Brazil continues to struggle with the Covid-19 pandemic, recording over 40,000 new infections daily, and the Secretariat of Economic Policy, part of the Ministério da Economia, released its second-quarter GDP forecast calling for a plunge between 8.0% and 10.0%. It will follow the 1.5% decrease registered in the first quarter and place Brazil into a technical recession. The government of Jair Bolsonaro predicts a 2020 contraction of 4.7%, better than the 5.2% drop financial markets expect. The USD/BRL completed a breakdown below its resistance zone, ending a counter-trend advance.

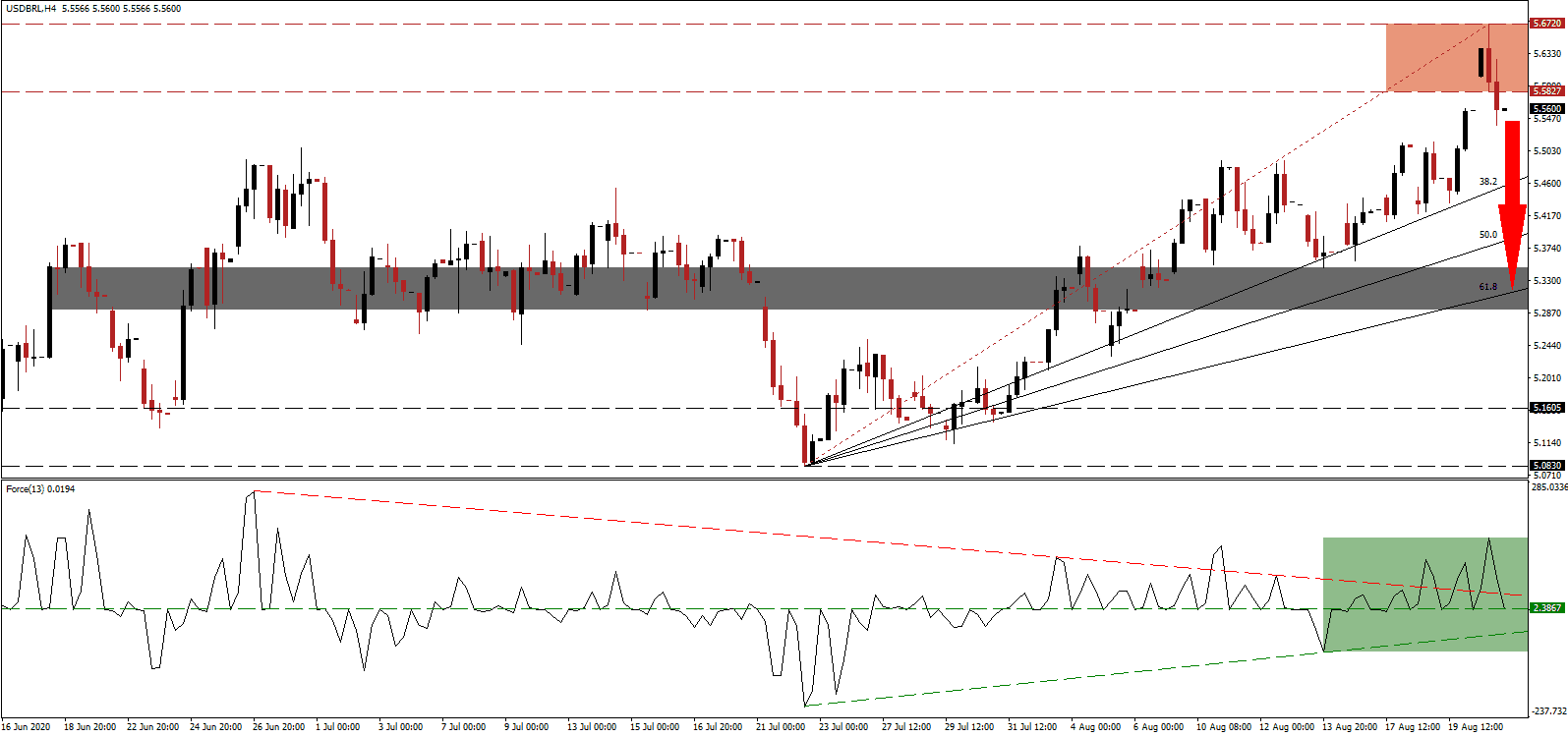

The Force Index, a next-generation technical indicator, recorded a new multi-week peak before collapsing below its descending resistance level. It is now challenging its horizontal support level, as marked by the green rectangle. Due to weakening momentum, this technical indicator is likely to correct below its ascending support level, into negative territory, granting bears complete control over the USD/BRL.

After three more resignations from the Ministério da Economia, Economy Minister Paulo Guedes denied rumors that he intends to step down amid government pressure for more spending. Roberto Campos Neto, the President of the Banco Central do Brasil, was cited as his replacement. Other reports confirmed both are working on reducing spending following s surge in Covid-19 related emergency spending. The USD/BRL is gathering bearish momentum after sliding below its resistance zone located between 5.5827 and 5.6720, as identified by the red rectangle.

While Latin America’s largest economy failed to reign in the Covid-19 pandemic to date, the economy is outperforming expectations. Industrial output and retail sales exceeded forecasts, placing the country on track to accelerate ahead of its neighbors. June service sector data printed the first increase since January, adding to optimism, but the threat of the virus must not be ignored. The USD/BRL is well-positioned to drop below its ascending 38.2 Fibonacci Retracement Fan Support Level and into its short-term support zone located between 5.2919 and 5.3480, as marked by the grey rectangle.

USD/BRL Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 5.5600

- Take Profit @ 5.3300

- Stop Loss @ 5.6300

- Downside Potential: 2,300 pips

- Upside Risk: 700 pips

- Risk/Reward Ratio: 3.29

A sustained breakout in the Force Index above its descending resistance level can lead the USD/BRL into a brief price spike. US initial jobless claims defied misplaced optimism and rose, crossing above 1,100,000 with an upward revision to the previous week’s data. The outlook for the US Dollar remains bearish, and Forex traders should sell any advance. Price action will test its next resistance zone between 5.9210 and 5.9900.

USD/BRL Technical Trading Set-Up - Confined Breakout Scenario

- Long Entry @ 5.7700

- Take Profit @ 5.9700

- Stop Loss @ 5.6300

- Upside Potential: 2,000 pips

- Downside Risk: 1,400 pips

- Risk/Reward Ratio: 1.43