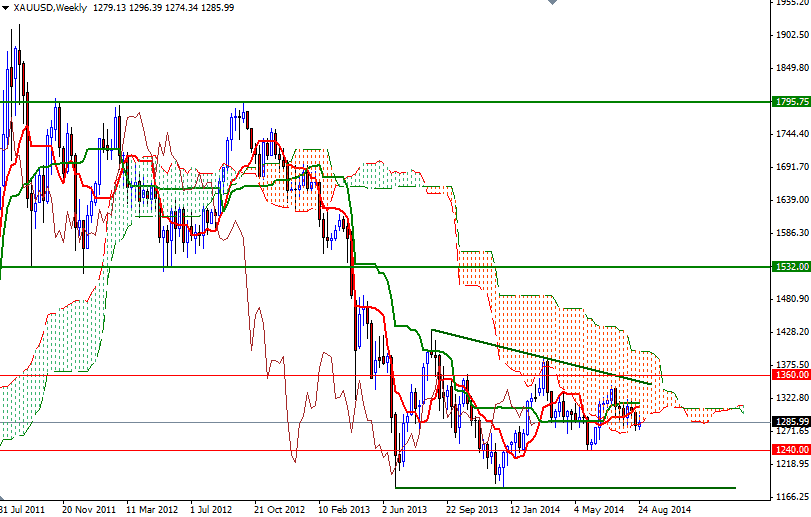

Gold prices are exactly at the same level where they were 5 months one year ago and since geopolitical events tend to be transitory, where the market may rally over the short-term but then tends to retreat quickly, market participants want to see if these price gains stick before getting more aggressive. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 113169 contracts (the lowest level in ten weeks), from 137976 a week earlier. Of course, the other side of the coin is U.S. economic data. Improving economy will give Federal Open Market Committee members the confidence to raise interest rates. Because of that, I still think that the descending triangle forming on the weekly chart will contain the market for the next several weeks. If you somehow insist on having gold as a disaster insurance, buying it against the Euro (or possibly the Japanese yen) might be a better option.

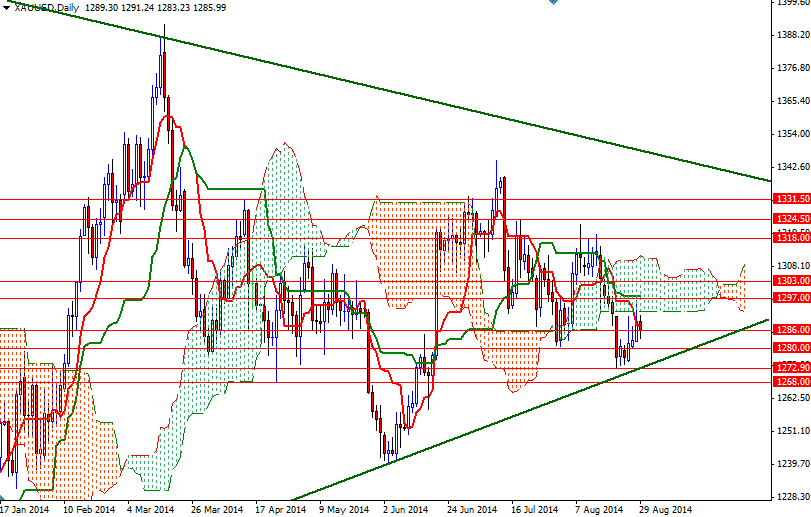

Speaking strictly based on the charts, the path of least resistance for gold appears lower. In other words, I expect the Ichimoku cloud on the daily time frame (currently the area between $1292.70 and $1311) to continue acting as barrier. If the bulls take over and push prices above the clouds, the market could go as high as $1340 an ounce. On its way up there will be critical hurdles such as 1318, 1324.50 and 1331.50. To the down side, there is an interim support at the 1280 level. Breaching this support means the next target will be the 1272.90 - 1268 area. It is quite possible that the pair will continue its bearish tendencies (and test the 1240 level eventually) if this vital support gives way.