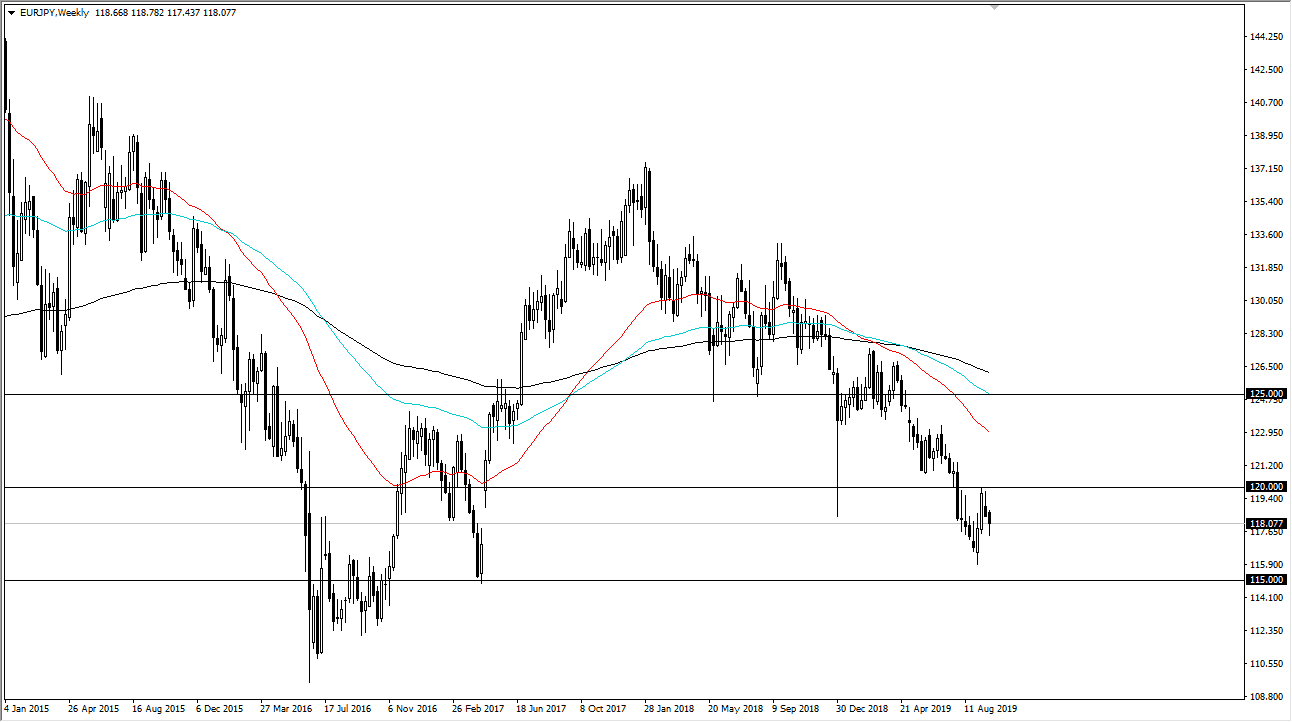

The EUR/JPY pair has been volatile during the month of September, going as low as ¥116, and as high as ¥120. We are finishing the month right around the ¥118 level, so essentially it is an unchanged month. That will make this month of October very interesting, because there seems to be a lot of push and pull when it comes to this currency pair.

When it comes to the Euro, you should start to look at the fact that we are heading into a recession for much of the European Union. Beyond that, the other part of this pair is the Japanese yen so that of course has a major influence on the way it behaves. The Japanese yen is considered to be a “safety currency”, so with that in mind it’s likely that we will continue to see a bit of a push towards that direction overall, as there are a whole plethora of problems out there that could pop up at any given moment. Some of them include the US/China trade relations, Brexit, potential recession in Germany, recession in Italy, geopolitical tensions between the United States and Iran, global growth slowing down, and of course a whole host of other issues out there that could have a bit of a “risk off” move coming back into play.

If the market does rally from here, it’s probably going to be somewhat difficult to break above the ¥120 level. In fact, if you drill down to the shorter-term charts you can identify a 100 PIP range of resistance so it’s really not until we take out the ¥121 level that the market starts to look impressive to the upside. We are much more likely to see this market reach towards the ¥116 level this month than ¥121. Short-term selling of the rallies probably continues to be the mantra for most traders here, so therefore it’s likely that the “risk off” trade will continue to be a major player in the marketplace. Granted, we have broken down rather significantly over the last several months, but there’s nothing on this chart that suggests any of this is going to change anytime soon. With that, I remain bearish but I also recognize we may see a short-term pop in this market that offers more value in the Japanese yen. The Euro would need some type of major turnaround over all to influence this pair.